OnMobile Global Limited (NSE: ONMOBILE, BSE: 532944), current market price (CMP) Rs. 105.40 is in the business of providing end-to-end solutions for network operators, media companies, and consumers. The company operates in the telecom space and provides value-added services. It is headquartered in Bangalore, India and services customers in 59 countries. Their end customer is the smartphone user.

Shareholding Pattern & Recent Changes

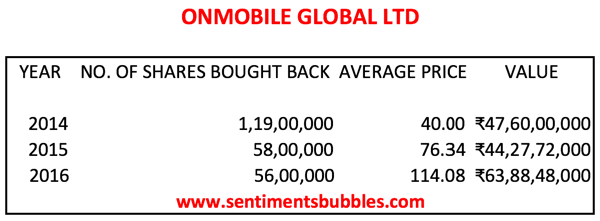

The promoters of the company, OnMobile Systems Inc, have been continuously buying back shares from the open market. A summary of their open offer and buy-back operations over the last couple of years is shown below:

As a result of the above, the promoter shareholding of OnMobile Systems Inc has been increasing rapidly. This is shown below:

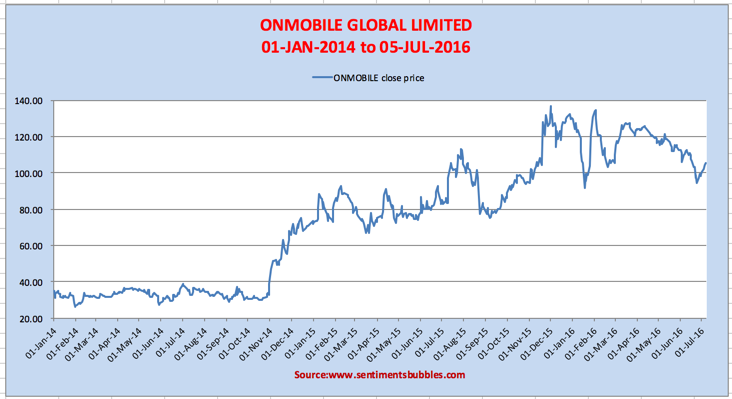

The effect on the share price has been positive thus far:

Investment thesis

The company claims to transform everyday mobile communication into an enjoyable, exciting and personal experience for consumers. It seems that OnMobile is a one-stop shop for mobile solutions. The following points merit consideration:

- Their flagship product is the Ring Back Tone (RBT) offering. It seems that the OnMobile’s Ringback Tone (RBT) product now reaches 61 million mobile customers worldwide and delivers approximately 500 million music plays daily. The company’s RBT is currently deployed across 41 countries through more than 60 top-tier global telecommunications operators.

- In the year 2015, OnMobile became the exclusive Caller Ringback Tone partner (RBT) for Tata Teleservices (Tata) in India. Similar deals have also been signed in Bangladesh and Brazil.

- OnMobile is a mobile services company in the technology space. In the technology sector, changes can be very fast and debilitating. At the same time, in the ringtone business, OnMobile seems to have a monopoly. In my opinion, visibility about future revenues is clouded and hazy (at best).

- However, from the track record of buybacks shown above it appears that the promoter group is very confident about their business model and prospects. The Balance Sheet does not carry any excessive debt burden. The book value is roughly Rs. 67 per share.

Conclusion

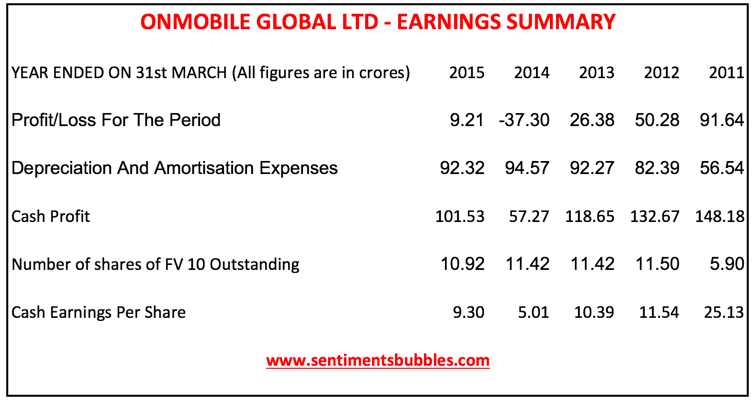

OnMobile is a growth stock in the technology space. As a result, there is no point looking at traditional metrics like price to earnings. What I have done is to look at the cash earnings per share instead. This is shown in the table below:

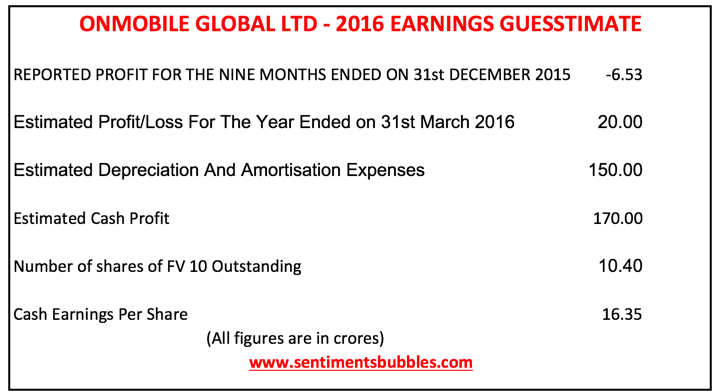

It is apparent that even thought OnMobile does not generate sizable net profits after all adjustments; it does make substantial cash profits. In other words, the business is profitable but after depreciation, the profits get restated lower. The cash so generated is being put to good use by the Promoters by buying back stock at regular intervals. The question is what would earnings look like in the future. I have tried to make an educated guess. (Please note that the figures below are all guesstimates and not actual). Take a look:

The usage of smartphones in increasing at a rapid pace. Has a point of saturation been reached? For OnMobile the question is irrelevant. The ringtone business model is not dependent on the level of saturation of smartphone usage. In fact, the greater the saturation, the greater the opportunity. Add to this; the fact that the Promoters seem to buy back stock repeatedly does inspire confidence. All in all, I think that ONMOBILE at the current CMP of Rs. 105.40 is a safe bet.