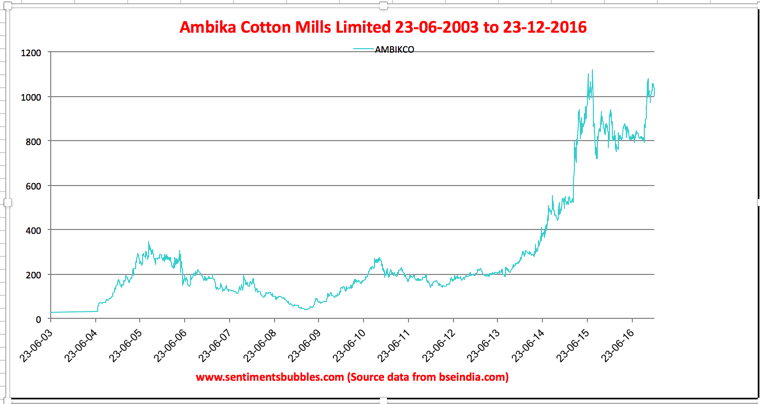

Insider Sentiments – 11 of 2016 – Ambika Cotton Mill Limited (AMBIKCO)

Ambika Cotton Mills Limited is engaged in manufacturing and selling of speciality cotton yarn. The company caters to the needs of manufacturers of premium branded shirts and t-shirts. Exports constitute a significant portion of the operations. The company operates with total installed spindle capacity of 108228 in a small facility housed in four units. The company has an installed 27.4 MW wind power capacity for captive consumption of spinning segment. The Spinning Plants are located at Kanniyapuram, Dindigul and Windmills are located in Tirunelveli, Dharapuram and Theni in the State of Tamil Nadu.

Indian Textile Industry & Prospects of AMBIKCO

India’s textiles sector is one of the oldest industries in Indian economy. It contributes approximately 11 percent of the total exports made by our country. The textile industry has two broad segments. The unorganised segment consists of handloom, handicrafts and sericulture, which are operated on a small-scale and through traditional tools and methods. The organised sector consisting of spinning, apparel and garments segment which apply modern machinery and techniques such as economies of scale. The two segments lead to a large amount of diversity within the Indian textiles industry, with the hand-spun and hand-woven textiles sectors at one end of the spectrum, while the capital-intensive sophisticated mills segment at the other end of the spectrum.

The decentralised power looms/ hosiery and knitting sector form the largest component of the textiles industry. The close linkage of the textile industry to agriculture (for raw materials such as cotton) and the ancient culture and traditions of the country regarding textiles make the Indian textiles sector unique in comparison to the industries of other nations.

The main raw material for the textile sector is cotton. Since the Indian textile industry is labour intensive, the Government announced a new textile policy on 22 June 2016 with the focus of generating employment. The new system is expected to increase the demand for cotton yarn.

AMBIKCO, on account of manufacturing speciality cotton yarn, continues to have good demand for its products and has created specific markets for its products. It ensures more sustained profitable operations. The company continues to strengthen its production base by modernisation and adding balancing equipment and improvising the manufacturing process. The Company has installed windmills for 100% of its captive requirements and installed an EHT line (110 KVA Sub-Station) for smooth flow of quality power. These measures will continue to support the operations of the company.

Investment Thesis

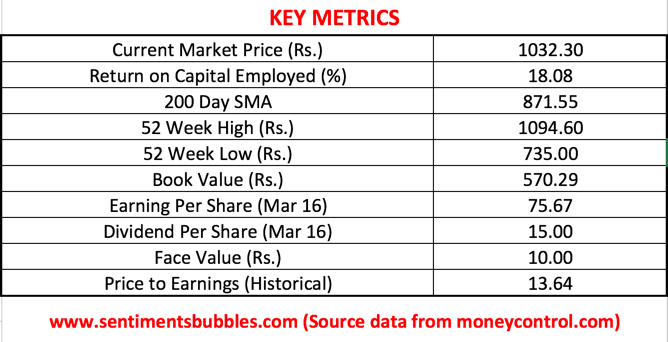

AMBIKCO is not that expensive and commands a reasonable valuation. The key metrics are shown below:

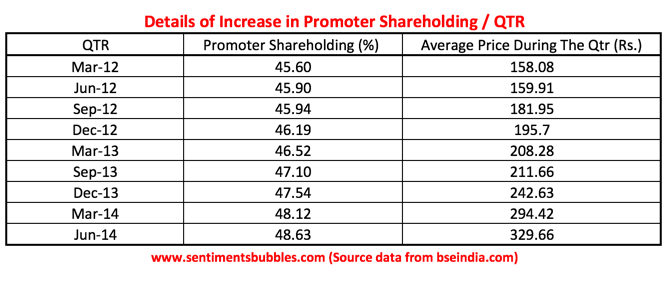

The Promoters have been increasing their stake at a steady clip over the years. The historical increase in Promoter shareholding is shown below

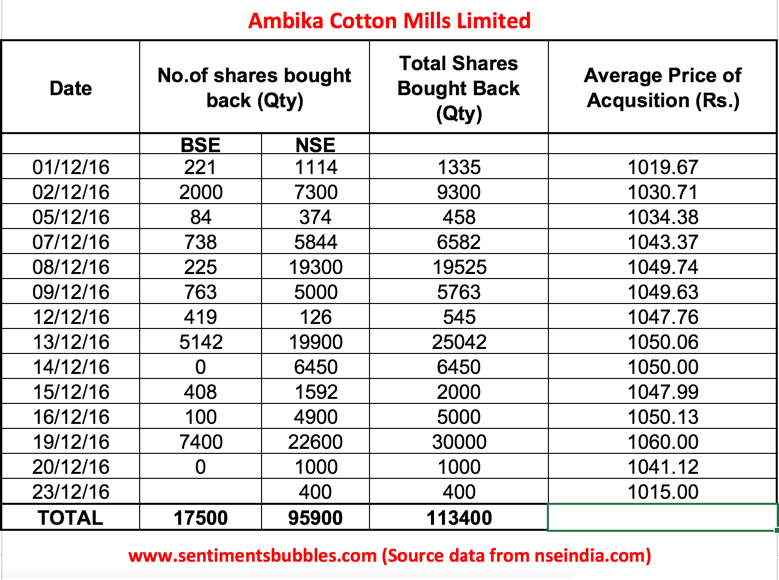

Currently, AMBIKCO is buying back roughly 2.55 percent of the floating stock from the open market representing. It represents 150,000 shares, and the maximum permissible price at which these shares can be bought back is Rs. 1100 per share. On completion of the Buyback, the Promoters will hold 51.37 percent of the share capital. The number of shares that have been bought back as on date is shown below:

Ambika has an issued equity capital of just 5.88 crores, and liquidity is poor. The valuations are attractive, and there is practically no debt. I think that AMBIKCO represents an attractive buying opportunity at the current market price of Rs. 1032.30