(Cartoonist: Mike Shapiro; cartoonstock.com) (Sunday, 14 August 2016)

Mutual Funds are now the preferred vehicles for investing in the Indian Stock Market. Can Expense Ratios predict future performance of any given Mutual Fund Scheme?

What are Expense Ratios?

Expense Ratios refer to the annual fee that all Mutual Fund Schemes charge their shareholders. Expense Ratios are expressed as a percentage of the Assets Under Management (AUM) of the concerned scheme.

The calculation is pretty simple. In India, Asset Management Companies (AMC) are the ones that control or own the various Mutual Funds. The total expenses incurred by an AMC are charged to the Mutual Fund Scheme in question before arriving at the schemes Net Asset Value. An Expense Ratio tells a prospective investor how much he or she is paying for hiring the services of the Mutual Fund. Expenses that typically form part of the Expense Ratio calculation are management and advisory fee, trustee fees, audit fees, selling expenses including commission paid to agents and all other administrative costs.

Morningstar Report on Expense Ratios in India

Morningstar India Private Limited is a subsidiary of Morningstar Inc. They provide independent investment research. They also release, on a biannual basis what they call the Global Investor Fund Experience Report. The report assesses the experience of Mutual Fund Investors in twenty-five countries across North America, Europe, Asia, and Africa. India was given a grade of C+, which isn’t saying much since the lowest grade was a D.

Interested readers can click on the link above and read the entire Morningstar report. I’ll just stick to the part about Expense Ratios. The report cited above states that ”However, Indian funds still have average-to-expensive total expense ratios overall for equity and allocation funds.”

Expense Ratios In India

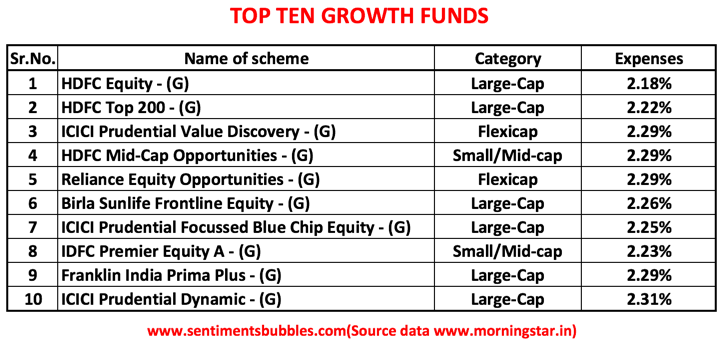

Currently, as per norms stipulated by the Securities and Exchanges Board of India (SEBI), Equity Oriented Funds in India can charge a maximum of 2.5 percent of the average weekly net assets as expenses. In the case of debt funds, the percentage is stipulated as 2.25 percent. The table below shows the Expense Ratios on the top ten Mutual Fund Schemes in the Indian Stock Market as on date:

It is apparent that the Expense Ratios are just a shade below the SEBI prescribed maximum limit. Internationally the norm is for Expense Ratios to be capped at around 1.50 percent. A low Expense Ratio would be one that is below 1 percent. After the Morningstar report, SEBI has been keen on bringing down the Expense Ratios charged by Mutual Fund Schemes in India.

Expense Ratios & Mutual Fund Scheme Selection

As investors embrace mutual funds as an investing vehicle, the number of investors who own individual stocks keeps decreasing. Effectively as the share of managed money keeps increasing with each passing day, the job of outperforming indices becomes even more challenging for money managers of Mutual Fund Schemes. It is a scenario that is undeniable and unstoppable at the same time.

Come to think of it, what is the difference between selecting a mutual fund and directly buying a diversified bunch of stocks? In my opinion, not much. In fact, Equity Research is readily available for those who wish to buy stocks directly. However, Mutual Fund Scheme research does not exist. In such a scenario, I think that investors in Mutual Fund Schemes in India need to get a bit more discerning about Expense Ratios. My thoughts:

- In a way, an Expense Ratio is what we as investors pay for access to higher skill in the arcane world of stock-picking. In other words, what investors ought to get in return for the higher Expense Ratios has to be visible in terms of higher returns.

- In the world of Mutual Fund investing, there is no reliable way to pick outperforming Mutual Fund Schemes or managers. Once we have invested in a Mutual Fund Scheme, the investing process, stock and sector allocation and timing decisions are all made by someone else.

- The consensus as on date is that it is humanly impossible for any fund manager to beat the benchmark indices consistently over the long-term. Top-performing fund managers find it tough to stay at the stop. It is not a question of lack of skill. It has more to do with intense competition and the law of averages.

- Expense Ratios are probably the only thing that investors can exercise their discretion over – before they decide the Mutual Fund Scheme that they wish to invest. I think that for the layman investor, Expense Ratios are hiding in plain sight and should not be ignored even at the risk of being dogmatic about the concept. In a nutshell, the lower the Expense Ratio of a Mutual Fund Scheme, the better.

Can Expense Ratios Predict Future Performance?

An article published by Morningstar and titled Fund Fees Predict Success or Failure highlights the fact that Expense Ratios are strong predictors of performance. Morningstar has also published a White Paper titled Predictive Power of Fees: Why Mutual Fund Fees Are So Important.

According to Morningstar, funds that have higher Expense Ratios are likely to underperform those with lower Expense Ratios – in the long-term. In my opinion, the long-term is the only term that matters. Very briefly, what the research report highlighted above says is as follows:

- The research paper seems to emphasize that cost, not skill, is the critical attribute when it comes to Fund performance metrics over the long-term. As a result, the researcher, Russel Kinnel of Morningstar concludes that Expense Ratios more than anything else seem to predict the future performance of any Mutual Fund Scheme. In fact, Kinnel goes on to state that the cheapest funds were found to be two to three times more successful as compared to their pricier counterparts.

- The researcher acknowledges that the skill of the fund manager is equally important. However, according to Kinnel, higher skills of the fund manager translate into lower costs. In Kinnel’s opinion, amongst the criteria that investors use while selecting a Mutual Fund Scheme, Expense Ratios should receive top priority.

In conclusion, it would be unfair to write a post about Mutual Fund investing and not mention Jack Bogle. In the world of Mutual Funds, Jack Bogle has no peers. Practically anything that anyone writes or innovates in the world of Mutual Fund investing is in some way or another borrowed from what Jack Bogle has said or done. His focus on Fees and Expense Ratios is relentless. Investors will do well to heed his advice. In his words, “In investing you get what you don’t pay for”.

What about Markets?

Moving on to the market action, over the last fortnight, the Bank of England joined other Central Banks with their version of Quantitative Easing. In a sense, analysts (and markets) seem to live from one Central Banker meeting to the next. The Japanese Central Bank always has a policy meet that seems to follow the meeting of the U.S.Federal Reserve. In between the two, we have the European Central Bank and now the Bank of England.

Effectively, what we are witnessing in India and globally is a ‘liquidity-driven-Central-banker-sponsored-rally’. In other words, markets are now completely ‘hooked’ on Central Banker ‘stimulus’. In such a scenario, Central Banker pronouncements, unbeknownst to them, have attained the stature of epiphanies. How much should an asset manager or an investor ‘read into’ Central Banker policy statements and utterances?

On 27 July 2016 Duvvuri Subbarao, the former Governor of the Reserve Bank of India released a book titled Who Moved My Interest Rate?: Leading the Reserve Bank of India Through Five Turbulent Years. The book, it seems talks about what he learned at the helm of India’s Central Bank. I haven’t read the book. However, I did read an extract from a chapter in the book. The extract provides an insight into how we should parse policy statements and utterances of Central Bankers in general. I’ll send you there now; happy reading: The Signal and The Noise.

Superb observations!

SEBI a couple of years ago removed the ability of MFs loading the Intermediary commissions on Investors ie.When you gace MFs Rs10 the MF actually invested 9.50 and gave away .5psto the Agent!!

Thankfully this has been done away with but instead MFs charge ahigher Expense loading on the NAV!!

SEBI needs to work fora more just process.

Thanks for the eye opener.

Unfortunately, nobody asks about Expense Ratios when they invest. SEBI will definitely reduce the cap to 1.50 percent in the near future. Then all the Mutual Fund Schemes will have their Expense Ratios aligned at somewhere between 1.25 to 1.50 percent. Till such time I suppose investors have to exercise due diligence while investing.

Why do you charge Indian investors more than overseas investors?

Inspite , that they will be calling you up at night and ruining your sleep…

I think SEBI is in a better position to answer that, assuming I have understood your comment correctly.

Are mutual funds also invested into by. Larger financial institutions and nbfc’s just to spread their risks or are they primarily small investors domain. Can that be treated as a bench mark also to invest ?

Mutual Fund Schemes are open to everyone, no restrictions unless specified. In the case of Alternative Investment Funds (AIF’s) the ticket size is larger (One Crore). However, Mutual Fund Schemes are primarily for the retail investor. It is tailor made for retail. Retail would include almost everyone including the big fish!