Dr. Reddy’s Laboratories Ltd

Dr. Reddy’s Laboratories Limited (DRL) was founded in 1984 and is India’s second-largest maker of generic pharmaceuticals. While discussing their plans, the Promoters vision of DRL in ten years is that of a global company that thrives on innovation.

Indian Pharma Industry

The Indian pharmaceutical industry ranks third in volume and thirteenth in value across the globe. The market size is estimated at R. 2,52,000 crore in the current calendar year (2016). It is estimated that currently, the Indian Pharma market is the sixth largest in the world. The growth projections mean that by the year 2020 it will be the third largest.

DRL – Analysis and Investment Thesis

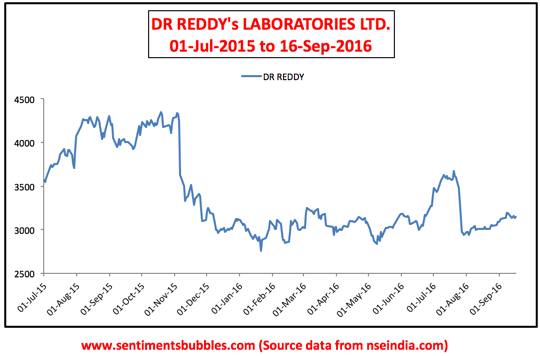

In October 2015 the U.S.Food and Drug Administration (FDA) noticed a breach in production standards at DRL. As a result, the U.S.FDA has ordered third-party audits at various manufacturing facilities of DRL. It has adversely affected sentiment and the stock price of DRL. In other words, the negative sentiments from the U.S.FDA directive are priced into the current valuations of DRL. This is shown in the image below.

DRL has been complying with the U.S.FDA standards and is now set to complete remediation work. The U.S.FDA embargo is expected to be lifted by the end of the current calendar year. In my opinion, the management of DRL has used the opportunity in a profitable way by (1) buying back stock from the open market via a corporate buyback and (2) the Promoter group has also made some insider purchases.

Buyback of shares from the open market

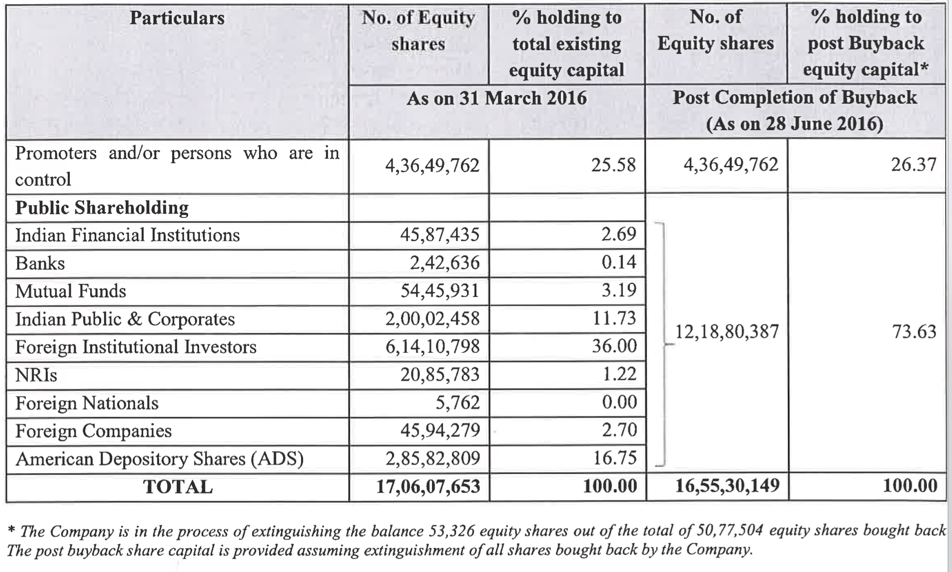

Vide Public Announcement dated April 11, 2016, DRL initiated a Buyback of equity shares of the Company up to a maximum price of Rs. 3500 and an aggregate amount not exceeding Rs. 15,694,171,500 (Rupees One Thousand Five Hundred Sixty Nine Crores Forty One Lakhs Seventy One Thousand Five Hundred only). The Buyback was from all Shareholders of the Company using the open market route following the provisions contained in SEBI (Buy Back of Securities) Regulations, 1998 (including any statutory modification(s), or re-enactment for the time being in force).

Under this, DRL bought back 5,077,504 equity shares at an average price of Rs.3,090.92 per share. The buyback was completed on 28 June 2016. How significant is this? The fact that the buyback was not made using the tender offer route is positive and shareholder-oriented. It reflects good corporate governance.

(For the uninitiated, Stock Buybacks: The Good, The Bad & The Ugly talks about buybacks in the Indian Capital Market).

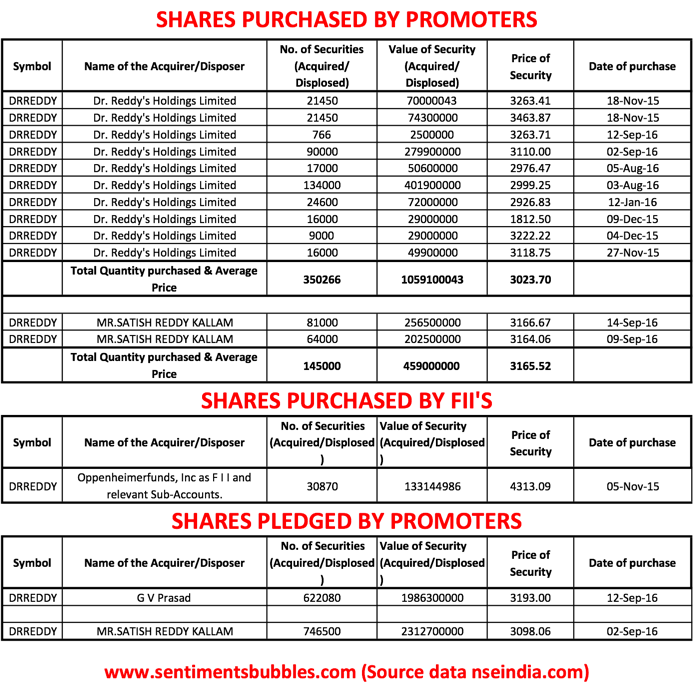

Insider purchases by the Promoter group.

In addition to the corporate buyback highlighted above, the Promoter group has also been making purchases from the open market. This is shown below:

DRL- Growth Prospects

There are some other positive triggers for DRL. These are listed below

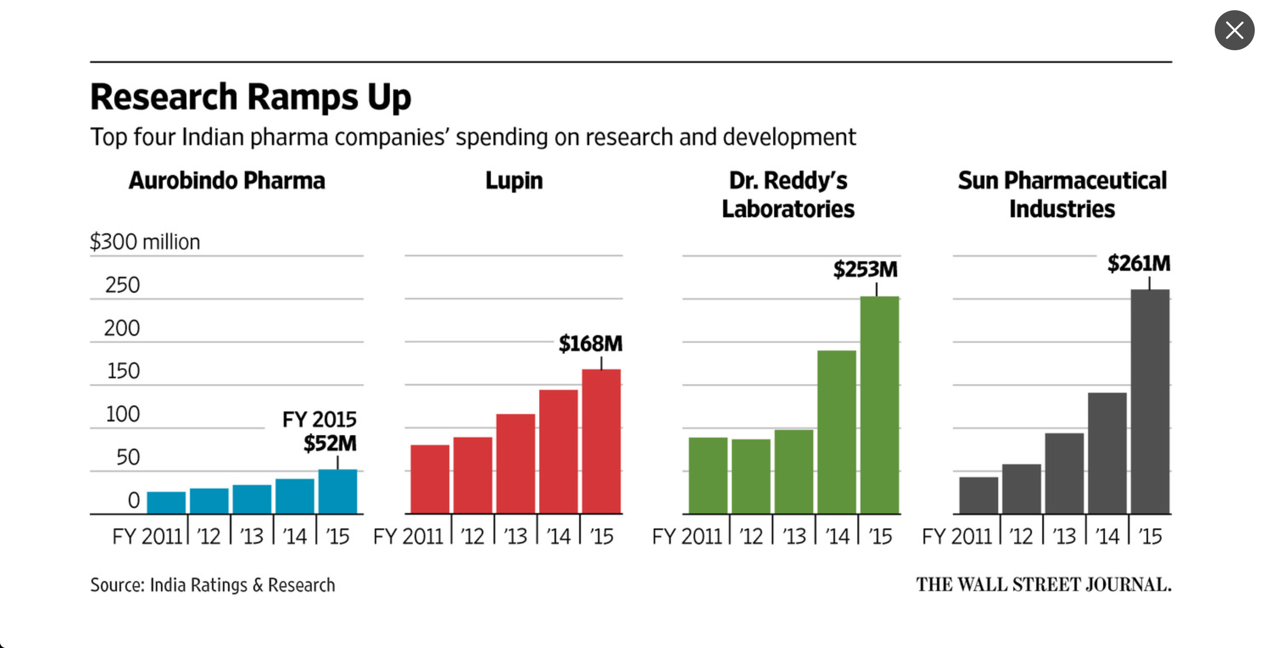

- DRL also has a presence in the United States. A slew of drugs await approvals with the U.S.Food and Drug Administration. Growth in the U.S. markets depends on the number of new product launches that DRL can manage in the USA. The number of FDA applications for new product launches gives an idea of what lies ahead. According to media reports, roughly one-third of all FDA requests made in the first nine months of 2015, were from Indian Pharma companies. Indian Pharma accounts for forty percent of the generic drugs sold in the United States. As a result, to get a feel of what kind of approvals lie in store for DRL over the next twelve months, one has to look at the R&D spend of Indian Pharma companies. DRL has one of the highest R&D spends among Indian Pharma companies. This is shown in the image below:

- DRL has been listed as an index component of the Dow Jones Sustainability indices. The Dow Jones sustainability indices is a leading global benchmark for corporate sustainability. This is a shot in the arm for DRL and speaks volumes for the long-term vision of the Promoter group.

- Apart from these triggers the Indian Pharma industry also has a huge opportunity in the domestic market. Medical Tourism is seen to be booming. Primarily, this is a boon for the hospital management companies. However, the ripple effects will be felt by Indian Pharma companies as well.

Conclusion

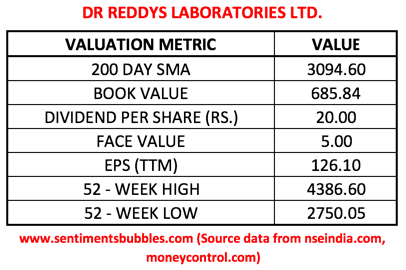

The valuation metrics are shown above. What matters is the quality of the management. In my opinion, management quality at DRL is exemplary, and they are committed to achieving long-term growth for their shareholders. Reshaping an Emerging Market Giant by McKinsey & Company provides an insight into the Promoters long-term approach and vision. All in all, DRL seems to be a growth stock available at a reasonable valuation and is a safe buy at the current market price of Rs. 3150.15.