(Cartoonist: Bacall, Aaron : Cartoonstock.com)

We are back to the earnings season. INFY, the IT bellwether announced numbers on Friday, 10th Oct, 2014. The stock had declined for most of the week on the back of ‘sell’ recommendations by some FII brokers. On Friday it recovered all its weekly losses, and then some. Since the market gave its price a nice bump, I assume the numbers and guidance must have been encouraging.

The INFY Price Target

How have I arrived at the price target in the header above? Well, actually I replaced the four alphabets of the symbol, with the numbers on the key-pad of a mobile phone, and it gave me 4639!! This, in a lighter vein, is what targets are all about. INFY did not disappoint and was the star performer on Friday, with a bonus issue thrown in. Will it reach my price target? You will have to read on to find out.

Investing with Price Targets and Analysts Recommendations

To put matters in the correct perspective, a word on the analysts themselves. There are basically two types of analysts, BUY side analysts and SELL side analysts. A layman would think that the buy side ones are the ones who give buy calls and the sell side ones are the ones who give sell calls. Actually, the BUY side analysts are the ones who work for fund houses. As investors we don’t need to be bothered about them. The SELL side analysts are the ones who give the BUY and SELL calls which are broadcast on the media network. From the point of view of the brokerage house (which employs the analysts) what you buy and sell is something which they are recommend. Effectively, the SELL side analysts recommend what investors should buy and sell.

INFY – What are the Analysts saying?

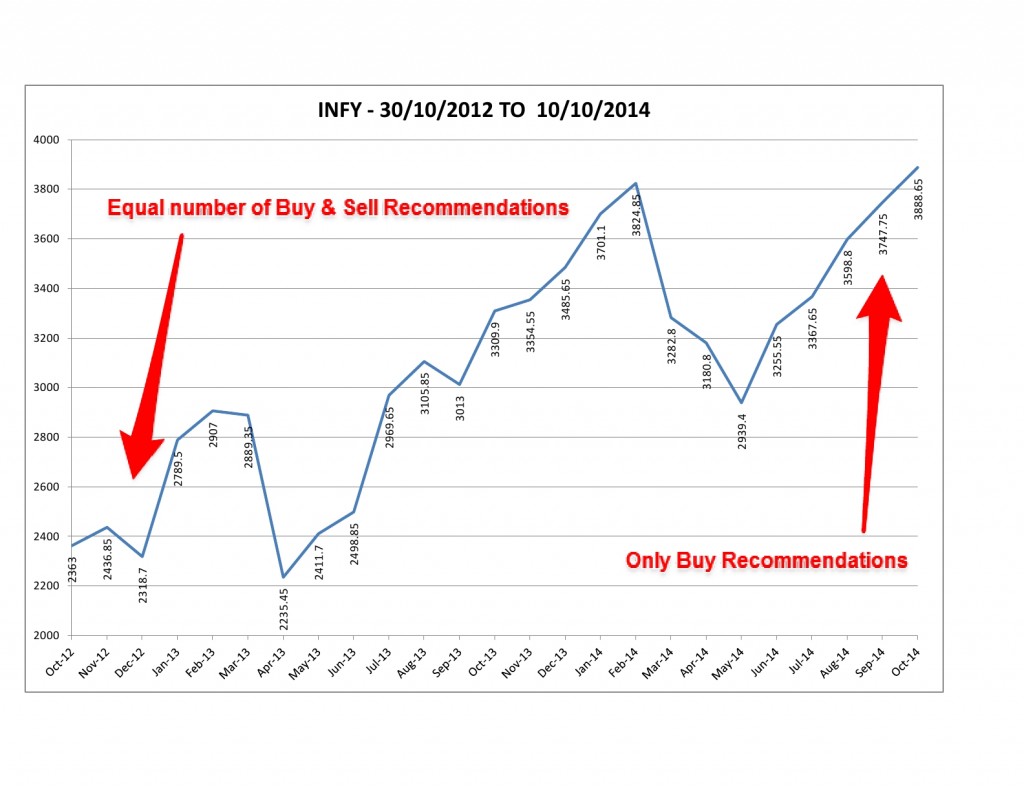

The graph below shows INFY stock price for the period 30th October, 2012 to 10th October, 2014.

The following points are pertinent:

1. The high and low of INFY in the last three months is Rs. 3908 (10/10/2014) and Rs. 3185.8 (14/07/2014). If one had bought at the low, and sold at the high made in the last three months, one would have made approximately 23 %. However, I do not think any one has these magical abilities (of buying at the low and selling at the high). The median price in the last 3 months is Rs. 3565. By that metric, assuming one did sell at 3908 on 10th October 2014, one made roughly 10 % of which 7 % was on Friday, 10th October, 2014 alone. That does not look very pretty, does it?

2. I did an analysis of all the analyst recommendations on INFY in the last 3 months. It is not surprising to find that there were only buy recommendations. In many of the recommendations the upside projection is just 5 %. As the price starts moving up, the financial media starts getting excited. We then have a slew of buy calls, exhorting investors to join the momentum.

2. Just to remind readers, INFY was considered as ‘finished’ by the analyst community in the last quarter of 2012. Was it not an excellent long-term bet in December, 2012. The stock soared 17 % on 11th January, 2013 on the back of quarterly results. Were there any buy recommendations in the last quarter of 2012? The answer is, very few. In fact, I came across a research report with a sell recommendation, and that too in the Futures segment!! What happened to all those much publicized beliefs of investing when there is blood on the street, and for the long-term? Does equity research and analysis mean buying and selling with the momentum?

3. We have now travelled the full distance, in so far as analysts recommendations and price targets for INFY is concerned. From a stock which was written off, to one with only buy recommendations. Why is it that analyst recommendations and research have become an echo? Why do analysts and the financial media follow the price action in the market and not precede it? In what is, arguably, the most researched stock in the Indian stock universe, is it not surprising that not a single brokerage house gave a screaming buy call on INFY in December 2012? Why is there a herd mentality in equity research? The answers to these questions, in my opinion, can be summarized as follows:

-

We live in an environment where a stock is considered attractive, only if it is on the buy list of many large institutional investors. Unfortunately, due to their inherent limitations, analysts at most large outfits prefer to recommend a buy on stocks, which, in case they are wrong, the chances are that, the downside will be limited. Hence, it is safe to publish an analyst report on INFY with a target price which is reachable. This can be revised as events unfold, so it is the most convenient format.

- No one ever gets fired for recommending INFY. On the other hand, if one recommends any lesser known or unknown stock, and one is wrong, then the analyst has to feel the heat. The idea is to succeed, but at the same time one has to guard against looking stupid. Mediocre performance is acceptable, but diverse or negative performance is not. All this, measured on a quarterly basis. It is actually sad, that mediocrity in a quarter is not acceptable, when it can transform in to excellence in the longer term.

- In reality, all of us are investing in the market for windfall gains. Everybody claims to be a long-term investor, in reality nobody is. Effectively, the term ‘long term investing’ has become an oxymoron. The windfall gains in stocks are made by investing in unknown stocks, which unfortunately are outside the research universe.

- I do not find fault with the analysts, since, fund management is a difficult job. You can get fired for under performance, there is no job security. So it is a systemic fault. Being an analyst is a un-doable and thankless job. Why? The analyst has a brokerage house bias. I would love to hear analysis published by an independent firm, with no brokerage house bias. Unfortunately it does not exist. Effectively, the analyst has to balance both the sides, (a) the owner-broker who pays his salary and (b) the client who effectively enables the owner-broker to be able to afford his salary. He has to be consistent with his calls and flexible at the same time.

-

The analyst community, due to their inherent bias has become synonymous with the financial media. We, as investors, must understand that the financial media and the brokerage business go hand in hand. That is, as they say, the nature of the beast. Nothing suggests that this is about to change. The financial media is dedicated to a basic principle of marketing which is ‘When the ducks quack, feed them’.

As an investor, who now understands the nature of the game, what should one do:

1. Use the research as background information, i.e. use the factual part. Use it to find out about what the smart money thinks about a particular stock. The research reports do give an excellent feel about the business scenario, expansion plans and the sector prospects.

2. Understand clearly that the financial media has a job to do and they do it to the best of their ability. The whole financial media universe is set up to deceive investors. The best bet is to ignore the financial media en masse.

3. Actually, obsession with the financial media and their price targets, inadvertently, results in investors ignoring the earnings. Actually price is the least useful of all metrics which any investor should be tracking, if he is trying to make money by investing in stocks. He should be tracking earnings, instead of price. It is indeed a paradox that currently price is the only metric which is tracked 24×7.

Shareholder activism and INFY

What is shareholder activism? Shareholder activism is the way in which shareholders can assert their power as owners of the company to influence its behaviour. It has been successfully used, especially where companies have huge cash surpluses on their balance sheet. It is practically unheard of in India. However, in the U.S. markets it is popular, and has delivered surprisingly positive results. With the changes in the Indian Company Law that have been enacted recently, it is possible that there can be, in the future, a similar scenario in India. The fact that a group of shareholders are uncomfortable with INFY’s cash pile has been reported in the media in the recent past. Mohandas Pai, the former Chief financial officer of INFY is in the forefront of all such activities. Click here to read an interview he gave to the media, post the results and bonus announcements. It does appear, that the bonus issue has been thrown in to appease all such aspiring activist shareholders. This however, does not ensure that the dust has settled on the issue. A cursory reading of the interview reveals that the former CFO is very much in sync with the U.S. markets. INFY also now has an independent CEO & MD, Dr. Vishal Sikka, who is based in the U.S. With INFY now devoid of all the promoter shareholders in their top management, this issue can resurface in the future. For the layman investor (you and me), this, and not the bonus issue, is the only reason for initiating a buy on INFY, on meaningful declines.

Conclusion – Hate the Price not the Asset.

I have actually used INFY as a case study, to make the post more relevant for readers. I have no position, short or long in INFY, neither am I a shareholder. What I have said about INFY applies to every listed stock which is heavily researched and followed . So one can extrapolate it to other stocks as well. I wish to make it clear that this post should not be interpreted to mean that one should sell or go short on INFY. What I am trying to highlight is that, at the current market price, there is no point buying INFY just because every analyst has a buy recommendation on it. Nor is it worth buying just for enjoying the bonus. In case you are fortunate to be an existing shareholder, I suppose it makes sense to sit on it and do nothing. If you buy the correct stock at the wrong price and at the wrong time it is not going to do you any good. In other words, we, as investors, cannot get carried away with loving or hating sectors or stocks. In investing, it pays to hate the price, and not the asset.