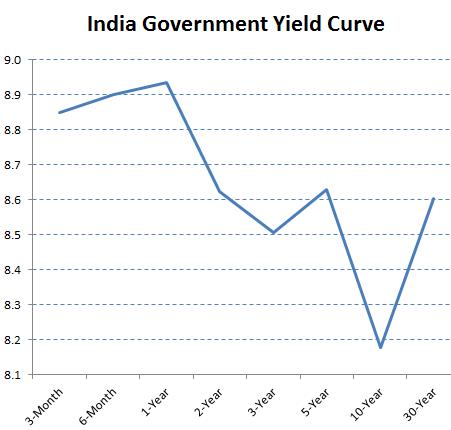

I think that with all the euphoria over the new government and which sector is going to outperform, the single most important metric is the Interest Rate scenario. If interest rates start moving down then this will indeed be the mother of all bull markets, so how can one take a call on the interest rate scenario as on today. In simple terms it has to be monitored and one of the tools is the Yield curve. The basis of the yield curve is the relation of the short-term interest rates vis-a-vis the long-term interest rates. Typically short-term rates are lower than long-term rates all over the world. The yield curve is basically a curve showing several interest rates across different time duration’s for the same instrument. The yield curve must have an upward rising slope from left to right which is good for the market and is a bullish signal for stocks. In India it is the opposite i.e. the short-term rates are higher than the long-term rates which gives rise to an inverted yield curve and it looks like this:

The market is betting on a flattening of the curve which will be a precursor to an upward sloping yield curve which signifies a change in the economic cycle. Just like epidemics, business cycles are an unavoidable and largely unpredictable feature of market economies. Moreover business cycles and market cycles reinforce each other. In other words the market is betting on a change in the cycle and I am all for it but I think the market has got a little impatient and is in a tearing hurry. In anticipation of this change in the yield curve dynamics there has been a runaway rise in banking stocks and one has to consider what has changed in the last three months and I think apart from sentiment, practically nothing. Consider the following :

(a) All the expected positives have been factored in to the current valuation of stocks in the banking space. On the contrary any negatives might surprise and spook this market.

(b) Exactly a year back we were at the beginning of a sell off in the bond market which took its toll on the currency. The reason for the resultant sell off in stocks and banking stocks in particular was the perception that India was facing the insurmountable trinity of sticky inflation, elevated interest rates and deteriorating current account deficit (CAD). While the CAD situation has been arrested and brought under control, the other two factors remain the same.

(c) The runaway and uncontrolled price increase of the last couple of years was one of the most contentious issues facing the earlier government and one which worked in favour of the BJP. In such a scenario curbing inflation is bound to be one of the most important objectives of the new government. The earlier RBI governor was up in arms against the government over this issue and he kept on reiterating that there was a limit to what the RBI can achieve and it was up to the government to take steps to curb inflation. The earlier government was populist and though the BJP’s manifesto is not populist, a political party’s manifesto is just that nothing more. The present government will have to fight the ‘karna padta hai boss’ syndrome and take some unpopular decisions. The upcoming budget and the 100 day report card of this government will shed more clarity on this.

(d) The current RBI governor is a man with a mind of his own and only time will tell whether he and the finance minister are on the same page. I think that investors have forgotten the RBI stance that the Governor is going to follow the Urjit committee report and has set inflation targets. The reports suggest that RBI should aim to reduce headline consumer price inflation to 8 % within a year, 6 % within 2 years and 4% thereafter. These are stiff targets and definitely not easy to achieve. For these targets to be achieved the Government has to whole heartedly back the RBI Governor and the RBI alone can do little without the backing of the Government. The Finance Minister had written a blog post after the vote on account in February where he had said the next Finance Minister will be in trouble, click here to read the post.

(e) There has been a comparison of the RBI governor with Paul Volcker in the media. Paul Volcker was the FED chairman from 1979 to 1987 and is credited with a sustainable reduction in inflation in the U.S. in that period and what he did was to raise the nominal policy rate well above inflation for a prolonged period of time.

(f) The bank nifty and the PSU banking stocks have moved considerably and consistently upwards despite there being no clarity or announcements on policy issues. There is another metric to look at this space and that is the price to book value of the stocks. In the whole PSU banking space many banks still trade below book value though the index as a whole does not. There may be opportunities among these but stock selection will be critical. The argument against looking at book values is that they are incorrectly reported or are inflated considering the likely NPA’s. Given below is the price to book value for the CNX BANK and the PSU BANKING indices on various dates.

| BANK NIFTY | P/E | P/B | DIV YLD | PSU BANK INDEX | P/E | P/B | DIV YLD |

| 31-Mar-08 | 16.16 | 2.88 | 1.02 | 31-Mar-08 | 10.21 | 1.85 | 1.58 |

| 31-Mar-09 | 7.69 | 1.20 | 2.21 | 31-Mar-09 | 5.35 | 0.99 | 2.94 |

| 31-Mar-10 | 17.72 | 2.54 | 1.12 | 31-Mar-10 | 9.25 | 1.74 | 1.84 |

| 31-Mar-11 | 18.54 | 2.80 | 1.01 | 31-Mar-11 | 11.09 | 2.08 | 1.53 |

| 31-Mar-12 | 15.25 | 2.32 | 1.31 | 31-Mar-12 | 9.05 | 1.51 | 2.21 |

| 31-Mar-13 | 13.58 | 2.32 | 1.29 | 31-Mar-13 | 6.72 | 1.14 | 2.53 |

| 31-Mar-14 | 14.33 | 2.24 | 1.40 | 31-Mar-14 | 8.78 | 0.98 | 3.03 |

| 30-May-14 | 16.46 | 2.58 | 1.22 | 30-May-14 | 12.10 | 1.31 | 2.27 |

(g) In late March RBI issued a circular whereby the deadline for meeting Basel III norms was extended from March 2015 to March 2016, this has given a leg up to the rally in PSU banks and this lifeline that was thrown by the RBI has just delayed the inevitable. Many of the country’s public sector banks had no hope of meeting the regulatory requirements by March 2015 and the market is betting that their balance sheets will improve in the interim period. This I think is a very very optimistic outlook. These banks are estimated to require anything between Rs. 200 to 450 billion in order to meet the Basel III norms. This lifeline explains the sudden and sharp change in the above ratios (and valuations) from 31st Mar 2014 and the ones on 30th May 2014. The implied meaning of this is that it is too late to play this trade and if anyone has they should book profit.

(h) The PSU banking space has been the most hot sub sector and the FII’s (who for all practical purposes run the Indian stock market) have publicly been very vocal as to how they avoid this space. Among the PSU banks the only one’s which arouse FII interest are the ones which form part of the CNX BANK index and in most of them the FII limit has been reached. The current spike in the remaining banks in this sub sector does not appear to be FII driven at all.

(i) The above does not in any way suggest that one should go short in the BANKNIFTY, far from it be a ‘dip buyer’, but stock selection will be critical. Please remember India is being referred to as the ‘global swing state’ of the 21 St century, Mr. Narendra Modi’s victory is a global event.

Investors desirous of having a diversified portfolio need to have an exposure to the banking space since the weight-age of this sector in the Nifty is very high. In fact the Nifty shows meaningful gains or losses only when this sector moves. In view of this though it is imperative that every investor has an exposure to banking stocks it is critical that they select the right stock and that is easier said than done. They will be well advised not to get carried away with the momentum names being bandied about by the media and to wait for negative surprises to enter this space. In the meanwhile I would suggest sticking to the defensive stocks and sectors viz FMCG, Software and Pharma.

MAY MONTHLY MARKET RECAP

This must have been one of the most memorable months for indices in a long time and there was a one-sided movement in the main indices. The defensive sectors under performed.

| INDEX | 30-Apr-14 | 30-May-14 | % CHANGE |

| CNX NIFTY | 6696.40 | 7229.95 | 7.97 |

| CNX BANK | 12855.85 | 14793.40 | 15.07 |

| CNX AUTO | 5866.50 | 6385.10 | 8.84 |

| CNX ENERGY | 8310.80 | 9667.50 | 16.32 |

| CNX FINANCE | 5308.00 | 5949.45 | 12.08 |

| CNX FMCG | 17573.25 | 17831.60 | 1.47 |

| CNX IT | 9227.95 | 8970.30 | -2.79 |

| CNX MEDIA | 1740.45 | 1951.30 | 12.11 |

| CNX METAL | 2501.20 | 3096.90 | 23.82 |

| CNX PHARMA | 8100.00 | 7712.90 | -4.78 |

| CNX PSU BANK | 2973.15 | 3646.00 | 22.63 |

| CNX REALITY | 179.20 | 242.95 | 35.57 |

| INDIA VIX | 30.59 | 16.34 | -46.60 |