(Cartoonist: Mark Lynch; jantoo.com) (Sunday, 28 August 2016)

Stock buybacks or repurchases by companies of their floating stock is a relatively new concept in the Indian Stock Market. Of late buybacks seem to be gaining traction.

Types of Buybacks

When and how can Indian Corporates buyback their shares? The Securities and Exchanges Board of India (SEBI) has issued guidelines for governing buyback of shares by Indian Corporates. Broadly, there are two types of buybacks:

- From the existing security holders on a proportionate basis through the tender offer;

- From the open market through (a) book building process, (b) stock exchange and (c) from odd-lot holders.

Buyback Basics

What we as investors ought to be looking for in a buyback is a company run by a shareholder-oriented management and an undervalued stock price. Before I get into the Good, Bad and Ugly connotations of any buyback, the following pointers might be useful:

- A stock buyback is a capital allocation decision for any business. Promoters have a controlling stake in the enterprise. It is they who decide how corporate cash is spent and distributed. Minority shareholders (you and me), will typically only receive cash via dividends and see their ownership stakes increased via share buybacks.

- Often companies that are flush with cash use the same for an unrelated diversification, mergers, and acquisitions. More often than not, these destroy shareholder value. In such cases buying back stock trading at cheap valuations makes sense.

- Value is a critical component while evaluating the buyback strategy of any corporate. Hence, a stock repurchase or buyback would be considered prudent when significant discrepancies exist between the market price of the stock and the intrinsic value of the business.

Buybacks: The Good

I think that a ‘good buyback’ would be one that increases shareholder value, and is considered bullish for the following reasons:

- A prudent buyback policy demonstrates that (a) the Promoters find the current market price of their stock as too low or below its intrinsic value and (b) the Promoters don’t have a better utility for the excess cash that the business is generating.

- Buybacks conducted in cases where the current market price of the stock is trading below its intrinsic value leads to higher estimates of the future earnings potential of the business. As a result, share prices of such companies tend to align with their intrinsic value in the long term.

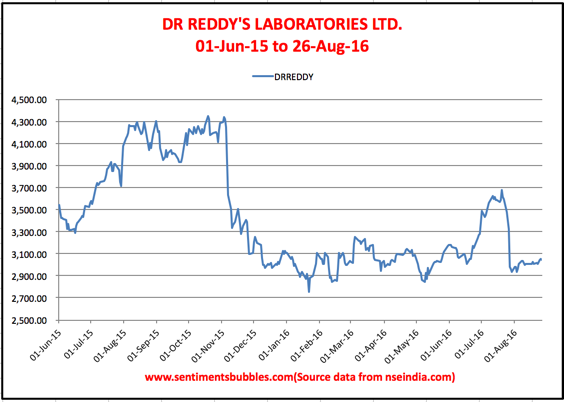

Dr. Reddy’s Laboratories Ltd just completed a buyback that seems to check all the boxes.

Buybacks: The Bad

Under the existing provisions, SEBI allows stock repurchases through a tender offer process. Promoters of companies are allowed to offer their shares in such a buyback once their intention to do so have been disclosed in the offer document. In my opinion, tender offer buybacks are bad. The reasons are:

- More often than not, tender offers for buyback of shares are at a premium to the current market price. By participating in a tender offer, Promoters seem to be inadvertently signaling that the price offered is above intrinsic value.

- Share repurchases of an underpriced stock ought to enhance value in the hands of the continuing shareholders. For eg., if the intrinsic value of a share is Rs.100 and one gets to purchase it in the market at Rs. 50, share repurchases make sense. However, in the case of buybacks conducted via the tender offer route, the reverse seems to be happening. Inadvertently, ‘tender offer buybacks’ destroy shareholder value in the hands of the continuing shareholders. I don’t see any reason to own such businesses.

In my opinion, the tender offer route is an Indian innovation and meant specifically to enable the government to meet its divestment agenda. Nothing stops Corporate India from using the tender offer route. Recently Wipro Ltd completed a stock buyback using this route. To be fair, the pre and post Promoter shareholding pattern of WIPRO shows little by way of change. However, the Indian information technology sector is under a cloud (pun intended). The market isn’t impressed., that can be seen in the image below:

Buybacks: The Ugly

If Stock Buybacks fail to reduce the number of shares that are outstanding, I think it is insidious. In many cases, it may be due to new shares issued to employees at discounted prices. Shares sold at a discounted price to employees dilute value in the hands of existing shareholders. I would classify a buyback as ugly when both the conditions are satisfied; it is conducted at a premium to the market price (via the tender offer route) and is accompanied by fresh share issuance at discounted prices. In such cases, buybacks are a sleight of hand.

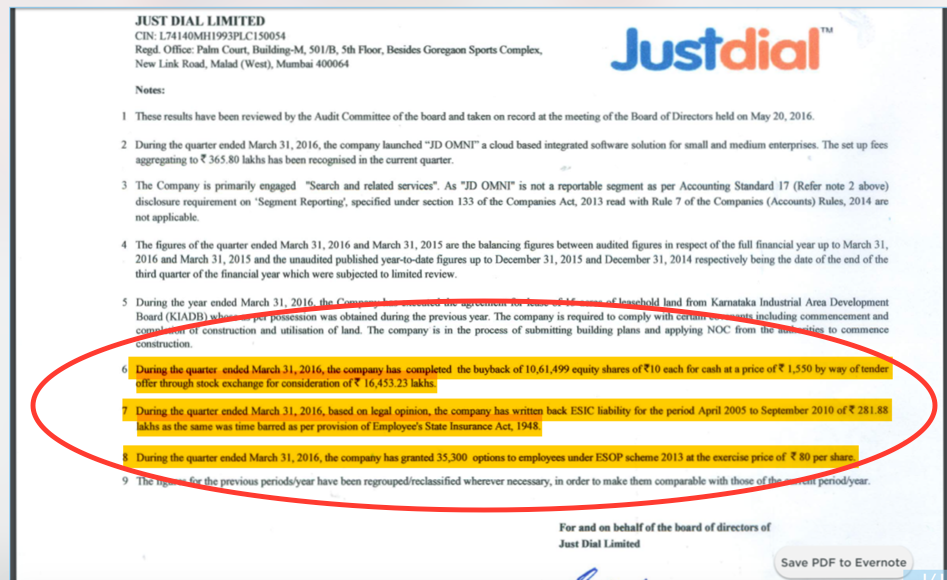

The Promoters of Just Dial Ltd recently completed a buyback that, in my opinion, checks all the boxes of an ugly buyback. Why do I categorize it as ‘ugly’? The reasons are:

- The Buyback was conducted via the tender route and the Promoter group participated in the buyback. JUSTDIAL repurchased shares at a price of Rs. 1550 per share through the tender offer process. At the time the buyback was announced the share price was Rs. 551. In other words, a portion of the floating stock was bought back at a huge premium to the prevailing market price. Click here to read.

- The Buyback process was completed on 10 March 2016. JUSTDIAL proceeded to issue 42365 new shares in the quarter ended 31 March 2016. Of these, 35300 shares were under their Employee Stock Options Scheme. What price do you think the issuance took place? Take a look:

(Click on the image to enlarge) (Source: Justdial Quarterly Financials)

- Effectively, the Promoters of JUSTDIAL repurchased shares at a huge premium to the prevailing market price. They then proceeded to make a fresh share issuance at an abnormally low price. Investors who continue to hold shares of JUSTDIAL end up paying for this ‘buy high and sell low’ operation. I am only trying to highlight how an ugly buyback can destroy shareholder value. The number of shares bought back and any other attendant questions that such a buyback raises are, in my opinion, irrelevant.

Warren Buffett defines the role of corporate managers as stewards of shareholder capital, and the shareholders are the suppliers and owners of such capital. According to Buffett, the best managers think like owners in making business decisions – they have shareholder interests at heart. The point is, have the Promoters of JUSTDIAL been good stewards?

I think that with equity dividends now becoming taxable, share repurchases by Corporate India will gather steam in the days to come. We will undoubtedly see all kinds – the good ones, the bad ones and the ugly ones. In such a scenario, it is high time that investors elevate stewardship to its rightful place in the pantheon of factors to be considered while making investment decisions.

(Disclosure: I am neither short nor long in any of the names mentioned in this post. Nothing contained in this post should be construed as a Buy, Hold or Sell recommendation).

Markets Diary

Shifting gears to the market action, money managers were glued to what Janet Yellen had to say in her speech over the weekend. In her speech, she seemed to be asking global markets to ‘prepare for a rate hike.’ Come to think of it; she couldn’t have said, ‘have a party, there are no hikes on the horizon.’ In that sense, she stuck to the script.

Why is her speech so important? The reason is that Emerging Markets in general and the Indian market (and the Indian Rupee) in particular have historically been hydraulic in nature; inflating when the Foreign Institutional Investors pump in dollars and falling when they decide to pull them out. In a nutshell, ‘following the flow of money’ is a strategy. Forecasting and market analysis now seems to be concentrated on determining which way the money will flow.

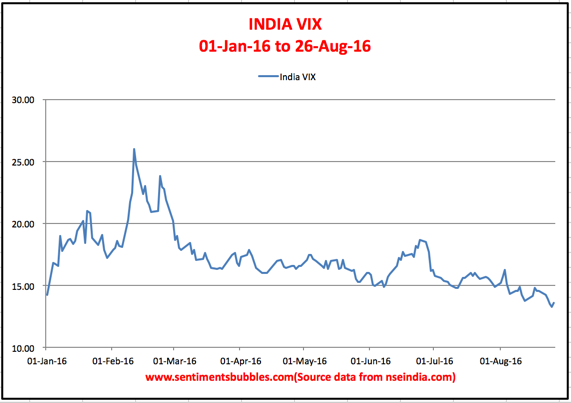

Volatility has been low, over the last couple of weeks. However, Volatility is not predictive of market direction and most important of all, who says the VIX can’t go lower? As the VIX makes new yearly lows, markets have been stuck within a tight sideways range. For market denizens, who always need something to worry about, things are boring. As a result, the temptation to cash out or go short is almost irresistible. For all those who might consider succumbing, just remember the aphorism; Never short a dull market.

Another studious article, nicely written.

Coal India, Nalco may be the latest examples of real buy back. In the issues like Sun Pharma the real intention may be to save on dividend tax imposed on the promoters receiving more than Rs. 10 lacs, as dividend. As you rightly said the buy back offer of Sun is for 75 lac shares when company is having 240 crore shares!

Still in my view Sun Pharma and Dr. Reddy’s will be good stocks to bet, with a long term perspective.

Thanks. Quantum of buybacks is still low. Nobody is interested in the long-term!

Hello Sir,

I always enjoy reading sentiments & bubbles every week. You pointed out several things that i will remember for years to come. Looking forward to read your next newsletter.

Thank you for your thorough research & clear writing

Thanks

Yashodhan

A very insightful article. It cleared my doubts about why some companies opt for buyback, even if their market cap is very low in the first place.

Thanks!

Shailesh

Thanks

You missed out Buyback for treasury operations..like Reliance ..

I am unable to understand the comment. Could you elucidate