(Cartoonist: Wilfred Hildonen; cartoonstock.com)(Saturday, 18 June 2016)

Brexit is the abbreviated form of ‘British Exit from the European Union’. It refers to the possibility that British voters will vote to leave the European Union in the referendum to be held on 23rd June 2016.

Brexit: What are the fears?

I am assuming that the upcoming Brexit vote and the Scottish referendum in 2014 are comparable events. Prima facie, the similarities between the two referendums are apparent; Both the referendums are over issues related to independence, sovereignty, and the economy. The fears too are similar. In a nutshell:

- If the United Kingdom (UK) were to leave the European Union (EU), other European countries might follow. The threat that the EU will fall apart and Brexit would be a catalyst in expediting this process has been articulated by the financial media. Eurozone break-up fears have repeatedly surfaced since 2011. However, no one has made money betting on the dissolution of the Eurozone.

The images below show the closing prices of the Nifty and the MSCI World Index for 90 trading days leading up to the Scottish referendum and the 90 trading days leading up to the Brexit referendum. It is apparent from the images that the indices seem to be tracking similar paths in the days leading up to both the referendums.

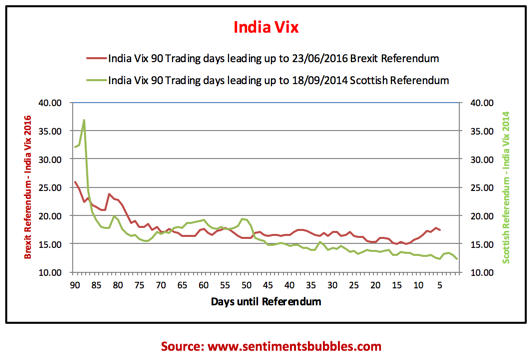

Considering the nature of the event (Brexit), markets have been pretty calm over the last fortnight. Volatility has spiked, but the spike has not been extraordinary. It seems to suggest that either the market expects the UK to remain within the EU or if they opt to leave, things wouldn’t be as catastrophic as the financial media is projecting. In my opinion, in the short-term, markets generally get it right. Heading into the vote, markets don’t seem to be in a state of panic. That is apparent from the India VIX shown below.

What does Brexit mean for the Indian Stock Market? For us in India, the Brexit vote is a one-sided risk. What that means is that in case the U.K. votes to remain in the EU, the relief rally is expected to be modest, at best. If the U.K. votes to leave, it can result in a sharp sell-off.

Is Brexit inflating the Bond Market Bubble?

I think that what is happening in the Global Bond market is far more worrying than the Brexit vote. None of this concerns the Indian market directly. However, Indian markets are susceptible to global risk aversion and flow-risk. As a result, when the bond market has been behaving in the way it has in the past two weeks, one needs to sit up and pay attention. The image below shows the yield on the 10 Year U.S. Treasury Bond from 01 January 2011 till date.

For the uninitiated, I need to clarify the following:

- Bonds are fixed income instruments and are inherently safe. The U.S. 10 Year Treasury Bond is the Gold Standard in this category. Apart from the safety it affords, the U.S. 10 year Treasury Bond is the most liquid fixed income instrument in the World.

- Yields on bond instruments move in the opposite direction to bond prices. As a result, higher bond prices translate into lower yields. The U.S. 10 Year Treasury Bonds closed at a yield of 1.6111 percent on 17 June 2016. In layman terms what that means is that you can lend money to the U.S. government for a decade, and you will end up making a total return of 16.111 percent over a period of ten years. In the Developed World, the U.S. 10 Year Treasury Bond commands the highest yield. Comparable 10-year instrument yields for German and Japanese Bonds are either at zero or in negative territory.

- Bond prices are a function of two things; interest rates and inflation. If either of these two rises, bond prices fall and bond yields rise. The U.S. 10 Year Treasury Bond image shown above, indicates that the market expects neither inflation nor higher interest rates. As a result, yields have been falling continuously for the last couple of years.

- The U.S. 10 Year Treasury Bond yields are now within striking distance of their All-Time Lows. Historically, the U.S. 10 Year Treasury Bond yield falls when investors become risk-averse or pessimistic about future growth prospects. As on date, declining bond yields seem to suggest that the longer-term story is pretty deflationary.

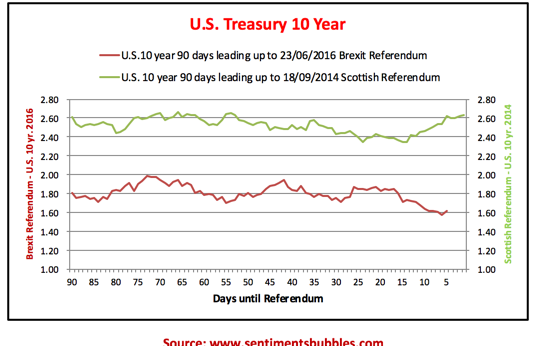

The image below shows the same instrument i.e. the U.S. 10 Year Treasury Bond yield in the 90 days leading up to the Scottish Referendum in 2014 and the 90 days leading to the upcoming Brexit vote.

1. As we get closer to the Brexit vote, the U.S. 10 Year Treasury Bond Yield is falling. The commentary is that the bond yields are pricing in the risk of the UK leaving the EU – an actual Brexit. Some anxiety is warranted, I agree. However, we didn’t see anything like this at the time of the Scottish referendum.

2. The Scottish referendum was about breaking up the U.K. into two countries. The uncertainty that such an event would have brought about would have been, in my opinion, far greater than the one that the Brexit referendum entails. In spite of this, the U.S. 10 Year Bond yields were rising in the run-up to the Scottish vote.

3. The financial media is obsessed with the concept of ‘flight to safety’ and ‘safe-haven assets’. I disagree. If it is ‘haven investing’ that we are witnessing in the bond market, why were yields rising in the run-up to the Scottish referendum? Does the bond market perceive the Brexit vote as being riskier than the Scottish referendum? I don’t think so.

4. If the financial media is to be believed it would be tantamount to saying that buying negative or zero yielding debt instruments is safe. Have these guys lost their marbles? Investors will do well to remember an old market aphorism that says: ‘What appears safe is infinitely dangerous.’ In my opinion, ‘flight to safety’ and ‘safe-haven investing’ is not what is happening.

5. The crash in U.S. 10 Year bond yield appears logical when you consider that the European Central Bank (ECB) started buying the debt of some of the continent’s biggest companies around 8th June 2016. (The ECB buying corporate debt was announced much earlier, but the purchases commenced only on the 8th of June or thereabouts). Savvy bond traders sensed an opportunity to make a quick buck. Front running of announced policy initiatives by market mavens is common, and there is nothing wrong with that. As a result, German bond yields or Bunds as they are called crashed to a shade below zero and the U.S. Treasury Bond yields fell to four-year lows.

6. The fact that the bond market is in bubble territory has been repeated ad infinitum over the last couple of years. Bond yields have continued to drop relentlessly, and the so-called bond bubble has grown bigger. The ECB actions last week, combined with the anxiety over Brexit, are driving down yields and inflating the bond bubble. The questions that come to my mind are:

- Can the Bond market bubble inflate even further? I think it can. If the Japanese Central Bank were to announce an expansion of their monetary policy, it would take the U.S. 10 Year Treasury Bond yields even lower and inflate the bond bubble even further. The Japanese held fire at their policy meet last week, how long will they continue to do so? Nobody knows.

- The U.S. Federal Reserve policy statement issued last week seemed to concur with what the bond market is predicting – lower growth and recession. We are now in a situation where the bond markets appear to be dictating Fed policy. I always thought it was the other way round!

- Consider the fact that the U.S. benchmark equity Indices, (S&P 500) are flirting with their All Time Highs. It means that the stock market thinks that there is nothing to worry about in the world economy. Effectively, the bond market and the stock market are pointing in diametrically opposite directions. Obviously, one of them is wrong. Which one? What if it is equities that are in bubble territory and not bonds? Only time will tell.

- In my opinion, regarding price discovery, both the U.S. 10 Year Bond Market and the U.S. Equity Market are reasonably efficient markets. The question is; Are bond prices lying or are equity prices lying? OR Can the global equities continue to rally and the U.S. 10 Year Bond Yield continue to fall at the same time? Maybe, they can. They have done that in the recent past, haven’t they? How long can this continue? Again, nobody knows.

- At some point, the bond bubble will burst or deflate. When will that tipping point be reached and what will be the consequences? I don’t know, is the short answer. What I do know is that, when bubbles deflate they seldom have happy endings.

- Before I begin to sound too bearish, I need to put some disclaimers in place. I have only analysed what has been happening in the markets over the last two weeks. There are no extrapolations and neither have I tried to predict outcomes. All-in-all, one ends up with a very muddled outlook with too many loose ends and unknowns. I am unable to make an educated guess, and that is what disturbs me the most. I suppose, we will have answers only with the benefit of hindsight.

7. I’ll conclude with a quote by Warren Buffett: “In economics the most important thing to remember… after anything that happens if somebody tells you, ‘This is gonna happen,’ you gotta say, ‘And then what?'”

Excellent article!

Thanks

Yashodhan

Again, a well studied article.

But I would have thought you would comment on the RBI governor’s exit and the ramifications rather than Brexit. Surely that is more pertinent to the Indian stock market at the moment?

Regards

Shailesh

Thanks. I wrote about Rajan in my previous post. As a result, I didn’t mention it this time. The question is of the independence of the RBI. If that is what the government is trying to throttle then there is a problem. Let’s see who the replacement is. That should give the market all the clues that it needs.

wonderful analysis of expected situations after BREXIT.

Thanks

On the panic side – Gold/ premium for Gold sentiment/ gold mining/ Dollar/ silver /precious metals seem to be behaving the same way last few months and weeks. Gold did quickly jumped from around 1200 to 1300, but it is still in the same range for while. Although some indices have doubled from Jan of this year such as $DJGSP, but nothing related to Brexit, at least yet. REITS are hitting all time high, but that could be related to bond yields. FED are not in control but the outside events as you correctly point out.

Yes, Gold has gone up. Indian investors as households are always overweight on Gold, irrespective of what is happening anywhere in the world.