As we head into the month of May, we are bound to hear the calls for ‘Sell in May and Go Away’. I decided to revisit the ‘sell in May’ syndrome for this post.

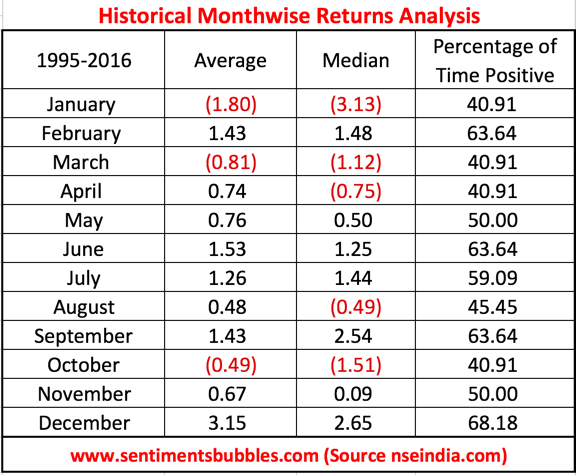

Should we sell in May 2017 or should we just hold and do nothing? While trying to answer this question, what I have done is to look at the seasonality. How does ‘sell in May’ look like historically? The month-wise seasonality for the Indian Stock Market from 1995 till date is shown below. It is apparent that the month of May tends to give positive returns fifty percent of the time. In other words, trying to ’time’ May has the same probability as the toss of a coin.

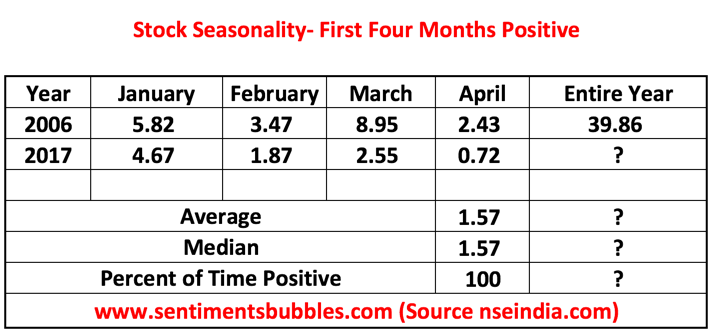

In the current year, we face a slightly different predicament. The current year is the only calendar year since 2006 that the Nifty has given positive monthly returns for the first four months of the calendar year, as can be seen in the image below:

The cumulative up move for the first four months of 2006 was 25.45 percent. As against this, in the current year, we have had an up move of 13.75 percent. The magnitude in percentage terms isn’t indicative; the lower base in 2006 leads to a higher percentage. In absolute terms, the Nifty had an up move of 721.65 points in 2006 and of 1124.55 points in 2017. Continuing with the seasonality and the comparison with 2006, May 2006 saw a Nifty correction of 14.82 percent. It also happens to be the fourth largest monthly correction in the history of the Indian Stock Market.

I am not suggesting that something similar will happen in the current year. The fact of the matter is that, if one were to look at the data from 1995 onwards, it has never been the case that the first five months of the year have been positive. In markets, one ‘never says never’, I know that. May 2017 may well end up giving positive returns and set a record of some kind. However, from a probabilistic point of view, the odds that the Nifty will provide positive monthly returns in May 2017 are small.

In the stock market, thinking long-term is what is preached and rightly so. The reality is a bit nuanced. The nature of the beast (the stock market) is such that most of us tend to trade in the short-term as well. Hence, to address the ‘sell in May and go away’ conundrum, I have twisted the analysis and asked the question, ‘what to sell?’ instead. While trying to decide on what to sell, what I have done is to look at the sector-wise returns.

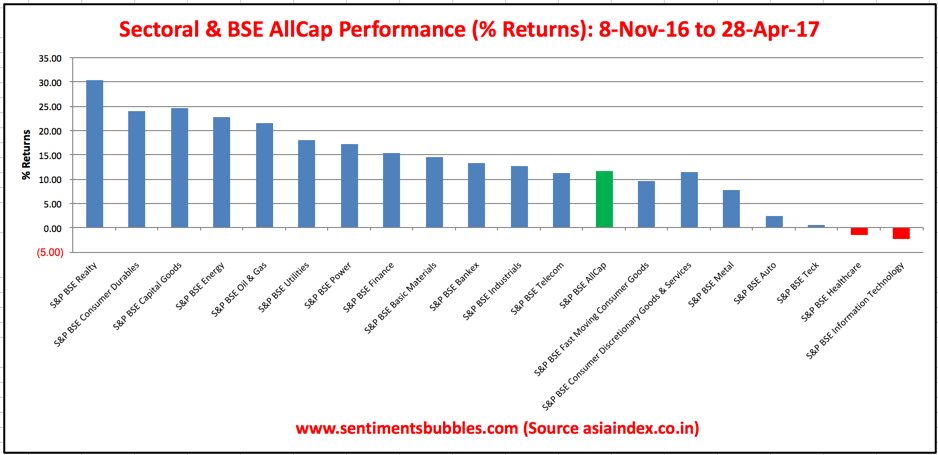

There has been an 180-degree shift in the investor sentiment from the demonetization announcement (8 November 2016) and till date. It would be safe to say that, the 8th of November 2016 represented the nadir regarding the sentiment indices. Hence, I have computed the sector-wise returns from 8 November 2016 till date; they look like this:

While investing in the stock market, everyone wants to buy low and sell high. What we end up doing is to buy high and try to sell even higher. Buying high and trying to sell higher, does tend to work; until it stops working! In any case, from a risk-reward perspective, it makes sense to buy the unloved. From the image above, it is clear that currently Health Care and Information Technology are the most unloved sectors. Is there a buying opportunity in the stocks that are comprised in these sectors? At the same time, we want to know if it makes sense to book profits in the ‘hot sectors’?

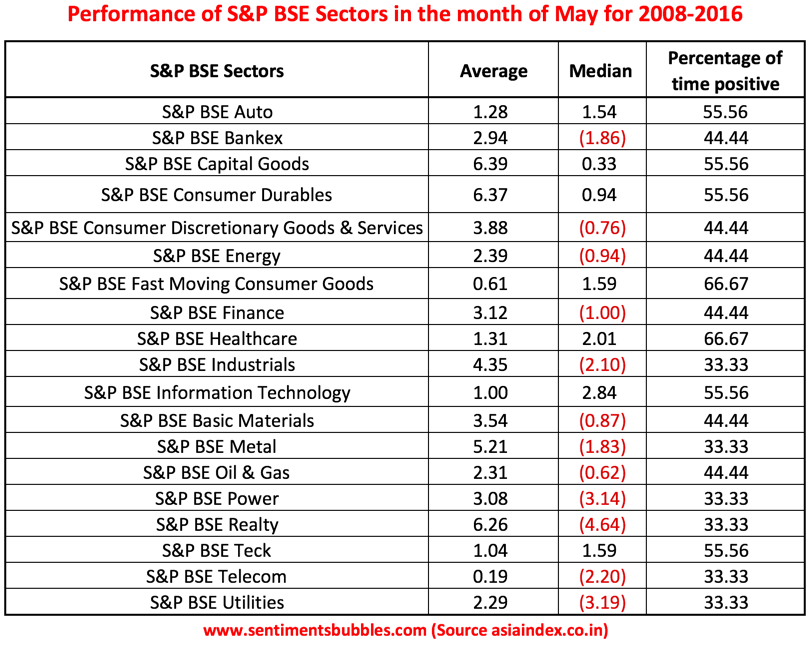

To gain perspective, what I have done next is to analyse the month wise, sector wise seasonality. In other words, what is the historical, calendar-wise performance of the different sectors? For the month of May, the sector-wise seasonality is shown below:

I think that the above is pretty indicative of historical trends. It is apparent that historically the best performing sectors for the month of May are S&P BSE Health Care and S&P BSE Fast Moving Consumer Goods. These are followed by Information Technology and a host of others with similar probabilities.

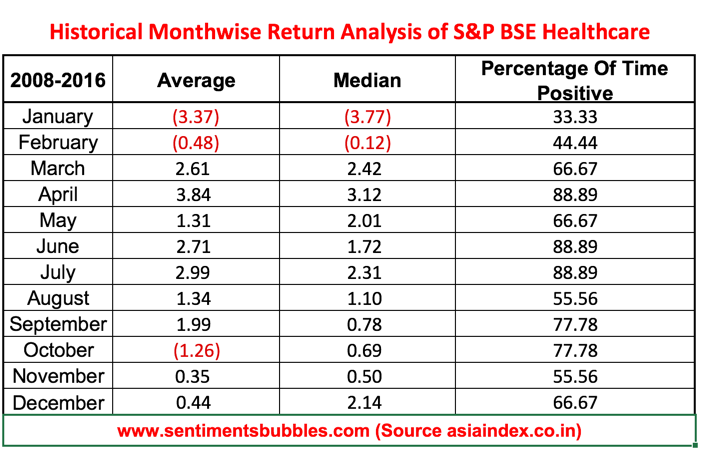

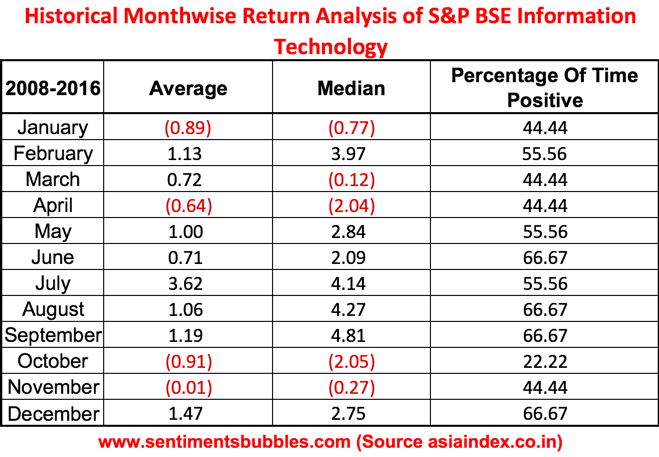

Since Health Care and Information Technology are the most battered sectors in the image shown above, what I did was to look at them separately. The month-wise, historical seasonal trends for these two sectors computed for the period from 2008 till 2016, are shown below:

The images are self-explanatory, and I don’t think any commentary is required. The fact that these two sectors are out of favour is not without reason. While there are compelling grounds for the current price action, is it the case that the leading companies in these two sectors are under some financial distress? I don’t think so. Most of the issues are regulatory and will be addressed sooner rather than later. Money managers ( Mutual Fund Schemes) are slaves of their market capitalisation weighted benchmarks. What that means is that both these sectors are being sold and the herd mentality is clearly visible in the price action.

While investing in stocks, It makes sense to focus on the price you pay. The current depressed prices of these two sectors is a function of weak sentiment. That can change; we don’t know when. At all times, I think we need to remember two things while investing in the stock market, (a) you can’t pick the bottom and (b) one doesn’t know when we are going to get paid if at all we do. In the current scenario and looking at the seasonality, the health care sector, in particular, seems to be a compelling buy. The seasonality appears to suggest that things do tend to get better from here onwards. How much worse can regulatory hurdles get before they get better on a relative basis? In a follow-up post, I’ll try and focus on some of the stocks in these two sectors.

What about the stocks in the sectors that have been on a tear since 8 November 2017? I think the change in valuations is more a function of a shift in sentiment than anything else. The question that comes to mind, is that should a sharp/sudden shift in sentiment mean a change in allocations? Since sentiment can turn on a dime, I think it does make sense to book profits in the hot sectors. For those who have invested in these sectors, it might make sense to take some money off the table by booking profits. For those who do not have any exposure to these outperforming sectors, it makes sense to wait for a dip in these valuations before committing capital.