(Cartoonist: Jim Naylor; Cartoonstock.com)

The fact that dividends create value in the hands of the receiver is one of the least appreciated features in the investment business. The only time dividends make headlines is when it is skipped. In sideways markets, like the one we seem to be in, dividends can be put to good use.

Sideways Markets – Big Moves Little Change

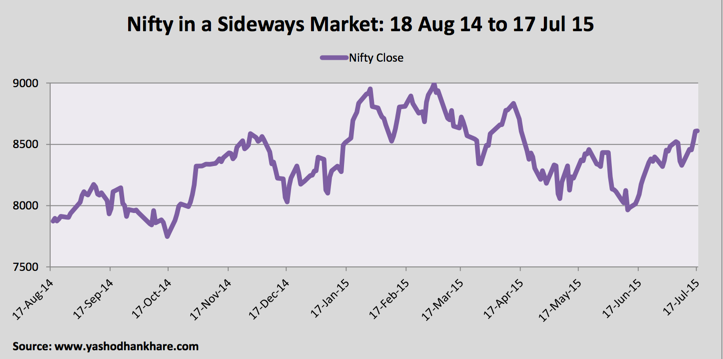

The benchmark is locked in a tight trading range. The image below says it better than words:

(Click on the image to embiggen)

From the picture it is clear that from August 2014, the market has been devoid of any discernible trend; bullish or bearish. This range-bound market is popularly called a sideways market. The following are the peculiarities of a sideways market:

-

In sideways markets, you don’t expect stock prices to go anywhere. Investors tend to freeze their decision-making process, resulting in inaction.

-

Currently, we have low trading volumes, half-hearted rallies and high levels of cash with money managers. These are common in all sideways markets.

- Constant volatility hides the sideways nature of the market. We have bursts of exuberance, driving the market toward the upper end of the range. Market denizens keep looking around till they find

anythingsomething to worry about. This ensures that optimism gives way to despondency and fears, resulting in markets correcting back to the lower end of the trading range. Most portfolios tend to stagnate, with a downward bias.

-

One of the best ways to invest and prosper in these kind of sideways markets is to buy the companies that pay out an increasing stream of dividends. Stocks of companies that pay dividend hold up well in sideways markets. In such range bound markets, dividends are a critical driver of equity returns.

What is Dividend Growth Investing?

The process of purchasing stocks of businesses that grow their dividends over time is popularly called dividend growth investing. To maximise returns from this strategy, one should reinvest the dividend received in the stock of the company that pays the dividend. The argument boils down to this: if investors think they can compound the money they receive as dividends at a rate higher than the dividend-paying company, it makes sense to invest the dividends outside the company. If not, it makes sense to buy more shares of the dividend paying company.

Dividend Growth Investing in a Sideways Market

In the mad rush for buying the hottest sectors and trying to predict the economic cycle, all of us tend to ignore the power of dividends. When using dividend growth investing as a strategy one has to remember the following:

1. Returns from investing in stocks is a function of capital appreciation and dividend income. In sideways markets, there is little or no capital appreciation. In such a scenario, dividends account for a bulk of the returns obtained from investing in stocks.

2. Dividends represent cash that has left the company. Businesses that pay dividends are the ones that are generating positive cash flow. Only high quality and financially healthy companies can afford to pay dividends consistently. Effectively, dividend growth is one of the best indicators of a company’s business. More often than not, dividend growth means an increase in earnings. In other words, companies in which the dividend payout ratio is increasing or is constant are safe bets.

3. Stocks that have an uninterrupted dividend paying record, automatically qualify as recession-proof companies. I should hasten to add, the idea is not to find the lowest priced and highest yielding stocks. Chasing a high yield can be dangerous since the search for yield may obfuscate the thinking process. Many investors end up buying high yielding stocks of companies having bad business models. This is avoidable.

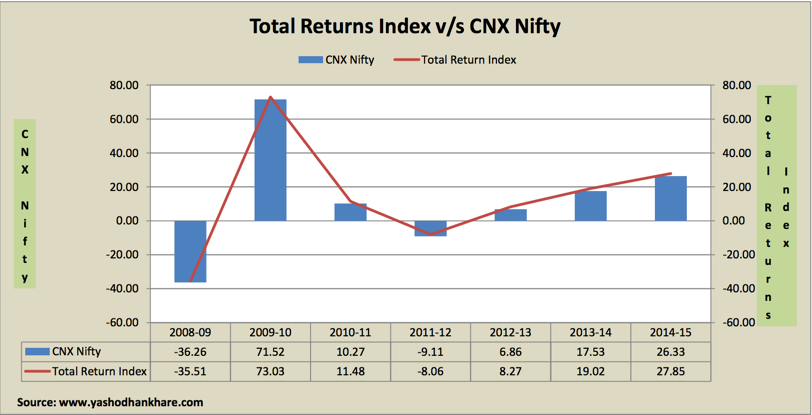

4. The National Stock Exchange of India disseminates a ‘Total Return Index’. The Total Returns Index differs from the benchmark Nifty. The difference is in the calculation methodology. The benchmark is a price index and reflects returns that would have been obtained by investing in its constituents. On the other hand, the ‘Total Returns Index’ reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from the component stocks. (Click here to read more about how the Total Returns Index is computed). From the image below, it is clear that the Total Returns Index outperforms the CNX Nifty at all times. This is how the comparison between the Total Returns Index and the CNX Nifty looks:

(Click on the image to embiggen)

5. From the image above, it is clear that the outperformance of the Total Return Index is roughly 1.5 percent per annum. In the long-term, this is substantial.

6. Each one of us can duplicate this concept of ‘Total Return’ with our respective portfolios. By reinvesting the dividends received one can accelerate the returns earned on the stock. It is all the more relevant in the case of stocks that have an uninterrupted track record of paying dividends.

7. Simply stated: Dividend-paying stocks are a trade-off, not a free lunch. They tend to outperform in sideways markets. They will underperform in bull markets. Most companies who have declared dividends will distribute the same in the next two months. Investors can maximise their returns by pursuing the ‘total returns concept’ elucidated above. It seems foolish to ignore the compounding effect that dividends can bring to an investment portfolio.

8. I have tried to identify stocks that qualify as ‘Dividend Growers’. While doing so, I have ignored dividend yields. In most cases, the yields may appear to be low. The list is not exhaustive, but it is representative. I have segregated the names into PSU and non-PSU categories. In the case of Public Sector Undertakings (PSU’s), dividend policies are based on government diktats, not business realities. This has to be factored, hence the differentiation. Click here to downloadDIVIDEND GROWERS

How long can the market remain sideways?

As investors, we cannot fix the economy. However, we can attempt to nullify the effect it has on our portfolios. Maybe, the time has come for fundamentals and not central banks to drive stock market returns. It follows that we are now dependent on the economy for pushing stock prices higher. As investors continue to wait for the all elusive ‘crash’, markets might go into a prolonged sideways mode instead. The following pointers might be helpful:

- The only way to trade in a sideways market is to try to figure out the trading range. Randomness is omnipresent in markets and can safely be taken for granted. Hence, there can be no precise definitions of the two ends of the trading range in a sideways market. Effectively, defining trading ranges in sideways markets is impossible.

- For the ‘buy and hold’ type of investors, it doesn’t matter how long we remain in this sideways trend. They just need to reinvest their dividends and accumulate dividend growing stocks. For the ‘trader’ types, theoretically one may consider it viable to try to sell at the upper end of the trading range and buy at the lower end. That translates into predicting market direction. All the best with that!

- There will be plenty of false signals on both sides of the trading range. Whenever the market trades outside the range, expect to read and hear the words ‘break out’. Markets ‘breaking out’ means that the market has moved decisively in a particular direction. One of those break-outs will be the ‘real thing’. Which one and in which direction? We will know only with the benefit of hindsight. How long will the market remain sideways? Nobody can predict that, just remember that in the case of all sideways markets; ‘It ain’t over till it’s over’.

I have been investing last 40 years & Iam happy about result. My thinking & philosophy matches with your thinking.I appreciate your writing very much. Keep on doing good work. I would like to meet you & disscus with you when you have time.

Regad.

Dange

Thank you for your kind words, Sir. You can meet me anytime, just give me a call before coming.

As usual, one more studious article on dividend yield. In Indian scenario dividend is tax free and this may create an attraction for an investor. However this element also discourages good companies to remain generous. It is observed that whenever the promoters and/or FII hold more than 60% shareholding in any stock; they used to declare dividend liberally. CSR is additional compulsive burden on the good listed companies prescribed under the companies Act, which in long run reduces the distributable profits. It is observed that “dividend distribution” is one of the criteria for listing of a security and good companies continue to maintain their dividend history .

Frankly speaking, very seldom we used to buy/ accumulate stocks to earn dividend. Considering the market value of good stocks it tends to be low or very low in comparison with (tax free) interest from fixed deposit of banks or post. Secondly it becomes complicated due to the fact that most of the quality stocks are now having face value less than Rs. 10, due to subdivision. Some of the stocks you have mentioned are worth noting from the dividend perspective, however I feel them less promising on the count of capital appreciation.

As you rightly said dividend criteria should be considered when the markets are in a sideways territory. Even in situations where the investor predicts a downtrend in the market; SIP in such stocks leads to be a prudent solution to maintain moderate returns!

The idea is to buy dividend growers and then reinvest the dividend giving the compounding effect. Needless to say, it will work only in the long term with stocks which are bought for ‘keeps’ and not for those which are bought with a view to selling them.

Rajas

Good reply!

Shailesh

Yashodhan

Why does the download require a n e-mail ID? Why does it not just download immediately?

Regards

Shailesh

The email id is a requirement of the service provider. It is a paid service for me. They give me a fixed number of downloads. I am open to suggestions, if you have any better or cheaper ideas!

Let me develop a new website for you replete with all functionality you need. That would pay you better dividend in the long run 😉

Shailesh

Good one