Subex Limited

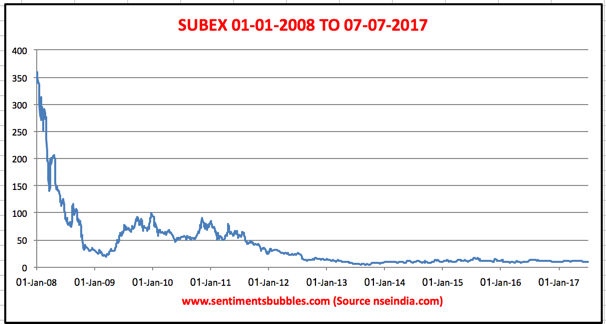

Subex is a turnaround story with a twist. That’s why the price is languishing at Rs. 10.20 for a stock which has a face value of Rs. 10.

Background Information

Subex was founded by Subhash Menon. Subex accumulated massive debt, partly from its decision to buy a Canadian Telecom firm by the name of Syndesis for US$ 170 million in January 2007. It was Subex’s seventh and last acquisition. Menon was advised against using equity for the purchase and that he should use debt instead. Hence, Subex took the FCCB route and issued $180 million of Foreign Currency Convertible Bonds (FCCB’s) with a five-year maturity. The underlying assumption was that the equity shares of Subex would trade at least Rs. 656 per share. After the financial crisis of 2008–09 Subex was trading at Rs. 26 in 2009. In September 2011, Subex sold Syndesis for a tenth of its acquisition price.

In 2009, Menon restructured the debt, issued fresh equity and re-priced the conversion from Rs. 656 to Rs. 80. This process of restructuring debt continued, and the maturity date for the debt was pushed to July 2017. The mode of debt repayment has primarily been that of converting the debt into Equity Shares at various rates. The net result of all this restructuring was that the business suffered and the shares issued bloated. As on date, the paid-up equity capital of Subex is 562,002,935 equity shares of the face value of Rs. 10 each.

Anil Singhvi, former Chief Executive Officer os Gujarat Ambuja Cements Limited and founder of Institutional Investment Advisory Services (IiAS) joined the board of Subex in April 2011 and is now the non-executive chairman of the beleaguered firm. In 2012, the institutional shareholders along with Singhvi got rid of Menon. Surjeet Singh, formerly Chief Financial Officer of Patni Computers also joined the Board as on that date. Hence, Subex has no ‘Promoter Shareholding’ as on date. (It shouldn’t bother an investor though since it is a matter of classification than of anything else).

Business & Outlook

Subex’s revenue comes from four streams: (1) licensing; (2) professional services related to installations and configuration activity; (3) annual support contracts; and (4) managed services. Subex is a leading global provider of Business and Operations Support Systems (B/OSS) that empowers communications service providers (CSPs) to achieve competitive advantages. Subex’s pioneering platform is the Revenue Operations Centre (ROC®). It seems that it brings together business intelligence, domain knowledge, and workflow support. It can be used by telecom companies to build their processes so as to achieve several objectives like lower cost, higher margin, higher revenue, etc.

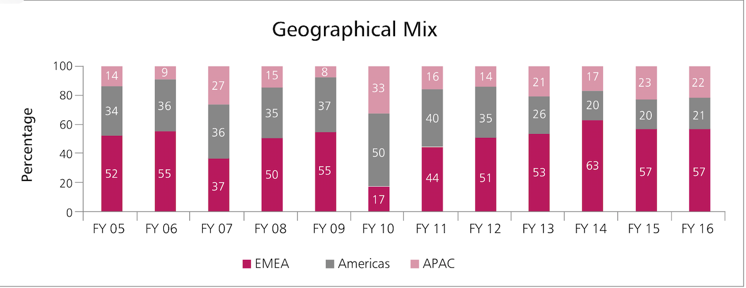

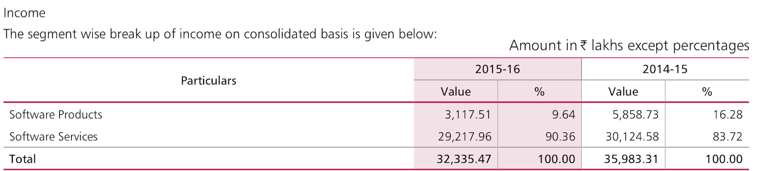

Subex’s customers include 39 of top 50 operators and 7 of the world’s ten largest telecom companies worldwide. The Company has more than 300 installations across 70 countries. Global telecom companies seek to moderate capital investments. It seems that Subex helps telecom companies streamline operations and minimize costs. The analytics function (provided by Subex), helps service providers understand ‘what happened,’ understand ‘why it happened’ and forecast ‘what is likely to happen’ leading to enhanced value and viability. While doing so, Subex can graduate from a position where they deliver what they have been asked to, towards assuming a larger position of telling clients what would be holistically good for their business. Subex calls this graduating from projects to solutions. The geographical and revenue mix of Subex’s business is shown below:

The management is optimistic about the road ahead. Subex has made its foray into the analytics market which provides a lot of headroom for the business to grow and capitalize on the need for business insights. In the analytics market, Subex seeks to demonstrate that it stands apart from the rest in the following manner:

- The efficient management of customer data entails investments. Mobile operators have to continuously invest to enhance capacity. All of them seek to optimize the return on these investments. As such, there is a need for ‘network intelligence.’ Subex addresses this reality by providing a solution that accurately predicts customer yields.

- The biggest challenge encountered by telecom companies is their inability to monetize network traffic value without being able to access or interpret traffic data. Subex’s new generation of systems analytics tools and solutions empowers service providers to optimize existing network and to plan network expansions – knowledge is indeed power.

- Fraud is probably the single biggest revenue drain in the global telecom industry. Following the advent of Over The Top (OTT) vendors, competition for telecom companies is no longer limited to within conventional spaces. The result is that an increasing number of telcos are seeking analytics experts to locate and eliminate fraud. Subex’s fraud management solution leverages data-mining algorithms to identify and alert telcos about suspicious behavior and probable customer fraudulence.

The management discussion and analysis does seem to suggest that business opportunities can be expected to grow at a steady pace. The reason for the discounted price seems to lie elsewhere; it is not about the business that Subex is in or the prospects thereof.

Conclusion

A study of the financials and cash flows for the year 2012 and till date seems to suggest that most of the cash generated was used to service the humongous debt. With the company becoming practically debt-free as on date, there is a kernel of an opportunity that Subex might be able to run a ‘for profit’ business operation in the years to come. To be frank, this is an investing idea, not a recommendation to buy. Whether or not one should invest in Subex would be a function of each investor’s risk profile and conviction. The following might help:

- The multiple FCCB conversions can create a demand-supply mismatch. Plainly, institutions who have willy-nilly converted their debt to equity might sell the shares so converted. In other words, the conversion of the debt held by such institutions has given them an exit route which they may choose to exercise. In my opinion, this is the single largest risk factor. Whether or not these institutions sell, time will tell; there is no point trying to predict what is unknowable.

- There is little top line growth over the last three years. However, cash flow per share has been growing at a steady pace. In the absence of any further interest outgo on account of the FCCB’s, cash flow per share can be expected to increase further.

- As on date, Subex is EPS neutral. Considering the fact that there are a total of 56 crore shares that have been issued, that in itself is an achievement. The risk-reward ratio at the current price of Rs. 10.20 is favorable. Buying Subex from a long-term perspective with a strict stop-loss might be the best way of investing.