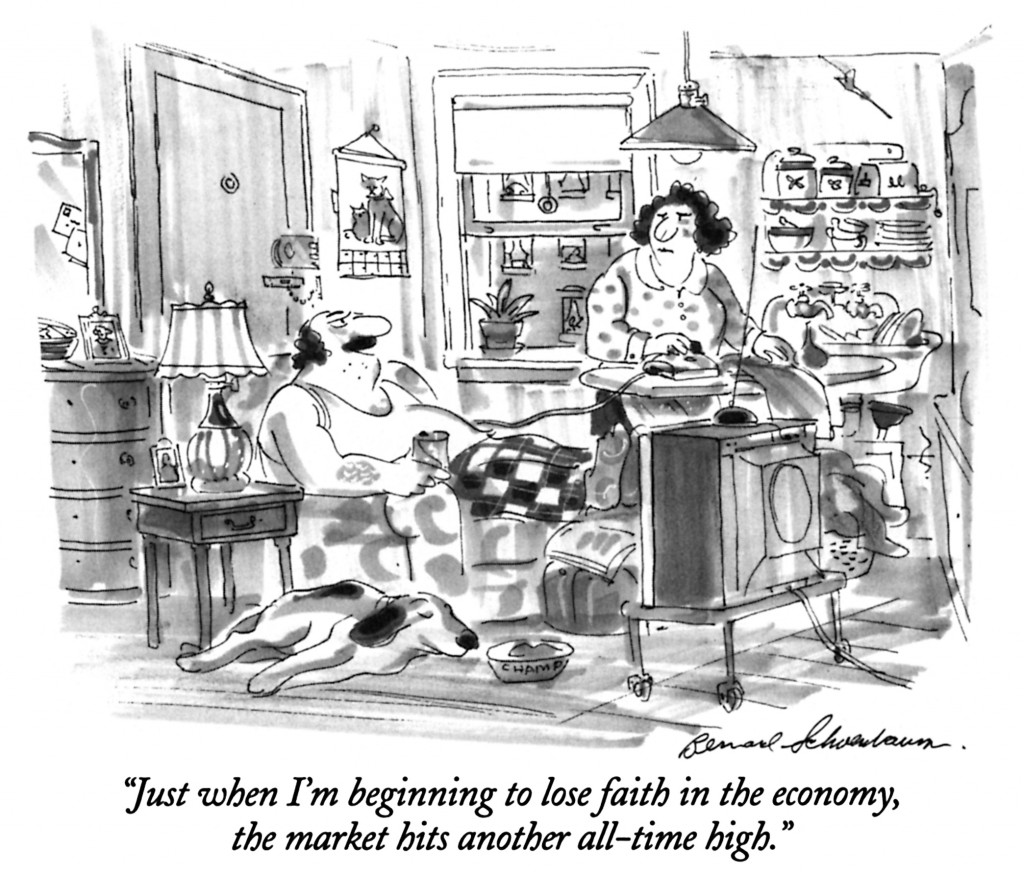

(Credit : Bernard Schoenbaum The New Yorker Collection/The Cartoon Bank)

The Gamblers Fallacy

As per Wikipedia “The Gamblers fallacy, is the mistaken belief, that if something happens more frequently than normal during some period, then it will happen less frequently in the future, or that if something happens less frequently than normal during some period, then it will happen more frequently in the future. In situations where what is being observed is truly random, this belief though appealing to the human mind, is false.” This is a cognitive defect and each one of us is prone to it. We innately believe that random occurrences are short-lived. For eg. ten straight coin flips landing on heads virtually assures us that the next flip will be tails. This is not necessarily a corollary, since the next flip is an independent event in itself and not governed by prior occurrences. How does it apply to our markets? We have been making new all time highs on the benchmark indices since around March 2014. The initial uncertainty with the election outcome is done with and we continue to trend higher. So every time you have a screaming headline saying that the Nifty is at an all time high or new all time high most investors just seem to think that it is just a matter of time before this house of cards comes crashing down. The markets unfortunately, think otherwise. New all time highs are being followed by fresh ones.

New All time Highs on the Nifty

Winston Churchill had said the further back you can look, the further forward you are likely to see. Hence, I had a look at the period from 2003 when the Nifty first made it’s all time high (after the dot-com bubble). I found that for the period from 2003 to 2008 the nifty made a total of 176 new all time highs. Please note, I am not talking about 52 week highs. A new all time high (ATH) means a price at which the stock or index has never traded in its trading history. The price has never been seen before. It is used to comment on a price which has never existed. In this post, all figures for highs are on closing basis and not intra day occurrences. The intra day high might be higher, but I prefer to look at closes. The table below shows the year wise all time highs for both the periods:

| YEAR | ATH | YEAR | ATH |

| 2000 | 1 | 2013 | 2 |

| 2003 | 7 | 2014 | 35 |

| 2004 | 15 | ||

| 2005 | 46 | ||

| 2006 | 54 | ||

| 2007 | 49 | ||

| 2008 | 4 | ||

| 176 | 37 |

The following is worth mentioning:

- The dot-com bubble saw the Nifty make a closing high of 1756 on 11th February, 2000. This was breached on the way up, and for the first time on 18th Dec 2003.

-

It proceeded to make an all time high of 1982.15 on 14th January, 2004.

-

There was a general election in 2004. The left parties sprang a surprise and were a part of the new government.

-

On this backdrop the Nifty corrected to 1388.75 on 17th May, 2004, and then made its next new all time high of 1999.00 on 2nd December, 2004. From this point, the Nifty made a total of 162 new all time highs till 08th January, 2008.

-

The Nifty made a total of 176 new all time highs from 18th December, 2003 to 08th January, 2008.

-

In the current scenario the Nifty first broke its January 2008 high on 05th November 2010 but it proved to be a short-lived, one time occurrence.

- It decisively broke this pinnacle on 03 rd November, 2013 by closing at 6317.35. Since then till 14th Aug it has made 37 new all time highs.

- In the current bull run as many as 28 of the 50 stocks in the Nifty have made new all time highs in the calendar year 2014. You can see the list here. (Please note these are intra day prices not necessarily closing prices).

This does not mean there were no corrections in the 2003- 2008 period. There were plenty, but all of them were ‘fast and furious’.

What do New All Time Highs signify?

In the context of the market, new all time highs signify the following:

-

It means that a lot of people who have been waiting for that much expected pull back to enter the market are left out. It means that there are plenty of people sitting on cash waiting to ‘buy the dip’.

- For the people who have bought and are riding the market, their buys are their winners and something with which they will not part with easily, since the stock has been a ‘lucky mascot’ or it has just been ‘good to them’.

- A new all time high is a coronation for the stock/index and should be treated as such.

- A stock trading at a new all time high means the smart money has bought in to the stock, and is willing to pay a new price for acquiring more of it. This is not a normal phenomenon and is an abnormality in itself.

- It effectively means, that there is practically no one nursing a loss or waiting to get out, since the price has never made a prior occurrence. In effect, no one is waiting to get back to even so they can sell and get out.

- It also means you have a lot of folk who bought early, but bought too small a quantity, are now waiting to add more in the event of a correction. This explains the short-lived and ‘running’ corrections that we are witnessing for the last 2 months.

- It means that every single sell recommendation / downgrade and negative prognostication was wrong, and a whole load of bullshit. It means the media which went gung-ho on the fed taper throughout 2013 and till date were wrong, and prefer to stay wrong.

- It means that everyone who sold on the way up, got out early. They are now tracking the price daily, and counting their notional losses. It also means investors are calculating notional losses on stocks which they were contemplating to buy, but did not end up buying. In fact, I find investors (me included) keep watching notional losses as actively as they watch their own portfolios!!

- It means that discussions about the fundamentals of the Indian economy were all a waste of time. Historically, no one has ever called the top using fundamentals, so it is a waste of time looking there.

- It means that stocks making new all time highs will be first ones to recover in the event of any broad-based sell off.

Conclusion

The favourite investor tagline is that all time highs are dangerous, and a sign that the market has gone too far, thereby implying that this is their last chance to get out of the market. If one looks at the data, this is not the conclusion one will reach. Actually, reaching an all time high is one of the most bullish things that can happen in any market. This ought to be intuitive but it is not. The way all time highs are tom-tommed, gives a signal to investors that a crash is inevitable imminent. The higher the market goes, the louder and more vociferous are the forecasts of a crash. In secular bull markets (like the current one), new highs are endemic. Multiple new all time highs are signs of a mature bull market. Yes, I agree, that all time highs are unnerving, since a new bear market will start at one of them, but nobody knows which one and when. It is worthless making doomsday predictions when the data is what it is. I am not saying that investors should rush in and buy any stock that is hitting a new all time high. What I am saying is that in the event of a correction they know which stock to buy. There can be many valid reasons for selling stocks, but a stock or an index hitting a new all time high is not one of them. How many more new all time highs do you think this bull market will make?

The article found quite informative, nicely explained. You may consider giving advice on riders for stock selection, if you are of the view that fundamentally strong stocks tend to perform better than the nifty/ index.

Frankly speaking, there are over expectations from Modi government initially. After settling the turbulence, I expect the new government will keep this market rolling, with one or the other news and consequently more and more elevations are inevitable.

After the (1st full fledged) finance budget of new government however chances of more to see the declines, which may probably give more opportunity for staunch investors to accumulate and average their inflated quality stocks for next rally initiation (expected in 2017-18).

Stock selection in the entire listed universe is risky. So I prefer the Nifty stocks which are inherently well managed companies. I agree that it is difficult to get multi baggers in this list. However I think even if one makes 25 % per annum one who should be happy. Trying to pick multi baggers from the balance stocks is fraught with risk.

The problem is expectations from the honourable PM were sky high, so the reality is catching up. Investors still look at churning and not investing. The brokerage business runs on churn. Equity MF’s the less said the better!! Actually, stock selection is critical. Ideally stick to the Nifty, that is why I have given the list in the link. Some stocks might beat the Nifty.

Looking at the current global geopolitical problems and strengthening USD especially visaviz INR , i am very sceptical about this continuing trend of new highs that too when Modi magic is not working as he needs time to open up his pandora atleast unless inflation cools off, which I believe is primary n difficult task to achieve by this calendar end.

Corporate profitability will grow at a decent pace, but PE multiple is a function of the market psyche. At current level of conviction of savvy investors , it seems almost fully priced in with max potential upside of around 5 percent max by this calendar end in Nifty terms.

The blunder done by the lawyer turned FM about the debt funds will help equity investments in MFs over a period of time provided the next 2 quarterly results are decent and obviously the Agents get good commission on the SIPs and direct investments through them.

One thing is sure that Equity will be the best allocation class for retail and even HNI investors to beat the combined percentage of inflation plus GDP growth.

Problem is that, their conviction due to past experiences of burning their fingers in direct equity secondary markets is very low. BUT , then they can ideally invest in Equity Mfs which in fact is the best way for investors who don’t have time to watch mats on a daily basis,… Unless they have a good equity advisor who can manage the funds and create wealth far better than the Mutual Fund Managers……..