The Rupee dollar parity is the single most determining factor for the prices of stocks in India. It is ahead of the economy, earnings, global cues, etc. It seems that as per the REER (Real Effective Exchange Rate) calculation the Rupee is overvalued. The Big Mac Index suggests that it is one of the most undervalued currencies in the world. Surely, one of them is wrong. I have tried to make sense out of this apparent dichotomy.

Real Effective Exchange Rate (REER) of the Rupee

In forex land, Real Effective Exchange Rate – REER is defined as ‘the weighted average of a country’s currency relative to an index or basket of other major currencies adjusted for the effects of inflation’. In India, there are two ‘baskets’ of currencies which RBI monitors to arrive at the Real Effective Exchange Rate (REER) of the Indian Rupee. These ‘baskets’ are

- Basket no 1 is of six currencies comprising U.S.Dollar, Euro, Japanese Yen, British Pound, Swiss Franc and the Australian Dollar

- Basket no 2 contains thirty-six currencies. These are the currencies of those countries with whom India has its principal external trade.

In the case of the second basket, it seems the RBI keeps a track of inflation in these thirty-six countries. To remain competitive the currency of the country in which inflation is high, should depreciate against the currency of the country in which inflation is low. By this rule, the Indian Rupee should depreciate every year to make up for the difference in inflation levels. However, when it comes to markets of any kind, currency commodity or equity, ‘rules’ are usually pretty flexible in operational terms.

The Big Mac Index and the Indian Rupee

The British magazine ‘The Economist’ has been publishing what it calls the ‘Big Mac Index’ since 1986. The Big Mac Index is not a precise indicator of exchange rate parity but is used as a tool for people like you and me to understand the complex world of forex. It is a global standard and has obtained cult status for comparing over and undervaluation of currencies. I tried to see where the Rupee fits into the Big Mac calculation.

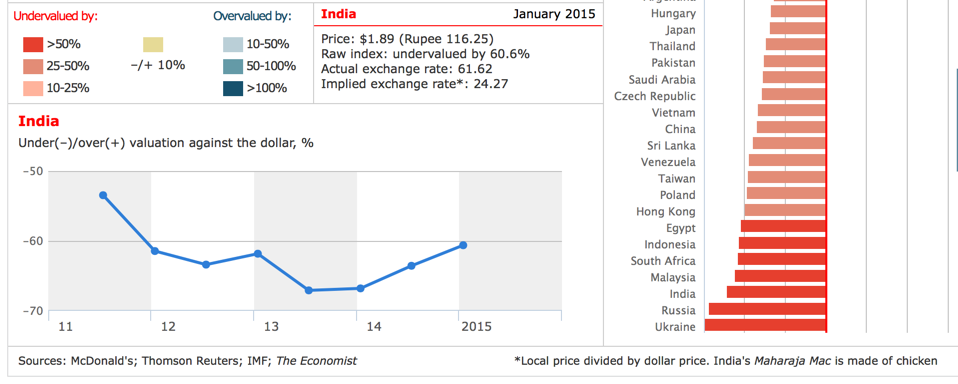

The Big Mac index talks of Purchasing Power Parity (PPP). According to the PPP argument, over the long-term, currency exchange rates should equal the price of a basket of goods and services in different countries. The total number of countries covered is 120. The Big Mac Index is calculated by dividing the price of a Big Mac hamburger in one country by the price of a Big Mac in another country in their respective local currencies. The resulting value is then compared to the official exchange rate between the two currencies to arrive at a figure of under or over valuation. As of January 2015, the Rupee – U.S.Dollar parity as per the Big Mac Index would be computed as follows:

- A Big Mac burger costs $ 4.79 in the USA

- The Big Mac is a beef burger. Hence, the Economist compares the cost of a similar Maharaja Chicken Burger in India costing Rs. 116.25.

- Thus, the parity works out to a rate of 116.25 / 4.79 = Rs. 24.26 to a US dollar. It means that the Rupee is undervalued by around 62 % versus the US dollar.

(Click on the image to embiggen)

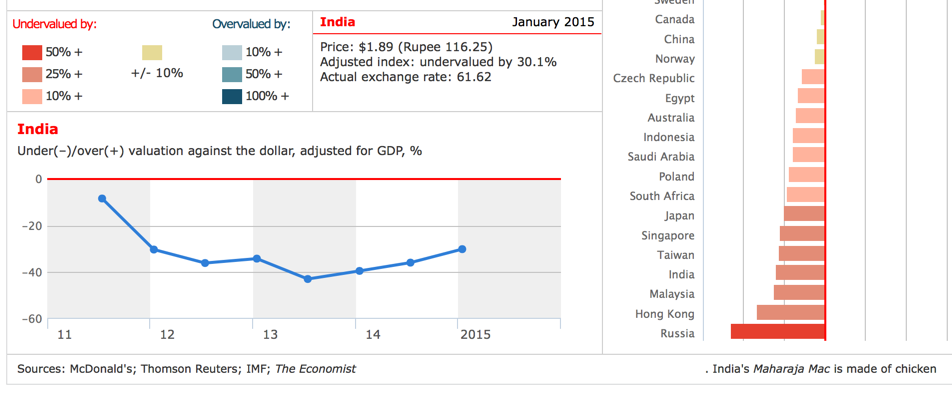

They call this the Big Mac ‘Raw’ Index. The Big Mac Index attracted criticism because in poorer countries labour costs are lower. Hence, average burger prices would be cheaper. To address this, they started computing the ‘adjusted index’. This adjusted index represents the relationship between Big Mac prices and Gross Domestic Product (GDP) per person in the respective country. The Big Mac ‘Adjusted’ Index gives a better idea about today’s equilibrium rate. As per the ‘adjusted’ index, the undervaluation is 30.1 percent. Effectively the adjusted Rupee Dollar parity as per the Big Mac Index should be in the mid-forties.

(Click on the image to embiggen)

Both the images clearly show that the Rupee is one of the most undervalued currencies in the world, as per the Big Mac Index. It all boils down to whether or not we can use the Big Mac Index to construct patterns that reflect the exchange rates between countries. Surprisingly, the answer to this question is in the affirmative. The Big Mac Index can be used to establish a ‘ballpark’ figure of under or over valuation of respective currencies. There is an obvious limitation in this method since the Big Mac itself is a non-traded commodity. Probably that is the reason it works!

Fed Speak and the Indian Rupee

Of late, market participants have been obsessed with the Fed rate hike and its fallout on the market. Hence the fear that we will have a ‘rupee tantrum’ once the Fed starts hiking rates. I think there are two important takeaways from the recently concluded meeting of the Federal Reserve in the U.S. These are

- In the words of Janet Yellen: “Let me emphasise that the importance of the initial increase should not be overstated. The stance of monetary policy will likely remain highly accommodative for quite some time after the initial increase in the federal funds rate in order to support continued progress towards our objectives of maximum employment and 2% inflation.” The statement above does give the impression of the Fed rate hike being a ‘one and done’ kind of a thing. According to me, this impending ‘one and done’ hike is already priced in the current valuations of stocks and the Rupee.

-

After the first hike, it seems that the Fed will be in ‘wait and watch’ mode, before implementing any further rate hikes. According to her, what is important is that the whole ‘lift off’ process will be tackled very ‘gradually’.

Is the Rupee Undervalued or Overvalued?

I think that, for the Indian Rupee, things can only get better from here, not worse. My reasoning is as follows:

-

Whether the Big Mac Index is accurate or otherwise is beside the point. The fact remains that the Indian Rupee is one of the most undervalued currencies in the world. As of January 2015 the only countries whose currencies were more undervalued than the Rupee were Russia and Ukraine.

-

All this talk of REER is all statistical mumbo jumbo. It is so easy to lie with statistics. The REER is a myopic way of looking at things. The ‘relative’ strength of the Rupee makes India ‘the best house in the neighbourhood’. It is the reason we will continue to attract robust inflows. Using this as a justification for rupee weakness sounds stupid.

-

When you widen the lens, as I have tried to do, it is apparent that the currencies with which the Rupee is being compared are not as undervalued as the Indian Rupee. The Indian currency is already at the top of the undervaluation rankings. Clamouring for more is a bit too pessimistic.

- The Prime Minister, through his ‘Make in India’ campaign, wants to transform the country into a manufacturing hub. The ‘Make in India ‘ campaign is about attracting Foreign Direct Investment (FDI). If one were to follow the dictum, ‘watch what they do, not what they say’, one will realise that FDI flows are rising since 2014. It does translate into a stronger Rupee.

-

Recently the Commerce Minister very clearly said that a weaker rupee is welcome since it will increase exports. Click here to read. Currency devaluation is not the only way of obtaining export growth. International competitiveness is about removing price distortions, ‘bread and butter’ efficiencies and making it easier to do business. This is what the ‘Make in India’ campaign is all about. This is what the Prime Minister has been known to do. All in all, even if Narendra Modi delivers on half of what is expected from him, we will have a stronger rupee in the days to come.

-

In the ultimate analysis, Rupee volatility is just another reason for investors to procrastinate and delay their decision-making. This bull market is a manifestation of the ‘Modi trade’ and the ‘Rajan trade’. If anyone is bearish on the Rupee, then one cannot be bullish on these macro trades. The FII’s have been net sellers of late. It does translate into an opportunity for all of us to participate in the ‘Modi trade’ without the ‘Modi premium’.

-

Karl Krauss, an Austrian writer, has rightly said: “What can no longer be imagined must happen, for if one could imagine it, it would not happen.” Nobody is talking of a ‘reverse Rupee tantrum’ which can take the Rupee to 48; unimaginable, just might happen!

Yashodhan

A well written article.

I for one, think the Rupee will touch about 65 and then stabilize around 60 vis a vis the dollar.

Regards

Shailesh

Thanks. The stronger the Ruppe gets,the better for Indian corporates!

Well, the weaker it gets, the better it is for me….more money to invest in shares. 😉

Regards

Shailesh