What does Survivorship Bias mean in the investing world and how is it relevant in the Indian context?

Survivorship Bias – Definition

Survivorship Bias is defined as the logical error of concentrating on the people or things that “survived” some process and inadvertently overlooking those that did not because of their lack of visibility.

I’ll try and make sense of the above definition. Mutual Fund Schemes now account for the bulk of the equity allocations made by investors in the Indian Stock Market. While selecting a Mutual Fund Scheme, most investors tend to choose from the list of best performing funds. Asset Management companies too routinely promote funds that are doing well. No mention is made of the non-performing funds that are doing poorly or those that are eventually closed down. While tabulating the performance of Mutual Fund Schemes, the data that is collected uses funds that have survived for the entire period under reference. In reality, many fund schemes might liquidate or merge during the reference period (due to poor performance).

In this way, the analysis of Mutual Fund Schemes that we are presented with tends to focus only on winners; it ignores the losers totally. Since those Mutual Fund Schemes that closed or did not survive are ignored, it inadvertently results in the comparison being biased in favour of the fund category. This bias is known as the Survivorship Bias.

SPIVA – Mutual Fund Scheme Performance Analysis

S&P Dow Jones Indices is the largest provider of financial market indices in the world. In India, the S&P Dow Jones Indices have inked a partnership with BSE Ltd. Not only do they offer a broad suite of indices for investors, but they also publish fund related information and reports. One of their publications is called the SPIVA Scorecard.

SPIVA is an acronym for Standard & Poor Global Indices v/s Active Managers. It is published bi-annually. As the name suggests, SPIVA compares the performance of active managers with their stated benchmarks. In this way, the SPIVA scorecard helps to compare the performance of actively managed funds with their passive counterparts. The necessity of such a scorekeeper in the marketplace is apparent. Hence, the importance of the SPIVA scorecard cannot be understated.

S&P Dow Jones Indices has been publishing this scorecard since the year 2012. What was initially used as a scorecard exclusively for the U.S.markets has now spread across the global. The SPIVA India Scorecard is now being published. In my opinion, the SPIVA India Scorecard is a must read for every Mutual Fund investor in India. You can read the latest scorecard by clicking on the link below:

Markets Diary

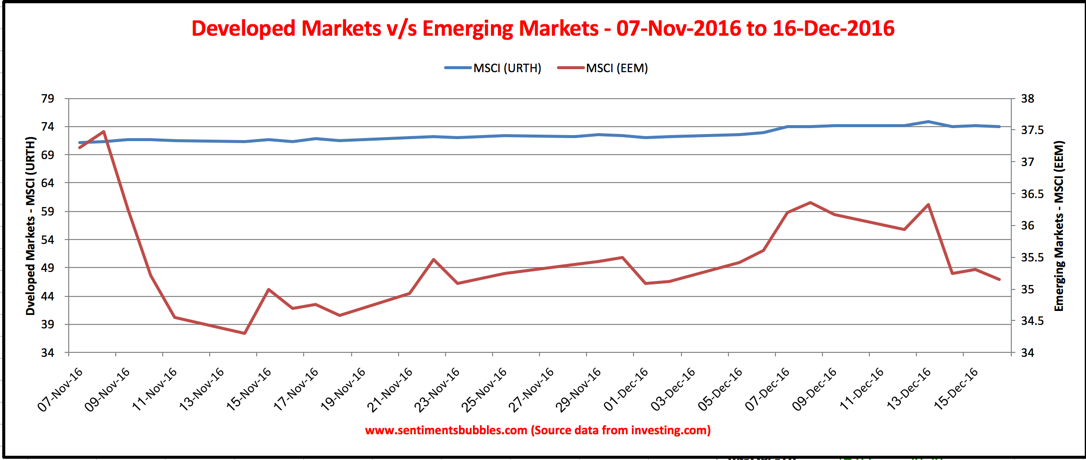

In the aftermath of the U.S.Presidential election, Emerging Markets (EM’s) have been the biggest losers. Currently, the gap between EM and DM performance is at its widest, as compared to the recent past. At all times, the strength of the U.S. Dollar has been a matter of growing concern.

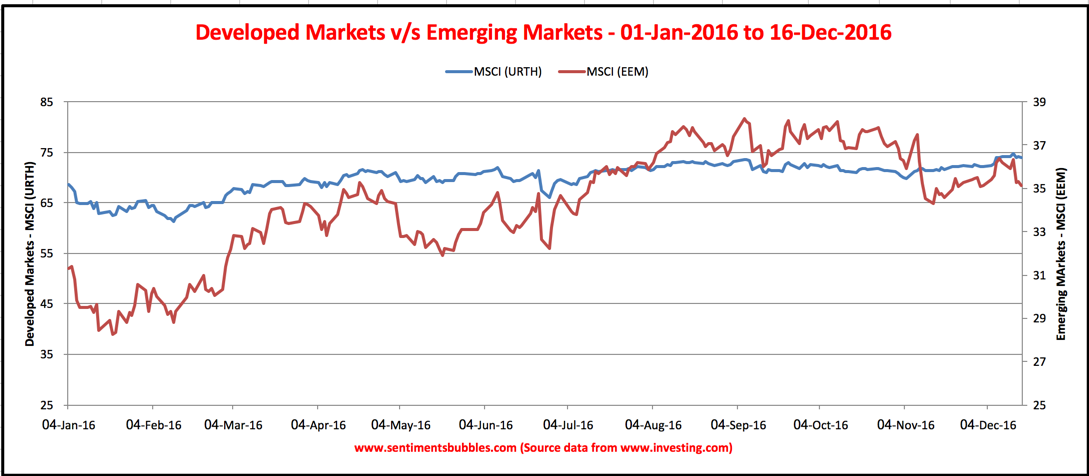

Over the last couple of years, divergences between EM’s and DM’s have occurred at least once every year. When Emerging Markets move up and Developed Markets (DM) move down (or sideways) the ‘decoupling’ rhetoric is peddled. When the reverse happens, it’s called a tantrum, by whatever name. In my opinion, decoupling and tantrum are the same things. In the long-term, capital will move to where it is best treated. As a result, eventually, all markets ought to go in the same direction.

The current divergence is being called a tantrum. This is how it looks:

In the short-term, the divergence is clear. When you widen the lens, it doesn’t seem so bad, as is shown below:

In my opinion, the divergence between EM and DM will narrow, sooner than later. How soon is that? Nobody knows. S&P Just Demolished One Big Distinction Between Emerging and Developed Markets seems to suggest that higher valuations for DM’s relative to EM’s are unwarranted.

When the tide does turn and the gap narrows, how much of the fund flow will the Indian Stock Market attract? My thoughts:

- In my opinion, the threat of further strengthening of the U.S. Dollar is real and cannot be ignored. It follows that capital will flow into those Emerging Markets whose economies are considered as relatively less vulnerable to further dollar strength.

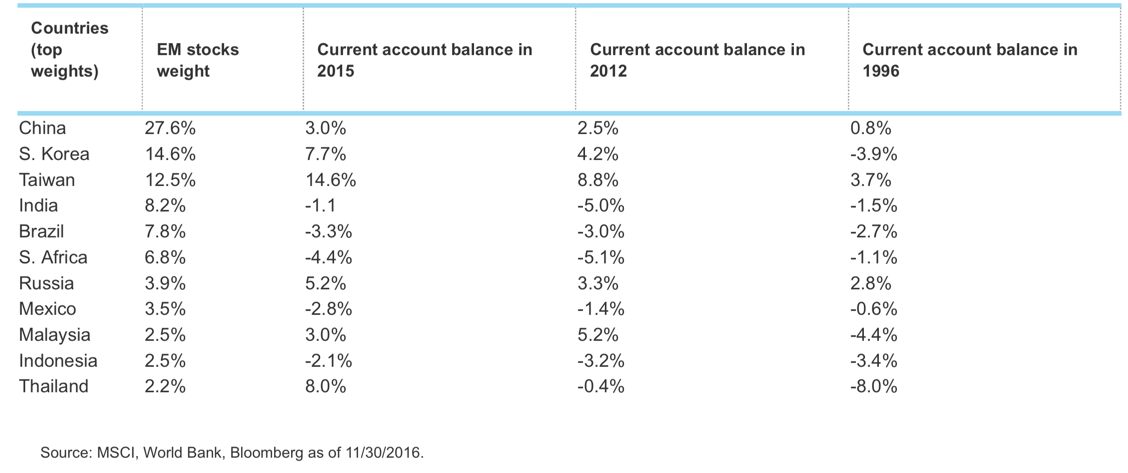

- While ranking vulnerability of any economy, one of the methods is to look at the country-wise current account balances. A current account surplus indicates that the value of a country’s net foreign assets (i.e. assets minus liabilities) grew over the period in question, and a current account deficit indicates that it shrank. Needless to say, the most vulnerable EM economies are those that have negative current account balances. The image below shows a comparison of current account balances in different Emerging Markets.

- From the picture, it is clear that the Indian economy is not that poorly placed, as far as current account balances are concerned. Looking ahead, the Indian economy is the only one where interest rates are likely to trend lower. The Indian Rupee has been pretty resilient in the wake of the dollar onslaught. Putting it all together, the prognosis isn’t that bearish.

- A lot has already been written about demonetization and its effects on the Indian economy. To me, with each passing day, it becomes crystal clear that nobody has a clue. In the interim, what seems to have happened is that sentiment has got whacked. As a result, individual investors continue to remain leery of investing in the stock market.

- However, sentiment can turn on a dime. In the stock market, sentiment changes when prices change. What looks bearish and scary can suddenly start to look bullish and exciting. As Yogi Berra has famously said; 90 percent of the game is half mental.

Excellent article! liked the comment on demonetization.

Thanks. You can try this https://sentimentsbubbles.com/insider/

SPIVA India Card is the new thing I learnt today, probably useful and reliable for my broad analysis on Indian Stock Market. In my view our market may tend to keep sideways and even find deceleration, in the coming months particularly due to demonetization. Banks may hit the most. I am more concerned about the US market as if it collapses, which seems to be evident, our market may find a knee jerk reaction and severe negative impact, anytime!

Too much noise. Difficult to predict.