(Cartoonist: Fran; Cartoonstock.com)(Sunday, 27 March 2016)

Distressed Debt is the debt of companies that have filed for bankruptcy or have a significant chance of doing so shortly. Hitherto the Indian retail investor never had the option of investing in a distressed debt fund, now they do. Is it worth biting the bait?

What is Distressed Debt Investing?

Any discussion about Distressed Debt Investing would be incomplete without referring to Howard Marks, Chairman and Co-founder of Oaktree Asset Management in the United States. Distressed Debt Investing as popularised by him can be interpreted to mean the following:

1. The idea is to buy the debt of companies that are in default. Distressed Debt can be purchased at a haircut to its par value. The hair cut would differ from case to case.

2. Marks’ mantra has been ‘good company, bad balance sheet’. He has made it his business to try to catch ‘falling knives’. His preferred route has been debt, not equity.

3. The distressed debt has to be bought at a steep discount to its intrinsic value. Investments in distressed debt carry an optionality for wresting control of the indebted company. This results in any of the following:

-

The indebted company is turned around and brought to life. As a result, if you bought an ownership stake using the ‘debt route’, at an attractive price, you make money.

-

In case the company cannot be ‘turned around’, the distressed debt investors have a charge against the assets of the enterprise. Owners of debt instruments have priority over equity shareholders. They exercise that claim in a process called bankruptcy. Since the debt in question has been purchased at a steep discount, the risk is mitigated.

4. Needless to say, things are not as simple as has been stated above. There can be many a slip between the cup and the lip! All proposals do not result in profit.

5. Mark’s track record speaks for itself. In the twenty-two years that he has been running Oaktree Capital, his seventeen distressed debt funds have delivered annual gains of nineteen percent, after fees.

Distressed Debt Investing in India

Investing in distressed debt has become a big business in India. The reasons are:

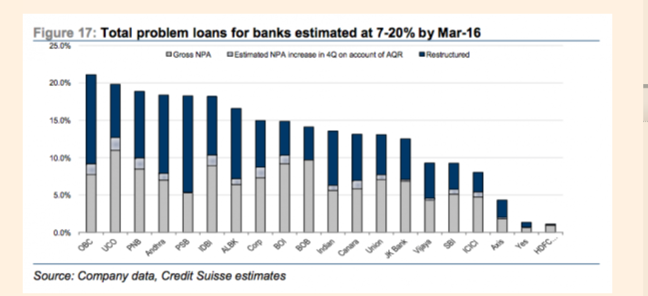

1. India’s Public Sector Banks need to be recapitalized. In a democratic set up that we are so used to, it is unlikely that large-scale mergers and amalgamations between banks and other forms of corporate restructuring will go through smoothly. There is a more than even chance that, ‘financial alchemy’ can be achieved by reviving India’s distressed debt. The image below depicts the size of the opportunity in an appropriate manner.

(Courtesy: ft.com)

2. As a result, the government is rolling out the red carpet to enable global distressed debt investors to participate in reviving indebted Indian companies. A slew of foreign funds have already announced their intention of entering this space.

3. With ‘Clean Up’ Rajan at the helm, expectations are that the proposed Insolvency and Bankruptcy Code, 2015 will be a game changer for distressed debt investing in India. The reasons are:

-

The current insolvency regime India is a time-consuming process. As a result, it is pretty ineffective. According to the World Bank, currently, it takes more than four years to resolve insolvency cases in India. The proposed code aims to bring this period down from four years to less than one year. Effectively it will improve the ‘ease of doing business’ in India.

- For Public Sector Banks, the sale of a distressed debt to an Asset Reconstruction Company (ARC) is the last resort. As a result, in the past, banks tended to wait for an inordinately long period before taking action. The new code forces banks to act early in the cycle instead of waiting.

Distressed Debt Investing – Why & How?

Distressed Debt Investing is popularly called an Alternative Investing Strategy. Funds that invest in Distressed Debt are referred to as Alternative Investment Funds (AIF’s). In India AIF’s are governed by the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012. From an investing perspective, the following is relevant:

1. Since distressed debt investing is an alternative investment strategy, SEBI mandates the minimum investment from an individual applicant as Rupees One Crore. It is a formidable entry barrier. There is no doubt about that. I wouldn’t want to belabor this point. Suffice to say that investing in a distressed debt fund ought to be considered as an alternative to investing in second homes, holiday homes, retirement homes, etc.

2. In the Indian real estate market ‘buy to let’ has gained tremendous popularity. The returns from ‘buy to let’ are abnormally low. In comparison, investing in a distressed debt fund is likely to be beneficial. A major positive of investing in a such a fund is that it has practically no correlation with what is happening in the stock market. In other words, it is a very effective means of diversification.

3. A section of the market deems investing in distressed debt funds to be a risky proposition. I think that is an incorrect interpretation. It is true that the skill of the individuals who run the fund is critical. However, this managerial ability or skill, is essential in the case of equity mutual fund investing as well. Hence, I think that investing in a well-managed pure (not structured) distressed debt fund is in fact, less risky than investing in an equity mutual fund.

4. It is important to remember that not all debt that is restructured will end up being successfully restructured. Success in restructuring would be a function of the nature of the business and how indebted the firm is. As a result, the selection of the fund and the credentials of the people involved would be critical for making an investment decision.

5. Which distressed debt funds are currently accepting subscriptions? I tried to reach out to a couple of institutions that have announced their intentions of starting distressed debt funds. The response was not encouraging, to say the least. I didn’t understand what the secrecy was all about. Apparently, distressed debt funds will not be sold to us. It is something that the Indian retail investor will have to buy of his volition. There is a difference between the two!

Will Distressed Debt Investing work in India?

Currently, distressed debt investing has become a big business all over the world. The meltdown in commodity prices has ensured that there is a lot of stress in the developed countries as well. I think that distressed debt funds will deliver. My reasoning is as follows:

-

There is a heavy dose of scepticism built into anything that has even the remotest connection to public sector banking in India. The usual refrain, will the ‘system’ stop all of the above from working? What about the political ownership of the distressed debt? My answer is: Does the government have a choice?

-

In the current instance, the regulator is the Reserve Bank of India. The popular opinion is that India’s Reserve Bank is independent of the government, a view that is borne out by events that have unfolded over the last couple of months. In such a scenario and given the lack of choices that the government has, the odds are in favour of investing in distressed debt funds.

-

Just because distressed debt investing has worked in the developed world; it doesn’t mean that it will succeed in India. I agree, this is a valid argument.

-

In the ultimate analysis, it is a matter of perception. What the foreigners perceive as an opportunity, we perceive as risk. Foreign investors are eager to enter India’s Distressed Debt sector. Surely, they are aware of the ‘system’ and how it works. They seem to be betting on the Insolvency and Bankruptcy Code, 2015. In other words, they are betting on a change in the way the ‘system’ works. I don’t see why the Indian retail investor cannot bet alongside them.

-

If history is to be used for judging the efficacy of the proposed changes in legislation, distressed debt investing is doomed. However, just because the ‘system’ has prevailed in the past, does not mean that it will prevail in the future as well. To paraphrase Warren Buffett, “If past history was all there was to the game, the richest people would be librarians.”