(Source: Harolds Planet)

“Price is a liar”. Attribution: John Burbank of Passport Capital. Never heard of him? Neither had I, till I watched the two-minute video below:

John Burbank on Investing: ‘Price Is a Liar’ by FORAtv

I need to clarify: he hasn’t uttered the four words ‘Price is a liar’ in the current scenario. John Burbank gave a one-hour presentation sometime in early 2015. To watch the entire presentation click here.

With events in China deciding price action since the beginning of 2016, it reminded me, time and again of the four words that he has uttered: “Price is a liar”. Are stock prices sending us a veiled message of an approaching tsunami, or are prices lying to us?

What’s with Chinese Stock Prices and the Yuan?

Tepid growth in the Chinese economy, its effect on World GDP and China’s ‘hard landing’ are well documented. The twist in the tale since the beginning of 2016 is the Chinese currency, Yuan. The slump in equity prices in China and the depreciation of the Chinese Yuan are being viewed as part of the same story. I prefer to treat Chinese stock prices and the Chinese Yuan as two distinctly separate issues. I see no reason to mix them up.

Chinese Stock Prices

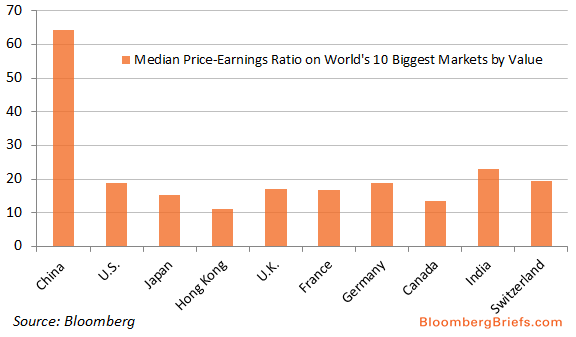

I wouldn’t get too carried away by the happenings in the Chinese Stock Market. The reason is evident in the image below.

The Price to Earnings ratio of the Chinese market is shown as a shade above 60 in the picture above (as on January 07, 2016). It is safe to conclude that:

- No stock market, anywhere in the world, trading at 60 times earnings reflects economic fundamentals. In such a scenario, following stock prices is tantamount to heat chasing or playing momentum. You cannot call it investing.

-

By any valuation metric, the Chinese stock market was and probably still is in bubble territory. In India, we need to stop looking at Chinese stock market indices for direction.

Chinese Yuan

To me, the Yuan is the epicentre of the current down move in global share prices. The Peoples Bank of China (PBoC) is moving the currency towards a market-set exchange rate. This, it seems, will boost growth. The methodology adopted by the PBoC to achieve their avowed objective of Yuan devaluation is a doosra. The Chinese method is as follows:

- The Chinese Central bank sets the yuan’s rate each day at 9.15 a.m. local time. Once trading commences in the Chinese domestic market, the yuan is ‘allowed’ to trade two percent above and below this fix.

- Following the sudden and unexpected 1.9 percent devaluation of the yuan in August 2015, the PBoC said that it would set the daily fix in line with what the Yuan had closed at the previous evening. They stuck to their word between August and December 2015. During this period, the currency was fixed at .02 percent of its previous close.

- This link – the one between the previous day’s close and the next day’s fix – broke as the new year began. The PBoC changed tack and started playing with the fix leaving markets guessing.

- The Chinese authorities are giving the impression that much of the currency volatility is intentional and is here to stay. Uncertainty is a part of their monetary policy. Markets abhor uncertainty.

To market participants, the daily ‘fix’ and ham-handed attempts at controlling stock prices, give the impression that the Chinese authorities are losing control over the currency and the economy. It is being interpreted to mean that Chinese currency bungling will end up in a cataclysmic global financial accident, with its epicentre in Beijing.

Is this a Buying Opportunity?

If the Central Bank of any country starts playing with its currency and tries to ‘fix’ it on a daily basis, it is bound to breed uncertainty and volatility. What happens when the country in question is China? I am tempted to come to the conclusion that the volatility that we are witnessing is not entirely unjustified.

The Indian economy is largely insulated from developments in China. Should the current downtrend be considered as a buying opportunity? OR Is that a pernicious assumption to make? It is a call each investor has to take. Just remember that:

- In the current situation, there is just one thing that can make prices gyrate towards a big move in either direction: liquidity or flows from Foreign Institutional Investors.

- Are we in a bull market or a bear market or a ‘bear within a bull’ or a ‘bull within a bear’ or whatever. I have never understood this bull-bear mumbo-jumbo. How does it matter? In case you feel it does, click here to read what the bears are saying. Just as a reminder, they were saying something similar in September 2015, you can read the old version by clicking here.

- In my opinion, no matter how bearish the market, a bullish trend always exists. You can interchange the underlined and italicised words in the last sentence to change the meaning, depending on your outlook.

‘Price is liar’: Indian scenario

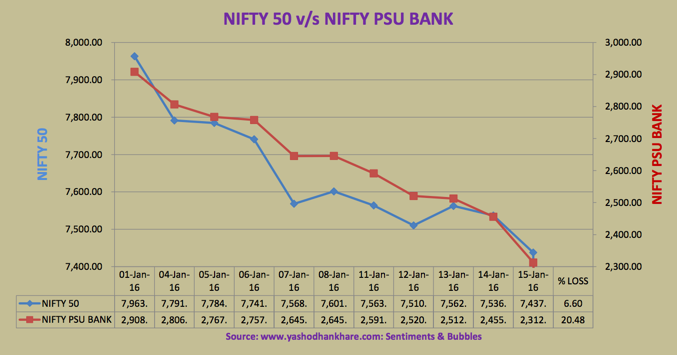

The image below shows the Nifty and the Nifty PSU Bank Index for 2016:

The following conclusions can be drawn from the picture:

-

The benchmark has declined by 6.8 percent since the beginning of 2016. It is in line with global markets. No surprises.

-

The Nifty PSU Bank Index has surprised by declining a whopping 20.48 percent in the current year. The Nifty PSU Bank Index is a Sectoral Index that captures the performance of India’s Public Sector Banks (PSB’s). (Click here to read the index composition.)

-

The fear is that Chinese currency devaluation will lead to a devaluation of the Indian Rupee. The falling Rupee would hurt corporate borrowers carrying U.S. Dollar debt. It could lead to defaults and would exacerbate delicate balance sheets of India’s beleaguered Public Sector Banks. Click here to read the story.

- I find the above logic to be a bit nuanced and hence faulty. In my opinion, a stronger dollar and exploding debts were discounted in the stock prices of PSB’s in the year 2015. I am unaware of fresh negative triggers for public sector banking in India in the year 2016.

- Prices of PSB’s are being hammered mercilessly. Investors seem to be putting steeper discounts on expectations of future earnings, pushing prices even lower. Volatility in the stock prices of PSB’s appears to breed even more volatility. This cannot continue ad infinitum.

Where are we going?

Will events of 2016 have a catastrophic effect on world markets much beyond what we have already witnessed? OR Is the price action likely to have a salutary effect? This is a tricky question. No reliable indicator can predict market direction; there never was one. You might be better off flipping a coin. The following pointers might help:

-

All of us have got used to accommodative central banks. The Chinese central bank has a tendency to surprise. How many more surprises will the Chinese spring on world markets? Nobody knows. How long will the market continue to react to Chinese central bank surprises? Time will tell.

- Chinese authorities are expected to release their 2015 GDP on 19th January 2016. The expectation is that Chinese GDP would have fallen below seven percent. The Chinese growth rate is also expected to decelerate further. Expect volatility to top out after the release of Chinese GDP numbers.

- The slide in Oil prices continues unabated. The market is gripped by fears of ‘oversupply’ arising from the expected flow of Iranian oil. I thought fears of Iranian oil were discounted in June 2015. I was wrong. In the new format, markets seem to be discount the same event twice! This is a classic example of a negative feedback loop. It will get broken eventually; the question is: when?

- Market prices aggregate the views of a vast number of participants who are continually assessing the future. As such markets tend to give important warnings when conditions change. At the same time, markets also tend to give wrong signals and cannot be slavishly followed. The reality is somewhere in between: markets do not always reflect economic fundamentals. In such a scenario, how does one know when prices flickering at us are telling the truth or they are lying? One has to have a long-term view and keep guessing. There is no other way.

- Where does the market go from here? David Bowie, the English singer who passed away on January 10, 2016, seemed to have the perfect answer. To modify and rephrase what David Bowie famously said (emphasis is mine); ‘I don’t know where

I amthe markets are going from here, but I promise it won’t be boring’.

Excellent write up Yashodhan. Just ring me when you see message in NSE market announcement that market just bottomed out……… hehehehe take it with lighter note.

Thanks Pradeep.