(Source: www.shutterstock.com/cartoonresource)

Value investing is a strategy wherein the concept of growth is automatically ingrained into the calculation of value. The worldwide ‘search for economic growth’ seems futile. It does seem that value investing is on the verge of making a ‘comeback’.

What is Value Investing?

From an investment standpoint value investing would mean buying stocks of a company that meets the following criteria:

- The products of the company are such that they will continue to be in demand in the foreseeable future. This automatically reduces the number of stocks available to those which have a strong brand name and a demographic dividend.

- The company stock price should be ‘cheap’. Benjamin Graham, the father of Value Investing, defined ‘cheap’ to mean buying assets at a discount to their intrinsic value. Graham did not differentiate assets on the basis of ‘quality’.

- Charlie Munger has redefined what can be considered as ‘cheap’ from a value investing perspective. According to Munger, ‘cheap’ from a value investing perspective means buying assets that are at a discount to the ‘quality’ of the business. Munger looks at the management of the company and the business model to ascertain quality. Hence, one has to look at both, intrinsic value and quality. In other words, value investing has evolved to mean that one cannot own any bad businesses, however compelling the valuation.

- In a nutshell, value investing would mean buying stocks of high-quality businesses with good managements at ‘relatively cheap’ valuations.

Value Investing – Why?

The uncertainty over U.S. interest rates in now poised to continue. Market upheavals like the ones we are currently witnessing always result in tectonic shifts in the incumbent investment theme. What should be a sensible investing strategy in such a scenario? With this in mind, consider the following:

-

Even though an interest rate rise in the U.S. has been kept on hold, some day interest rates in the U.S. will rise. When, nobody knows. Markets will discount a rising rate scenario before any actual increase takes place. Hitherto, stocks with growth narratives have been commanding premium valuations. In the changed scenario, everything that worked because of money printing should reverse course. To me, a shift from growth to value seems imminent.

-

Subsequent to the Fed meeting, the ‘bad news is good news, and the good news is even better’ spiral appears to be have been decisively broken. The tendency of investors to chase past returns ensures that not enough investors are willing to get off this ‘bad news is good news’ trade. At least, not as yet. In investing, the best time to chase performance is when there isn’t any, not when it is underway. Value stocks have underperformed growth stocks since the last couple of years. It does present an opportunity for the long-term investor.

-

In the mutual fund universe for every value fund, there are roughly eight growth funds. 1:8, that’s the growth funds: value funds ratio. Money managers who have a ‘show me the money’ mandate cannot whole-heartedly embrace value investing. As a consequence, growth funds always outnumber value funds in the mutual fund universe. This is a worldwide phenomenon. It does result in ‘growth’ becoming a ‘crowded’ trade in today’s scenario.

Value Investing – How?

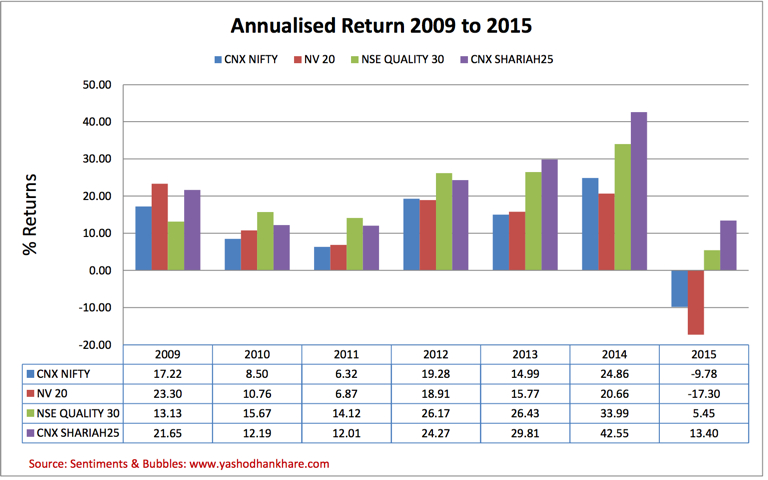

The next question is where does value lie? What screeners must a value investor use? Most importantly, what are the historical returns of value investing? To find out, I computed the annualized returns for the following three indices that are constructed and disseminated by the National Stock Exchange (NSE).

1. The NV20 index (Click here to read). The NV20 index reflects the performance of a diversified set of twenty value companies forming part of the CNX Nifty index.

2. The NSE Quality 30 index (Click here to read). Charlie Munger’s definition of value investing talks about ‘quality’. The NSE Quality 30 index comprises thirty quality stocks that have a durable business model and sustained growth.

3. The CNX Shariah25 index (Click here to read). The CNX Shariah25 index offers investors Shariah-compliant investment solutions. It comprises of twenty-five Shariah-compliant companies. Shariah-compliant investing is a value investing strategy. It is used to screen companies whose businesses comply with Islam as a religion. Shariah investing considers the following businesses as ‘unacceptable’ for investment:

-

Banks, insurance companies, finance and investment companies including stock broking.

- Production, sale and marketing of non-Halal food and beverages such as Pork, Alcohol, Tobacco and such other items.

- Production or distribution of films and media flouting vulgarity and promiscuity.

- Hotels and restaurants that provide non-Halal products.

-

Companies engaged in the businesses of gambling, narcotic drugs, arms, ammunition, and weapons.

The annualized returns of the three indices mentioned above and their comparison with the benchmark are shown in the image below. (Period: 01 January 2009 to 25 September 2015).

(click on the image to embiggen)

The key takeaways from the image above are:

- The NSE Quality and CNX Shariah25 indices have outperformed the benchmark comfortably in all the years from the calendar year 2009. They continue to do so in the current year as well. I was surprised with the quantum of outperformance and the consistency. (The base date for the NSE Quality 30 index is 1st October 2009. Hence, for the NSE Quality 30 index, data for the year 2009 is not comparable).

- Shariah-compliant investing appears to be a big winner. In the image above the CNX Shariah25 is the best performing index. One doesn’t have to be a Muslim to embrace Shariah-compliant investing. In fact, most of the non-Muslim world has taken to Shariah-compliant investing in a big way.

- In four of the last six years, the NV20 index has outperformed the benchmark. In the current year, the NV20 index is the trailing the benchmark. The gap between the NV20 index and the other three indices has never been this wide in the last six years. It does not mean that the gap can’t widen further. It does mean that value investing is being ignored in the search for growth.

Value investing – Caveats

The advantage of using value investing as an investment strategy is that even if you make a mistake as regards timing, as long as you stick to quality, it would not matter. In the long-term, value investing works. The caveats to a value investing strategy are:

- Value investing comes with extensive periods of under-performance. Investors who cannot accept investing underperformance in the short-term should stay away from value investing. In other words, value investing is about ‘absolute performance’ in the long-term and not about ‘relative performance’ in the short-term.

- Long-term in value investing can safely be defined as three years. Hence, ‘waiting’ is the hardest part of a value investing strategy. When the ‘value’ will be realized is anybody’s guess.

- Since value is hard to quantify, value traps are common. The ‘value’ in value investing is never a fixed number. With technology being what it is, businesses and economies have too many moving parts. As a result, perceptions of value do tend to change over time. Hence, rebalancing is an essential component of any value investing strategy.

Conclusion

The index seems to be doing a bungee jump on almost every trading day. This does make it very difficult to take an investment decision, leave alone deciding on which stock or sector. Most investors seem to be confused as to whether they should be investing in stocks in the first place. In a schizophrenic market environment, the following pointers might help in arriving at an investment decision:

- While looking at market returns and setting expectations, one must remember that annualized returns from investing in stocks are always non-linear. Markets don’t go up all the time. Stock prices are fallible. It follows that returns from investing in the stock market don’t necessarily follow a straight line that always points upwards.

- Indian equities continue to be treated as ‘untouchable’ by Foreign Institutional Investors (FII’s). Nobody believes the Indian government’s growth numbers. The cocktail of subdued economic growth, relatively high valuations, and lagging reform is considered ‘toxic’ by most FII’s. Is this the ‘new normal’. Nobody knows. In such a scenario, making short-term predictions on market direction is neither possible nor is it necessary.

- Value investing works because in the long-term stock prices tend to reflect the underlying value of the corporation. Someone has rightly said; ‘Value investing is a pretty good thing to have as part of your portfolio, but it does not always work because nothing does.’

Your data period is too short to make any comments/conclusions about any of the mentioned indices. 6 years is hardly a period to come to any conclusions. I really wonder , why you chose this specific period from 2009-2015.

Like I have mentioned in the post, for the NSE Quality 30 index the base date is 01 Oct 2009. In the case of the other two indices, the base date is 01 Jan 2009. Why should six years be short? In fact, the Nifty has moved only from Sep 2013.

Yashodahan

Again, a thought provoking article. Interesting to note about the Shariah Index – did not even know such an index or concept exists.

I think the article would have been complete if you mentioned a few companies that fulfill all these parameters. In other words, if you had mentioned a few stocks to buy.

Shailesh

The stocks would be from the three indices mentioned. Thanks for the suggestion, all the same.

Went there. No real clues. Can you not narrow it down to three or four?

Shailesh