The National Stock Exchange of India (NSE) uses the colour Red to indicate a downward tick in the Last Traded Price (LTP) and the colour Blue to show an uptick in the LTP of a given stock symbol. Bloomberg terminals all over the world also use colours to highlight changes in the LTP. Three types of shades are ubiquitous; Red, Blue and Green. Whereas the tone Red is ALWAYS used to indicate a downward tick, one of the other two colours (Blue or Green) are used to highlight upticks in the LTP.

The colours bring about an association in our minds. As a result, we associate the colour blue with an uptick and the colour red with a downward tick. On live screens, (with prices continually getting updated during market hours), the changes in the colours form a wave-like formation. The stream of imagery does affect the way we think and decide. The question is: do these waves of colour have a deleterious impact, whereby they tend to nudge the investor into activity when none is needed?

Effects of Colour on Investment Behaviour

In a research paper, published on July 20, 2017, Messrs William J. Bazley, Henrik Cronqvist, and Milica Mormann examine the effects of Colour on Investment Behaviour. You can click here to read: In the Red: The Effects of Color on Investment Behaviour. For the sake of brevity, I’ll stick to the conclusions that they have arrived at:

- Since potential losses are displayed in Red and potential profits in Blue, the colours act as stimuli for determining investor behaviour.

- The colour Red leads to reduced risk-taking behaviour by investors/traders.

- When historical graphs of individual stocks or the index are shown using colours, a red colour in the historical chart leads to lower expectations about future returns.

- There are two exceptions (that prove the proposed thesis). These are: (a) Colour Blind investors are immune to the effects of the colours and (b) in China it was found that ‘colour effects’ were muted since the tone Red is NOT used to portray financial losses.

Richard Thaler and Behavioural Economics

Behavioural economics is the study of the effects of emotional factors on the economic decisions of individuals. A macro-economist and a behavioural economist are as different as chalk and cheese. Richard Thaler is a Behavioural Economist, and he was announced as the winner of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel for 2017.

In his book titled Nudge: Improving Decisions About Health, Wealth and Happiness he talks about ‘nudges’. According to Thaler, Nudges are small design changes that affect human behaviour. He stresses the need to use ‘nudges’ ethically. In his book, he highlights the fact Nudges should not be used to sway people into making decisions that they will regret later. His definition of ‘nudge for good’ is one that incorporates all of the following three elements:

- All nudging should be transparent and never misleading.

- It should be as easy as possible to opt out of the nudge.

- There should be a good reason to believe that the behaviour being encouraged will improve the welfare of those being judged.

I have no doubt in my mind that the colours cascading before us on our trading screens tend to nudge us into activity (been there, done that). Hence, I have tried to see if the cascading colours meet the three elements of being a ‘nudge for good’. In my opinion, the colour imagery fails all the three tests that would make them a ‘nudge for good’. My reasoning is as follows:

- Some of us don’t log in to the live terminals and trade off-line. However, almost all investors, irrespective of whether they trade online or offline, do check on their portfolios on a daily basis, if not multiple times a day. Portfolio Tracking Software uses colours for showing ‘day’s gain’ and ’overall gain’ on individual prices and the portfolio as a whole. In other words, almost all investors (other than those who are not connected to the internet or do not have a smartphone), are susceptible to being nudged. The colours tend to influence our emotional thinking process. One doesn’t have to trade for this to take place.

- In the case of investors who use the Mutual Fund route, we as investors are not aware of our money manager is in fact, sitting in front of a live terminal. He or she is at risk of being influenced by the colours just as we are.

- The colours are misleading since they keep changing at random. The cascading effect of the red and blue colours on the trading terminal causes a wave-like formation, one that seems to flow and ebb almost continuously; it tends to draw the attention of the user and distract him or her as the case may be. The colours are made seemingly relevant when in fact they are not consistent at all; this is equally true in the live environment and the portfolio tracking software. In my opinion, the cascading colours conform to what Thaler in his book calls Supposedly Irrelevant Factors (SIF’s). More often than not the cascading colours lead to dramatic shifts in actions and costly overreactions, not to mention the missed opportunities. In such circumstances, the nudge more often than not turns out to be a knock!

- Can one opt out of OR change the colours? In the case of the NEAT terminals (of the National Stock Exchange of India), one can fidget with the background colours. However, the red and blue wave formations are not variable, they are system defaults and cannot be changed. Ditto for Bloomberg terminals and the portfolio tracking software.

- Does the behaviour that the colours encourage improve the ‘welfare’ of the user? It is a loaded question. I’ll split it into two parts: (a) Those who do not trade online but do check on their portfolios feel that they are in some way ‘in charge’ of their allocations and that not checking on them would be tantamount to irresponsible behaviour. Taleb calls this ‘illusion of control’. Since most of these ’types’ are not trading on margin, the whole exercise is a grand waste of time and is likely to cause more harm than good. (b) Those who log in and trade live or for some reason are staring at prices from 9:15 a.m. To 3:30 p.m., the waves of imagery are addictive, there is no doubt about it. If for a brief period the colours stop appearing (for eg., in an outage), traders are lost and behave like mice in a maze.

- Savvy traders with good temperaments can use the colours to improve their welfare. For that to happen, one has to eviscerate the effects of the colours from the thinking process. This breed is rare, but it does exist. For the vast majority of ‘us’, the colours do not improve our welfare.

Markets Diary

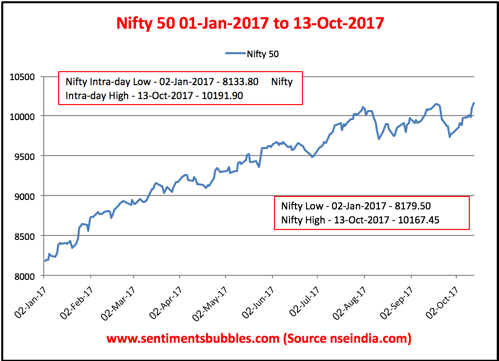

It is rare that one sees an Index move from the bottom left to the top right in the manner it has in the current calendar year. (Individual stocks have seen fleeting corrections). Most of the experts are dumbfounded with the pattern. Almost all global markets, irrespective of whether they are part of the Emerging Markets or Developed Markets, sport similar chart patterns. Global markets just seem to grind higher. Momentum strategies have dwarfed everything else in the current year.

‘The more you believe something to be true, the more you will have accumulated evidence to support it’, is a quote by a trading coach called Van Thorp. According to him, we tend to trade our beliefs, and in a way, one’s trading system is a set of beliefs. What he says makes a lot of sense, there is no doubt about that.

As each of us tries to trade our beliefs, the stock market ends up representing the combined beliefs of thousands of human beings responding to information, misinformation and whim. The melange of human emotion in the stock market is one of the factors that drive price discovery. However, the advent of algorithmic trading has to some extent taken emotions out of the trading process. As a result, using sentiment as a contrarian indicator has failed miserably in the current year, (thus far).

All of us are trading our beliefs, and at the same time, we are forever obsessed with market direction. Will the current upward trend intensify or will it fade? Jesse Livermore, known as the boy plunger who could ‘read the tape’ is one of the investing greats of yesteryear. He has famously said, ‘The obvious rarely happens, the unexpected constantly occurs’. Go figure!