(Cartoonist: Harley Schwadron;Cartoonstock.com)(Sunday,13 March 2016)

Negative interest rates represent an upside-down world. There is something about negative interest rates that makes one uneasy; it ‘s almost visceral.

FII flows & Negative interest rates

Emerging Market (EM) financial assets are considered as risk assets by the Foreign Institutional Investors (FII’s). FII flows to EM’s, and the Indian stock market is a function of how risk averse FII’s are. Have negative interest rates accentuated risk aversion or alleviated it? The following points are relevant:

- In the Indian stock market, global risks manifest themselves in the form of FII inflows and outflows. I’ll just call it ‘flow-risk.’

- How correlated are risk aversion and flow-risk? My guess is that they are positively correlated. The more risk averse FII’s get, the higher the flow-risk.

- Risk aversion has meant that FII’s were worried about the return of their money rather than the return on their money. As a result, FII’s have been net sellers of Indian equities from May 2015 (roughly).

- The FII’s have been net buyers in March 2016 after a ten-month hiatus. What happened all of a sudden? There was nothing in the Union Budget announcements made on 29 February 2016 that can be attributed to this change in stance. I think it is safe to conclude that risk aversion has declined. Are negative interest rates responsible for this shift?

Are Negative Interest Rates, Positive?

Are negative interest rates, in fact, positive for Emerging Markets (EM) and Indian equities? I think that negative interest rates have alleviated FII risk aversion. My reasoning is as follows:

1. What negative interest rates seem to have inadvertently done is that they have put a floor under falling commodity prices.

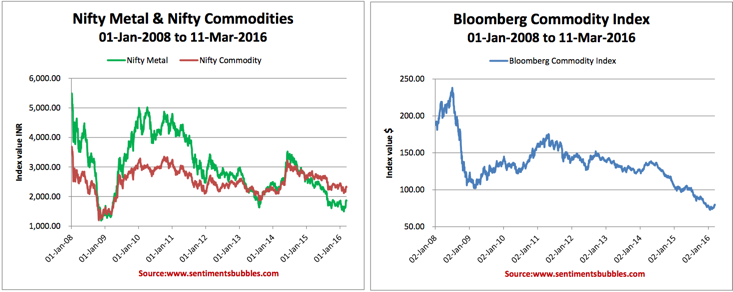

2. Negative interest rates have meant that holding cash is a sin. Negative interest rates reduce the cost of holding metals, as opposed to holding cash. In other words, whether you buy Gold or Platinum, or any other metal is irrelevant. Most of us see Gold as the only escape route. The market seems to think otherwise. Prices of metals like copper, nickel, steel, silver, platinum, zinc, etc., have gone up. In other words, prices of industrial metals have gone up along with the prices of precious metals. I think that what the market is pointing at is correct; any metal will do. Take a look:

3. As metal prices go up, input prices for the manufacturing sector ought to increase. It is inflationary. In the past, price rises in commodities/metals have always been the culprit for rising and uncontrollable inflation. In other words, commodity prices and inflation are positively correlated.

4. The avowed objective of negative interest rates was to encourage banks to lend. Negative interest rates were supposed to encourage borrowing and spending and ultimately lead to an uptick in inflation indices. This was the circuitous route that the Central Bankers had mapped:

Negative Interest Rates—->Lending—->Growth—->Inflation

The commodity market seems to have taken a more direct route or a short cut. For market participants, it doesn’t matter which path inflation takes, as long as we get there!

5. Can the behavior of commodity prices predict future rates of inflation? I think that the answer ought to be pretty easy and in the affirmative. However, it seems that this is a hotly debated topic. What I could gather was that inflation occurs when there is a persistent rise in the prices of commodities. A one-time increase would not matter. Sounds logical.

6. If it is that simple, why the fuss? I think there are two unknowns:

- Will the global economy will see ‘real growth’?

-

Is the increase in commodity prices sustainable or is it just a flash in the pan?

7. ‘The cure for high prices is high prices’ is a traditional commodity axiom. What it means is that as commodity prices trend higher, it results in an increase in supply and an almost simultaneous destruction of demand. However, the reverse; ‘the cure for low prices is low prices’, is equally true and is bullish. It seems to be what the market expects.

8. It does seem to me that negative interest rates have had the desired effect of priming inflation expectations. It has led to a fall in the risk aversion metric. As a result, FII flows have returned. I don’t see any reason to complain.

Does the current rally have ‘legs’?

There is a section of the market that calls this a bear market rally. The fact that the most beaten down sectors – EM and commodities have rallied is seen as a justification for this thesis. Are prices of metals and commodities preceding fundamentals OR are commodity prices lying OR is this just a bear market rally? In the investing game, when things are bad, and they move towards being less bad, it is considered as bullish. The following thoughts might help:

- We are never going to get an ‘all clear’ signal from the market. It is just not going to happen. Will a fall in risk aversion lead to an asset rotation into EM? Is that too optimistic, too early or too biased a guess to make?

-

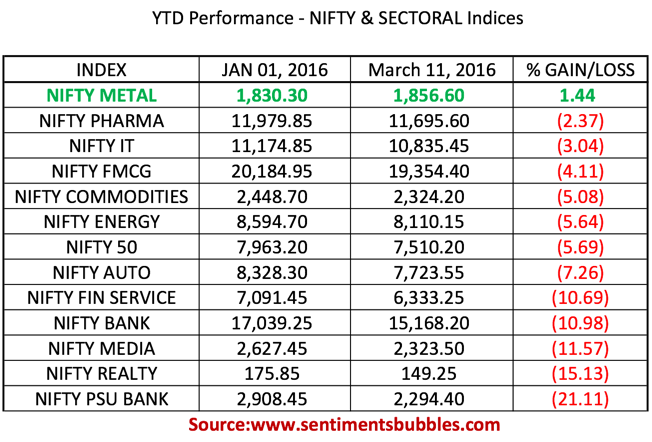

From an investing standpoint, what matters is that we have a positive feedback loop. The market seems to think that the bottom for commodity prices is in place, this is not a fake head and that the global search for inflation is nearing its end. The Nifty Metal Sectoral Index is the best performing sectoral index in the current year. Take a look:

What if Negative interest rates go deeper into Negative Territory?

1. What if negative interest rates dive deeper into negative territory? I think this is the biggest risk. Purely from an investing perspective and without any regard for economics, if rates were to go deeper into negative territory, I think it would be extremely bearish for one singular reason:

-

In the words of Albert Einstein:“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

I am unable to figure out how compounding will work if negative interest rates were to spread. It would, in fact, work in reverse. That would be disastrous.

2. I don’t think negative interest rates will go deeper into negative territory. The reasons are:

-

On 10 March 2016, Mario Draghi, the President of the European Central Bank, signaled that there will be no need to cut rates further. Click here to read. In his words:

“From today’s perspective, we don’t anticipate it will be necessary to reduce rates further.”

-

On 07 March 2016, Stanley Fischer, the Vice Chairman of the U.S.Federal Reserve gave a speech titled “Policy Challenges in an Interconnected World”. Click here to read. In his words:

“Since the U.S. economy is now below our 2 percent inflation target, and since unemployment is in the vicinity of full employment, it is sometimes argued that the link between unemployment and inflation must have been broken. I don’t believe that. Rather the link has never been very strong, but it exists, and we may well at present be seeing the first stirrings of an increase in the inflation rate–something that we would like to happen.”

3. Market participants have been so overwrought since the beginning of this calendar year that hope has given way to pessimism. The way the market has gyrated, this is hardly surprising. Sir John Templeton has penned the most famous words to describe stock market cycles, and they are:

“Bull-markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

Which stage of the cycle are we? The answer to this question would help in framing one’s investing ideology in the current scenario. Simple: Yes, Easy: No!