Do you benchmark? More often than not, the answer to this question will be in the negative. Reality is a bit nuanced. Investors do end up getting caught up in the benchmarking process, albeit inadvertently.

Benchmarking

Benchmarking is the act of comparing our investment performance with that of a standard. I have written on benchmarking before. But I have never spelled out how it works in the market. I need to explain the way in which benchmarking works and how most investors end up benchmarking (inadvertently or otherwise). Hence:

- Money management broadly takes two forms; either we park money with an Active Manager in a Portfolio Investment Scheme or we use the Mutual Fund route. In the case of investments via the Portfolio Management route the minimum cap is Rs. 25 lakhs. Clearly, that is on the higher side. As a result, most investors opt for the Mutual Fund route. I will stick to the Mutual Fund route to make things more relevant to the reader.

- Consider the fact that almost no one invests of his or her volition. Investors end up investing in a mutual fund scheme that is sold to them. Part of the selling process is an analysis of the historical returns of the Mutual Fund Scheme in question and the comparison with its stated benchmark. Every marketing strategy that is used by the Mutual Fund industry has the words: ‘compared to the benchmark’ in it. In this way, investors do end up getting caught in the benchmarking process, albeit inadvertently.

Since comparison between various Mutual Fund Schemes and their benchmarks is very popular, I think we need to know a little bit about the pitfalls of benchmarking.

Curse of the Benchmarks?

In a paper titled Curse of the Benchmarks published in March 2016, Dimitri Vayanos and Paul Woolley have attacked the concept of benchmarking. Interested readers may click on the link and read the whole thing. In a nutshell, what the researchers wish to highlight is as follows:

- If a money manager thinks that a particular sector or stock is undervalued, he or she is constrained from investing in that sector by the benchmark. The money manager has to invest in the sector that is working and not in the one that he or she thinks will work in the future. The researchers conclude that money managers are slaves of the index to which they are benchmarked.

- It follows that money managers prefer to trade with the inherent systemic biases. In other words, very few of the money managers short overvalued assets and buy undervalued assets, which in fact is the correct thing to do. According to the researchers, money managers must over-weight the undervalued assets and under-weight the overvalued assets.

Are the conclusions of the researchers valid? I think that there is a kernel of truth in the research findings.

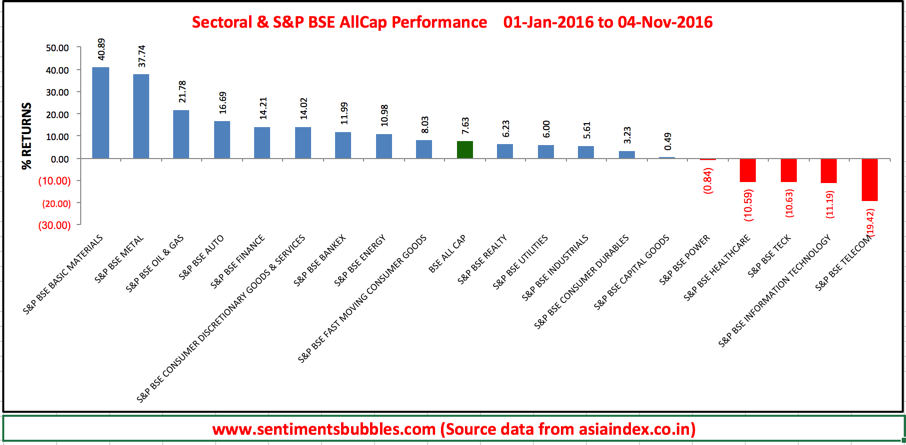

What I did was to map the returns of the sectoral indices alongside the benchmark for the period from 01 January 2016 to 04 November 2016. To do this, I have used the S&P BSE All Cap Index.

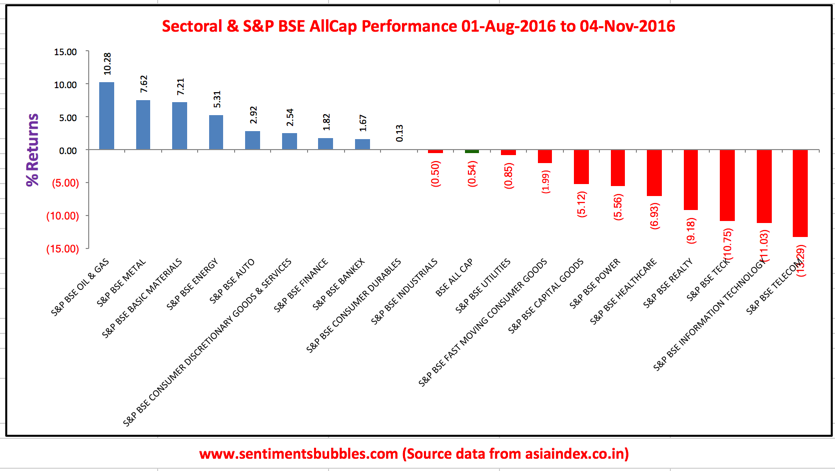

What I did next was to repeat the exercise for the period from 01 August 2016 till date.

It is easy to conclude that in the period from 01 August 2016, the market has been stuck in a tight range. Despite this, sectoral indices have recorded sharp swings. Looking at the two images, which of the following is the correct interpretation? Either:

(A) Since markets are forward-looking, is it correct to conclude that the growth prospects of the laggard sectors, have been deteriorating as the year has progressed. Not only is this the case, but the group of outperforming sectors has also shrunk in size as more sectors have moved to the laggards group. At the same time, the growth prospects of the winning sectors are improving with each passing day.

OR

(B) Money managers are moving towards what has been working (the winning sectors) and away from the laggard sectors. To comply with the tracking constraints, a manager has to control how far the composition of his or her portfolio deviates from that of their stated benchmarks. As a result, money flows from the laggards to the winners.

To me, (B) above is what seems to be happening. It is pretty clear from the images that benchmarks constrain fund managers, encourage herd mentality and exacerbate price distortion. I should hasten to add that there is no attempt to denigrate the business of fund management. Just that there is an inbuilt systemic flaw. Since fund managers have to lash themselves to the mast of their benchmarks, the herd mentality visible above would continue until the end of the calendar year. The matrix flips in January of every year.

The next question is, so what? In my opinion, it is possible to use the systemic bias in the benchmarking process to our advantage. Towards this end, long-term investors can do one or all of the things mentioned below:

- Investors must use rolling returns for comparison purposes and not just those of the immediately preceding year. For example, three-year rolling returns would account for those beginning on the inception date and advancing sequentially every month. Using rolling returns ought to iron out the benchmarking flaws.

- While looking at historical returns for any Mutual Fund Scheme, it makes sense to benchmark with the total returns of the benchmarked index and not the plain vanilla one.

- Since nobody knows what the future holds, it makes sense to invest where the margin of safety is higher. In other words, invest in a fund that has a contrarian investing methodology.

Markets Diary

Over the last fortnight, global investors have been obsessed with predicting the outcome of the U.S.Presidential Elections. Global markets have drifted lower, albeit very slowly and on low volumes. Apparently, correlations between the world markets and the Indian Stock Market have gone up, not down.

I think that investors have yet to recover from the shock of the Brexit vote. The Brexit vote served as a testament to the wisdom of the crowds and reminded investors that prediction markets were fallible. As a result, this time participants are not sure of what to expect if Donald Trump becomes the next President of the United States of America. The rationale behind the Brexit vote was to make Britain Great again, and now the United States proposes to make America Great again. That’s where the similarity ends. Everybody knows that. We haven’t seen any dip buying. Is Mr. Market correctly predicting outcomes and how relevant are they for us in India?

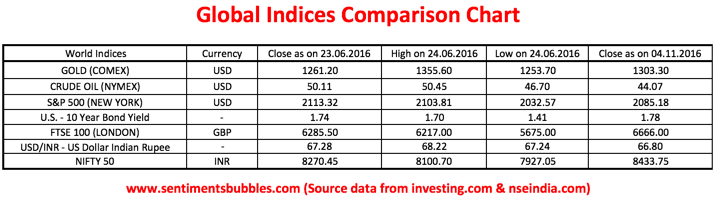

The Brexit vote was on 23rd June 2016. What I have done is to tabulate major global indices on the day preceding the election and the levels that were hit in the aftermath of the Brexit vote. The closing levels as on 04 November 2016 are also shown to get a ‘feel’ of where we stand as on date.

We are trading comfortably above the pre and post-Brexit levels. In fact, the Indian Rupee has strengthened, and that is bullish. I think it would be fair to conclude that according to Mr. Market, the U.S. Presidential Election is a non-event for us in India, irrespective of electoral outcomes. What about those who don’t agree with the above and think that the U.S.Election does matter for the Indian Stock Market? I suppose, they are busy preparing for the ‘mother of all dips’ in the event the United States elects Donald Trump as President. In other words, they are preparing for a correction.

Peter Lynch is known as one of the best money managers of yesteryear. He is also the author of two seminal books on investing, titled Beating the Street and One Up on Wall Street. He has coined some of the best individual investing strategy mantras. I think he hit the nail on the head when he said: “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves.”

Yashodhan

Again, a well researched article.

I agree about your views on the benchmark. However, the tacit assumption seems to be that anyone who invests in shares does through MFs or PMS. How valid is that assumption?

Self-investing is very much popular. But the bulk of the funds is through Mutual Fund Schemes and expected to increase with each passing day. The IT and DINK’s crowd is not in the self-invest mold. They are either day trading or staying away or using Mutual Fund Schemes

For evaluation benchmarking is must, in my view. Unless you get to know a deviation from the standard how one can ascertain his performance? In my view, one needs to see whether he/she earns more than 12% p.a. (8% risk free + 4% risk) returns…..and this itself should be the benchmark!

I endorse to your opinion that US election results will be a non-event for Indian markets. In my view investors around the globe are finding reasons to accumulate stocks in EMs and those people have already got a fair chance of late and continue to get better opportunities in days to come, if the market shrinks!

The winners in market needs to have lion’s heart, who acts in confidence over his firm position!!

True. Incidentally, the historic returns of the Indian Stock Market are between 12 and 14 percent.