Nitta Gelatin India Limited

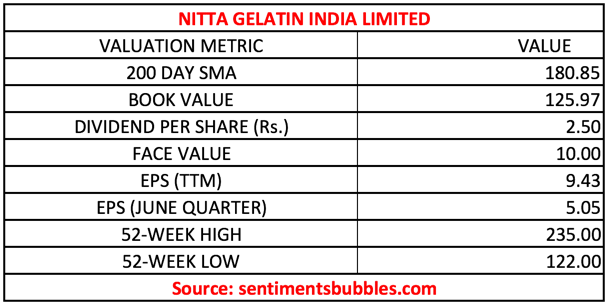

Nitta Gelatin India Limited is jointly promoted by Kerala State Industrial Development Corporation (they hold 28,62,220) shares and Nitta Gelatin Inc, Japan (they hold 39,00,300) shares. Effectively, the Promoters jointly own 74.48 percent of the total share capital. The shares have a face value of Rs. 10 and the market capitalisation at the current market price of Rs. 188.85 is roughly Rs. 171 crores. The shares are listed only on The Bombay Stock Exchange, and the script code is 506532.

Business Characteristics

Nitta Gelatin India Limited is one of the leading Gelatin Manufacturers in India. What is Gelatin? Gelatin is defined as a ‘product obtained by partial hydrolysis of collagen derived from natural sources such as skin, connective tissues, and bones of animals’. India has one of the largest population of livestock and generates close to 21 lakh tonnes of cattle bones. As a result, India is one of the biggest exporters of Gelatin. The salient characteristics of Gelatin are:

- Gelatin is not a chemical or a chemically modified substance. Gelatin is classified as a derived protein.

- It is produced in powdered form, is slightly yell in colour and is tasteless and odourless. The shelf life is between two to three years.

- The main raw materials required for manufacturing of Gelatin are Cattle Bone, Hydrochloric Acid. Lime and Solvent.

Gelatin is used in three industries. These are food, pharmaceutical and photographic. The applications of Gelatin in these industries are as follows:

- In the food industry, Gelatin is used in confectionery products, ice creams and as a binding agent in meats. Gelatin is present in Dairy (ice cream, sour cream, yoghurt, cottage cheese), Meat, Desserts, Confectionery and other food products like sauces.

- In the pharmaceuticals, industry Gelatin is used to make the shells of hard and soft capsules for medicines and dietary supplements. It is digestible and hence serves as a natural protective coating for pills.

- In the photographic industry, Gelatin is used in preparations of silver halide emulsions in the production of photographic film.

Prospects

German based Gelita is the number one manufacturer of Gelatin in the world, and it manufactures about 85000 tonnes per year. The top three producers of Gelatin in India are Nitta Gelatin India Limited, Sterling Biotech Limited and Narmada Gelatines Limited (526739). They export roughly half their produce.

Nitta’s products have an enviable market demand. During the year ended 31st March 2016, entire sale of Ossein / Limed Ossein, 44.5% of the total sale of Gelatin and 38.6% of Collagen Peptide were through exports. Nitta has decades of expertise in the manufacture and marketing of Gelatin and is backed by the Japanese parent, M/s. Nitta Gelatin Inc., Japan. As a result, Nitta Gelatin is on a firm footing and is uniquely positioned to take advantage of business opportunities. The business prospects can be summarised as follows:

- The growing use of Gelatin in applications such as food & beverage, pharmaceuticals and nutraceuticals is expected to drive the demand for Gelatin in the years to come.

- The demand for Gelatin is projected to increase mainly in the Asian markets such as China and India, driven by population growth and economic development.

- Nitta exports Gelatin to global tablet manufacturers and food processing industries. The Rs. 5000 crore capsule industry is one of the largest buyers of Gelatin in India. In many cases, capsules are the only delivery mechanism. Lately, Ayurvedic medicines are also being sold in pill form in addition to the traditional allopathic usage.

- Nitta has also diversified into manufacturing collagen peptide, a protein supplement from Gelatin, used for treating knee pain. Sports and fitness are high-growth segments where Collagen Peptide is used since it contains significant volumes of proteins which help in muscle building. It is reported that Collagen in the human body starts to dwindle from the age of 25 and needs to be supplemented by external sources. The increasingly sedentary lifestyle of the working class population due to the advent of information technology has increased the demand for functional food and beverages. Collagen Peptide is offered in multiple formats such as dietary supplements and powders, which can be easily incorporated into functional foods and beverage formulations. The ageing population across the globe especially in developed nations such as the United States, the United Kingdom, Western European countries and Japan is a key growth driver for Collagen Peptide. Collagen Peptide also represents a potential market in the beauty segment. Nitta is fully equipped to manufacture both Bovine Collagen Peptide and Marine Collagen Peptide.

Risks & Concerns

Nitta is a single product company, in a way it is a double-edged sword. The risk factors that threaten the business model of Nitta are:

- In India, most Gelatin manufacturers use Buffalo bones. It is hard to trace the bones that are used; the source may be cow bones, but one doesn’t know for sure. The slaughter of bulls and bullocks is banned and is punishable by incarceration up to five years in Maharashtra and ten years in Haryana. Buffaloes, which are a primary source of beef, are not covered by the ban. In any case, due to the ban, supply of bones is hampered. It has had a two-pronged effect; a rise in price and a simultaneous fall in the quality of bones. The increase in prices of crushed animal bones apart from its poor quality is not conducive to the business of the Company. Crushed bone prices rose by 11 % during 2015–16 as compared to the previous fiscal.

- With all the domestic Gelatin plants (in India) operating at full-scale during the year and the resultant massive demand for crushed bone, the quality of supplies could not meet the quality export specifications for Ossein and Limed Ossein in the year ended on 31 March 2016. It led to a reduction in Export volumes of Ossein / Limed Ossein by 19% during the year.

- The demand for Collagen Peptide witnessed a setback in the primary overseas markets like Korea and Thailand. In the domestic market, the unduly long delay in granting new product approvals by the regulatory authorities has resulted in a poor offtake of Collagen Peptide.

- The improvement in USD / INR exchange rates during 2015–16 as compared to 2014–15 has also contributed to improved sales realisation on exports. In other words, Nitta’s topline is vulnerable to exchange rate fluctuations.

- The Kadukutty Panchayat in Trichur District did not renew Nitta’s factory licence for their Ossein Plant at Koratty. The grounds for the rejection were issues related to compliance with guidelines laid down by the state’s Pollution Control Board. However, the Kerala State Tribunal for Local Self Government Institutions has stayed the orders of the Panchayat until further orders. The denial of factory licence by the Kadukutty Panchayat for earlier years was challenged before the Hon’ble High Court of Kerala, and the Court has ordered status quo in the matter till final disposal of the writ petition filed by the Company. The recent review of the effluent management system at Ossein Division by the National Environmental Engineering Research Institute (NEERI) has confirmed the efficacy of the system by which the Pollution Control Board has renewed the Consent To Operate up to 30.06.2018. Based on expert legal advice, the Company expects a favourable resolution of the matter.

- Owing to restrictions in the quantum of discharge of treated effluent, there has been considerable under utilisation of capacity at the plants operated by Messrs Reva Proteins Ltd, a subsidiary of Nitta. As a result, Reva Proteins Ltd has incurred cash losses. This is the biggest concern. The company has made an investment of Rs. 1250 lakhs in the issue of 6% Optionally Convertible (Non-cumulative) Preference Shares of Rs. Ten each at par of the said subsidiary (Reva Proteins Ltd). In addition to this a Capital investment Rs. 900 lakhs is financed out of term loans from the promoter, NGI Inc. Japan. In other words, Nitta has a revival plan in place and a turnaround is expected.

Investment Thesis

The Company has issued 929412 Optionally Convertible Preference Shares (OCPS) of the face value of Rs. 170 each, aggregating Rs. 15,80,00,040 to Messrs Nitta Gelatin Inc, Japan. These carry a fixed dividend @ 5.4029 percent and are redeemable at par at the expiry of seven years from the date of allotment. The date of Allotment is 28 April 2015. They also carry a put and call option at the expiry of five years from the time of allotment. These OCPS have the option to get converted into equity shares either in full or in part at a value of Rs. 170 per equity share (Face Value Rs. 10 plus Rs. 160 Premium), not later than Eighteen months from the date of allotment of the OCPS. The period of eighteen months will expire on 27 October 2016.

The Financial Summary of Nitta is shown below:

From the figures, it is apparent that Nitta is fairly valued at the Current Market Price (CMP) of approximately Rs. 188.85. The basis for the BUY recommendation at the current market price can be summarised as follows:

- The risk factors mentioned above seem to be priced into the current valuations.

- As per guideline issued by the Securities and Exchanges Board of India (SEBI), the Promoters cannot increase their ownership stake beyond the current limits. In case the Promoters do decide to convert their OCPS, it would require SEBI approvals and a capital restructuring. In other words, a conversion of OCPS cannot be ruled out on technical grounds.

Will the Japanese guys exercise their option to convert their OCPS into Equity shares? Their option expires on 27 October 2016. In my opinion, this is irrelevant. My reasoning is (a) The Japanese Promoter has invested @ Rs. 170 per share. It is pretty close to the CMP and (b) even if they do not exercise the conversion option, the fact that Promoters have infused cash does not change. In the end conversion of OCPS into equity capital is a book entry. All-in-all, Nitta appears to be a safe bet at the current market price of Rs. 188.85.