Introduction to Behavioral Investing

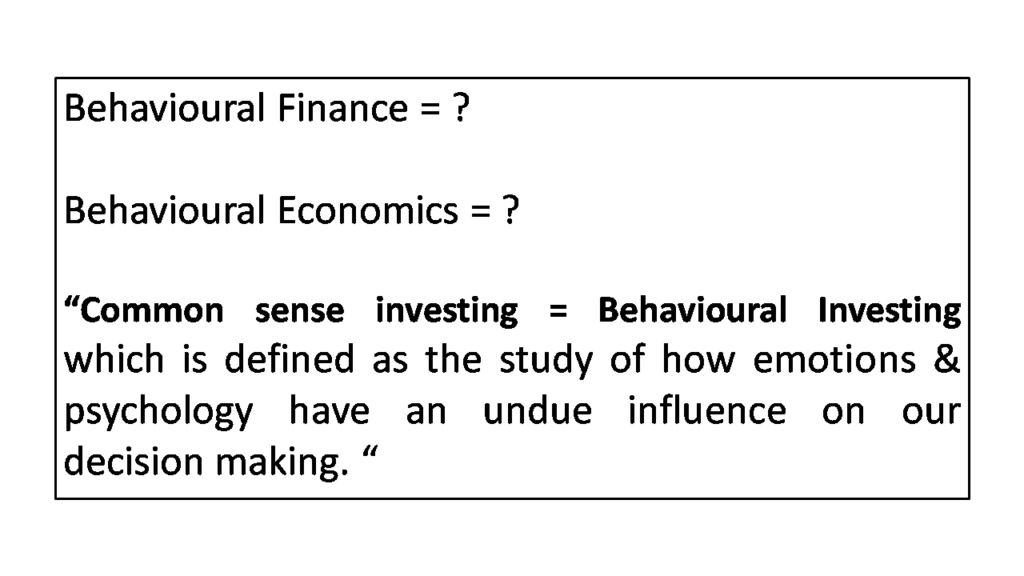

In this series of interactive lessons, I’ve tried to explain some of the important concepts as they relate to the decision-making behaviour of human beings when we invest. I have no idea why this course is called Behavioral Economics or by some as Behavioral Finance. What you’re about to learn here has very little to do with the Economics or the Finance functions as they are commonly understood. What you will learn is how to control one’s emotions and attitudes once we enter the noisy world of investing. Behavioral Finance helps in decision-making and that’s why one must study it. Some of you may not be interested in the stock market, yet a working knowledge of Behavioral Finance wouldn’t hurt.

The importance of human behaviour in the investing process had been recognised by Benjamin Graham in the 1930s. Since human behaviour seldom changes, what he said then is true as on date and will remain so in the future as well.

The human mind being what it is, once all of you have finished this course, you will be able to see and identify many of the biases among your friends, but you will be blind to these very biases in so far as they relate to you. Please don’t convince yourself (since the man/woman in the mirror is the one who is easiest to convince) that you are in any way immune from bias. You are not and in fact, nobody is. If any of you think that you’re immune from the biases that you see in others, banish the thought. That would be tantamount to saying that you’re not human, you’re an alien.

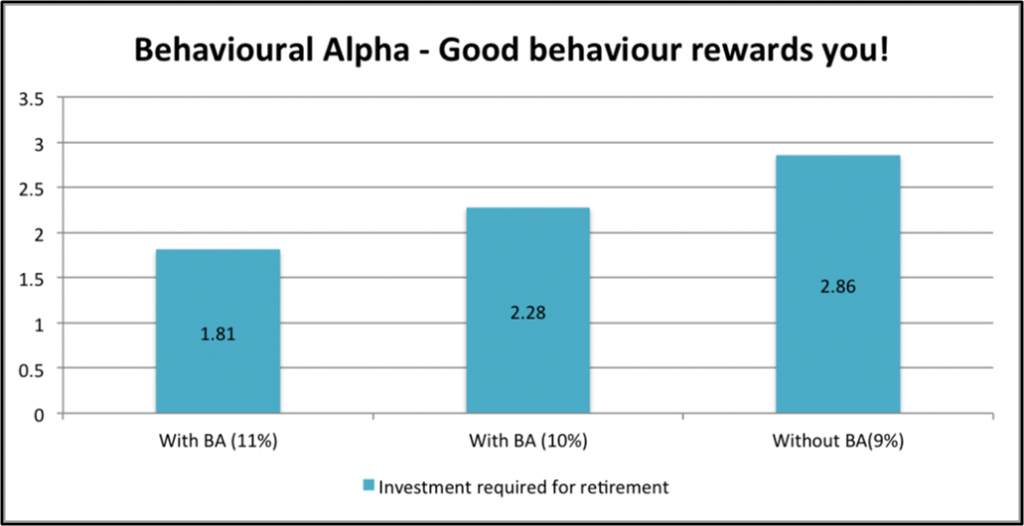

Many of you reading this are I presume, connected in some way with the stock market. In the stock market, as you would have learnt by now there are money managers and there are investors. The job of anyone who manages money is to generate Alpha. which is defined as outperformance over the benchmark. The outperformance that we generate as a consequence of our behaviour is called Behavioral Alpha. To generate Behavioral Alpha we don’t have to possess a high IQ or be financial wizards, we have to be well behaved.

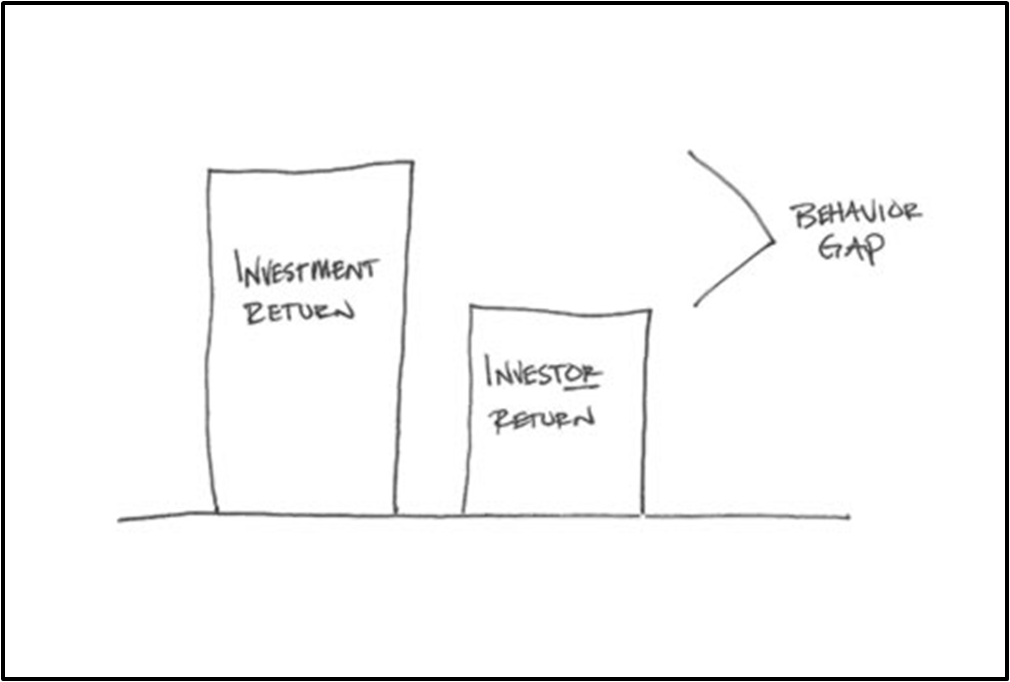

On the contrary, many of us end up underperforming our stated benchmarks. This underperformance, generated as a result of misbehaving is called the Behaviour Gap.

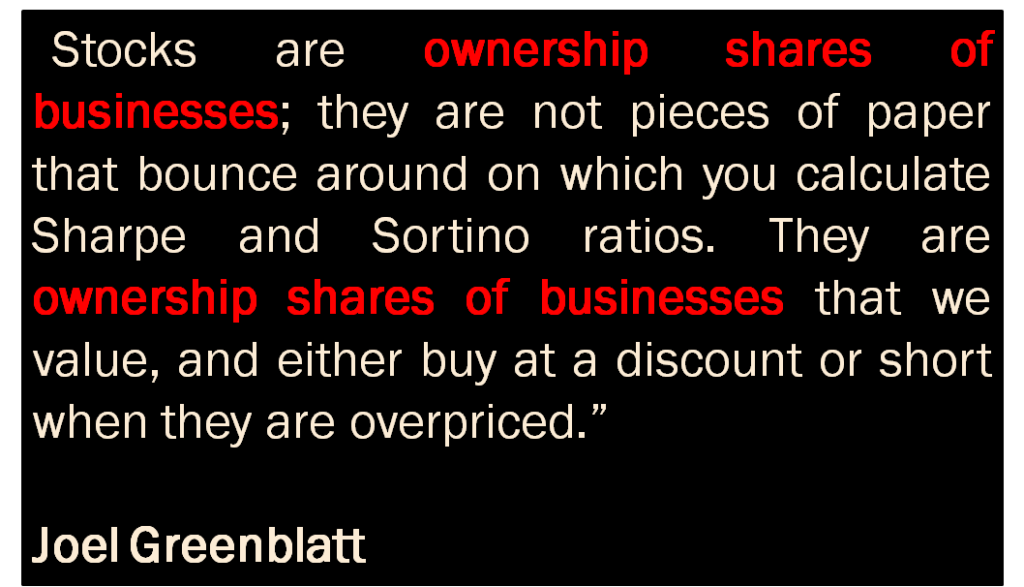

To start with, I want to talk a little bit about what a stock market is. The reason for this introduction is that in my business as an investment advisor and a stockbroker, I find that most people do not have a clear idea of what a stock market is and what function it serves. Due to the glamour element attached to the stock market, many of us have lost perspective about the stock market or if we have a perspective that is flawed. To begin, any stock market has the primary and important function of providing liquidity to owners of businesses. Suppose one of you starts a business and wants to raise capital. Technically you can raise capital for free by issuing shares which are ownership stakes in your business. Don’t underestimate the potential of this methodology. By way of example, companies like Infy and Reliance have been started in a similar fashion. Entrepreneurs whose businesses are listed as stocks can use the stock market mechanism for raising fresh capital and a host of other purposes. The capital so raised does not attract any cost or interest burden. It is ownership capital and when you buy a stock you are a part ownership of the business. I want to stress this, because most participants don’t fully grasp this concept and it leads to bad behaviour.

The Economy & the Stock Market

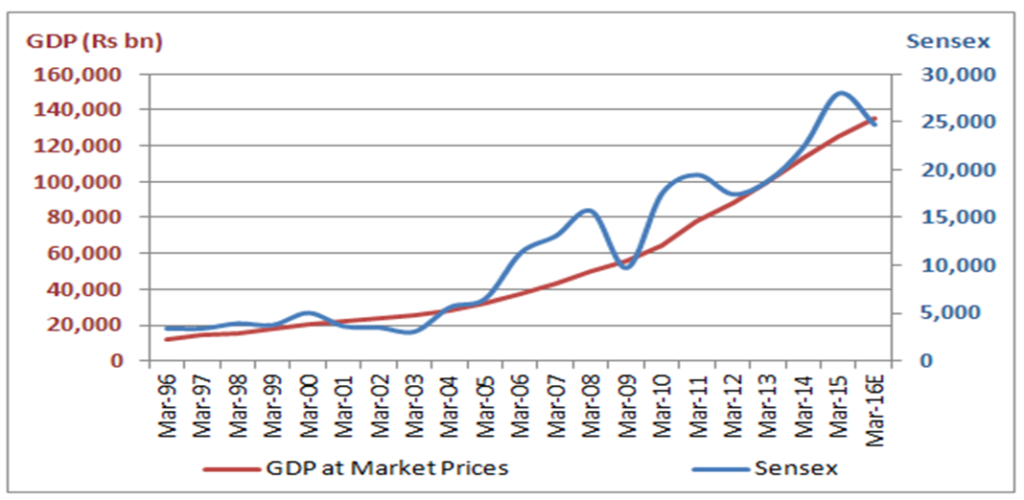

The second most important functions of the stock market is that it acts as a barometer of the economic health of the country. In a perfect or efficient market, the stock market and the economy should be indecipherable, perfectly in lockstep with one another. In the short-term, that’s not what happens. As you can see in the slide, when the economy is doing well, the stock market also does well and vice versa. If you want to judge the strength or weakness of any economy the long-term chart of the country stocks market will give you an accurate picture. Please note, I said the long-term chart; over the short-term, the stock market does not reflect the economic health or lack thereof of any country or economy. What happens over the short-term? Why do the stock market and the economy diverge over the short-term? The reason is human behaviour or rather it is our misbehaviour. The image below shows the growth of the Indian economy and also the growth in the benchmark index. You will notice that the growth of the economy is a smooth graph, but that of the Index is jagged. the question is: why is it so?

The analogy of a man or a woman taking their dog for a walk is a good one. When you see a man or a woman walking a dog in the park, what do you see? You see that the man or the woman is taking normal steps and generally walking on the given path, be it in a straight line or whatever. What is the dog doing? The dog is barking at butteries, chasing birds, sniffing, peeing, digging; the dog is generally all over the place and definitely not moving in one direction for any length of time. The dog is the stock market and the man or woman is the economy. The stock market and the economy are connected just like the woman and the dog – but they do not act the same even if they are walking in the same direction. The question is why does the stock market behave like the dog? And the answer is – human behaviour.

“The investor’s chief problem and even his worst enemy is likely to be himself.” – Benjamin Graham – Investors Pick their own pocket

A stock market is a place where people buy and sell stocks. There is a sea of human beings that interact with one another. In a way when people refer to the market, they seem to refer to a living person who is conspiring against them. It is common for the layman investor to say for example that ‘they sold when we bought’ or ‘they bought when we sold’. In all such instances, the ‘they’ are always the ones who win. Any market commentary always refers to ‘they’ or as ‘the market sold off’ or ‘the market moved sideways’. No one asks who ‘they’ represents. In other words, nobody seems to be interested in identifying who ‘they’ are. Who are the ‘they’ in stock market parlance? In reality, ‘they’ represent the collection of human beings that Benjamin Graham referred to as Mr Market. And why do ‘they’ behave in such a restless and random manner like the dog? The reason is that human sentiment is fickle and sentiment drives prices.

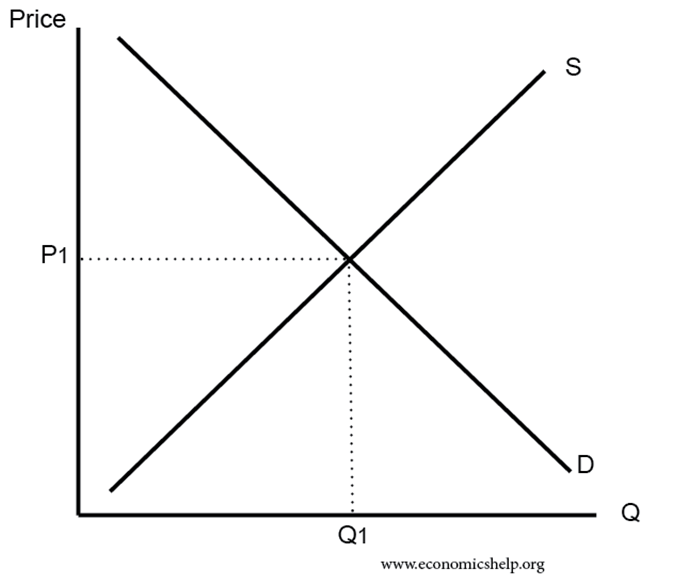

How does the human mind work and why does sentiment drive prices? To understand that, we need to first understand how markets function. I am presenting a very simplistic explanation, but the basic theme remains constant at all times. Assuming, there are 30 students in this classroom and this classroom represents the market. If 20 of you decided to buy 100 shares of Reliance and 10 decided to sell 100 shares of Reliance, the price would move up, since there would be a demand for 2000 shares and a supply of only 1000 shares. Of course, I am assuming that the market size is limited to this classroom and each of you transacts an equal quantity of 100 shares each. In other words, the demand-supply mechanic in the stock market is not in any way different from any other market like the wholesale market for fruits and vegetables or the fish market, for that matter. The essence is the same and prices of the different stocks that are traded on the stock market are decided by the demand and supply for the stock. If the demand for a stock exceeds supply, the price will rise and vice versa. Price discovery for a stock or a commodity takes place when the demand and supply meet or intersect.

The next question is: what determines demand and supply for stocks in the stock market? A host of factors contribute to the flow and ebb of the demand-supply cycle. We live in the Information Age and are bombarded with headline news, breaking news and fake news on a 24×7 basis.

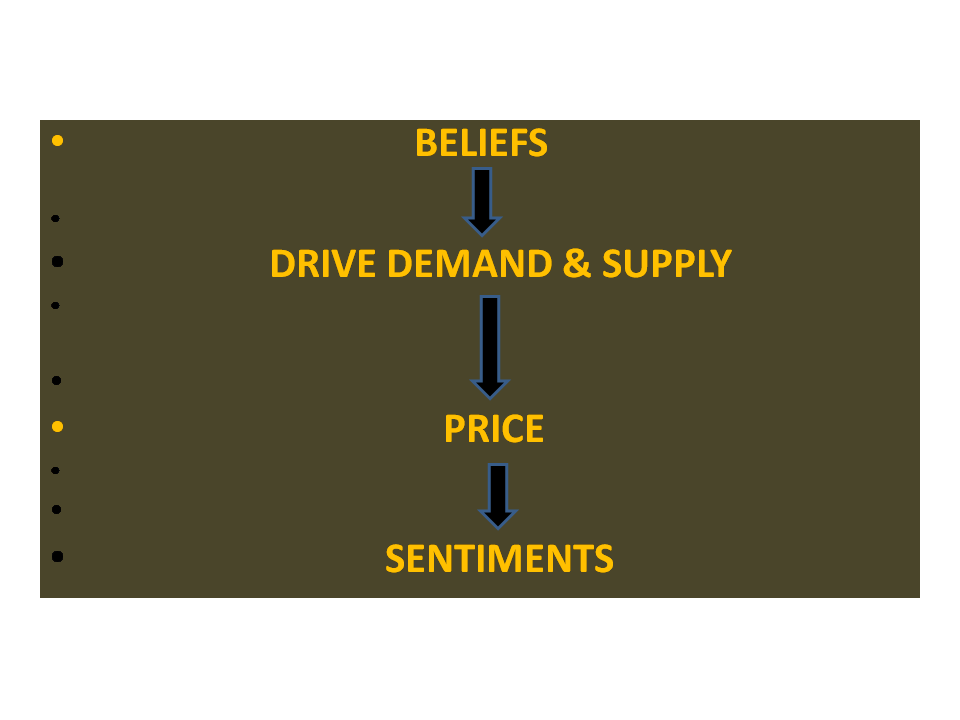

Every news we hear or read contributes to our belief system. When we trade in the stock market, we trade our beliefs. How do we form our beliefs? In the example above, 20 of you believe that Reliance is fully priced or worth selling and 10 believe the opposite. All 30 of you are privy to the same news stories and headlines about Reliance. But the same news being interpreted differently by different people. Some of us BELIEVE that a rise in oil prices is bullish for Reliance and others BELIEVE that higher oil prices are bearish. Based on what we BELIEVE and our level of conviction, we place our trades accordingly. As we trade our beliefs, prices respond. Just to repeat what I said earlier, beliefs drive demand or supply as the case may be, demand or supply drives prices, and prices drive sentiment. If prices move higher sentiment improves and vice versa.

In the example above, we are analyzing a single data point which is higher oil prices. This cannot be BOTH bullish and bearish for Reliance at the same time. It’s either one of the two and the person who interprets it correctly wins. But, you will find that two human beings respond differently to the same data, some interpret it as bullish and others as bearish. It’s almost as if, you and your girlfriend or boy friend are watching the same movie, but there are two screens. It is the same plot but each of you see things differently, you always do. Each of you takes sides, many of the time we take opposing sides. Its almost as if there are two screens within one movie, not a single screen that both of you are facing. The reasons for this varied interpretation of essentially the same data, is that all human beings are inherently irrational and our decision-making process is biased in a variety of ways.

BROWNIAN MOTION

The point I’m trying to make is this: the stock market is a mélange of human emotion that represents the combined behaviour of thousands of people responding to information, misinformation and whim. As a result, price action in the stock market is random and can be represented as Brownian Motion. In a nutshell, Brownian Motion is the random movement of particles in a fluid or a gas.

The price action in the stock market resembles Brownian Motion because of the fact that there are as many opinions as there are investors. Of the 30 people present here, no two opinions will match perfectly, they never do. And with the internet, now everyone has an opinion and most of us hold our opinions very firmly. Hence, the study of human behaviour vis-a-vis the stock market is critically important. In fact, in the Information Age that we live in, the study of human behaviour and its effect on price discovery has become even more important than it was at any time in the past. Moreover, human behaviour is the most important and most unpredictable part. at the same time, the sentiment that arises because of the way we behave has the greatest influence over the price discovery (since sentiment contributes directly to the demand and supply mechanism). Behavioral finance is the study of how emotion and psychology have an undue influence on our decision making.

Rational Investing

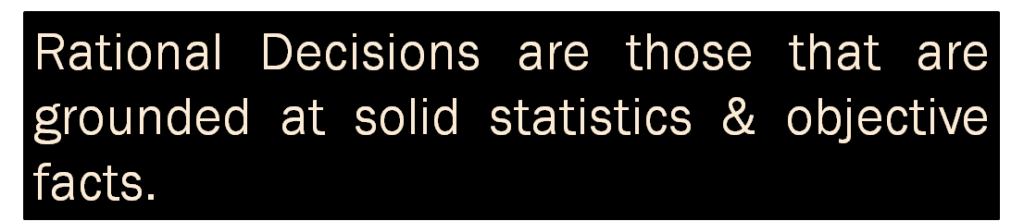

A rational investor can generate Behavioural Alpha and reduce the Behaviour Gap if he is well behaved and aware of his cognitive biases. Most of us, (I included) think that we are rational. That’s a fallacy. Humans are inherently irrational. What is the definition of a Rational Being or what is a Rational Decision? Rational decisions are those grounded on solid statistics and objective facts, resulting in decisions that would be the same if they were to be made by a robot. Unfortunately, humans do not have the time nor do they have the capacity of engaging in constant rational thought. We are not wired to behave in a rational manner on a 24×7 basis. If we were, we would make decisions only after calculating probabilities and weighing the risk-reward equation for each of our choices. Clearly, we don’t do that all the time, some times we do. But in the stock market, we almost always don’t engage in rational thought. In fact, most of us will be at our irrational best when it comes to investing in the stock market. The question is why does this happen? The answer is that it’s genetic, we have became created irrational and it’s not without reason.

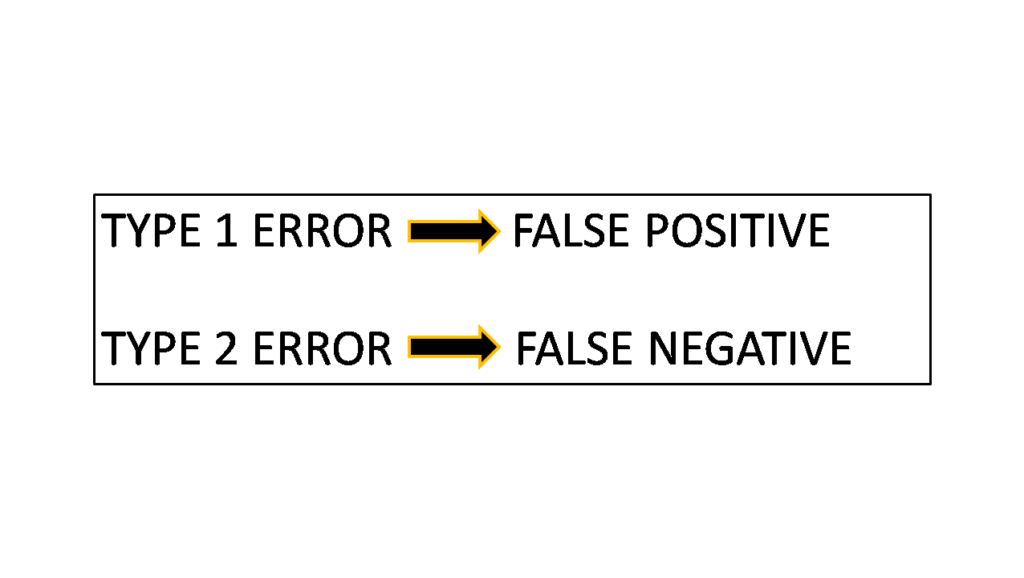

Humans are born irrational, but it does help us in many ways. Many a time, our irrationality makes us better decision makers. Let me give you an example. Suppose you’ve gone for a trek or a hike in the forest and there are lot of bushes and trees and you’re not using google maps, because there is no internet connectivity. You’re using the trodden path and you hear a rustling sound. Now it could be the wind or it could be an animal, maybe a tiger or a lion. A rational being will stand his ground, try and judge the wind speed and think of the probabilities, in the process he so she might get killed; that doesn’t sound like a prudent thing to do. Almost all of us will run. Actually, the probability of there being a tiger is lower than the probability that its the wind making the rustling noise. Effectively, we would be making a wrong decision by running away, but it is better to be safe than sorry. This is called a Type 1 error – False Positive – incorrectly interpreting rustling from the wind as a lion. The converse is called a Type 2 error – False Negative – hearing rustling and assuming it to be the wind. Type 1 errors are less grave than Type 2 errors. Our irrational behaviour helps us in many ways, we want to be safe rather than be sorry. The point is that irrationality that is baked into our system also helps our survival instincts. It’s not always bad.

Instead of relying on complex statistics to make choices, humans tend to make decisions according to instinct. Often, these instincts rely on “heuristics,” or mental shortcuts, where we focus on one key factor to make a decision, rather than taking into account every tiny detail. Oil prices going up is interpreted as either bullish or bearish in a fraction of a second. Once we’ve made up our mind, we trade blindly. However, our instincts aren’t always correct. Many a time they lead to wrong decision making and an incorrect decision is more often than not the result of irrational behaviour. In the world of behavioral investing, these are called cognitive biases.

Let me give you an example. Suppose, the mall that you visit, (be it Central or any other similar mall, or say you’re shopping online at Amazon or Flipkart), and its announced that on the occasion of Christmas, they are going to have a sale and prices will be marked down by 25 percent. What would we do? We would go to the mall, tell our friends and family and would buy what we wanted. In fact we would end up buying unwanted stuff as well. In other words, lower prices lead to an increase in demand. In the stock market, it works in the opposite way. The stock market is the only place where when prices go down, we tend to panic and we don’t celebrate. In all other instances we cheer lower prices. When stocks go higher, our confidence rises and vice-versa. It is a form of cognitive dissonance. Why does this happen in the stock market and not in the shopping mall?

Greed & Fear

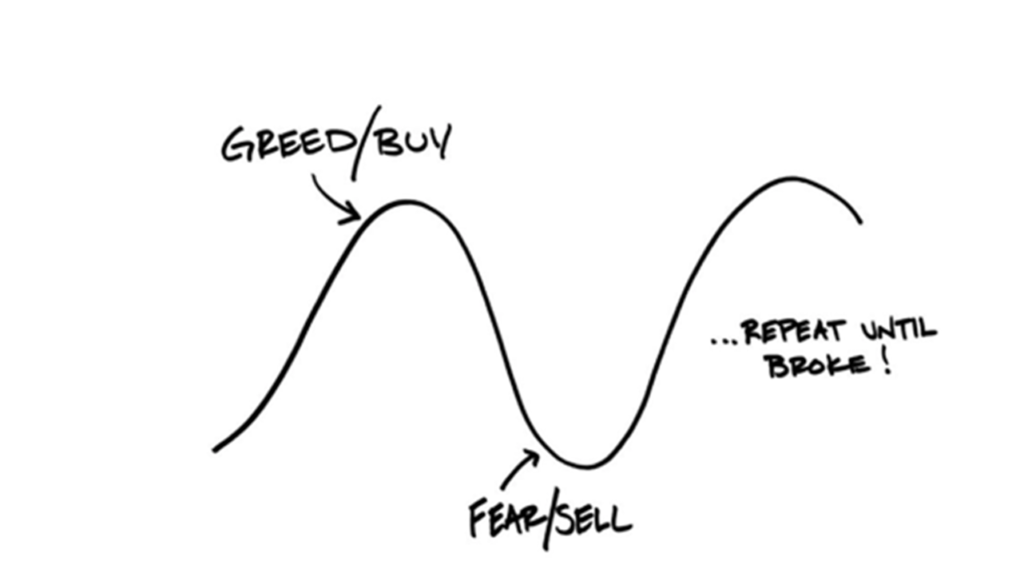

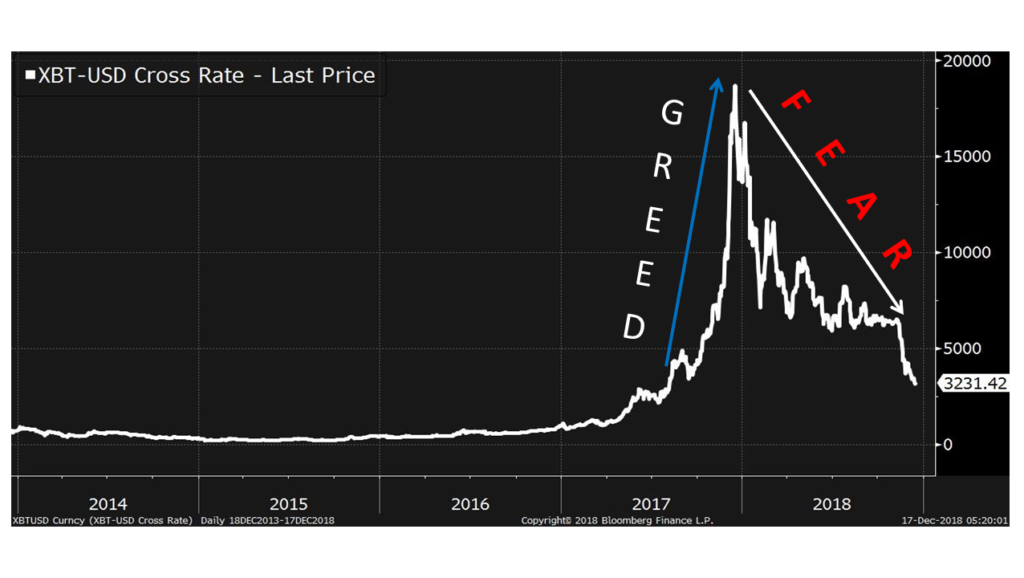

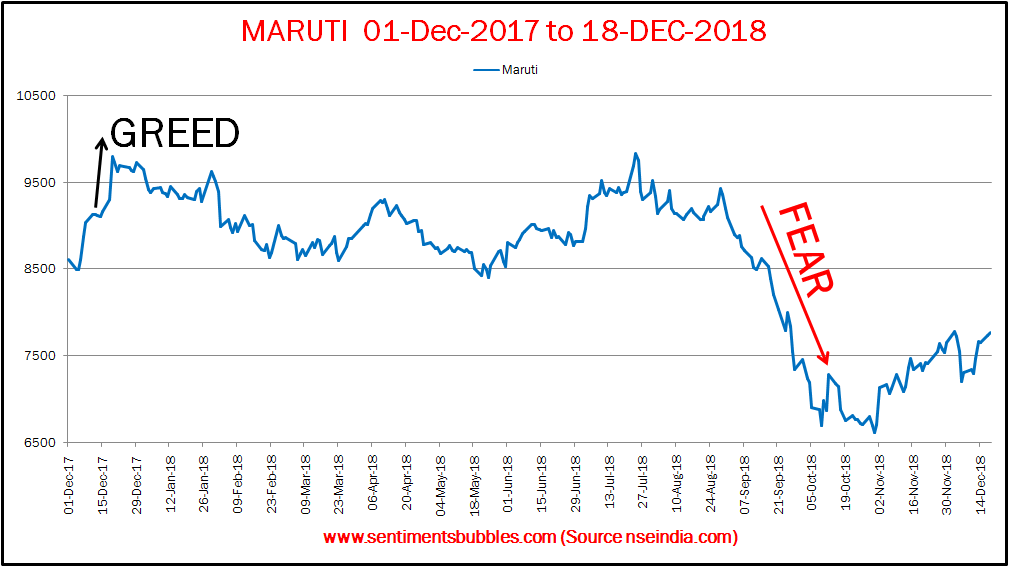

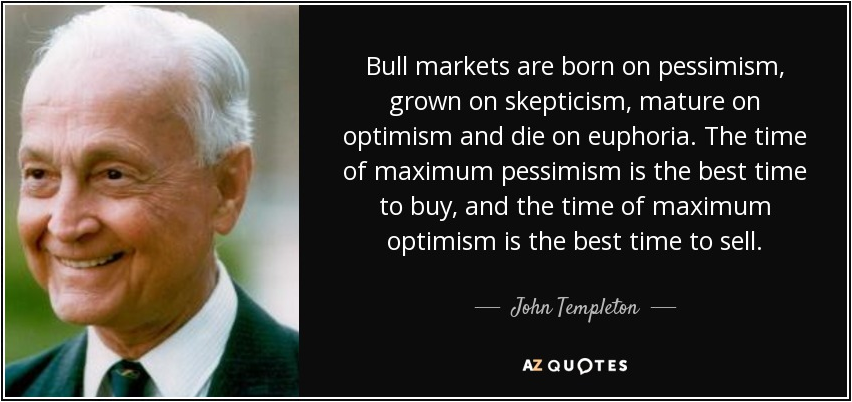

There are many reasons why this behaviour is prevalent in the stock market. The primary reason is the Greed and fear syndrome. As prices edge higher we get greedy and want to buy more of what is appreciating. But when prices start falling, fear takes over and we want to sell just to quell the fear. There are many other reasons that can be ascribed to this Greed and Fear cycle, but they all the reasons have one thing in common – human beings are inherently irrational – and that applies to all the investors all over the world. Don’t think that the Americans or the Europeans or the Japanese or the Chinese are any different, they are not. Everyone behaves in an identical fashion and follows the Greed and Fear cycle, barring a few who are more rational than the rest. The important point to remember is that greed drives prices higher and fear drives them lower. Warren Buffett says that be Fearful when others are Greedy and be Greedy when others are Fearful.

- THE HIGHER THEY CLIMB, THE CHEAPER THEY LOOK

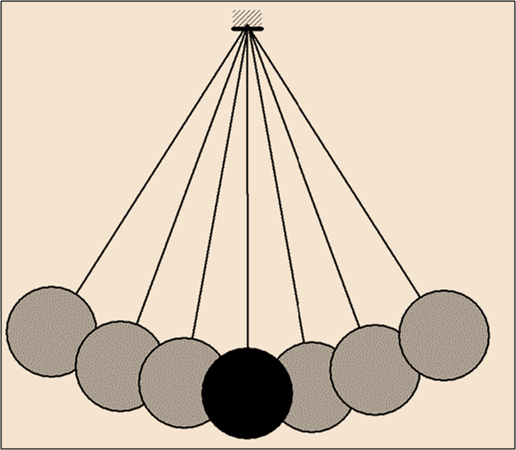

PENDULUM SWING

Market Cycles always result in prices moving from one extreme to another. Hence, market cycles resemble the swing of a pendulum, they seldom stop at the equilibrium price or at the centre. In fact, market equilibrium (the stage when demand meets supply) is never achieved, it keeps shifting all the time, until it reaches an extreme and then swings back.

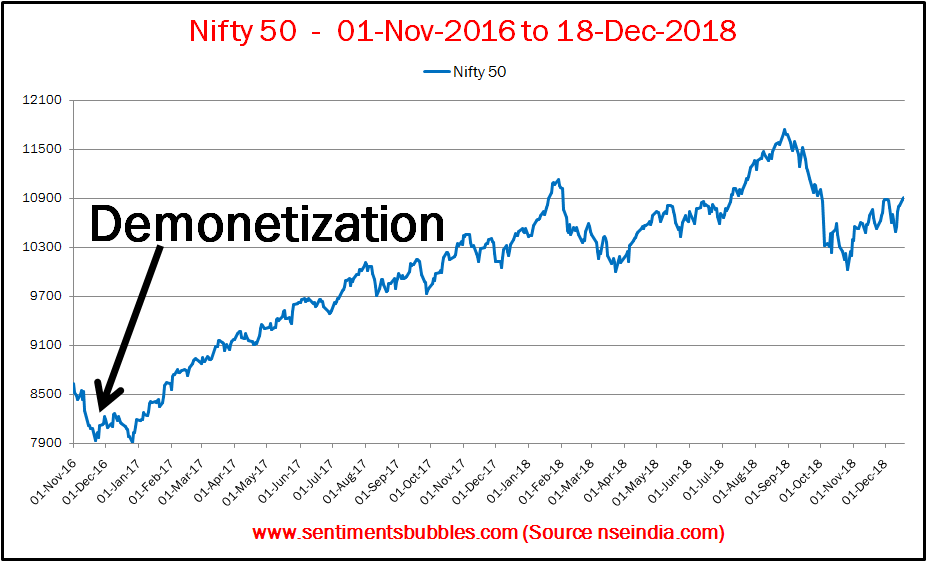

The point of maximum uncertainty is always the point at which the fear is the highest. Generally speaking, its a good time to invest as can be seen in the image below. The Nifty 50 hit a low of 7300 and today it is 10500 or thereabouts. Demonetization resulted in fear and nobody invested.

NIFTY 50 after Demonetization

Mindfulness and Mindlessness

You can read and learn all you want about human behaviour but none of what you read will be useful unless you are mindful of your own behaviour. That leads me to the next part about human behaviour – being Mindful as against being Mindless. They are antonyms. Let me define each of these two terms and they are critically important definitions. Being Mindful is the process of actively noticing new things. Its what our parents teach us, KEEP YOUR EYES AND EARS OPEN. Being mindful is being attentive and aware. Mindfulness is the broad term used for bringing our attention to the present moment in an open, kind and non-judgmental way. Its a skill, a way of seeing and a way of being that allows us to engage with our surroundings. Mindfulness reduces stresses and increases happiness. We can develop mindfulness in two ways- one is meditation and the second is by aligning our thoughts with our behaviours in everyday life – what is called stopping to smell the roses. It means giving your attention to a person when engaged in a conversation, allowing the other person to speak, being a good listener and not interrupting the other person when he or she is speaking. Mindfulness is being an independent thinker. It leads to greater clarity. Mindfulness is a work out for the mind. We engage in it when we perform an activity we love like say jogging. Mindfulness is bringing this calm and clear perspective to all our moments.

Being Mindless is being on auto-pilot – letting your thoughts and emotions drive your decisions and actions. It’s being in the back seat of a car, not in the drivers seat. For example when we forward WhatsApp messages or act on them without using our thought process. The best illustration of Mindlessness is our eating habits. For example when we eat popcorn in the movie theatre. In fact, there is a book called Mindless Eating which is worth reading.

I think many of you may have read or heard of Sherlock Holmes? Sherlock Holmes was a fictional character created by an author named Sir Arthur Conan Doyle. In all the books, Sherlock Holmes is the fictional private detective who helps Scotland Yard uncover many mysteries. Sherlock Holmes is caricatured as a rational mind. He is mindful. His assistant is caricatured as Dr Watsn who is mindless. For those of you who are interested in how a rational mind works, I urge you to read the book Mastermind by Maria Konnikova.

• And last of all remember that the four most dangerous words in the stock market are: ‘This time it's Different’ - it's never different since Human Behaviour always remains the same.

What can we do to combat our biases?

• Widen your time horizon. The problem is that our culture has evolved more rapidly than our brains and because of this we cannot keep a long-term perspective on our investments. When you time-weight short-term information for investment decisions, you behave in a reactionary manner not in an anticipatory manner.

• Be Mindful, not mindless. For the most part, do nothing. It is better not to try and act smart than doing something and acting stupid.

• Don’t stare at the trading screen, it spurs us into action.

• While making decisions, focus on the probabilities and not on the possibilities. Anything is possible, you have to continuously ask yourself – how probable is it.

• The Type 1 error highlighted above comes directly in the way of long-term investing. Unfortunately, evolution has programmed us to pay more attention to what is happening now, than to what might happen in 10 or 20 years. Mistaking a rustling sound for an animal made sense to our ancestors but makes little sense today.

• Be radically open-minded – pursue learning what is true instead of pursuing what you believe to be right. Find people who disagree with you. See things from their eyes and make them do the same, you arrive at better decisions. Look for thoughtful disagreement leads to the difference between seeing things in B&W as against seeing them in colour. In other words, argue to learn, don’t argue to win.

• Don’t hold Opinions too strongly. Strong Opinions should be weekly held. In other words, we should be actively open-minded. Moreover, don’t concentrate on what people say they are going to do, concentrate on what they are doing or have done; there is a subtle difference between the two. Be mindful of the people who you talk and interact with, choose those who see things differently than you do. Replace the FEAR with being open-minded. At the same time, just remember that none of us likes to talk about our failures; we love to keep talking about what we got right.

• Our Ego and our Blind Spot Barriers exist because of the way our brains work. Our Ego does not allow us to accept our weaknesses. Our need to be right exceeds our need to find out what’s true. Hence we believe our opinions without properly stress testing them – we don’t want to look at our mistakes and weaknesses.

• Everyone has blind spots. The blindspot barrier is when a person believes he or she can see everything, but we know that no one alone can see a complete picture of reality – we are blind to our own blindness. It follows that we cannot appreciate what we can’t see. Some can see the big picture, others can see the details.

• Lastly, you will find these investing biases in highly educated people as well. Almost all investing biases can be explained by genetic factors and education does not moderate genetic behaviour.

• Don’t miss the forest for the trees. What that means keeping ones focus away from the day to day fluctuations and while studying a stock ignore the price and concentrate on the business instead.

What is an ‘Investing Edge’?

An Investing Edge is defined as ‘a technique, observation or approach that creates a cash advantage over other market players. It doesn’t have to be elaborate; anything that adds a few points to the winning side of an equation builds an edge that lasts a lifetime’.

Why is an Investing Edge so important?

In the investing game (in so far as it relates to the stock market), what we are trying to do is to profit from the ignorance of others and if that is true (and it is), it translates into the need for an investing edge. In a world where there are over 300,000 Bloomberg Terminals and over 200,000 professionally qualified analysts, the importance of an investing edge cannot be understated. Investing is essentially a zero-sum game. When we buy or sell a stock, the odds are that someone far smarter than we are is selling it to us (or buying from us, in case we are selling). However, we don’t know who is on the other side of the trade. Hence, the question: What is our ‘edge’ over the person who is selling to or buying from us? In a market that is now dominated by institutions, the competitive aspect has ensured that markets are now far more efficient than they were at any time in the past.

The fact of the matter is that most investors don’t understand that they require an edge to succeed in the market. So, if you don’t have an edge to start with it doesn’t matter. Knowing that you need an edge means that you are already ahead. All of the above does not mean it is impossible to build an edge. It is tough and as an investor, the greater sin is in not trying. If the market seems efficient, one has to look for inefficiencies and sure enough, we will find them, if we try hard enough.

Types of Investing Edge

There are broadly three types:

- Informational Edge. It is the one most of us concentrate on, but it has disappeared with the advent of the internet. Since information is disseminated in real-time and is mostly free, there is practically zero informational edge that can be acquired as a result of possessing information. Most of the information is already public and the price discovery is over by the time we read it. The news media cycle follows the price action and not the other way around as most of us would want to believe. If you are privy to insider information that is not public, using it to gain an undue advantage is basically illegal and against the law. Moreover, changes in the corporate law have meant that companies have to disclose all material information in real-time thus ensuring a level playing field for all market participants. Pursuing an informational edge means that you are short-term oriented and looking to profit from intra-day or intra-week price action. The idea is to look for hidden information that the market is unaware of.

- Analytical Edge. All of us can acquire an analytical edge by crunching numbers and doing the hard work. In financial markets, things are not what they seem: Much of what most people think is treasure is, in fact, trash. And much of what they think to be trash is, in fact, treasure. To succeed we need to develop a ‘variant perception’. In other words, as investors, we must be able to process information in a superior manner as compared to other market participants. Over time, as our perception starts differing with the common perception of the market, we tend to acquire an analytical edge.

- Time-horizon edge. Since most investors are short-term oriented it is easily possible to acquire this edge by just changing your time horizon. Instead of being focused on the next quarterly earnings, focus on the bigger picture and the long-term.

- Behavioural Edge. It is the one that can be attained by controlling one’s behaviour. This course is going to teach you how you can acquire a behavioural edge. In other words, you are going to learn something which is very valuable.

How to acquire a ‘Behavioural Edge’?

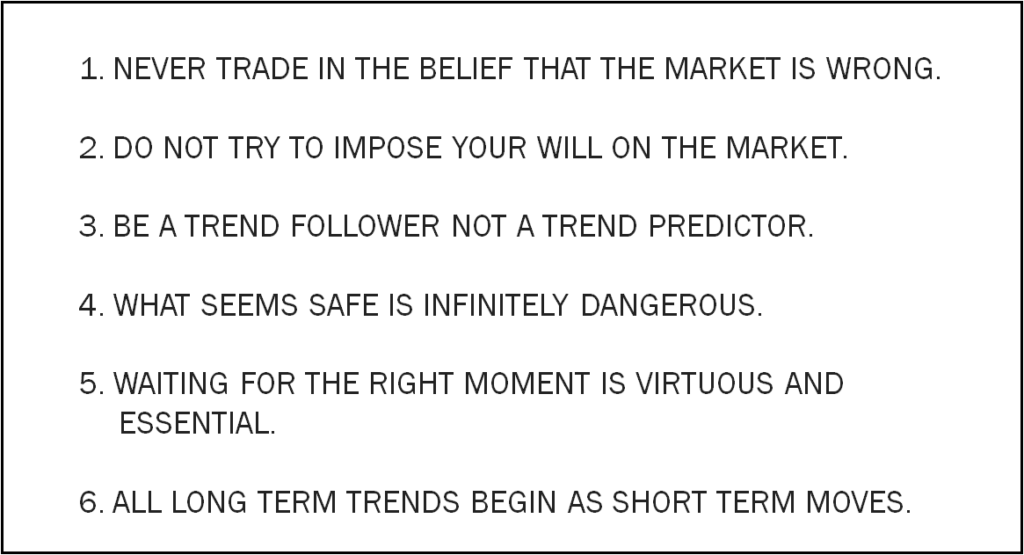

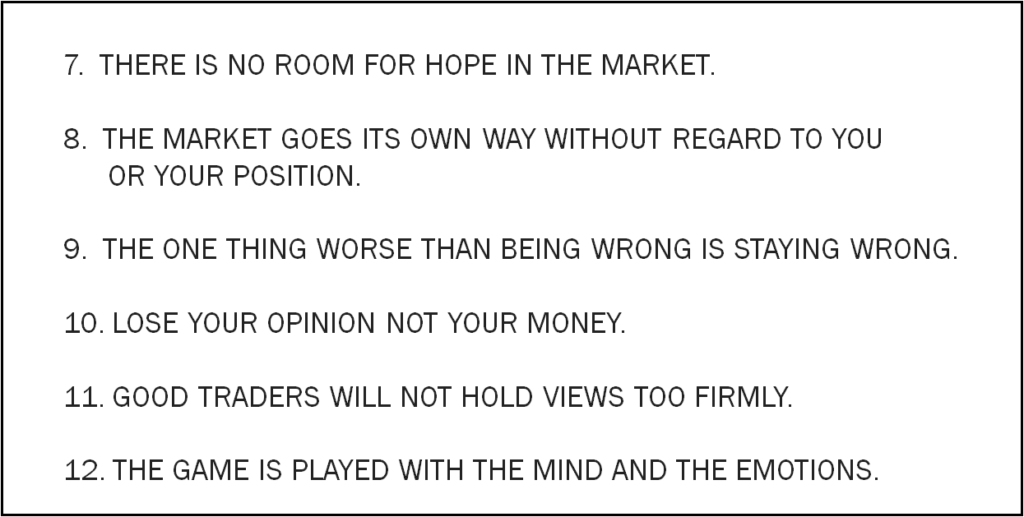

Acquiring a behavioural edge means being well behaved and its a critical edge that almost nobody seems to focus on. It’s also pretty easy to acquire. the most important feature of a behavioural edge is that once acquired, it’s more or less permanent, it stays with you since it becomes a way of life. By contrast, the other types of ‘edges’ are inherently ephemeral or temporary. Before we get into the rest of the course material, the following twelve commandments are a good starting point.

Twelve Commandments of Behavioral Investing