Insider Sentiments – 10 of 2016 – Finotex Chemical Limited (FCL)

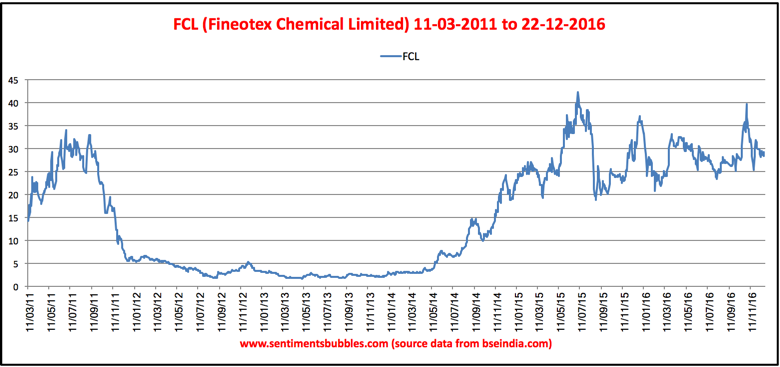

The Finotex group was established by Surendra Tibrewala in 1979. FCL was incorporated as a public limited company in 2007. FCL was listed on the Bombay Stock Exchange (BSE) in March 2011 and subsequently on the National Stock Exchange of India (NSE) in January 2015. This is how the price action looks from the listing date:

What does FCL do?

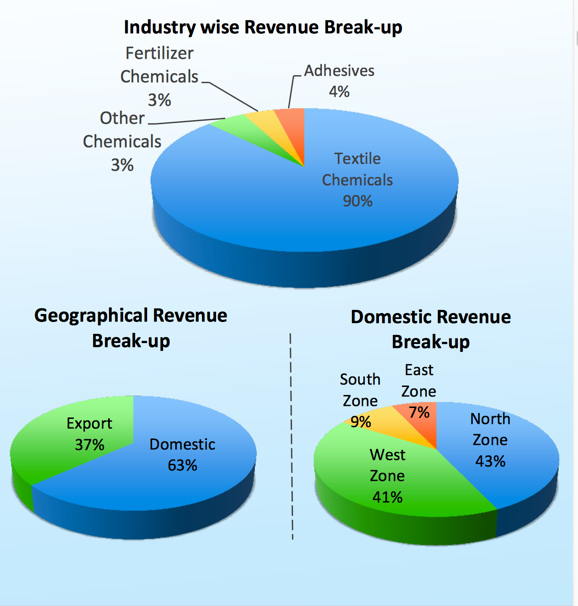

Finotex Chemical Limited (FCL) is in the business of speciality chemicals. Within the broad category that spans the Speciality Chemical industry, FCL is a manufacturer of Speciality Textile Chemicals. The key businesses and geographies of operation are shown below:

Business Scenario and Key Triggers

Globally, the Speciality Chemicals market is driven by extensive research. Development and innovation. FCL is one of India’s growing speciality textile chemical manufacturers. The company has a unique in-house technical expertise department. FCL manufactures over 400 speciality chemicals and enzymes that cater to the textile, garment, construction, leather, agrochemicals, adhesives and water treatment industries. The manufacturing facilities of FCL are located in Mahape, Navi Mumbai in India. It also has a facility located in Malaysia. FCL global presence spans 33 countries, and it has received the Star Export House recognition as an exporter. The majority of the revenue comes from the textile segment.

The global speciality chemicals market is expected to grow at a Compounded Annual Growth Rate (CAGR) of roughly 5.40 percent for the period ending with the year 2020. For the same period, the Textile segment of the speciality chemical market is expected to grow at a CAGR of roughly 3.70 percent.

According to FICCI, the Speciality Textile Chemical market in India is projected to grow at 12 percent per annum by 2019. The main reason being an expected shift from the unorganised sector to the organised sector. In addition to this, the government has taken various initiatives to aid the growth of the speciality chemical industry in India. These are

- 100 percent Foreign Direct Investment (FDI) has been allowed.

- Industrial Licensing has been abolished.

- The launch of the Draft National Chemical Policy with the objective of increasing the share of the chemical industry in the country’s GDP.

However, the primary growth driver lies elsewhere. Over the last few years, the Chinese Ministry of Environmental Protection has been enforcing strict penalties for non-compliance with regulations. It has resulted in a surge of exports at FCL. As a result, the Indian Speciality Chemicals segment has been growing at an annual rate of roughly 13 percent over the last couple of years.

Investment Thesis

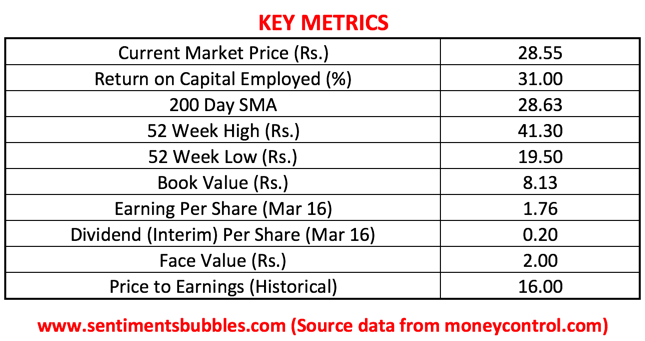

FCL has little debt on its books. Only working capital requirements are borrowed, and the amounts are negligible. The Key Metrics are shown below:

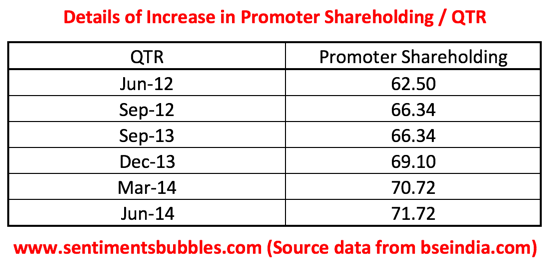

At the time of listing the Promoter shareholding was 62.50 percent, and it has been steadily going up since. This is shown below:

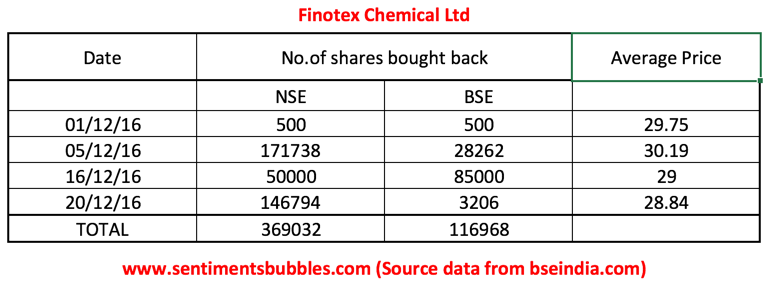

In November 2016 FCL has passed a Board Resolution for Buyback of Equity Shares from the Open Market. As a result, the company has resolved to Buyback a total number of 998110 shares from the open market at a price not exceeding Rs. 40 per share. Once the Buyback of shares from the open market is completed, the Promoter shareholding will reach 72.60 percent. The table below shows the total number of shares bought back till date.

I think that FCL is a compelling buy at its closing price of 28.85 on Thursday, 22 December 2016.