(Cartoonist: Lindsay Foyle;Cartoonstock.com)

The PSU Banking Index is the worst performing Sectoral Index in the current calendar year. There has always been a valuation gap between the public sector and private sector banks. This is despite the fact that, for both the sectors, the end customer remains the same. Since the beginning of 2015 the gap has widened. In my opinion, this widening of the valuation gap is an opportunity for buying PSU banks.

Why Banking is the key to economic growth?

The banking sector reflects the health of the economy. PSU banks account for around two-thirds of the assets of the Indian banking sector. The current market prices of PSU bank stocks correctly indicate that the economy is not in good health. In other words, prices of stocks in the PSU banking space reflect the malaise in the economy. However, there are reasons to believe that things are getting better. I have tried to highlight these.

The case for PSU Banking Stocks

Public sector banks are considered safe due to their implied government backing. At the same time, this logic is bereft from the valuations that these banks attract. Consider the following:

1. Most of the negative sentiments around the banking sector stem primarily from the fact that inflation is expected to tick upwards in the next couple of months. The reasons for expectations of an increase in inflation are three-fold viz, unfavourable base effect, stronger domestic demand and higher oil prices. The main uncertainty is by how much will inflation go up?

2. To put matters in the correct perspective, Consumer Price Inflation (CPI) has been between 4.9 to 5.4 percent since January 2015. The RBI projects inflation to exceed their 6 percent target ceiling by March 2016. The market fears that this may happen sooner than March. Hence the anxiety and the negative bias.

3. The RBI’s mandate explicitly allows inflation to breach the target on the upside for three consecutive quarters. The market is already discounting the fact that inflation will have moved upwards in the June quarter that just ended. The reasons why inflation is unlikely to breach RBI’s target in the next two quarters are:

-

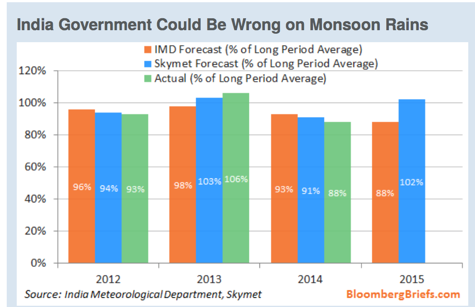

Everything depends on the price of oil and the price of food. Food prices have a 45.86 percent share of the CPI basket. They typically rise between April and September. Common sense suggests that the monsoon has a lot to do with food prices. The monsoon may surprise as is evident from the image below:

-

I compared the actuals and the estimates in the picture above. For the past three years, the estimates provided by Skymet Weather Services Private Limited mirror the actuals more accurately than those of the Indian Meteorological Department (IMD).

-

In the current year, the two estimates vary widely. The IMD is forecasting rainfall at 88 percent of the fifty-year average, whereas Skymet says it will be 102 percent.

-

‘So far so good’ has been the monsoon story to date. If the monsoon does surprise on the upside, then fears of heightened inflation will recede.

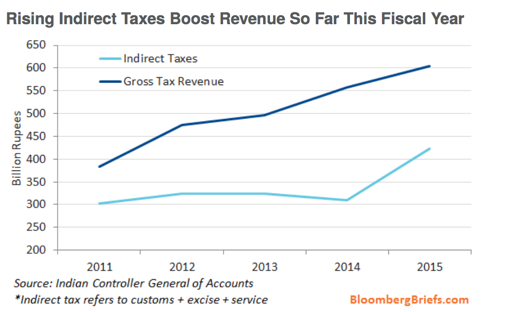

4. It seems that indirect tax receipts have jumped 37 percent in May 2015, as compared to a year earlier. Click here to read. The reasons for increase in indirect tax collection and the consequences are as follows:

-

Collections on account of excise duty have doubled. The withdrawal of exemptions and increase in diesel and petrol taxes is said to have resulted in the surge in indirect tax collection.

- Are these figures the result of the government statistician’s sleight of hand? I

hopethink not! I would be inclined to believe them since petrol and diesel taxes have gone up, that is a fact.

- Any rise in indirect tax collection signals that the government has got some money to spend. Government spending is a precursor to economic growth. Economic growth spells growth for India’s battered PSU banks.

5. The RBI has stated that the infusion of capital in public sector banks will be performance based. This performance-based system will lead to improved corporate governance and can act as a game changer for India’s beleaguered PSU banks.

Which PSU Banking stocks are worthy of investment?

Everyone knows what is wrong with PSU banks. They have poor asset quality, Non-Performing Assets (NPA), falling Net Interest Margins (NIM), etc. In distorted times like these, it makes sense to look at the price to book value for growth sectors like banking. Why look at book value, the reasons are:

-

Investing gurus preach that investors must buy stocks with a high margin of safety. One of the methods successfully adopted over the years for arriving at a Margin of Safety is to look at the book value. For all practical purposes book value is the liquidation value of the stock.

-

When you divide the current market price by the book value, you arrive at the ‘Price to Book Value’. Banking stocks attract a lower price to book value multiple than other sectors. This is because of the unique nature of the banking business.

-

Banking stocks quoted at up to two times their book value may be considered as safe bets or in other words stocks that have an adequate ‘margin of safety’ from an investment perspective.

-

No single valuation metric can be termed as perfect or fool-proof. Ideally, one should pair the ‘price to book value’ with some other metric to arrive at a good stock selection. Just as one looks at the net profit margin for any regular business, for the banking business one looks at the Net Interest Margin (NIM). Hence, I have paired the NIM with the book value of the respective bank to arrive at the stock selection in the table below.

| SYMBOL | PRICE ON 03/07/2015 | BOOK VALUE – CONSOLIDATED | PRICE TO BOOK | NET INTEREST MARGIN (%) |

| ALBK | 88.45 | 225.89 | 0.39 | 3.10 |

| ANDHRABANK | 68.85 | 148.59 | 0.46 | 3.00 |

| ORIENTBANK | 180.95 | 438.80 | 0.41 | 2.61 |

| BANKINDIA | 180.75 | 488.59 | 0.37 | 2.34 |

| PNB | 142.30 | 229.64 | 0.62 | 3.44 |

| SYNDIBANK | 100.90 | 202.26 | 0.50 | 2.38 |

| IDBI | 62.45 | 136.66 | 0.46 | 2.17 |

| UNIONBANK | 161.75 | 290.58 | 0.56 | 2.50 |

| CANBK | 287.25 | 569.99 | 0.50 | 2.25 |

| BANKBARODA | 150.80 | 176.27 | 0.86 | 2.36 |

All the stocks in the table above form part of the PSU Banking Sectoral Index. The following are the riders:

-

The bank which offers the highest margin of safety is mentioned at the top of the table and in descending order thereafter.

- IOB is excluded since it is a non-dividend paying bank.

- SBIN is available above its stated book value and hence excluded. All the others are available below their stated book value. However, the other listed stocks forming part of the State Bank of India family, viz. State Bank of Bikaner and Jaipur, State Bank of Travancore and State Bank of Mysore are available below their stated book value. From an investment perspective, these associates of SBIN offer a higher margin of safety than the parent bank.

-

There are PSU banks that do not form part of the Sectoral Index. Of these Central Bank of India, (CENTRALBK) is the only public sector bank that is positive for the current year. It is available almost at its book value, just a wee bit more (1.06 times) and its NIM is 2.79 percent. It has returned to the dividend list in Mar 2015, after skipping dividend in Mar 2014.

-

There is a view that the quality of assets of PSU banks is so poor that the book value as stated is inflated and incorrect. This I think is a bit too pessimistic. The Reserve Bank of India has clearly stated that the asset quality at PSU banks will get worse before it gets better. At the same time, they also expect improvement in the same by the end of the current fiscal year.

Conclusion

The growth of the economy goes hand in hand with the growth of the banking sector. There is an enormous debate about India’s projected economic growth. I understand little of all this cacophony of it being ‘darkest before dawn’ and ‘green shoots’. My premise is:

-

If you are convinced that the economy will grow then the right time to buy is when the price is attractive. I think India’s PSU banks are attractively priced. At current valuations, the chances of earning ‘better than market’ returns do exist in this space.

- All the RBI measures and government initiatives should not only spur credit growth but will also result in a reduction of Non-Performing Assets and improvement of NIM’s of PSU banks. This three-pronged benefit is a distinct possibility.

-

This post would not be complete without a word on Greece. Greek banks and related commentary is like a soap opera which started in 2010 and has now entered season five. Like all soap opera’s, we are all waiting for the elusive climax. In the Greek soap opera, new players have emerged to take the place of earlier ones, performing the same roles. This is likely to continue. The question of ‘contagion’ is very relevant. Contagion of any kind is always a risk, except when everyone is talking about it. We will undoubtedly have more drama on the Greek stage, each episode will present a buying opportunity, there is no doubt about that.

I don’t think it is the right choice to buy PSU stocks at this juncture. What I have observed recently in the market is that we are moving through a recessionary phase and banking industry is likely to burn its fingers due to cascading effect of deceleration. The NPAs are increasing tremendously of late and particularly for PSU Banks they are at horrifying stage for some banks.

In my view unless PSU banks join their hands together and keep 3 to 4 big banks across India, educate their staff in every desired perspective like private sector and bring no intervention from unions or political front; it will be just an over optimistic view to believe that PSU banks will still perform better in bleak days ahead.

It may not be out of context to mention here that the RBI has recently reported to the Finance Ministry, that Central Bank of India’s 21.5% assets are either bad or have been restructured to save them turning NPAs. Same situation carries for United Bank of India 19.04%, Punjab & Sindh 18.25%, Punjab National Bank 17.85%. Indian Overseas Bank, State Bank of Patiala, Allahabad Bank and Oriental Bank of Commerce also have their bad and restructured loans hovering at an alarming 15%. PSU Banks have tremendous exposure to companies in infrastructure, steel, textiles, aviation, and mining sectors. This may be the reason why top 30 defaulters account for around 1 lac crore gross NPAs in PSU Banks.

In the recently declared results United Bank of India, Indian Overseas Bank, UCO Bank, Punjab National Bank, Bank of Maharashtra and Central Bank of India have their NPAs more than 6%. Allahabad Bank, Andhra Bank, Oriental Bank of Commerce, Dena Bank have achieved gross NPA levels between 5% and 6%.

Nationalization of banks was just an idea created 1969 out of political aspiration, so called on the basis of the thesis written by a stalwart, who happened to be our most qualified Prime minister. Painfully, the same expert opined in another thesis in 1992 that it was wrong to carry the same opinion, which he expressed in 1969! Are we ready to re-organize, de-nationalize/ wind up our weak PSU banks? Till the answer comes in affirmative, keep away from PSU banks, for sure!

I appreciate your comments. Very frank indeeed. However, most of what you have said is known and priced in. That is what makes a market – people with divergent views. If everyone was aligned on one side then there would be no trade!

Until the PSU banks stop sleeping with powerful politican backed promoters, there is little hope.

I see little use for the “wilful defaulter” tag, unless justice (law enforcement) is fair AND swift. There is no scope (as yet) for recovering from a Kingfisher or to a smaller extent (3000 crore) say a Zoom Developers.

It is widely anticipated, that Zoom will fight in Indian courts (at least 10 year) and then in U.S. courts (another couple of years) before SBI can liquidate the attached assets, if at all. Banks are also not finding it easy to auction / liquidate assets. (Is there a conspiracy theory here again, with powerful people solidly throwing their weight against such auctions??)

In such a context, do PSU banks provide the needed “margin of safety”?

What you have pointed out is true. However, I think all that is priced in. Considering that the market will look ahead, as long as Rajan is around I think this is the best / only chance that PSU banks will revive. The Governor is also making changes to the system of appointing CEO’s to the banks. Basically, he is making all the right noises. There will be vested interests trying to foil all his attempts at cleaning up the system. I think he will get the process started. How much success he will achieve is a gamble one has to take. I don’t expect 100 % success in his efforts. Even if he achieves say 10 % and the results are visible, it will rub off. If Rajan is not around, the trade will not work. Some of the PSU banks have a 4 % yield. All are quoting below book value. The rating agencies have recently downgraded Canara Bank and Bank of India. Of late, these agencies are the best sentiment indicators. Things don’t get worse after their downgrades. They are the last to arrive like the cops in the Hindi movies. Hence, things should get better.