(Cartoonist: Schwadron, Harley; cartoonstock.com)(Sunday, 25 September 2016)

The Coffee Can Portfolio is a buy and hold portfolio strategy. Much like the ‘fill it, forget it’ motorcycle commercial, a Coffee Can Portfolio is a ‘Buy it and Forget it’ investing idea.

The Coffee Can Portfolio

In 1984 Robert G. Kirby wrote an article about portfolio construction and management. He called it the Coffee Can Portfolio. Click here to read. In the words of Robert Kirby:

“The Coffee Can Portfolio concept harkens back to the Old West when people put their valuable possessions in a coffee can and kept it under-the mattress. That coffee can involved no transaction costs, administrative costs, or any other costs. The success of the program depended entirely on the wisdom and foresight used to select the objects to be placed in the coffee can, to begin with.”

I’ll leave interested readers to click on the link and read about Coffee Can Portfolio investing. In a nutshell what Kirby is saying is that investors must (a) concentrate on the choice of stocks that they put into their coffee can, (b) focus on the long-term, (c) avoid churning their portfolio. The emphasis is on the long-term, as opposed to churning the portfolio. Hence, stock selection is critical.

Nowhere has Kirby defined (a) how to select stocks that one should put in one’s Coffee Can Portfolio and (b) what he means by the long-term. Portfolio construction is more art than science. There can be no ‘one size that fits all.’ My thoughts:

- How does one define the long-term? When investing in bonds or any fixed income instrument, one has a clear idea of (1) the date of maturity of the instrument and (2) the rate of return. When investing in stocks, one doesn’t have the foggiest idea of either of the two. In that sense, the maturity period for investment in the stock market is infinity. For my empirical evaluation of Kirby’s Coffee Can Portfolio, I have used a period of ten years.

- What does one look for while building a stock portfolio? It should consist of fundamentally strong businesses that are professionally run, have a proven track record and a consistent dividend paying history.

- The number of stocks in the portfolio should not exceed twenty-five. Since the Coffee Can Portfolio is for the ‘know-nothing-do-nothing’ investor who doesn’t have an ‘investing edge’ (you and me), it ought to consist primarily of large-cap stocks.

- In any stock portfolio, diversification is essential. The idea behind having a diversified portfolio is mainly to reduce risk. The only way one can compile a diversified portfolio is by selecting stocks of companies whose businesses are non-correlated. Since the businesses are not correlated, all of them don’t sink or swim together. In this way, the risk is reduced, and diversification is possible.

- Since no churn is envisaged, it follows that stocks that one selects must meet certain minimum qualitative criteria. In my opinion, the methodology of construction of the Nifty50 Value 20 Index fits the bill perfectly.

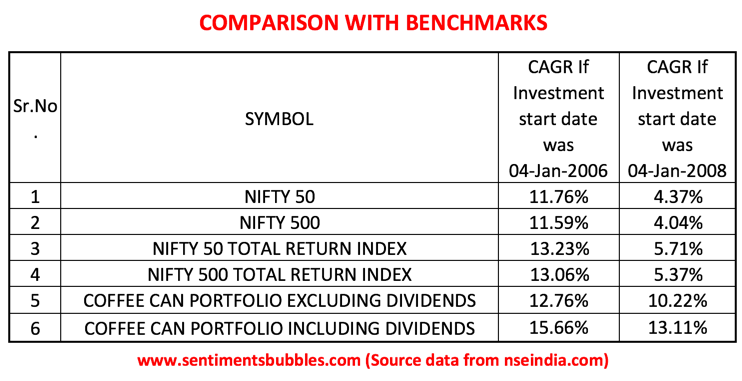

Does the Coffee Can Portfolio method work? If it does, what kind of returns can one expect? I have chosen the Nifty50 Value 20 Index as my Coffee Can Portfolio for empirical analysis and tried to answer these questions. I ran a backtest of the Coffee Can Portfolio using the components of the Nifty50 Value 20 Index. The value of the ‘Nifty50 Value 20 Index Coffee Can Portfolio’ and its returns as on 23 September 2016 look like this:

(Click on the Image to Embiggen)

I need to clarify the following:

- The underlying assumption is that a sum of Rs. 5000 is invested in each of the stocks shown in the table above on 04 January 2006. In other words, the portfolio is equal-weighted. If the stock-wise weights were to differ, so will the returns.

- After 04 January 2006, the investor does nothing – no further investment or activity is envisaged; no churn whatsoever. In my opinion, this is what Kirby means when he says that the Coffee Can Portfolio is ‘passively active.’

- I have considered only eighteen of the twenty components of the Nifty50 Value 20 Index. BAJAJ-AUTO and COALINDIA have been excluded. The reason is that historical prices for these two stocks (for the entire period) are not readily available. In my opinion, it will not affect the outcome of the analysis in a material manner.

- CAGR is the acronym for Compound Annual Growth Rate. It is defined as the growth rate over a period exceeding one year. The CAGR rate (expressed in percentage terms and as a yearly constant), gets your initial investment to its ending value. The basis of the CAGR calculation is that each year’s growth is compounded year over year.

To me, the returns look impressive. I think the Coffee Can Portfolio investing is a feasible option for long-term investors. What I want to highlight are the three shaded columns. These columns show the drawdowns. Drawdowns, in layman terms, is the amount or percentage by which these shares corrected at some point in time during the last ten years. The rate of return generated by the ‘Nifty 50 Value 20 Coffee Can Portfolio’ would have been realised if and only if an investor had remained ‘passively active’ for the entire period of ten years. In other words, he or she did not panic and sell when markets corrected. Remaining passive at times of heightened Volatility in today’s Information Age is easy to preach but difficult to practice.

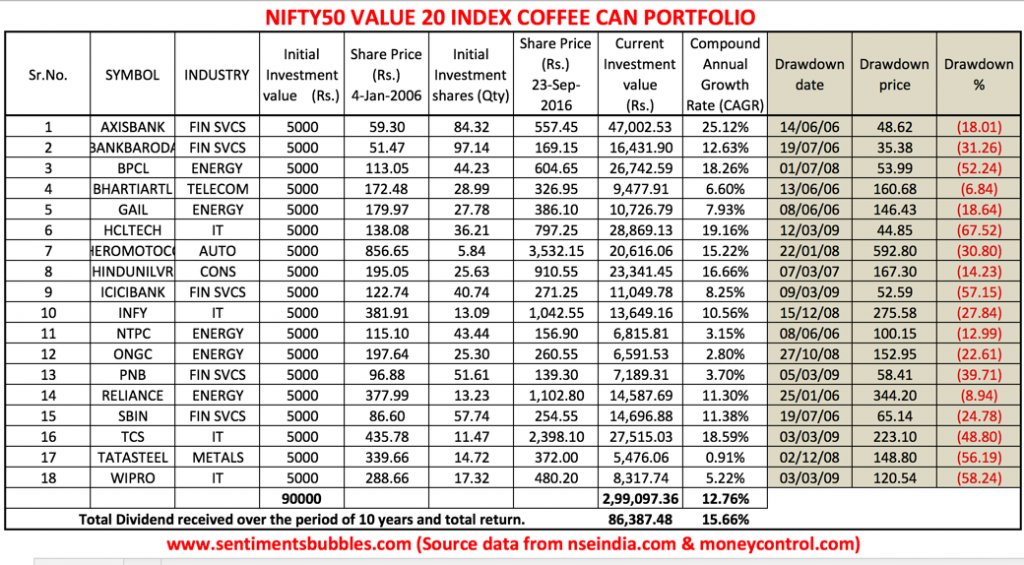

How do the returns of the Coffee Can Portfolio compare with the benchmark? What if one had invested on 04 January 2008, when the market was at its high? The comparison is shown in the table below:

The above is illustrative and not suggestive. Nothing stops an individual investor from devising his or her own Coffee Can Portfolio. Saurabh Mukherjea of Ambit Capital has also written about Coffee Can Portfolio investing. You can click here to read.

Markets Diary

The U.S.Federal Reserve and the Bank of Japan held their policy meetings over the last fortnight. The fourth estate goes into overdrive in the days preceding every meeting. The narrative is something like this: when interest rates rise the U.S.Dollar will strengthen and blah blah blah.

With negative interest rates now ubiquitous, how many of us understand what’s going on in the fixed income world? I certainly don’t. For the retail investor, most of what the Central Bankers are doing or attempting to do is abstruse. What if someone were to suggest that this obsession with interest rates and dollar strength is as old as the hills?

The cartoon below is drawn by Robert Mankoff for The New Yorker Collection, and the publication date is 1981–10–12. To me, the cartoon below sends a veiled message. It does seem to me (looking at the picture) that Wall Street has always been obsessed with interest rates. Wall Street’s obsession with interest rates has now become a global obsession (thanks to the ‘Information Age’). In the long-term, markets haven’t been too bothered about interest rates. I see no reason why they should be this time. As a result, I think long-term investors need to ignore the interest rate rhetoric completely. Unless, of course, you subscribe to the view that ‘this time it’s different’!

(Man listening to TV news announcer.) (Conde Nast TagID: cncartoons026671.jpg) [Photo via Conde Nast]

U were never in favor of buy and hold ??? This change of mind and or heart is only for the purpose of this article ?? -of duration of 1 week till next week’s article ???

I think you got me wrong. I have never been of a ‘churning mindset’. I think every client of Vimal & Sons will vouch for that. I have never advocated churn on the blog either. In fact, I have kept taunting investors that ‘nobody is interested in the short-term’. I think that the long-term is the only term that matters when one is investing and I have said this before. No question of any change of mind, I am unaware how you got the impression that I was ‘all for churn’.

Ok — it was more to tease and not taunt — but when ever we discussed or exchanged mails on “how to estimate over 3/5 years period in – expansion or growth in sales *% ebitda margin *Roe – — u have said future kisane dekha hai — then in absence on handle in abv business metric how do u estimate mathematically the theoretical incremental Mcap over 3/4 yrs ?? I am nt talking abt actual Mcap as it will be multiplied by pe expansion and divided if pe contraction –or will be same as theoretical estimate if Pe is steady over 3/4 yrs ???

Got that. What I mean is that future is unknown. In other words, one has to predict. That involves assumptions. How many people are good at that? In your case, you are also trying to generate ‘free shares’. If I mistake not, that is what Eklavya is all about. Once you have generated ‘free shares’, you don’t want to sell them – ever. SO for you as well ‘free shares’ have a term of infinity. Have I understood that correctly? The question is: how many people can generate ‘free shares’, especially those who are not from the investing profession? For them, I think buying QUALITY large caps and doing nothing else, ought to work.

Though more theoretical, well written article, as usual. I have observed that nobody these days is more interested to wait too long. Hence the prescribed period in the model remains only idealistic!

That is very correct. Nobody wants to wait. that doesn’t detract from the fact that the returns are higher if one decides to wait. The period may be idealistic, but it is not impossible. There are many people who just buy and forget, I know some. They are a very small minority, that is correct.

Yashodhan

Again – nicely written. I would buy shares anytime as compared to any other form of investment. Provided you choose the right shares, they are bound to give you better returns in the long term.

I would rather restrict my investment to 15 stocks though; 25 seem a bit too much.

Secondly, have you considered the dividend these companies have generated in all these years? Would it impact the CAGR calculations significantly if you do that?

Regards

Shailesh

Thanks. I have considered dividends, just that they are not shown stock-wise. Instead, I have taken the total of the dividends that an investor would have received and shown it at the bottom of the ‘Current Investment Value’ column. The CAGR including the dividends so received is shown alongside. I think you missed that. Thanks for reading.