Algorithmic Trading refers to the use of electronic strategies for enhancing the speed and execution of orders on the stock exchange.

What is Algorithmic Trading?

A trading algorithm (ALGO) is a set of rules that are used to enter and exit a trade. Instead of manually entering buy and sell orders, a computer program (Algorithm) is used to trigger the same. For this post, I have used the term ALGO to describe all automated strategies, by whatever name they may be called.

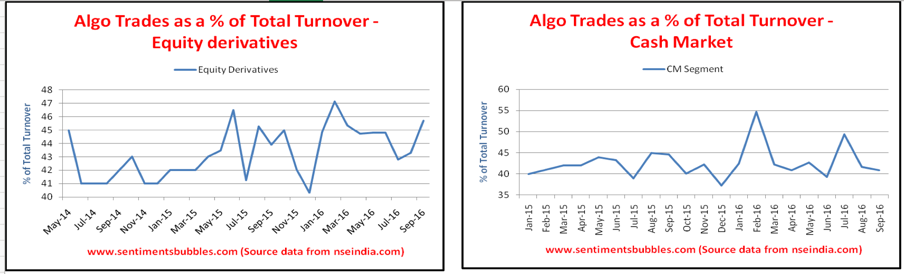

ALGO strategies are fully automated order driven strategies that enable real-time execution without human intervention. Once the ALGO (software program) is started, there is not much that an ALGO trader has to do. It is up to the individual trader when he wants to start the ALGO. As a thumb rule, one may assume that participants kick off (start) the execution of the strategy just before the market opens or immediately after that. The share of ALGO in the turnover metrics of the National Stock Exchange of India (NSE) is shown below:

Algorithmic Trading now forms upward of forty percent of the turnover on the National Stock Exchange of India (NSE). What surprised me was the very high percentage of ALGO trades in the Cash Segment. In any case, the percentage of ALGO trades on Indian bourses is slated to go much higher (than what it is shown above), in the days to come. The Indian Stock Market is referred to as the hottest Emerging Market for ALGO trades.

Implications of Algorithmic Trading

The National Stock Exchange of India (NSE) plans to list its shares on the bourses shortly, maybe as early as January 2017. It does mean that ‘NSE’ as a ticker symbol will attract analyst attention and scrutiny. Needless to say, profitability and growth metrics will be watched closely, every quarter. For the NSE, income is primarily in the form of transaction charges. It follows that the higher the turnover on the exchange, the higher the profitability. Hence, NSE will do ‘whatever it takes’ to boost turnover metrics using the ALGO route. Investors need to be ‘prepared.’ The following might help:

- When we buy or sell a stock, we don’t know who we are buying from or selling to. The counter-party to the trade is invisible, and most of us refer to the counter-party as ‘they.’ It makes the word ‘they,’ the most commonly used pronoun in the stock market. Like so: ‘they bought when we sold,’ ‘they always get out before everyone else,’ etc. As on date, the ‘they’ clearly are the ALGO traders.

- The stock market represents the combined behavior of thousands of human beings responding to information, misinformation and whim. The melange of human emotion in the stock market is one of the factors that drives price discovery. ALGO seems to be removing the element of human emotion from the price discovery mechanism. In that sense, ALGO is a game-changer.

- Algorithmic Trading is a short-term strategy. For the long-term ‘Buy and Hold’ investor, ALGO is of little consequence.

- ALGO strategies are focussed on trying to capture short-term price movements multiple times; it’s all about speed and precision. ALGO’s results in a high trading turnover. However, the profit margins on an individual trade are narrow. The idea is to capture small movements in prices, successfully and repeatedly. Hence, ALGO’s will inevitably lead to higher intra-day volatility.

- Strictly speaking, any trading methodology that is rule-based makes it predictable. Anything that is predictable is vulnerable and game-able; an algorithm can easily be written to execute the strategy. Computers can perform predictable strategies more efficiently than any of us. In my opinion, predictability has made it easier for the short-term guys who use ALGO strategies (to generate Alpha).

- What about those of us who don’t use ALGO, but do use strategies that are predictable or in some way based on a pattern? The bots (software applications that run automated tasks) are now ready to ‘game’ us. In all probability, they have identified the pattern before we have. In other words, generating Alpha in the short-term becomes even more challenging for the non-ALGO guys; something like chess, one has to think several steps ahead. I feel that this is relevant for those who use Technical Analysis for timing trades and also for those who trade Options using spread strategies.

- ALGO’s are fallible, and there are plenty of ways in which ALGO trading can lose a lot of money. The primary Garbage In Garbage Out (GIGO) logic on which computers operate, remains unchanged. When things go wrong, as in the programming or execution of the ALGO, trades get ‘torn up’ and prices can go anywhere.

- It ‘s hard to see how any Algorithmic Trading Strategies can be used with stocks that trade with small volumes. In my opinion, ALGO strategies can be effectively used for stocks that are liquid and readily tradable.

Is the Stock Market Rigged?

Many investor protection forums and similar organizations are increasing their anti-ALGO rhetoric. Some commentators have suggested that ALGO takes the equity out of the equity markets. The argument is that Algorithmic Trading strategies result in an undue advantage to some of the participants. Hence, ALGO results in a rigged marketplace. With an imminent NSE listing, I think investors will be better off embracing ALGO, instead of getting carried away with the rigging rhetoric. My reasoning is as follows:

- It is a fact that Algorithmic Trading Strategies can be misused. It may ultimately lead to a stage where ALGO’s turn out to be counter-productive. For that to happen the existing ALGO turnover will have to double. I think we are still a couple of years away from any such scenario. The fact that ALGO’s can be misused doesn’t mean that markets are rigged.

- The debate about stock markets being rigged was set in motion by the book written by Michael Lewis called Flash Boys. The book focusses on the rise of Algorithmic Trading on the New York Stock Exchange. Needless to say, Algorithmic Trading in India has its roots in similar practices being followed in the U.S. Equity Market.

- I did some research on the history of Stock Exchanges – globally. It so happens that the oldest stock exchange in Asia is the Bombay Stock Exchange (established in 1875) and the oldest one in the world is the Amsterdam Stock Exchange (established in 1602). The biggest stock exchange in the world is the New York Stock Exchange. In any case, Lewis’s book is based on the New York Stock Exchange.

- Wikipedia has it that the Buttonwood Agreement was instrumental in starting the New York Stock Exchange on 17 May 1792. The agreement was signed by twenty-four stock brokers under a Buttonwood tree. The Original Buttonwood Agreement Manuscript reads as follows:

We the Subscribers, Brokers for the Purchase and Sale of the Public Stock, do hereby solemnly promise and pledge ourselves to each other, that we will not buy or sell from this day for any person whatsoever, any kind of Public Stock, at a less rate than one-quarter percent Commission on the Specie value and that we will give preference to each other in our Negotiations. In Testimony whereof we have set our hands this 17th day of May at New York, 1792.

- What Michael Lewis’s ‘Flash Boys,’ seemed to imply is that the Stock Market is being manipulated dishonestly for personal gain. What the Buttonwood Agreement shows is that in any marketplace, there have always been and there will always be some participants who have an unfair advantage over others. Investors who are convinced that the Stock Market is rigged need to remember that it started off rigged – in the first place!

‘I think investors will be better off embracing ALGO, instead of getting carried away with the rigging rhetoric.’

–> How to embrace ALGO?

This link might help http://www.business-standard.com/article/markets/now-algorithm-based-trading-apps-for-retail-investors-115071600968_1.html

I wouldn’t recommend it unless the investor is trading blindly. In case one is studied or wants to follow rules, a deep understanding of the logic is necessary before one starts coding. So for eg., a deep understanding of Technical Analysis would be necessary. Once one has that, coding comes next and then the execution – necessarily in that order.

Excellent article!!

Thanks and Do Share the post.

Yashodhan

Yes, algorithm trading is going to be a part of life. But they can be fallible because all said and done, an algo is the result of some human’s thought process. If there is a flaw in their logic, the algo is bound to fail. Secondly, not all algos are same, so while one may trigger a ‘buy’ signal, another may trigger a ‘sell’ signal. in the end, i think it will all even out.

And yes, long term investors have nothing to worry about.

Regards

Shailesh

True, the ALGO is written by a human and only be as good or as bad as the person coding it. ALGO’s may not even out in a one-directional market. They would accentuate the move either way.