CCL Products (India) Limited

Continental Coffee Limited, now known as CCL Products (India) Limited is an Export Oriented Unit (EOU), founded in the year 1994. CCL is engaged in the manufacture of soluble coffee powder (instant coffee) and related coffee products. Their plant is located in Guntur district in Andhra Pradesh.

Business & Prospects

Despite the fact that ’instant coffee’ has been available for many years, its convenience ensures that the demand for the same continues to be robust. The fact that instant coffee has undergone considerable improvements over the years has ensured that a growing number of coffee aficionados have made the shift from their habits of drinking roast and ground coffee to the instant varieties; convenience of preparation does matter.

The global market for coffee is witnessing steady growth with sharp increases in coffee consumption in Africa and Asia. Also, a growing number of Chinese and Vietnamese citizens are switching from their traditional tea drinking habits to coffee. China now is the fourth largest global market for ‘ready to drink’ or instant coffee. Russia is one of the biggest global consumers of instant coffee. To summarise the global prospects for the instant coffee market are bright. Coffee drinking is not only a habit; it is a lifestyle.

In India, the growth of the instant coffee market is estimated at 15 percent per annum. CCL is in the process of expanding its footprint in the domestic market as well. As on date, the coffee consumption in India is about 10000 tonnes of instant coffee. There is enormous potential for growth of coffee consumption in India. In the developed world, despite a lower population, the consumption of instant coffee is much higher. (U.S. consumes about 80,000 tonnes, and Japan consumes 35,000 tonnes). In other words, the increasing Gross Domestic Product (GDP) of the Indian population does provide ample opportunities for consumption related growth of a hot beverage like instant coffee. CCL is capable of producing 200 varieties and blends of instant coffee. In other words, CCL is well placed to capitalise on the opportunity.

The risk of reduced rainfall and climate change, are twin risks to which the business model of CCL is exposed. Coffee as a crop is susceptible to temperature change and a variety of plant diseases. Moreover, shifts in the international prices of coffee beans tend to affect the fortunes of CCL. CCL is also exposed to currency fluctuations and is adversely affected by a strengthening Indian Rupee (INR) (as is currently the case). The current INR strength is a function of the weakness of the U.S. Dollar and the British Pound. Just as in the equity markets, predicting the course of currency movements is impossible and exchange rate parity can go all over the place. In other words, exchange parity will matter, but it is not knowable. Suffice to say that over the long-term, currency fluctuations don’t account for much, in terms of returns from equity investing.

Valuation

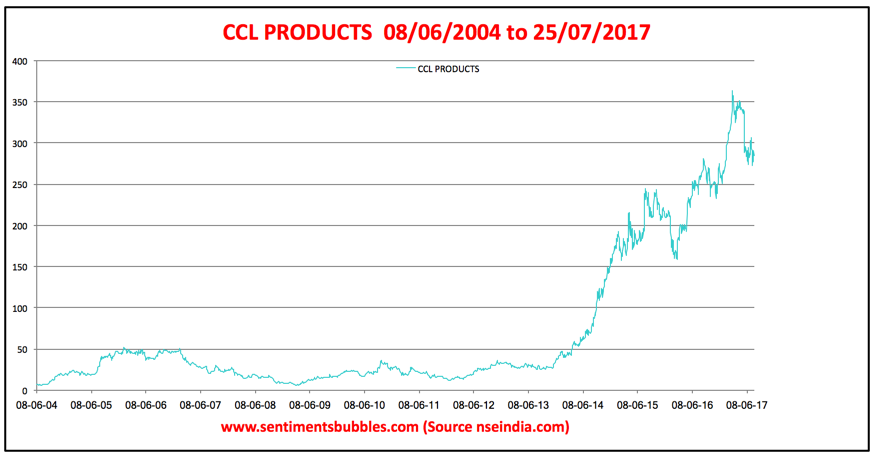

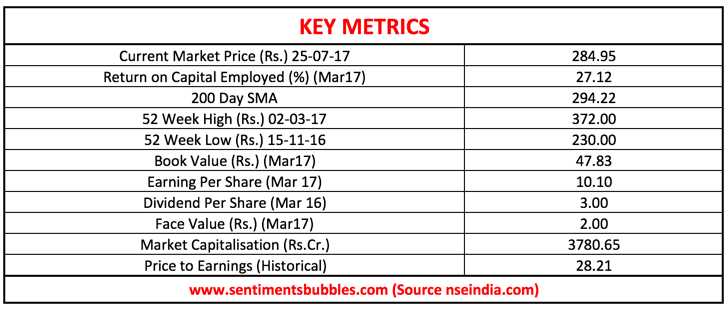

The Equity Capital of CCL consists of 13,30,50,000 shares of the face value of Rs. 2 each, translating into an equity capital of 26.61 crores. The company has very little debt on its books. CCL is a Small-Cap stock and has a market capitalisation of just Rs. 3781 Crores. The vital statistics are shown below:

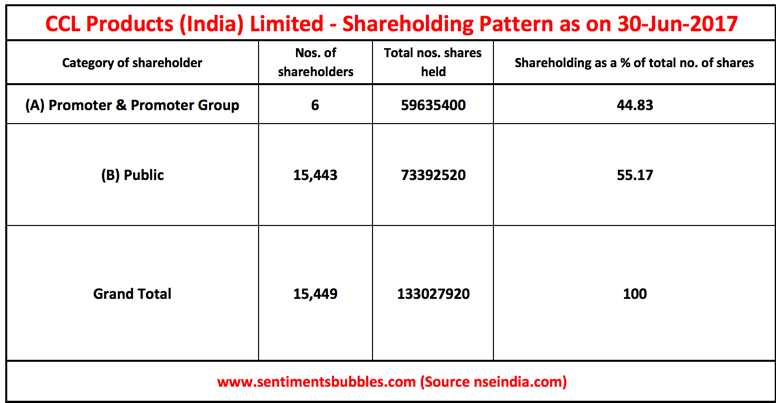

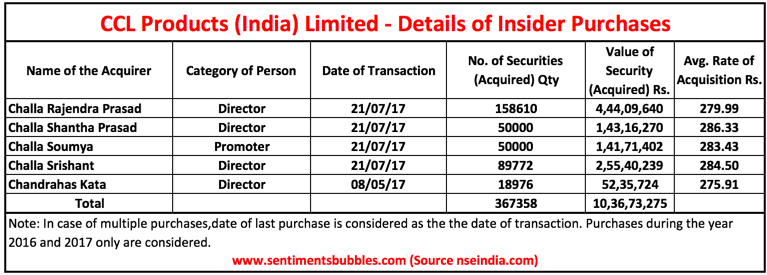

The Promoters of CCL have been buying from the open market at a steady clip. The shareholding pattern, average cost of acquisition and dates of the trades are shown below:

CCL is one of the largest private label manufacturers of instant coffee in the world. It exports to 85 different countries. The turnover of CCL is equally split across the world (U.S., Europe, Africa, Asian and CIS countries). As a result, CCL is not dependent upon any particular region or country. Over the years, the installed capacity of CCL has grown from 2000 tonnes to 30000 tonnes. The management of CCL seems to be very conservative, and guidance is muted. The motto seems to be to ‘underpromise and overdeliver’. I think that CCL is a risk-free buy at the closing price of 284.95 (Tuesday, 25 July 2017) on the National Stock Exchange of India (NSE).