In the current bull run, Small-Cap stocks have outperformed their Large-Cap counterparts. This feature is also known as the Small-Cap effect or the size effect. In this post, I have tried to (a) quantify the Small-Cap Premium in the Indian Stock Market and (b) find a way to ‘capture’ this Premium?

Small-Cap v/s Large-Cap Historical Returns

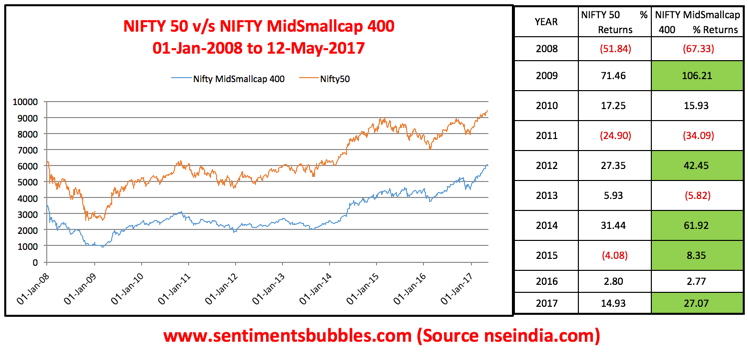

The image below shows the historical returns of the Small-Cap and the Large-Cap universe from 01 January 2008 till date:

I have relied on the classification used by the National Stock Exchange of India (NSE) for the definition of the words Small-Cap and Large-Cap. Hence, for comparison purposes, the Nifty 50 is used to represent the Large-Cap stocks, and the Nifty MidSmallcap 400 Index is used to represent Small-Cap stocks. From the image above, It is easy to draw the following conclusions:

- The yearly returns shown alongside the picture seem to suggest that the Mid and Small-Cap universe haven’t been runaway winners on a consistent basis.

- When markets turned bearish, investors were better off owning Large-Caps. In the current year, the Nifty MidSmallcap 400 Index is beating the Nifty 50 by a substantial margin.

- Over the entire period, an investor in the Nifty MidSmallcap 400 would have compounded his money at roughly 11 percent per annum. The comparable return for the Nifty 50 is 7.40 percent.

Nifty Small-Cap 50 Index

Among the broad market indices disseminated by the National Stock Exchange of India (NSE), the Nifty Small-Cap 50 Index is a subset of the Nifty MidSmallcap 400 index. The Nifty Small-Cap 50 Index is the best performing broad market index (since 08th November 2016), and it consists of just fifty stocks. Hence, for comparison purposes, I decided to use the Nifty Small-Cap 50 Index. Effectively, I am comparing (using market capitalization), the largest and the smallest stocks listed on the National Stock Exchange of India (NSE). Both the indices used for the comparison consist of fifty stocks each. What I have done is as follows:

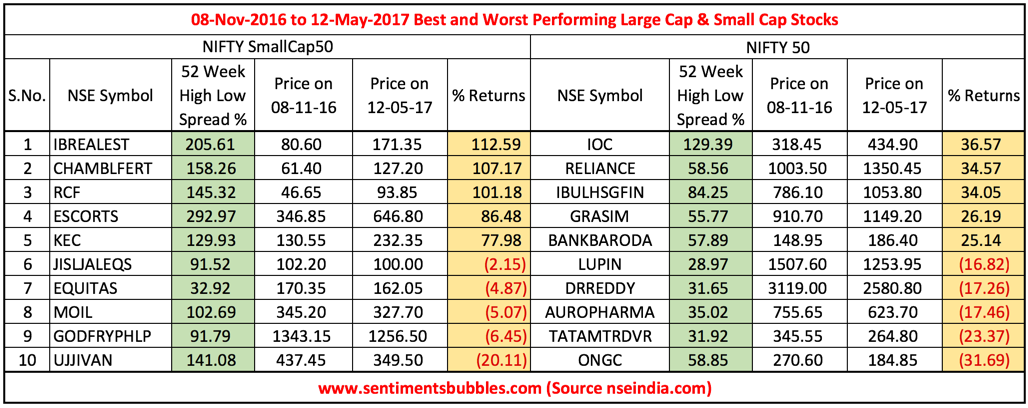

- I calculated the stock-wise returns for the components of both the indices for the period from 8 November 2016 (the date of the demonetization announcement), till date. The top five and bottom five stocks are shown in the table below:

- What I did next was to tabulate the 52-week highs and lows of the component stocks. In this way, I could calculate the spread between the 52 week high and 52 week low. To illustrate, in the case of IBREALEST, the 52 weeks high is Rs. 174.20 and the 52 week low is Rs. 57. The spread is calculated as 174.20 – 57 which equals Rs. 117.20. In percentage terms, the spread is 205.61 percent. Once I had calculated this for all the stocks, it was easy to summarize the results in a tabular form, as shown below:

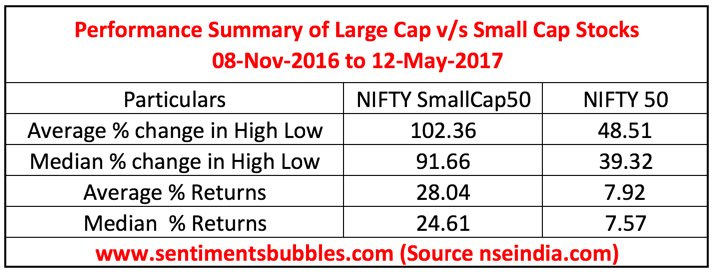

- In the image, the average returns and median returns from the components of both these indices is shown. The median spread percentage is shown as 91.66 percent in the case of the Small-Cap stocks and 39.32 percent in the case of the Large-Caps. The difference is substantial.

- I should hasten to add that the individual spreads look accentuated because the market has moved substantially higher in the last couple of months. The difference in the spread between the Small-Caps and the Large-Caps is what surprised me the most. If one were to regard the spread as an opportunity, the question that arose in my mind is: Is there a way in which this spread can be ‘captured’?

I found a research paper titled Size Matters, if you control your Junk. It is penned by Cliff Asness (& Others) of AQR Capital Management. In a nutshell what the researcher’s highlight is as follows:

- Size as a factor for investing decisions is as important as value or momentum.

- The quantum of the Small-Cap Premium and how to capture it is stated as the QMJ factor. The QMJ factor is defined as Quality-Minus-Junk. Quality stocks, strongly and significantly outperform junk stocks.

- Small-Cap stocks, it seems can be quite ‘junky’ as compared with their Large-Cap counterparts. Once these ‘junky’ components are removed, the Small-Cap Premium is, in fact, stronger and more stable.

- They conclude by saying that the Small-Cap Premium is non-existent if one were not to adjust for the quality factor.

A lot is written about how India is a ‘small-cap story.’ In my opinion, concluding that the Indian Stock Market is a haven for Small-Cap investing is wrong. The Small-Cap Premium is a global phenomenon. It is not unique to the Indian Stock Market. At the same time, the quality of any stock is always important; whether it is a Small-Cap or a Large-Cap doesn’t matter. The research seems to suggest that adjusting for quality, the Small-Cap Premium disappears; I think that is a very significant observation. To me, the Small-Cap Premium is a bit illusory since judging the quality of a stock is not for the faint of heart. How many of us can judge quality?

Conclusion

Many Small-Cap names have doubled in price in the recent past and are in the limelight. I think some amount of caution is warranted at the current prices of these stocks. The more popular the investing theme or market meme, the smaller will be its outperformance in the days to come. Small-Cap stocks are known to suffer from extended periods of underperformance. In other words, any investment in the Small-Cap Universe will test the resolve and conviction of the investor; that is par for the course. These caveats to Small-Cap Investing might be useful:

-

High-quality Small-Cap stocks are the ones that earn premium valuations. The word ‘quality’ is very subjective. Every individual investor will define quality in a different manner. Hence, I think that investing in Small-Cap names remains a risky proposition. Moreover, investors tolerance for risk has not been tested in the recent past. An investor’s tolerance for risk is not determined by how investors feel during periods of rising prices, but rather by how they feel during times of high volatility. Since the pain of a loss far exceeds the pleasure of a gain. It is far easier to be risk-seeking when asset prices are moving higher consistently than it is in times of plunging asset prices.

-

Many Small-Cap stocks are story stocks. The urge to chase story stocks is irresistible since all of us want to earn those storybook returns. The reality is a bit nuanced. The risk of pursuing a silly story and then getting wedded to one’s thesis cannot be understated.

- How does one know if a particular stock is a story stock? To identify a story stock, just look at the growth assumptions. Wrong assumptions lead to false expectations. Unrealistic expectations of expected growth and profitability are a sure sign that there is a false story tagged to the stock. The idea should be to invest in great businesses, not great stories, that’s what the gurus preach.

Focussing on size may produce premium returns. But identifying the high-quality Small-Cap stocks isn’t easy. When it comes to Small-Cap investing it would be apt to paraphrase Charlie Munger who has said that: ‘the best way to be smart is to not be stupid.’