(Cartoonist:Karsten Schley; cartoonstock.com) (Saturday, 30 July 2016)

The sharp run up in the benchmark indices, post-Brexit, has left investors wondering whether it is too late to join the rally. In such a situation, more often than not, one looks at the Price to Earning (PE) multiple in an attempt to get a ‘handle’ on current valuations.

For the uninitiated, the PE ratio is computed by dividing the current market price by the latest earnings per share of any given company. Nowadays we have two types of PE ratios. The historical or trailing PE ratio and the forward PE ratio. Historical PE ratios are derived from reported earnings, and forward PE ratios are derived from projected earnings. I’ll just stick to the trailing or historical PE ratios for this post.

PE Expansion: Benchmark & Sectoral

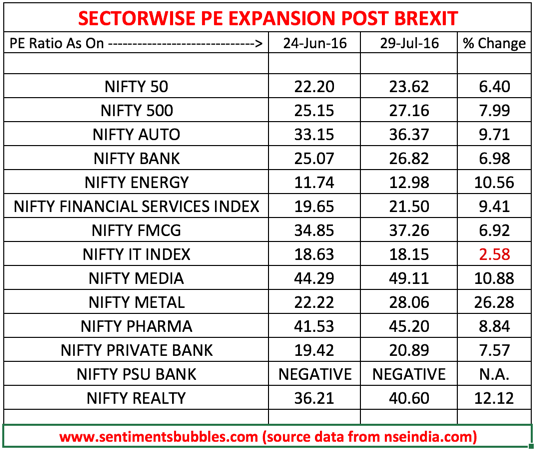

The fact that markets have simply taken off after the Brexit vote is undeniable. Brexit is the line in the sand. Sentiment indices are hitting All Time Highs in the post-Brexit era. What I did was to compare the PE ratios of the benchmark and sectoral indices, pre and post-Brexit. This is shown below:

When an index or any given equity benchmark rises faster than the underlying earnings, there is PE expansion. It is what we are currently witnessing. PE ratios always tend to expand when sentiment gets bullish. I think investors need to remember the following:

- The numbers in the table above are self-explanatory. The Nifty IT index is the only one that has seen a PE contraction. The table above could be interpreted differently if one were to use forward PE ratios.

- Stocks quoting below the average PE multiple are cheap, and those quoting above the average are expensive. What is the average PE of the Indian market? Based on historical trends and statistics, the average PE ratio of the Indian Stock Market is 19.

- However, the average PE ratio of the Indian Market is meaningless unless one factors in other factors like inflation and interest rates. Currently, both of these favour a higher PE multiple, as compared to the average. Trying to justify PE expansion using the low-interest rates and low inflation arguments is ‘old saw’. It is hardly an earth shattering discovery, and what has Brexit got to do with it?

- Since nothing seems to have changed on the earnings front, what could be the reason for a PE expansion, apart from investor sentiment? The equity research guys at leading brokerages are now saying that the current set of earnings is the ‘last leg of the down cycle’; whatever that means. I interpret that as the ‘green shoots’ rhetoric that these guys have been tom-tomming for the last 18 months. I think that the ‘green shoots’ analogy is a bit jaded. I don’t think the PE expansion can be attributed to expected earnings.

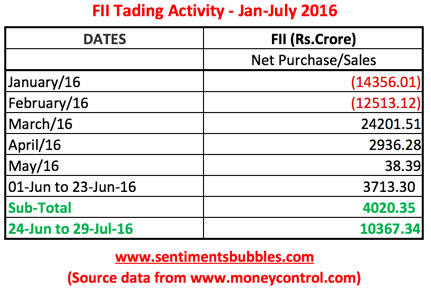

- PE expansion on account of the expected passage of the Goods and Services Tax Bill (GST) in the Upper House of Parliament is possible. GST has been on the horizon for quite some time. Foreign Institutional Investors (FII’s) flows have been robust in the post-Brexit era. Is it on GST alone that the FII’s are betting? From an FII perspective, what has Brexit got to do with GST?

Emerging Markets (EM) v/s Developed Markets (DM)

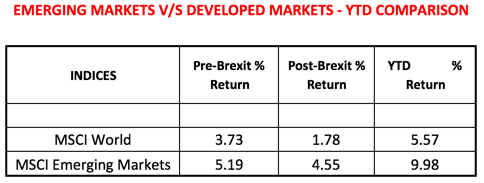

MSCI (Morgan Stanley Capital International) is an investment research firm that provides global indices. They have segregated markets on the basis of Developed Markets (DM) and Emerging Markets (DM). Under this classification, the MSCI World Index represents the Developed World, and the MSCI Emerging Markets Index represents Emerging Markets. The Year to Date (YTD) performance of these two indices (MSCI World and MSCI EM) is tabulated below:

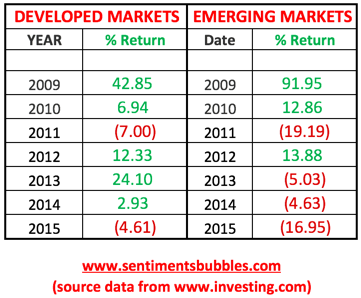

It is apparent that the MSCI Emerging Markets Index is outperforming the MSCI World Index for the first time since the calendar year 2012. Also, the gap or the degree of outperformance in the current year and till date is the largest since the one we saw in the calendar year 2010.

In my opinion, PE expansion in the Indian Stock Market is primarily a function of post-Brexit EM outperformance. Brazil is leading the global performance metrics, and since it is a part of the EM classification, it helps. I think the post-Brexit EM outperformance visible in the image above is significant. Can EM outperformance continue? Nobody knows for sure. The following might help:

- It seems that globally investors are sick of the incestuous monetary policies followed by the Japanese and European Central banks. Central Bankers of EM countries have been far less pro-active at fidgeting with monetary policy, with an attempt to manipulate currencies and influence markets.

- According to Bond Vigilantes, normalisation of monetary policy in the DM will be a function of the growth metric. The commentary is that, despite extraordinary measures, growth in Europe and Japan has failed to pick up. Money managers seem to have ‘thrown in the towel’ on the ‘hoping for growth to pick up’ metric (of the European and Japanese economies). As a result, funds investing specifically in these geographies have seen massive outflows in the aftermath of the Brexit vote. Most of the money seems to be finding its way into debt and equity assets in Emerging Market countries.

- In the EM World, the Indian Stock Market is not exactly the cynosure of all eyes, as many of us would like to believe. Indonesia, Thailand and Philippines are the countries that are attracting a greater level of investor interest than the Indian Stock Market.

- Globally, asset allocation is the starting point when putting money to work. In other words, investors always had a choice (between EM and DM). It does seem to me that they have begun to exercise it. Mean reversion is what is happening, and I don’t see any reason to complain.

How much can PE ratios Expand?

- The argument that PE ratios will trend higher in the absence of earnings growth is valid only in the short-term. PE’s tend to mean revert to their average – in the long-term. Over periods longer than one year, it is the growth metric that will inevitably take over. In other words, earnings growth is THE factor for PE expansion in the long-term, nothing else. Currently, we aren’t concerned with the long-term.

- Is there anything that can be considered as a safe PE multiple? Not really. High PE ratios are not necessarily bad and low PE ratios are not necessarily good. There are always justifiable reasons why stocks or markets in general trade at an excessively high or low PE multiple. I have written on this in one of my earlier posts titled High PE Ratios – Myth or Reality?.

Conclusion

To answer the rhetorical question; Is it too late to Buy Stocks? The answer is both yes and no. I need to explain. Given that nothing seems to be cheap, a certain level of cognitive dissonance is experienced by most investors (I included). In such a situation, should one buy, sell or just do nothing. The answer would differ from one investor to another, and there can be no ‘one size that fits all’ in this situation. My thoughts:

Benjamin Graham, the father of value investing, has famously said: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” What he meant was that the true value of a stock or an enterprise would only be correctly reflected in the long-term. Benjamin Graham did not define the words ‘short run’ and ‘long run’. How then does one interpret it in the current scenario? Investors have a choice:

- Interpret the knee-jerk reaction to the Brexit vote on 24 June 2016 as a voting machine response and the period after that as a weighing machine one. In such a scenario, investors ought to follow a ‘buy the dip’ strategy.

- Alternatively, if one were to interpret the period from 24 June 2016 till date as a voting machine response, it would mean that the market would behave differently in the weighing machine phase. In such a scenario, it makes sense to do nothing as on date.

We will know the correct answer only with the benefit of hindsight. Till then, I suppose we just have to keep guessing.

Market will continue to remain blue, going ahead, due to crowd’s expectations. Till the time they are not unreasonable, we may see better prices every-day.

In long run, it may not be late to buy good stocks. PE whether forward or trailing is just one criteria for consideration while making investments. For short term however intuition plays vital role, doesn’t it?

I certainly hope so.

Yashodhan

Maybe the market is positive because it is anticipating that GST will be approved in this session of the Parliament?

Regards

Shailesh

Maybe. But GST has been around for quite some time now. I still think it is due to the EM outperformance. That too can continue

Could you make a comment on company policies to buy back their stock are currently warping the PE ratios?

The current up move is in the BLACKOUT period where companies are not allowed to buyback. All the more surprising.