Performance Analysis

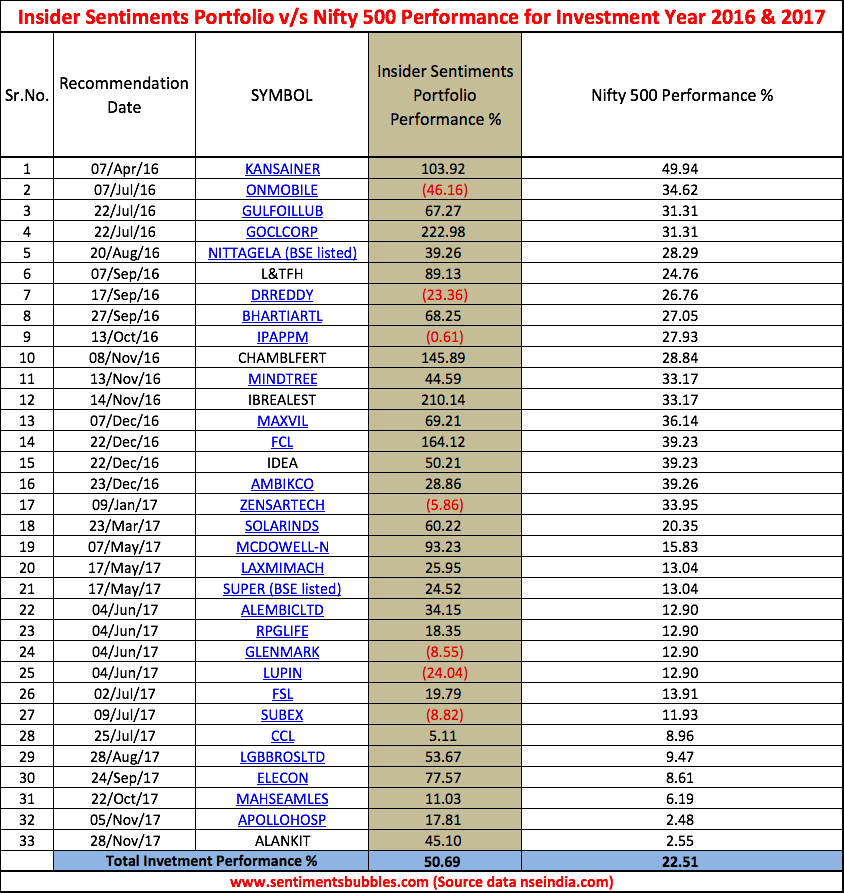

Insider Sentiments as a product and advisory service completes two years in April 2018. However, I prefer to look at it calendar-year wise. Hence, what I have done is to compute the year-wise returns from the recommendations, as also the combined returns. The methodology used for computing returns is as follows:

- I have used the Nifty 500 as the benchmark for comparison purposes. If one had invested in the Nifty 500 at the closing price as on 31st December 2016 (6982.80) and sold at the closing price on 31st December 2017 (9490.65) an investor would have earned an annual return of 35.91 percent. (The Nifty 50 returns, calculated in a similar manner are 28.65 percent).

- I am not aware of anybody who invests in the manner described above; neither is it recommended. Comparing the returns for the Insider Sentiments portfolio with these numbers is incorrect. Hence, for computing portfolio returns, I have assumed that an equal amount of Rs. 5,000 is invested in each of the names on the date that a stock has been recommended. Similarly, Rs. 5000 is invested in the Nifty 500 on the same date. The returns computed in this manner, for all the recommendations are shown in the table below. (Dividends have been ignored, to keep matters simple).

(Click on the image to enlarge)

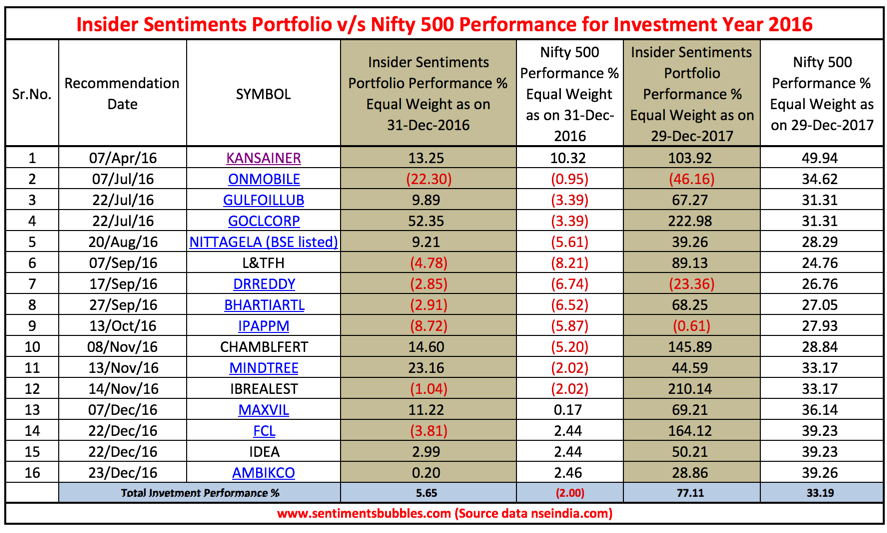

- Since the recommendations have been made over two calendar years, one may want to look at it year-wise. The recommendations made during the calendar-year 2016 have been ‘marked to market’ twice (at the respective year-end dates). In this manner, one tends to get greater clarity of the performance of the portfolio. The performance for the calendar-year 2016 recommendations on the two dates is shown below:

(Click on the image to enlarge)

- Peter Lynch is considered to be one of the investing greats of yesteryear. In his words: “I’m accustomed to hanging around with a stock when the price is going nowhere. Most of the money I make is in the third or fourth year that I’ve owned something.” Since all the recommendations are based on insider activity, I think we should follow what Lynch has preached.

- Personally, I like to think of the bunch of stocks for a recommended calendar year as a Coffee Can Portfolio. In other words, I don’t see any reason for ‘activity’; more often than not fidgeting with the names is unlikely to add value. Ergo, none of the recommendations has a price target; I don’t see the need to sell any of the above stocks.

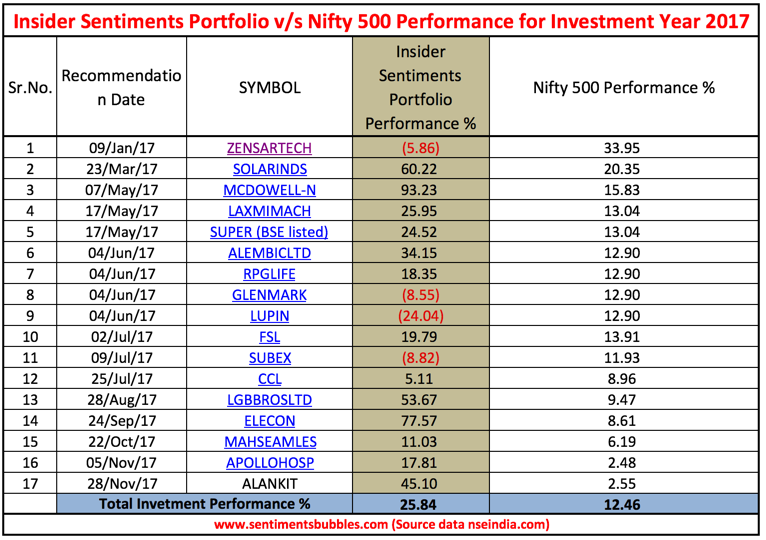

- The performance of the stocks for the calendar-year 2017 is shown below:

(Click on the image to enlarge)

Conclusion

It is imperative that subscribers to Insider Sentiments, buy ALL the recommendations and equal weight them. If one does not follow this rule, the performance of your portfolio and that of the Insider Sentiments portfolio will differ. This difference between investor returns and investment returns is commonly referred to as the behaviour gap. We let our biases get the better of us; not recommended.

While running the numbers, what matters is ‘How have the returns been computed’. Since comparisons are inevitable, it is imperative that all comparisons are made on an ‘apples to apples’ basis and not on an ‘apples to oranges’ one. If any of you is comparing the returns of the Insider Sentiments portfolio with any other Portfolio Management or Mutual Fund Scheme (or an advisory product), please take care to understand the methodology of computation that has been used. It will ensure an apt comparison.

It is apparent that the Insider Sentiments portfolio has outperformed the Nifty 500 benchmark index. What matters is that the Insider Sentiments portfolio returns are on par or better than most comparable or similar products that are available in the marketplace. In terms of ‘factors’, momentum has been the singular theme for 2017. My investing philosophy is the antithesis of what has worked in 2017. Despite this, I am extremely pleased that we have been able to deliver returns that are commensurate with those delivered by following a ‘momentum strategy’. Happy Investing and wish all of you a Happy New Year.