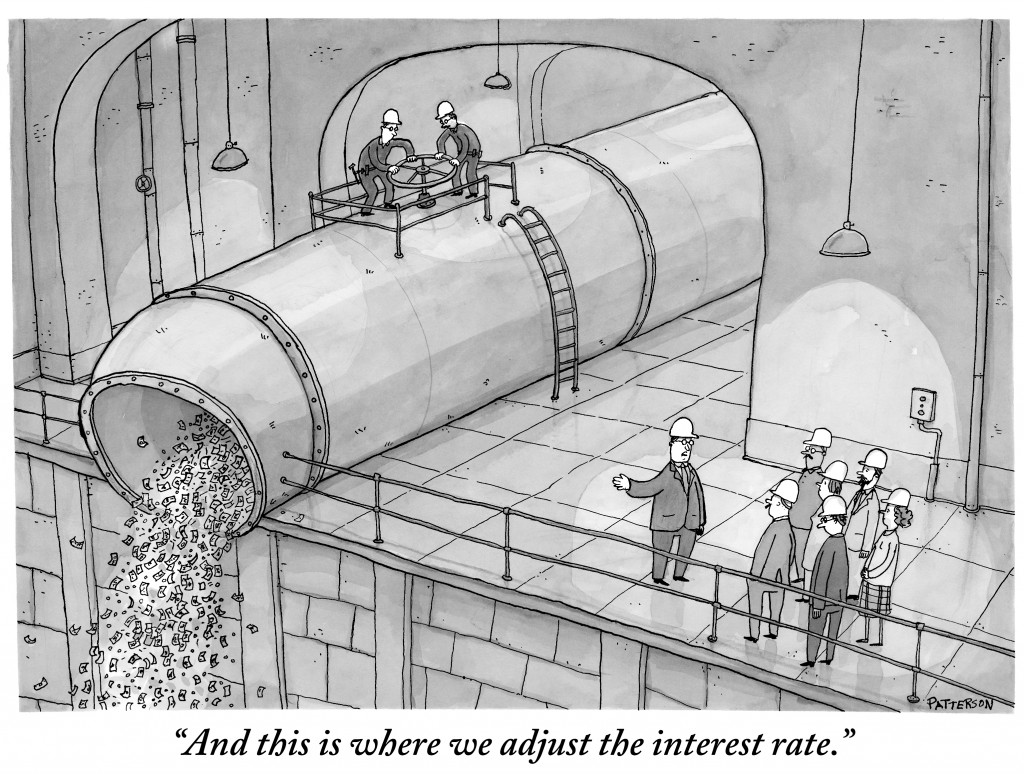

(Credit:James Patterson,The New Yorker Collection/The Cartoon Bank)

FII flows and the bull market

I had said in one of my earlier posts that Foreign Institutional Investor (FII) inflows are the single largest determinant of market direction. It follows that flows are dependent upon the U.S. Federal Reserve (Fed). In May 2013 the Fed announced that it will start tapering its Quantitative Easing (QE) program and what happened is history. So what happens when the taper is done with in October 2014. Common sense suggests that the Fed taper is discounted. The markets generally discount all known events and the reaction to the announcement of the taper is done with. However, fears persist over the aftermath of such an event, and the thought of interest rates in the U.S. moving upwards does cause considerable consternation. Since India is a ‘Emerging Market’ (EM) the implications of an imminent hike in interest rates in the U.S. are mixed :

-

Growth conditions are improving and

-

There is a perception that liquidity is likely to deteriorate (FII inflows)

The history of QE

This the third round of Quantitative Easing (QE 3) that is coming to an end this October. The table below shows the Nifty levels and exchange rate at the beginning and end of QE 1, QE 2 and QE 3.

| START DATE | NIFTY | RE V/S $ | END DATE | NIFTY | RE V/S $ | |

| QE1 | Nov-08 | 3043.85 | 50.10 | Jun-10 | 5312.50 | 46.63 |

| QE2 | Nov-10 | 6117.55 | 45.99 | Jun-11 | 5647.40 | 44.76 |

| QE3 | Sep-12 | 5703.30 | 52.71 | Oct-14 | ???? | ???? |

-

When QE 1 ended, I think the market had guessed that QE 2 was coming, so it just kept going up.

- When QE 2 was on going, the Nifty actually went down. This was due to 2G scams, mining scam and other local issues.

- In the case of QE 3, the market went nowhere right till Nov 2013, when it got a whiff of an impending BJP victory in the Delhi assembly elections. The actual move is from March 2014 and liquidity has helped fuel the rally so far.

- The data does show some correlation between the Nifty and QE, but it is not as significant as is being made out to be. In fact, during the last bull run from 2003-2008 there was no QE.

- QE 3 is unique, in the sense that the Rupee has depreciated sharply during the time it has been running. This is in sharp contrast to QE 1 and QE 2, when the Rupee appreciated. The rupee depreciation can be attributed to weak economic growth and the fiscal deficit.

- Most of the selling has been in the debt segment, resulting in sharp rupee depreciation. This has been the feature in every year since the calendar year 2011, and not only in 2013. The FII’ s have been net buyers in the equity segment for all calendar years from 2012 onward.

Rate Hike in the U.S.

In any case, the taper terror has played out last year. The market has already discounted it. Hence, even though there is an ongoing taper, the market continues to witness strong FII flows. It is true that EM have been beneficiaries of the low bond yields in the developed world. The ‘search for yield’ has ensured that Indian debt has been lapped up. The subject matter of the debate has now shifted to a hike in interest rates in the U.S. This, it seems, is likely to result in a run on our debt market. Contrary to this, as recently as 20th August, 2014, the FII’s poured a record amount of money into government bonds (see here). The following points are worth mentioning:

- The quantum of the hike that is expected is 0.25 % or 25 basis points. In my opinion, this is discounted. The rate hike is expected to move in a band 0-.25% to start with, and there will be full disclosure of further hikes in advance, so there is nothing to get so scared about.

- The other part is the timing of the hike. It appears from the commentary, that the U.S. Federal reserve will be in no hurry to hike rates, lest it imperils their economic recovery.The majority of the pundits expect interest rates to shoot up once the American economy takes off. However, in reality interest rates can stay low for a considerable period of time. This is more likely because it is least expected. Markets will always move in the direction that causes the greatest amount of pain to the largest number of investors.

- The money spigot is unlikely to be remain open for very long, but what about the money that is already in the system?

- There is a strong rumour of an upgrade by the rating agencies (see here). This makes a run on the debt market less likely.

- The other factor to be considered, and which no one is talking about is the quantum of FDI. The data thus far, in the current calendar year, shows an increase in the FDI flows in to the country. These can act as a balancing factor in case there is a run on the debt. So, even in case there is a run on the debt market, the FDI flows will act as a cushion. Again FDI is serious investments and not hot money (like FII).

- There are very visible signs that the economy is poised for growth. (See the four Bloomberg graphics here). If the economic recovery shown is real, then interest rates in the U.S. should not be a worry. Why? In the period from 2003 to 2008 the interest rates in the U.S. were in the region of 1 % to 4 % (compared to the current almost 0 %). The inflation high/low in the U.S. was 4.1 % and .1 % (compared to the current 2%). In spite of this, Indian markets hit new highs. The reason was that the Indian economy was growing. So, I think investors must focus on the economic recovery and nothing else. FII’s look for growth and that is all that matters. In case there is growth, the money will continue to flow. This is amply displayed in the statistics above. How? During the course of QE 3 the Rupee has depreciated and the market has not gone anywhere, despite buoyant liquidity. The reason for this is the de-growth in the Indian economy during QE 3.

- There is another very important point with regard to guessing the quantum of flows. The people who manage the fund flow are human after all, they are susceptible to irrational behaviour, just like you and me. Just like us, they too chase momentum. In other word funds follow performance, not value. The Indian market has been the best performer among the BRICS pack in the current calendar year, you can read more about it here. It follows that funds will flock to India and flows will exceed even the most optimistic of expectations.

Conclusion

If one looks at the historical evidence there have been three instances when the Fed has hiked rates, 1986, 1994 and 2004. In each case EM equities declined in anticipation of the hike and outperformed once the hikes were implemented. As per current expectations, the Fed is expected to start hiking rates by the mid of 2015 (earliest). This is pure guesswork, it could be later. In such a scenario the market is likely to take a view on this only after the end of the current calendar year, not before that. The question of FII inflows has always been a matter of conjecture, it is not new. The fact is that no one knows what will happen, so everybody is guessing, and that is a dangerous game to play especially when it comes to the stock market. I would base my decisions on what is known, that interest rates in the U.S. will stay low for a considerable period of time, that the Indian economy is due for a cyclical rebound and that the FDI (as opposed to FII) figures are on an upswing. In any case, all of the above and much more is known to the FII’s who are pouring money into our markets. They are convinced that Narendra Modi is the ‘Rajnikant’ of the Indian capital markets, so am I, are you?

You are right, I try and stick to the ‘Khare’ part.

Mr Khare,

Your writings are v Khare khare( true) like your surname. Bolder than Rajnikant….

I agree with you fully. FII money will keep on coming in to equities inspite of the hawkish stance of the Janet’s of the world, simply for the reason that our economy looks poised for a big recovery due to a vary stable govt (modi magic).

There may be redemptions in debt by FIIs. One needs to see the net tally is by the fall n Christmas , ie whether there are net inflows or outflows.

CAD figures are v dependant on them. Oil will surely help it keeping lower.

Any further clarity on reforms by year end coupled with result of States elections ( in BJPs favour will help in Rajyasabha) will lead to further rally in equities due to both growth in earnings as well as expansion in PE multiples.

If look at the holdings of top 200 plus leading companies, is v clear that FII holdings are going up every year and holdings by general public are going down. This phenomena has its fruits in a bull mkt and very poisoned thorns when the mats will reach the top of the growth cycles of major sectors.

The beauty(or the beast) is that reaching of the top of the mots is a very fluidic situation, where human interface plays a lot of role than figures. Let’s hope for the best of our country n pray for it, simultaneously keep on finding good quality stocks so as not to become the operators prey.

Thanks Jayant

Well studied & written, I agree with the views. KEEP WRITING.