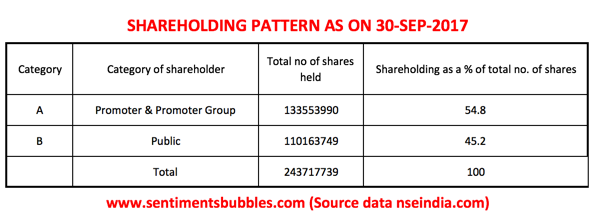

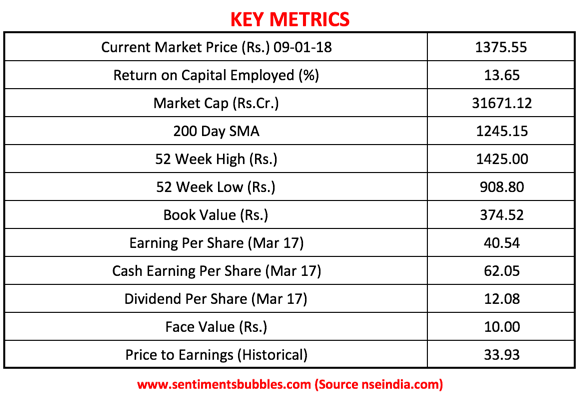

Container Corporation of India (CONCOR) is a Navratna Public Sector Enterprise (PSE) whose object is to provide efficient and reliable multimodal logistics and support for the country’s Export-Import (EXIM), and domestic trade and commerce. The shareholding pattern and Key Metrics are shown below:

Investment Thesis

CONCOR is a multimodal player in the Indian logistics ecosystem. How does one interpret the word ‘multimodal’? Multimodal would mean one that involves several modes of transport. Investing in multiple transportation modes is the need of the hour to bring about efficiencies in the ‘chain’ to reduce pilferage and attendant costs. In a nutshell, multimodal transport refers to the transportation of goods from one point to another via more than one mode of transport. The technical definition of multimodal logistics is: “the chain that interconnects different links or modes of transport – air, sea, and land into one complete process that ensures an efficient and cost-effective door-to-door movement of goods under the responsibility of a single transport operator, known as a Multimodal Transport Operator (MTO), on one transport document”.

It is a fact that the existing logistics infrastructure is crumbling under the weight of the ongoing economic development. We require adequate road and rail infrastructure. At the same time, coastal and outbound shipping routes are also in need of continuous improvement. I think CONCOR is the only player that seems to check all the boxes. I would go so far as saying that it is implausible, that any other corporation in the private sector can come even close. While this is the primary investment thesis, there are several ancillary reasons for the recommendation. These are summarised herein below:

- The implementation of the Goods and Services Act (GST) is a blessing in disguise for logistics companies in India; GST is a game changer. Over the next five years, the logistics map of India would look very different from what it is now. Already, the need for tax enforcement at state border checkpoints has vanished. The immediate relief has been felt in the road transport infrastructure where trucks that used to cover 250 km per day are now estimated to be clocking roughly 325 km. At the same time, GST is expected to change the whole warehousing and distribution paradigm in India.

- In November, the government announced that logistics companies would be treated as part of the infrastructure sector, allowing them to benefit from more liberal regulations when raising funds. From a glance at the Balance Sheet, it is clear that CONCOR is not constrained for resources. However, the full benefit of the regulatory changes will be felt only when the sector makes the full use of technology to maximise productivity. The technology focussed companies will grow the fastest. CONCOR is a technology focussed PSE with an interactive website. The management is committed to bringing about a digital transformation. Part of these initiatives is the use of e-tendering, e-tracking and a mobile app towards providing continuous cargo visibility to its customers. Among other digital initiatives are (a) a VSAT based network that has been extended to cover 73 locations, terminal Management Systems for Domestic (DTMS), for EXIM (ETMS), ERP for Oracle Financial, HR Payroll, Container Repair System, Operation system for the expanded network of terminals, a Data Warehouse Module for commercial applications on centralised architecture across field locations, (b) web-enabled customer interface, (c) Electronic filing facility of documents on the commercial system on all EXIM terminals and many others.

- CONCOR does face stiff competition from Private Container Train Operators (PCTO’s). However, it is practically the only multimodal player (of size); this together with the strength of its Balance Sheet makes it a unique player. In a way (indirectly), it ends up benefiting from what other companies are doing as well. In other words, CONCOR is an automatic beneficiary of all the infrastructure investments that other players will end up making. All in all, investing in CONCUR is a shortcut or a hack for benefiting from the evolving logistics infrastructure.

- The Ministry of Railways has set up the Dedicated Freight Corridor Corporation of India (DFCCIL). DFCCIL undertakes the planning and development, construction, maintenance and operation of the Dedicated Freight along the along the Eastern and Western freight corridors of India. The benefit arising from this initiative (in the future) is a vast and hitherto untapped growth opportunity for CONCOR.

- CONCOR is majorly dependent upon the global economy and the Export-Import (EXIM) trade of the country. Since the global financial crisis, the global economy has been suffering from low growth. Also, as on date, the EXIM trade faces challenges; a strengthening Indian Rupee is just one of them. If one were to analyse CONCOR by growth prospects based on historical precedents, it makes sense not to invest. However, we are not in the predictions business. Looking at the way global stock markets are behaving, it does seem that global growth is likely to stage a rebound. CONCOR is uniquely placed to tap into both, expected global and local growth. Hence, I would prefer to err on the bullish side in my analysis of CONCOR.

- The Indian economy is expected to clock a growth of roughly 7 percent. It is bound to result in additional demand for transport and logistics. The Make in India initiative, the large number of industrial parks, SEZ’s and Ports are all positive triggers. In the current scenario, CONCOR continues to place great emphasis on providing total logistics solutions to its customers by expanding the business in all segments of transport value chain, both in EXIM and Domestic sector. As part of this, CONCOR proposes to set up Multi-Modal Logistics Parks (MMLPs) for providing seamless connectivity and one-stop solution to its customers.

- Among the risk factors are over-dependence on railways and EXIM, vagaries of road logistics and most important of all – land acquisition.

- CONCOR is a Navratna PSU stock. Hence, the provisions for declaration of dividend and other related stuff that I wrote about in my post on NLC India apply similarly. The Board of CONCOR is slated to meet on 24th January 2018 for considering quarterly results and interim dividend.

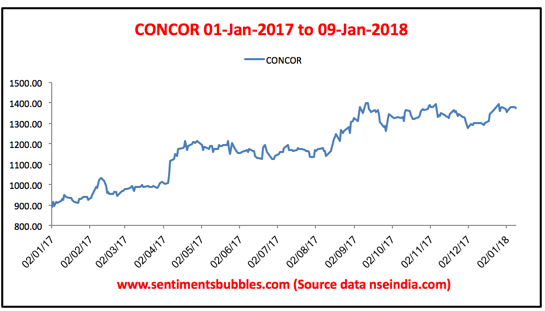

- The price action in CONCOR is somewhat dull for the most part. It is a long-term investing idea and trying to time it is foolish. I suppose the adage ‘time in the market’ as opposed to ‘timing the market’ would be the best way of summarising CONCOR as an investment. As such, I think CONCOR is worth investing in at the current market price of 1375.55 (closing price on Tuesday, 9 January 2018) on the National Stock Exchange of India (NSE).