(Cartoonist: Aaron Bacall; Cartoonstock.com)

Timing the market is popularly used by all of us in our attempt to buy low and sell high. How easy is it to time the market?

Timing the Market

Most of the investment gurus preach that time in the markets ought to take precedence over timing the market. Despite this the temptation to time markets is irresistible. I’ll get to the timing techniques in just a bit, before that it is necessary to clarify the following:

-

Markets are not rule-based; they are pretty much random. None of us want to be invested in equities at the wrong time. Since almost everyone is investing for the short term, the importance of timing is accentuated.

- There are two legs to every trade; buy and sell, though not necessarily in that order. It follows that timing a trade would involve timing both the legs. In other words, timing any trade involves calling correct twice.

- In my opinion, the first leg of any trade is comparatively easier to time. The reason is that the second leg is the exit trade. We’re either booking a profit or a loss. Most of us find it difficult to exit a losing trade. Greed prevents us from booking profits in a winning one. At all times the fear that the stock in question will reverse course as soon as we act remains.

Advance Decline Line as a Timing tool

Many techniques are used to time trades. As on date forecasting techniques, based on astrology, derivatives and technical and charting tools are popular. In my opinion, any timing technique that involves complex calculations and assumptions is strictly avoidable.

One of the most simplistic timing tools is the Advance-Decline (AD) line. The AD line plots changes in the value of the advance-decline index. What is the AD line and how is it computed? Very briefly:

- On any trading day, of the smorgasbord of listed stocks, some are advancing and some are declining. The number of advancing and declining ‘issues’ is updated live on the website of the National Stock Exchange of India (NSE). The information on the website shows the number of advances and declines in each of the respective sectoral indices and the Nifty. The total number of advances and declines on the exchange is not shown separately on the NSE website.

- For the purpose of plotting the AD line, all the listed stocks are considered. Net Advances for a day would show the total number of advancing stocks less the total number of declining stocks.

-

Net advances will be positive if the number of advancing issues is greater than the number of declining issues, else it would be negative.

-

The AD line is a measure of Net Advances plotted on a daily basis.

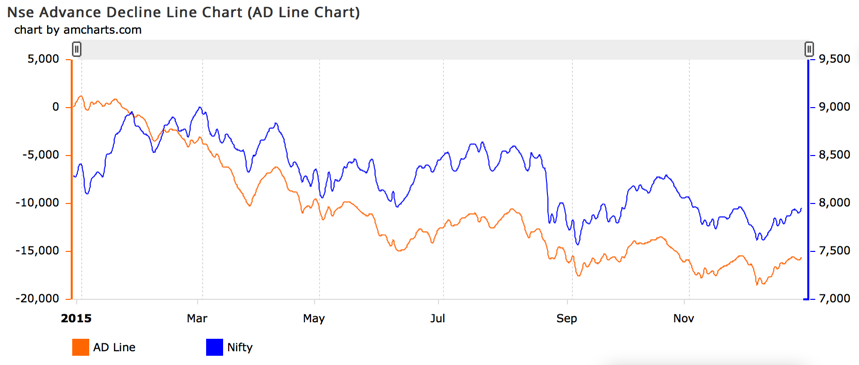

The AD line at the close of trading on 01 Jan 2016 looks like this:

(Source: TradersCockpit)

The AD line is a very useful timing tool. While drawing inferences from the image above one needs to remember that:

- There are approximately 1700 stocks that are currently listed on the NSE. Of these, the image above shows advances and declines plotted for roughly 1400 stocks. The remaining stocks are considered as illiquid or not frequently traded. Hence, they have been ignored for the computation.

- The AD line has been plotted against the benchmark in the image above. In this way, it is possible to compare the two. The AD line measures the degree of participation in an advance or decline.

- The slope of the AD line must be positively correlated with that of the benchmark. The logic is that any advance or decline in the benchmark must be mirrored by a corresponding advance or decline in the market as a whole. The AD line shows whether or not a move in the benchmark is being duplicated across all the listed stocks on the exchange. Hence, the AD line is called a breadth indicator.

- A rising AD line accompanied by a rising benchmark shows strong participation and is considered bullish. Needless to say, the converse is bearish. Any divergence between the slope of the AD line and the slope of the benchmark would signal a change in participation.

- In the image above a divergence between the AD line and the benchmark is clearly visible in March 2015. The benchmark was rising and made an all-time high; however the AD line was trending lower. It clearly indicated that participation was declining. The inevitable correction followed. With the benefit of hindsight, one can easily conclude that in March 2015, while ‘we’ were buying ‘they’ were selling. ‘They’ always seem to be blessed with such clairvoyance whereas ‘we’ are devoid of it!

- Divergences between the AD line and the benchmark can continue for prolonged periods. One cannot time the fallout of any such divergence. However, divergences do raise a red flag and signal caution.

-

The correlation between the AD line and the benchmark is important, not the absolute values. The AD line reflects participation and ignores everything else. It is said that ‘a rising tide raises all boats’; the AD line alludes to the tide.

Does Market Timing lead to ‘Cash Addiction’?

Once you’ve pulled the trigger and decided to ‘cash out’, it means you are trying to time the market. Inadvertently this has the following consequences:

- Even if the market drops, it becomes difficult to get back in. The reason is that our perceptions of risk keep changing all the time. The lower the price drops, the higher is the fear, and the greater is the risk aversion.

- If the market continues to move upwards, most of us end up attempting a ‘recovery trade’. Things start getting pretty complicated from here onwards.

When markets go up, all of us wait for a correction. When markets go down, we want them to fall further. As a result, many investors end up holding on to disproportionate amounts of cash. Large quantities of cash, much beyond what one would need in times of emergency, does result in:

-

Cash being converted from an asset into an investment. Cash as an investment yields negative returns.

-

Effectively, obsession with market timing is a gateway to cash addiction.

This does not mean that one should be fully invested at all times. Is there a way out? The SIP’s or Systematic Investment Plans, have become very popular over the last couple of years. In fact, the commentary is that the Indian Equity market has got ‘saved’ from the onslaught of Foreign Institutional Investor selling due to the humongous SIP contributions of Indian retail investors. Undoubtedly, SIP’s are the best way to time the markets. However:

- The crux is how long Indian retail investors persist with their respective SIP allocations. Needless to say, that ‘staying the course’ and not bailing out of SIP’s ought to qualify as a prudent strategy. In fact, in sideways markets, like the one we are in, SIP’s are a blessing in disguise for retail investors.

- There is a tendency among investors to time their allocation to SIP’s. The reason is that most of the SIP products have failed to deliver commensurate returns over the last fifteen months. This attempt at timing SIP’s leads to investor returns trailing those of the scheme or fund that they have chosen to invest in. Hence, this gap between fund returns and investor returns is popularly called the ‘behaviour gap’.

- Whether SIP contributions made by Indian retail investors have ‘saved the Indian equity market’ is irrelevant. A more pertinent question would be: Would SIP’s deliver market commensurate returns to the Indian retail investor? I wouldn’t want to belabour this point; suffice to say that, in my opinion, an Exchange Traded Fund (ETF) mirroring the benchmark is the safest way of minimising the ‘behaviour gap’.

Timing the Market or Time in the Market?

How important is market Timing? Irrespective of our view (bullish or bearish) the tendency to time the markets is ubiquitous. Most of us are convinced that market timing is the vector that we need to game the system. Whatever timing device you may choose, in my opinion, time in the market takes precedence over timing the market. The reasons are:

- Market timing based on events is tricky. If you guess correctly about the outcome of an event, the challenge of predicting market direction remains. You seldom get both correct i.e. your prediction of the event and your prediction of the markets reaction to the event.

- Market timing ensures that we cross over from the passive investing camp to the active one. Active investing is for professionals not for us. In any case, over the long term, passive investors achieve higher returns, as compared to those with an active mindset.

- Many of us sit out of markets for long periods, waiting for the perfect entry point. It does result in losing out on our single most precious asset, which is time. Effectively, in the investing game, time is a better ally as compared to timing. Market timing does result in mindless trading and that’s why it is said: “Don’t just do something, sit there”.