(Source: www.shutterstock.com/cartoonresource)(31 January 2016)

Is Volatility a friend or an enemy? When the markets are going up volatility is the investors friend. On the way down, Volatility is a sworn enemy. As a result, I prefer to call Volatility a frenemy. Is there any such thing as a ‘Low Volatility’ stock?

Volatility: The Way Out

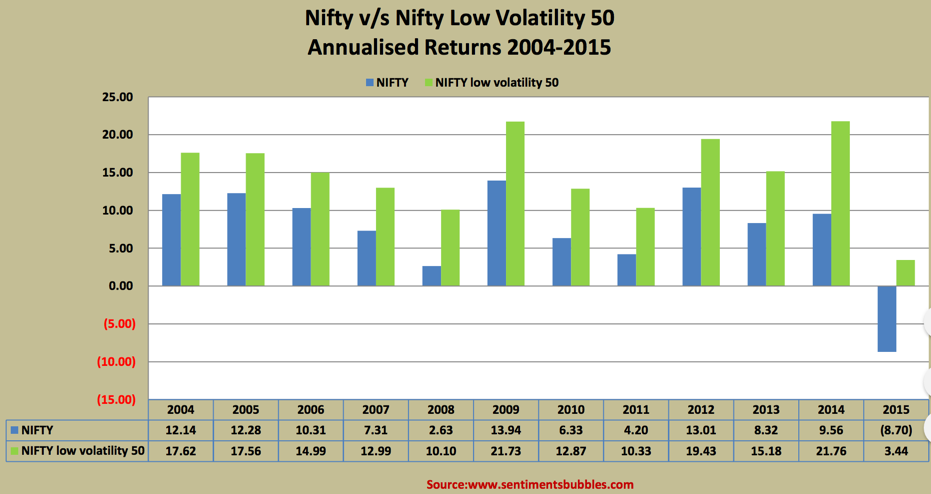

The National Stock Exchange of India (NSE) disseminates a Nifty Low Volatility 50 Index as part of its ‘Strategy Indices’. The image below shows the Annualised Returns (not yearly) of the Nifty Low Volatility 50 Index in comparison with the Nifty 50 (the benchmark).

I don’t see any point in trying to analyse the apparent outperformance of the Nifty Low Volatility 50 Index. What I did instead, was to take a deep dive into the methodology adopted for arriving at the composition of non-volatile stocks. In a nutshell, this is how it is done:

-

The Nifty Low Volatility 50 Index aims to measure the performance of the least volatile securities. The base value of the Index is 1000 as on 31st December 2003.

-

There are roughly 1500 stocks listed on the NSE. From these, the free float market capitalisation and aggregate traded turnover for the last six months for the top 300 stocks are considered. The standard deviation of daily prices is then calculated for these top 300 stocks. The stocks with the lowest standard deviation are considered to be the least volatile. The Nifty Low Volatility 50 Index comprises the top 50 of these least volatile stocks.

- The Nifty Low Volatility 50 Index is reviewed and rebalanced in January, April, July and October of every year. In my opinion, this is an excellent feature. In this way, the volatility of the index is reassessed periodically. In times of heightened uncertainty, like the ones we seem to be in, this is critical.

-

You can click here to read the Methodology Document of the Nifty Low Volatility 50 Index and here to read the fact sheet.

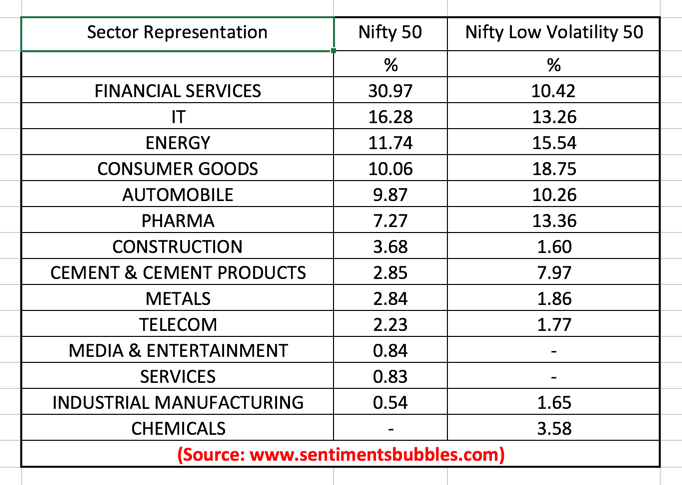

The Nifty Low Volatility 50 Index beats the benchmark in every year since its inception. A closer look at the two indices viz., the Nifty 50 and the Nifty Low Volatility 50 Index reveals the reason for the clear outperformance of the latter. Take a look at the sectoral allocation:

Again, no commentary required. We had a raging bull market till the calendar year 2008. Post-2008 and till 2014, the market was more or less sideways. Irrespective of the underlying trend, the Nifty Low Volatility 50 Index is a clear winner. Effectively you are left with fifty stocks that seem to outperform through thick and thin.

Volatility Index – India VIX

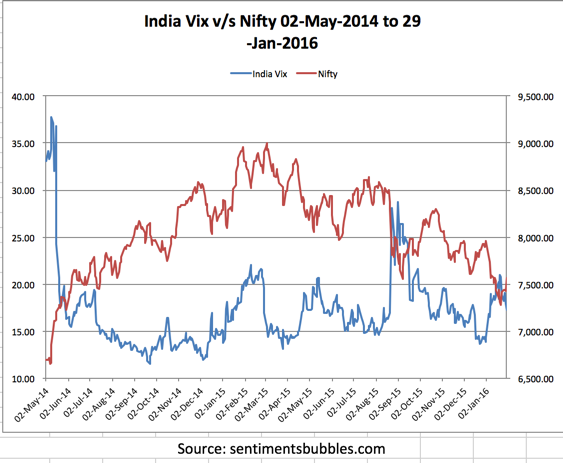

What about the India VIX? The India VIX is disseminated by the NSE and is defined as a measure of the market’s expectation of Volatility over the next thirty days. The Nifty and the VIX are inversely correlated. The image below shows the India VIX alongside the benchmark.

The India VIX is computed using the best bid and ask quotes of the out-of-the-money near and mid-month Nifty options contracts which are traded on the Futures and Options (F&O) segment of NSE. Effectively, higher the India VIX values, higher the expected volatility and vice-versa. However, I find the image above a bit strange for the following reasons:

-

In January 2016, the Nifty 50 broke its September 2015 closing low of 7558.80. In the ordinary course, since the two are inversely correlated, the India VIX ought to have made a fresh high in January 2016. Nothing of the sort has happened.

-

Is the VIX a timing tool? Maybe, if one is active in the F&O segment and trading options. That is why it is called a ‘coincident rather than a leading indicator’. For investing purposes, I think the India VIX is almost useless.

Volatility: What Lies Ahead

It is impossible to predict the type of Volatility (upward or downward) that lies ahead. My guess is, as far as Volatility per se is concerned ‘we ain’t seen nothing yet’. As we brace ourselves for this bull market in Volatility, the following thoughts might help:

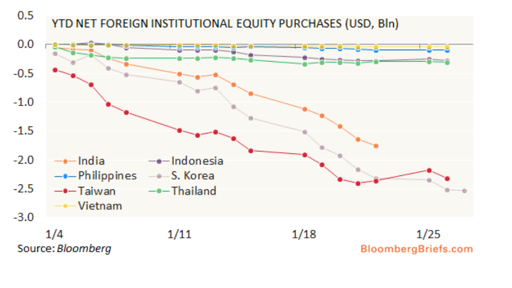

1. Do markets reflect economic fundamentals? Up to a point they do, and then, all of a sudden they don’t. After a point, they reflect the perceptions of the dominant investors. In India, the Foreign Institutional Investors (FII) are the dominant investors. The question that comes to my mind is: What about the Volatility of FII flows into Emerging Markets (EM) and India in particular? The image below shows the current trend (not very encouraging).

2. Goldman Sachs is a reputed international investment bank. According to Goldman Sachs, for EM economies, China will be a source of volatility not only for 2016 but also for the next five years. In other words, China doesn’t appear to be an attractive investment destination for the guys at Goldman. At least, not at current valuations of Chinese equities. It would be safe to conclude that FII ‘flows’ to EM’s and India will remain volatile for the following reasons:

-

The consensus is that India is the ‘best house in the neighbourhood’. As a result, Indian equities ought to be much sought after. I beg to differ. All of this China induced volatility is forcing money managers to stay underweight EM’s. As funds move from EM’s to the Developed world, equities in EM’s continue to go south.

-

Happenings in the Chinese economy have little to do with the Indian economy. However, allocations to Chinese stocks influence EM allocations. To that extent, it hurts FII allocations to Indian equities. In other words, if nobody wants to visit the neighbourhood to start with, why bother to check on the quality of the houses?

3. Of late, the word Volatility is always used in conjunction with the word contagion. Contagion rhetoric first started with Greece and the Eurozone. We then had financial contagion from EM debt, and then the Oil contagion, Chinese Contagion, etc. Jawboning by the media does result in every single world event being perceived as contagious. In such a scenario, I have come to the conclusion that the news items that are printed and broadcast follow the price action. After the volatility is done with, the media does the job of trying to glorify justify it. Ideally, it ought to be the other way round. In other words, is the price dictating the news or is the news dictating the price?

4. Volatility and Contagion have a positive side effect as well. They keep investor expectations low. That way, sentiment spikes favourably for the flimsiest of reasons. Something similar happened on Friday, 29 January 2016. Many investors had anticipated an expansion of the Japanese asset-purchase programme this year. Few expected Japan to join the European Central Bank and the central banks of Sweden, Denmark, and Switzerland in negative territory. As a result of this:

- The Japanese bazooka on Friday took markets by surprise. The size of the move, ten basis points, is paltry. As compared to this, the boost to investor sentiment was massive. Chinese currency manipulations gave rise to negative sentiment and Volatility. The Japanese ones are working in the reverse direction.

- When Janet Yellen raised interest rates in December 2015, it was perceived as, the beginning of the end, of central bank largesse. That is why Japanese central bank initiative on Friday had such a positive effect. Effectively, central bank induced Volatility is here to stay.

5. Jarring moves in world markets have made life difficult for global money managers. As a result, they seem to be moving from being cautiously optimistic to being cautiously pessimistic about EM equities. The perception that China is not an Emerging Market but is in fact, a Submerging Market is gaining ground. The attendant gloom is evident in the EM world. How long will this continue? At some point, the smart money will come in. That is why it is said: “If something cannot go on forever, it will stop.”

Some of these low volatility stocks are safe but slow on returns. Only a patient investor should hold them in his portfolio.

Got it Sunil. Very true, these stocks can test your patience. Thanks