NLC India Limited (NLC) is the new name for the public sector behemoth Neyveli Lignite Corporation Limited.

Existing Business

NLC operates two primary segments, (1) Mines and (2) Power. Under the Mines segment, the company is presently working four lignite mines in the state of Tamil Nadu and one lignite mine in the state of Rajasthan. Under the Power segment, NLC is operating four thermal power stations at Neyveli (Tamil Nadu). At the same time, NLC is a player in the renewable energy segment with wind power plants in Tamil Nadu and solar projects in some other states.

Outlook

The growth outlook for Emerging Markets (as an asset class) and the Indian economy is encouraging. ‘Power for All’, is presently one of the critical initiatives of the Ministry of Power. The ministry has prepared a roadmap for infrastructure addition and capacity development in generation, transmission and distribution of energy-efficient and renewable energy that is affordable to all categories of consumers. One of the vital government initiatives is that of launching 100 smart cities. NLC is a public sector Navratna that is poised to benefit from all of the above.

Investment Thesis

I have written a post on investing in Public Sector Enterprises; click Are India’s PSE’s worth a Punt? to read. NLC is not featured in that post. However, the reasoning is the same.

There are two reasons why NLC India is investment grade. These are:

(A) As per the guidelines dated 27 May 2016, issued by the Department of Investment & Public Asset Management (DIPAM) of the Ministry of Finance, the government has mandated that the Central Public Sector Enterprises (CPSE’s) consider various alternatives for restructuring and distribution of accumulated capital. The DIPAM circular highlighted above also talks of the dividend distribution policy of the CPSE’s. To comply with the circular, NLC has disclosed its dividend policy which you can read here

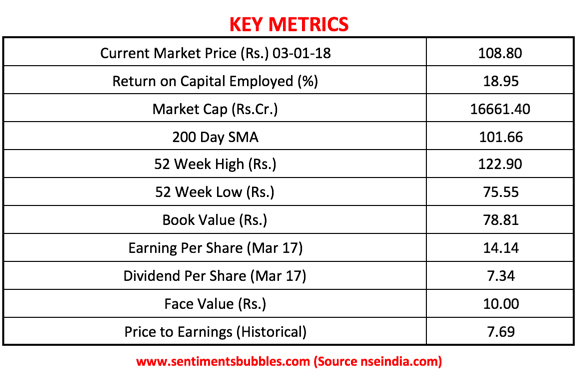

If one were to run the numbers, it is apparent that NLC India will declare a dividend of roughly Rs. 4 per share – at the very least. That works out to a tax-free yield of approximately four percent. It’s not an excellent yield, but it is almost twice that of the peer group companies. Most importantly, the yield would act as a cushion in the event of a correction. (In the year ended March 2017, NLC paid over Rs. 7 per share as dividend, almost twice the mandated amount).

The DIPAM circular also mandates that CPSE’s are to issue Bonus shares if certain conditions are met. In the case of NLC, the numbers do not fit the criteria for a compulsory issue of Bonus Shares’, but they do qualify for a discretionary one. In other words, they may issue Bonus shares, if they so desire.

(B) The Securities and Exchanges Board of India (SEBI) has mandated that listed CPSE’s bring down their government shareholding to 75 percent by August 2018. Click here to read.

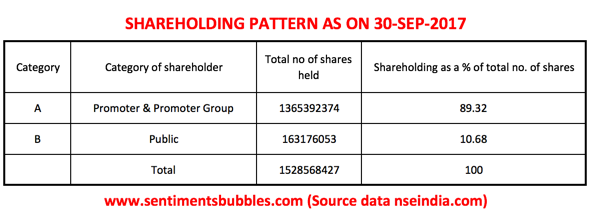

The current shareholding pattern for NLC is shown below:

In the table above the government, shareholding is shown as 89.32 percent as on 30 September 2017. In October 2017, the company conducted an Offer For Sale (OFS) at a price of Rs. 95 (roughly). As a result, the current shareholding of the government stands at 84.32 percent as on date. NLC has to reduce this to 75 percent before August 2018 to comply with the SEBI circular.

It is a pure infrastructure play in a business that has practically no competition (considering the capital-intensive nature of the business). To cut a long story short, NLC as an investment is a gift that can keep giving over the next several years. I don’t have any hesitation in recommending it at its closing price of 108.80 on Wednesday, 3 January 2018.