(Source: www.shutterstock.com/cartoonresource)

Good storytelling is exciting and memorable. The irresistible power of storytelling appeals to our storytelling bias. The content of the story does not matter.

The Power of Storytelling

There is an old Budweiser commercial called ‘Puppy Love.’ It was aired during the Superbowl, which is the annual championship game of the National Football League in the United States. Take a look:

Budweiser always uses the Clydesdale breed of horses and the Puppy in most of their commercials. Audiences identify the pair with the product. They want viewers to think of the brand as soon as they see the horse and the puppy. The commercial plays on the ‘buddies’ concept of the product. It does ensure that the next time someone wants to have a couple of beers with their friends, they will think of buying a couple of Budweisers.

Research conducted on the use of cute animals and use of celebrities to sell products or ideas predicted the success of the above commercial even before it was aired. The basis of the research was an analysis of 108 Super Bowl ads over a two-year period. The research findings turned out to be prescient. It seems, the basis for the research predictions were:

-

The commercial highlights the human bias of storytelling. The power of classic storytelling is irresistible.

- People get attracted to stories. The reason for this is that we’re social creatures, and we relate to other people. Hence, regardless of the content of the commercial, the structure of the content predicted its success.

- Storytelling gives us a false sense of understanding and an overconfidence bias. It does prompt us into taking bigger risks.

- In the commercial, attractive actors play bit roles. Storytelling is used to build trust and viewer ethos and pathos. Both of these affect viewer sentiment.

- The clever use of storytelling ensures that while our brain is trying to sort out the facts, our gut/instinct tells us that we can trust the person or the product. At the same time, our heart wants us to do something about it.

-

The commercial plays on the viewers minds and what users are thinking. At the same time, it doesn’t say a lot about the product being advertised. The product is shown just once, at the end. As a result, the commercial leaves a lot of room for viewers to interpret it in whichever way they want. The commercial uses a perfectly rhetorical situation and then through a subtle use of logos leaves the rest to the viewer’s imagination. It does provide a superb viewing experience and also appeals to the heart.

How does all of the above fit in with the Modi Sarkar story? Consider the following:

- There is no doubt about the fact that Narendra Modi (first as the Prime Ministerial candidate and then as the Prime Minister) has mesmerized Indian investors and FII’s (Foreign Institutional Investor) with his oratory skills and storytelling abilities.

- The Prime Minister keeps talking about his ‘grand vision’. Investors (both Indian and FII) have imagined, extrapolated and alluded all kinds of meanings to the Prime Minister’s ‘grand vision.’

-

Storytelling ensures that we attach emotion to the things that are happening around us. Good stories go to the heart; raw data don’t reach there. Moreover, data does not inspire people to act. Stories do. All of this ensured that the Prime Ministers storytelling abilities took sentiment indices and expectations to all-time highs.

I think we as investors must remember that all politicians are storytellers, it is the tool of their trade. (If you now read just the underlined, italicized and highlighted portions in the passage above once again, you might come to the conclusion that the power of storytelling has been put to good use by the Prime Minister).

The Modi Sarkar ‘Markets Report Card.’

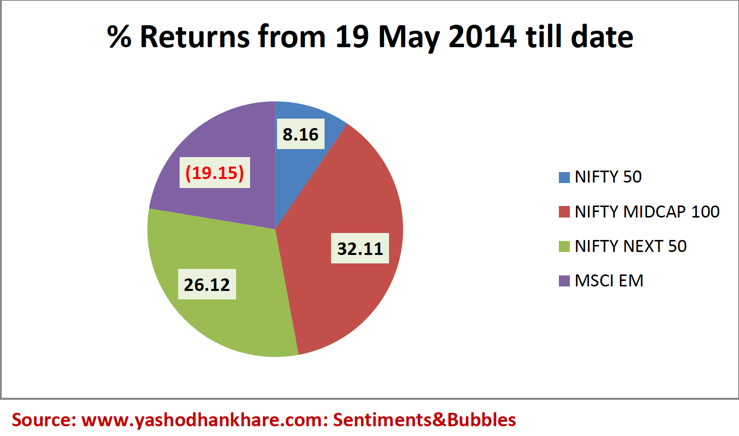

The performance of leading indices and their comparison with the MSCI Emerging Markets (EM) benchmark from 19 May 2014 till date looks like this:

The outperformance of Indian equities is apparent in the image above. The question is how much of this is a result of storytelling? I am assuming that economic growth and stock market returns are positively correlated. At the same time, I feel that economic growth and politics have little in common. In other words, what I am saying is that the impact of any political party or any by-election on the economy is vastly overstated. Consider the following:

-

Since May 2014, oil prices have cratered, the Rupee has weakened, and interest rates have been lowered. These are the reasons why Indian markets have outperformed the MSCI EM benchmark. All of these have absolutely nothing to with the Modi Sarkar storytelling saga.

-

Market participants are concerned with a stable government. It doesn’t matter which political party is in power. Apart from political stability, most of the big money is politically agnostic. The Bhartiya Janata Party (BJP) has historically been perceived as being friendly to business and industry. As a result, markets more often than not, side with the BJP. Justifiably, the BJP’s recent political setback is being priced in.

What about storytelling and Sentiment indices?

This is where the Modi Sarkar storytelling saga has gone sour, and the real damage has been done. Investor sentiment is shaken, waiting for the next shoe to drop. As a result, sentiment indices are at their lowest point since May 2014. How does one measure sentiment?

What we think of the Modi Sarkar story counts for little. Indian markets are run by Foreign Institutional Investors (FII’s). Hence, what matters is FII sentiment.

Christopher Wood of CLSA gave an interview recently. Why am I highlighting this particular conversation and ignoring all others? The reason is that the gentleman in question has been around for a very long time. He represents a formidable Foreign Institutional Investor (FII). Most importantly, what he writes and says makes sense. Hence, I feel it is safe to conclude that Christopher Wood echoes the views of the FII community. His opinion, in a nutshell, is as follows:

-

The FII’s are worried about the health of India’s Public Sector Banks (PSB’s). They feel that the incumbent government could have done more to address non-performing assets held by PSB’s. Whatever the government and the Reserve Bank of India have done thus far, is deemed to be ‘not enough’. It is seen as the primary reason for the lack of visibility in economic growth.

-

The FII’s are waiting for a pickup in the investment cycle. There has been none in the current calendar year. Until a pickup in the investment cycle takes place, he feels that India will continue to be a fixed income story rather than an equity story.

From the interview, it does seem to me that FII’s are disappointed, but they are not disillusioned. He highlights PSB’s. Is this disappointment a function of the fact that the Public Sector Bank Sectoral Index was the best performing sectoral index in the calendar year 2014? I think it is. To read the interview click here.

Does Storytelling always have a bad ending?

There is no correlation between storytelling and investment returns. Good stories may or may not end up making money for investors. Part one of the Modi Sarkar story has had a bad ending. I am sure the Prime Minister has many more stories to tell. Maybe, this time he will build stories around the reform process.

Politics cannot form the basis for investment decision-making; sentiments do. Political developments will continue to play havoc with investor sentiment. The following might help in countering the political rhetoric:

-

Currently, the risk of continued gridlock and policy paralysis is being priced into stock valuations. It does throw up an opportunity to buy stocks without paying the ‘Modi premium’.

- To me, the crux is the trade-off between expectations and actuals. Investor sentiments always overshoot on both sides. Trying to time markets by gauging investor sentiments is next to impossible. What we can do is to ‘reset’ our expectations. Even the FII’s are doing an ‘expectations reset’. Have we reached the nadir regarding the expectations v/s actuals equation? Only time will tell.

- Are we allowing sentiment indices to roil our investment decision-making abilities? Should we be more dispassionate while investing? Should we allow emotional storytelling to get in the way of intelligent investing? While I leave you to figure that out, I am reminded of Charlie Munger, who has famously said that ‘investing is simple, but not easy.’

Has the market priced in rejection of GST. Bill in Rajaasabha ?

Lets hope for the best

Good write-up. Like you have so many indices to measure abstract ideas like ease of doing business & corruption, is there an investment sentiment index ?

Thanks. There are sentiment indices but computations are vague and none of them are tailored for Indian markets

well thought of article

Love it

Thanks.

Complete different angle on story telling and the stock market. Quite amazing! The story telling had certainly played an exceptional role; however it may not support if the lacks in action. This is precisely happening in Modi Sarakar. People also have tendency to get fed up about story telling in a short while, as the purse is more important for a common man. Sarkar has been not successful in bringing on its front desk issues like GST, inflation, infrastructure development, black money, vigorously. The pace of taking action from our apex bank is also going by snail’s pace. This shows a clear conflict between Sarkar and Bank regulator… Anyways.

In short, story telling has a very little role in matured stock markets and unless there is any policy initiation, I don’t think FII will tolerate this, anymore!

True. It seems even the FII’s got carried away