MAX VENTURES & INDUSTRIES LIMITED

The restructuring of the former Max Group into three new listed entities, namely, Max Financial Services, Max India and Max Ventures & Industries Limited (MAXVIL) was completed in January 2016.

Max Ventures & Industries (MAXVIL) serves as the Group’s entrepreneurial arm. The idea is to explore the ‘wider world of business’, especially taking cues from the economic and commercial reforms agenda of the present Government, including ‘Make in India’, ‘Skill India’, ‘Digital India’, among others.

The business operations of MAXVIL consists of the following segments:

- Max Speciality Films. Launched in 1988, Max Speciality Films is a subsidiary of MAXVIL, based in Railmajra, Punjab. It is a leading manufacturer of speciality packaging films, with revenues of approximately Rs. 710 crore.

- Max Estates. The idea is to leverage the Max Group’s in-house experience in activities aligned with Real Estate and its access to the sponsor’s private and Group land bank. The company has already commenced work on its maiden project in Dehradun.

- Max India Limited. It is a wholly owned subsidiary that will provide intellectual and financial capital to early-stage organisations, with sound business models and proven revenue stream, across identified sectors.

- Education Vertical. MAXVIL’s Education vertical recognises the gap in the provision of quality education in India and views this as a genuine opportunity not merely regarding business but also regarding making a significant positive social impact.

The Chairman of MAXVIL, Analjit Singh has an enviable track record in the Indian Business fraternity. MAXVIL is an expression of the growth and diversification efforts that he proposes to undertake to encash upon the ‘fast evolving socio-economic dynamics of India’. In his words:

“Talking about some of the new initiatives planned under the MaxVIL umbrella, I see that we have the capability of making distinct improvements the way we did in insurance and healthcare. Real Estate and Education, suffer from a trust deficit. With our reputation for service excellence and the credibility built over the years, we have an immense scope of making lasting impressions in these two critical sectors.

The Real Estate sector, for instance, is marred by poor planning and an abysmal insensitivity to customers requirements. The deadlines are routinely exceeded, sub-standard materials are used in construction and customer norms are blatantly outed. This is shocking especially because India needs quality housing and commercial space. We are committed to excel on this front.

Similarly, in Education, it is pertinent to point that we are perhaps the youngest, amongst the major economies of the world. Young India is restless and as they go about seeking their aspirations in a growing India, it is our responsibility to create a citizenry that is compassionate, empathetic, considerate towards the less fortunate, sensitive to the environment, cosmopolitan in its outlook and mindful in its overall behavioor. Education, as a sector, has always been very close to my heart. My experience tells one that the opportunity to create a positive impact is maximum in the formative years of the child, i.e., during the course of school education.

We will also provide intellectual and financial capital to promising and proven early-stage organisations. We will cherry-pick businesses that are aligned with the Max Group’s interests and areas of expertise and which display a demonstrable hunger and passion for growth as well as strong entrepreneurial zeal. In return, we will provide not only capital investment, but also strategic guidance and mentoring to the businesses where we choose to invest.”

Summary of Business Activities

The various activities of MAXVIL can be summarised as follows:

Max Speciality Films

The primary business as on date is Max Speciality Films (MSFL). It has been a part of the Max Group since its inception. The industry is speciality packaging film. The Board of Directors has approved an investment of Rs. 250 crores towards the expansion of production capacity by over 60 percent to 75000 tonnes per annum. This new capacity is expected to commence operations from the third quarter of the financial year 2017–18. The expected incremental revenue is to the tune of Rs. 400 crores. The highlights are

- MSFL has approximately 9% of installed capacity in India. The global market for BOPP films is 8,200 KTA and the total market for polymer films for flexible packaging is $120 billion and growing at 2.5%. In India, penetration of polymer films is just 0.3 kg per capita, a fraction of the global average of 1.15 kg. These figures suggest tremendous opportunities for growth, especially as economic development is a national priority.

- MSFL exports approximately 34% of its output and exports increased 9% during the year. Europe is the largest overseas market, but the company has a growing presence in demanding markets such as Japan and the Americas. Sales to the fast growing food industry alone account for 66% of MSFL output. Though MSFL has only 9% share of the Country’s installed capacity, its market share in the speciality films segment is an impressive 36%.

Max Estates

The Real Estate subsidiary Max Estates, has initiated construction and site development activities on its project in Dehradun, Uttarakhand and is in the process of obtaining the requisite regulatory approvals. The project represents approximately 0.15 million square feet of residential and about 0.01 million square feet of commercially deployable space.

Max India Limited

The third business is MAXVIL’s fully-owned subsidiary Max India Limited, which has made its first investment in July 2016, after the MAXVIL Board approved an investment of Rs. 335 million in Azure Hospitality Private Limited in May 2016. Azure Hospitality owns and operates Mamagoto, a mid-scale casual dining restaurant chain and Speedy Chow/Roll Maal, a quick service restaurant (QSR) format for Indian & Chinese street food and an Institutional Catering Service.

Prospects & Risk Factors

Over the next one year and beyond, it is expected that MAXVIL’s business plans will continue to evolve and take a more concrete shape. While Max Speciality Films’ focus will be on successful implementation of the new BOPP line, Max Estates will explore asset-light residential and high-end commercial real estate development opportunities in North India. MAXVIL would continue to explore and accurately target strategic growth sectors such as Hospitality, Food & Beverages, Healthcare, Technology-based Financial Services, Education, Real Estate and Senior Living. MAXVIL is also expected to finalize its plans under the Education vertical in FY 2016–17.

The possible speed-breakers would be the volatility of input costs and installation of new capacity impacting the supply chain. The company’s growing speciality exports will partially offset pricing challenges in India.

Investment Thesis

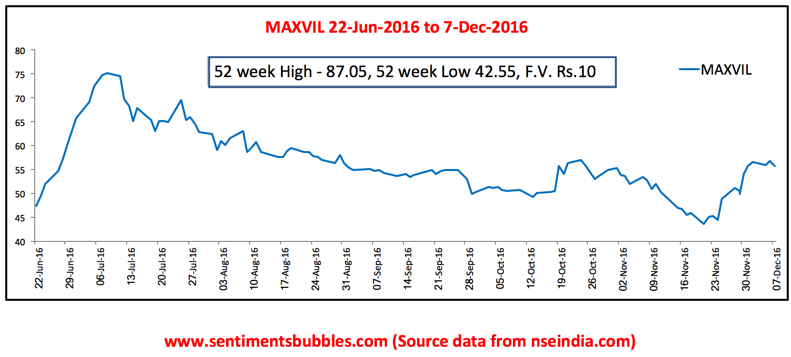

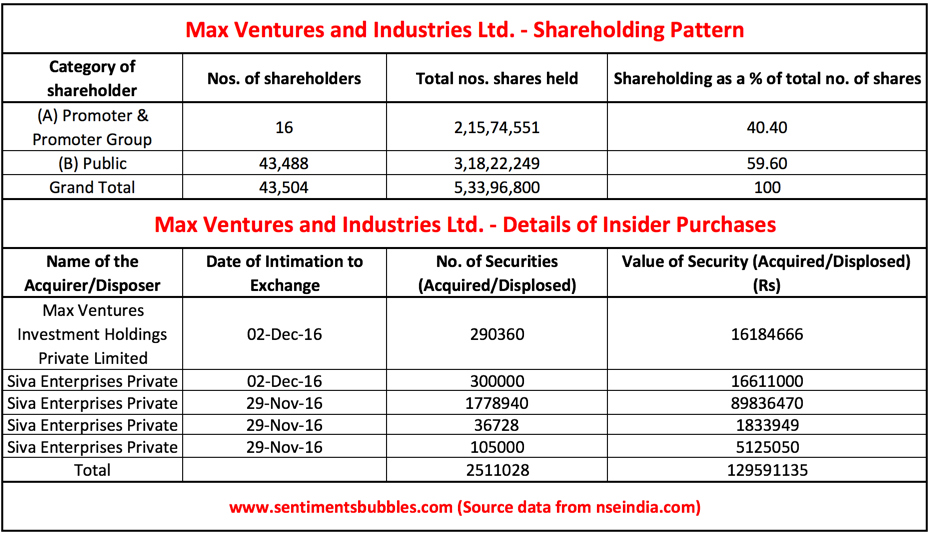

The Consolidated Earnings Per Share for the year ended on 31st March 2016 is Rs. 3.60. The shares have been listed only on 22nd June 2016. Hence, this is not a story about earnings, not as yet, at least. The fact of the matter is that the Promoter group is putting their money where their mouth is. They have recently increased their shareholding by from 40.40 percent (as on 30th September 2016 – shown below) to roughly 45.10 percent as on date.

I wish to highlight the following:

- The shares of MAXVIL were listed on 22nd June 2016. At the time of the listing, the Promoters announced an Open Offer to increase their shareholding up to 75 percent at a price of Rs. 31.50 per share.

- The open offer flopped, and the Promoters have proceeded to acquire 2511028 shares representing 4.70 percent via the creeping acquisition route. The average price at which these shares have been purchased is Rs. 51.60.

- The Creeping Acquisition route permits Promoters to increase their shareholding @ 5 percent per annum. The total number of shares (issued capital) is 53396800 and 5 percent of that amounts to 2669840 Equity Shares. In other words, they can acquire 158812 shares in the current financial year.

- In my opinion, the Promoters have made their intentions very clear. They will continue to increase their stake via the creeping acquisition route in the years to come. All in all, MAXVIL is worth investing at its current price of Rs. 55.70 on Wednesday, 7 December 2016.