Insider Sentiments – 8 of 2016

Mindtree is an international information technology consulting and implementation company. It delivers business solutions through global software development. The company operates in five segments: Retail, CPG and manufacturing (RCM), Banking, Financial Services and Insurance (BFSI), Technology, Media and Services (TMS), Travel and Hospitality (TH) and others. It offers services in the areas of analytics and information management, application development and maintenance, business process management, business technology consulting, cloud, digital business’s, independent testing, infrastructure management services, mobility, product engineering, and systems, applications, products (SAP) services.

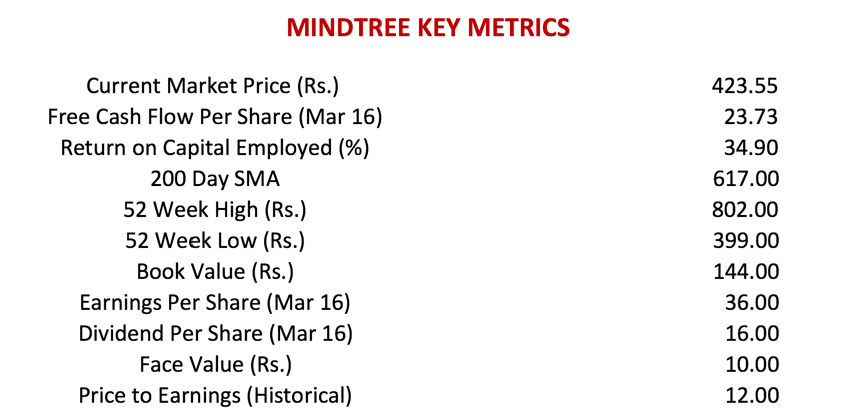

The price of software stocks in general and Mindtree in particular, have been battered over the last twelve months. Mindtree’s stock price hit a 52 week low of Rs. 399 on 09 November 2016 and it closed at Rs. 423.55 on 11 November 2016.

For the trailing period of 12 months, the stock has delivered a negative return of 43.53 percent as shown in the graph below. (To put matters into their correct perspective, and for comparison purposes, the trailing 12-month returns for the Nifty are 6.59 percent, and that of the Nifty IT index are negative 14.26 percent.

The slide in the stock price of the company started with the first quarter results and the management saying that global uncertainties arising as a result of Brexit have resulted in deferment of spending budgets by clients. At the same time, the management warned that the current financial year would be a rough year of quarterly growth rates. In my opinion, this can be interpreted both ways, up and down. The market seems to be taking the pessimistic view.

If we want to buy low and sell high, we have to buy when everyone else is selling. The consensus is that the software sector has got commoditized and that growth is tapering. In my opinion, there is an opportunity when prices get battered in the way they have been, provided the business is on a sound footing and the management is capable. In short, we are looking for an undervalued stock with a consistent past performance and a clean balance sheet. The basis of my buy recommendation is as follows:

- The stock has to have underperformed and has to be undervalued; that is the key. Many a time we have a stock that has underperformed, but it remains overvalued; we are not interested in these type of stocks. Mindtree has a minimal debt, a clean Balance Sheet. Historically Mindtree has a record of growing faster than the Indian Information technology industry.

- The business has to be on a sound footing, with a capable management. I think the record is eloquent enough. In March 2017, Mindtree completes ten years since it got listed. In this period, the company has distributed dividends every year and at a progressively incremental rate. In addition to this, Mindtree has issued Bonus Shares twice.

- The prospects of the company need to be at least as good, if not better than the past. What I did was to review the latest guidance that the management of Mindtree has given. Click here to read the transcript. In a nutshell, the management expects the revenue decline to be arrested in the third quarter of the current financial year.

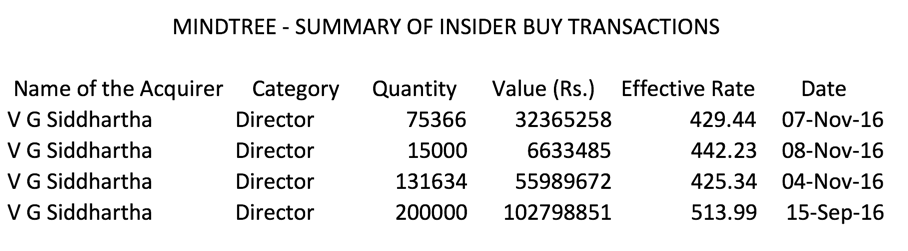

Most important of all, one of the Directors has been using the fall in price to accumulate the stock. This is shown below:

Conclusion

It is clear that Mindtree has got battered due to the uncertainties raised by the Brexit vote. These were compounded at that time by the coming U.S. Presidential elections. One has to remember that Mindtree derives roughly sixty-five percent of its revenue from the United States and twenty-five percent from Europe. In such a situation, indecision was ubiquitous across all businesses in the United States and Europe. However, now that we are past the election, companies are not bothered who is the President of the United States. The new realities are priced in almost instantly by all business and market participants. In other words, markets will look past the uncertainty; that is bullish. Looking at the key metrics of the company shown below, I think that the shares of Mindtree are a compelling buy at the current market price of Rs. 423.55