(Cartoonist: Baloo-Rex-May; cartoonstock.com)(Sunday, 3 July 2016)

As part of the announcements made at the time of presentation of the Union Budget in February 2016, the Finance Minister announced a comprehensive investment strategy for India’s Public Sector Enterprises (PSE’s). The government has since followed up on this initiative.

Are India’s PSE’s a safe bet?

Before I get into the meat of things, I think it is necessary to clarify the following:

- While taking an investment decision, I have always been of the opinion that it is prudent to avoid businesses that are (a) run by the government or (b) are in any way dependent on government policy. The reason is simple; the government doesn’t always take decisions that have the best interest of shareholders at heart. For better or for worse, there is an element of welfare (social well-being) that is inbuilt in all the decisions that any government makes. By avoiding these two types of businesses, one tries to ensure that the government won’t come in the way of a smoothly functioning business enterprise that we wish to own. While investing in India’s PSE’s, this is clearly not true. In other words, while investing in PSE sector stocks, one needs to remember that the government is already entrenched and is likely to stay that way for the foreseeable future.

- On the flip side, a glance at the PSE sector companies shows that they are all behemoths running monopolistic businesses, are consistently dividend paying and decidedly non-global. Since the government is in the way, it does mean that their anachronistic business models will enjoy government protection (unless the government decides to shoot itself in the foot).

- Trying to balance these two factors leads me to the valuation of PSE stocks. It does seem to me that the government roadblock is already priced into the current valuation of PSE stocks. Take a look below:

- It is apparent that India’s PSE’s are trading at roughly two times their book value, at a multiple that is approximately sixty percent of the benchmark and a dividend to boot. Should cheap valuation alone be a consideration for buying India’s PSE’s? Not really. However, there are two additional factors in their favour; (a) PSE’s are almost immune to geopolitics and (b) unlike the Public Sector Banks (PSB’s) the FII (Foreign Institutional Investors) community does not treat PSE’s as untouchables. All in all, it makes for a sound investment thesis.

Government regulations as a trigger for investing in India’s PSE’s

A recent circular (dated 27 May 2016) issued by the Department of Investment and Public Asset Management (DIPAM), is titled Guidelines on Capital Structuring of Central Public Sector Enterprises (CPSE). It says that henceforth, the Central Government will adopt a comprehensive approach for efficient management of its investment in PSE’s. The central government has mandated that cash-rich Public Sector Enterprises (PSE’s) have to reward their shareholders (the government) in case they met certain criteria. In other words, it is a tacit acceptance of the fact the divestment process is a non-starter and that the government needs the money.

These are the four guidelines that have been mandated:

- Payment of Dividend: Every PSE would pay a minimum annual dividend of 30 percent of Profit After Tax (PAT) OR 5 percent of the net worth, whichever is higher (subject to the maximum dividend payable under the existing legal provisions)

- Issuance of Bonus Shares: In cases where the Reserves and Surplus are equal to or more than five times the paid-up equity share capital, the Board of Directors of the concerned PSE’s have been directed to deliberate the issuance of Bonus shares. In cases where the Reserves and Surplus are equal to or exceed ten times the paid-up equity capital, the Board of Directors of such PSE’s have no choice but to issue bonus shares.

- Buyback of shares: Every PSE that has a net worth of at least Rs. 2000 crore and cash and bank balance of over Rs. 1000 crore shall exercise the option to buy-back their shares.

- Splitting of shares: In cases of those PSE’s where the market price or book value of its shares exceed fifty times its face value, the PSE shall split the shares (provided the existing face value is more than one).

What I did was to try to identify stocks of Public Sector Enterprises (PSE’s) that satisfy the above criteria. The National Stock Exchange of India (NSE) disseminates a Nifty PSE Index that has twenty components. I have used these twenty PSE stocks as the basis for stock selection. While arriving at the names of eligible companies, the following riders need to be highlighted:

- Since accounts for March 2016 are yet to be published, all the calculations are based on the numbers for March 2015.

- To avoid overlap in the dates on which dividends are declared, only those dividend declarations that have been made between 01 April 2015 and 31st March 2016 have been considered.

In my opinion, from an investing standpoint, both of these factors will not make any material difference to the conclusion.

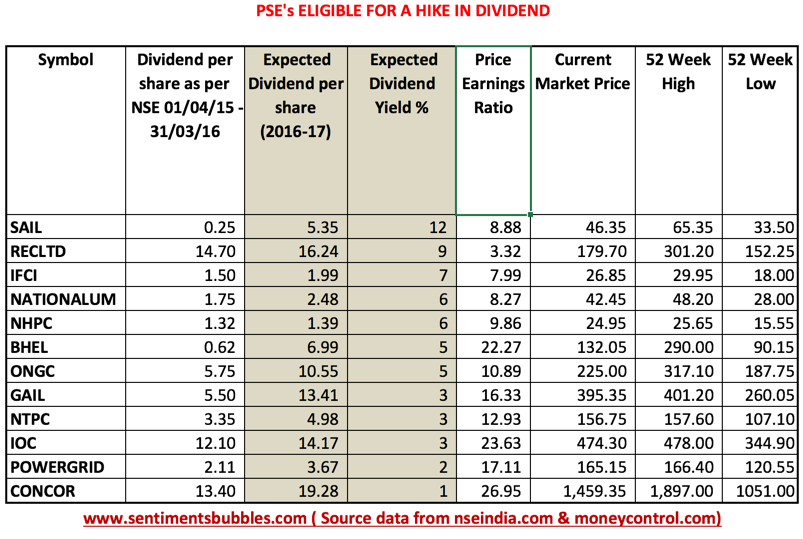

Payment of Dividend: The table below shows the list of PSE’s that are eligible for an increase in the dividend in the ongoing financial year. The shaded columns are derived guesstimates. The stocks are listed in descending order of their expected dividend yield. There is an easy way to read this. If you want to buy the most battered PSE stocks, start from the top of the table. If with you want to invest in those that are currently in favour, start from the bottom.

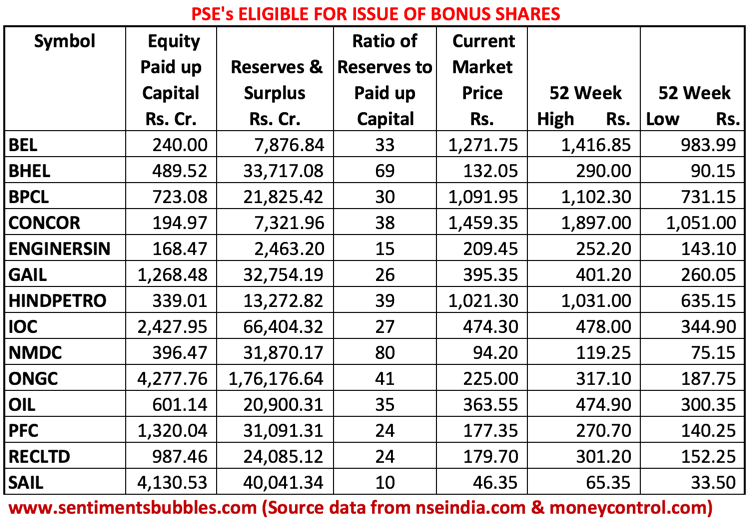

Issuance of Bonus Shares: Based on the guidelines, the list of stocks eligible for an issue of Bonus Shares is shown below:

The names are listed in alphabetic order. In the case of BPCL, the stock is currently trading on a Cum-Bonus basis. (Ratio is 1:1. & the ex-date is 13 July 2016).

I have not highlighted companies that are eligible for a stock split and those that qualify for a buy-back of shares (clauses 3 and 4 cited above). The reasons are (a) stock splits are not accretive and (b) buy-back of shares has a string of conditions attached, most of which are subjective in nature.

What about the rest of the PSE space – companies that are not highlighted in the tables below? There is an alternative way of investing in them. The NSE disseminates an index called the Nifty CPSE Index; it comprises of just ten PSE stocks. (The Nifty PSE Index consists of twenty stocks). In other words, the Nifty CPSE Index is a subset of the Nifty PSE Index. The main difference between the two is that the Nifty CPSE Index consists of dividend paying companies only. The Nifty CPSE Index is traded on the National Stock Exchange of India (NSE) in the form of an Exchange Traded Fund (ETF). The symbol is CPSEETF.

Brexit & Markets

The last couple of years has been dominated by the fears of a hard landing for the Chinese economy. Suddenly, nobody is interested in China anymore. What everyone wants is for Britain to manage a soft exit from the European Union. At the same time, the market is not interested in the ‘what if’ scenarios related to Brexit. Over the last fortnight, the Bulls behaved like they were not going to let a good crisis go waste. The ‘bad news is good news syndrome’ is back again and how! It does seem to me that Brexit is discounted and in all probability, Brexit related dips will be bought.

Jesse Livermore was a famous stock trader of yesteryear. A book aptly titled Jesse Livermore – World’s Greatest Stock Trader captures his life, times, and strategies. According to Jesse Livermore, “There is a time to go long. There is a time to go short. And there is a time to go fishing.” I think it’s time to buy India’s PSE’s.

Yashodhan

A very good article, and something I could comprehend in the first reading for a change 🙂

Yes, I am going fishing…

Regards

Shailesh

Ha,ha and thanks