(Cartoonist: Doug Pike; Cartoonstock.com)(Sunday, 10 April 2016)

Momentum investing or ‘Big Mo’ as it is popularly called, is the strategy of buying something that is going up and trying to sell it even higher. In reality, it is what most of us end up trying to do.

How to Trade Momentum?

Momentum investing is buying stocks that are appreciating relative to peers and selling those that are falling relative to peers in the broader market. The logic is that the winners will continue to outperform and the losers will continue to underperform, just as they have been doing in the recent past.

Since the presentation of the Union Budget, markets have been on a roll. The upward momentum is clearly visible. The question that came to my mind was: In which stocks is the momentum concentrated?

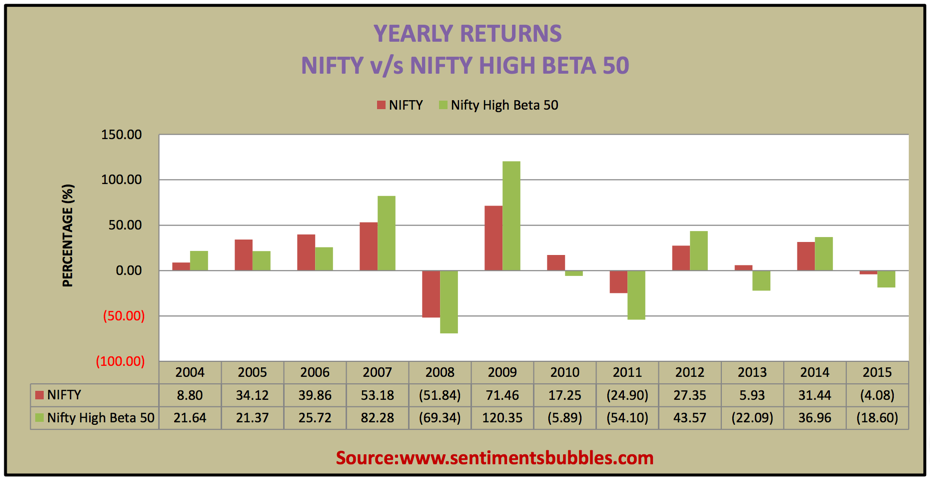

The National Stock Exchange of India disseminates an Index called the Nifty High Beta 50 Index. Beta is defined as the measure of the volatility of individual stock prices in comparison to the market as a whole. Stocks that have a beta exceeding one are considered to be more volatile than the market. Those that have a beta of less than one are deemed to be less volatile than the market. Stocks having a beta of exactly one ought to move in step with the market. The table below shows the yearly (not annualised) returns of the Nifty High Beta 50 Index and its comparison with the benchmark.

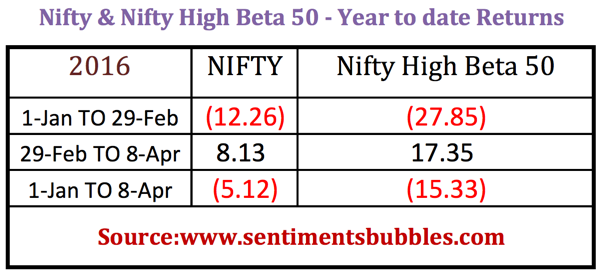

What about the current year? I broke up the period. This is how it looks:

From the data above, it is clear that:

- The Nifty High Beta 50 Index has outperformed the benchmark in the calendar years 2004, 2007, 2009, 2012 and 2014.

- The year to date return of the Nifty High Beta 50 Index lags that of the benchmark. However, post-budget, the Nifty High Beta 50 Index has simply taken off.

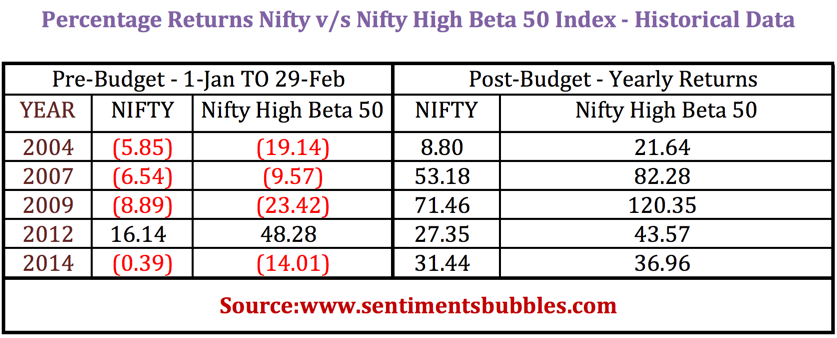

Will the post-budget outperformance of the Nifty High Beta 50 Index continue for the rest of 2016? To try to arrive at a calculated guess, this is what I did:

- For these five years, I broke up the period into pre-budget and post-budget segments.

- In four out of these five years, I found that the returns from the Nifty High Beta 50 Index were trailing those of the benchmark at the pre-budget mark. However, by the end of each of the five years, the Nifty High Beta 50 Index had smartly outperformed the benchmark. This is shown in the table below:

The degree of outperformance in four of the five years is quite astounding. Will 2016 follow the script? As usual, there are no easy answers. It would depend on flows by Foreign Institutional Investors (FII’s) and a host of other things. In other words, we just have to keep guessing!

A closer look at the Nifty High Beta 50 Index reveals that a broad-based resurgence is not visible. It is very stock specific, or as they say, the soldiers are not following the generals. Not as yet, at least. You can download the list of Nifty High Beta 50 stocks, their year to date returns, sectoral composition, and weight by clicking Nifty High Beta 50 Index Statistics.

As a student of the markets, the next question that came to my mind was: Is momentum the same as beta? The short answer is: No, it isn’t. The following needs to be clarified:

- Trading strategies have evolved with the markets. As a result, there are now multiple strategies. For eg., in the immediate instance, we have smart-beta, strategic-beta, alternative-beta, etc. There is a thin line that differentiates these three strategies. I don’t think retail investors need to bother with the differentiation.

- Momentum is in fact, the invisible component in any Beta strategy. Hence, it would be safe to conclude that momentum investing is an ‘Alternative Beta’ strategy. In any case, the Nifty High Beta 50 Index is the closest that we can get to ‘playing momentum’.

Momentum Investing – Caveats

As compared to other strategies momentum investing appears to be a pretty dumb strategy. How could one believe that prices ought to go up, just because they have been doing so in the recent past? Whatever may be our personal opinions about momentum investing, I hate to concede that momentum investing works. The caveats are:

1. Momentum investing does work, provided it is rule based. In other words, we must have rules for booking profits and for cutting losses. As a result, it is high on turnover and high on transaction costs. Ideally, the stop-loss percentage has to be smaller than the rate at which one books a profit. Else, momentum trading is a zero or a negative-sum game.

2. Momentum investing is frequently misunderstood. It is not a ‘long only’ strategy. When momentum investing strategies are used to trade just the upswing (as is done by most of us), it is risky. In the event of a downturn, momentum investing strategies have to be used for going short as well. Just trading one leg would not, in my opinion, a momentum strategy make. One has to trade both the legs to profit from the momentum.

3. Momentum investing will never get you into a beaten-down stock at the bottom, nor will it help you in exiting a hot stock at the top. It is a short-term strategy. There is no fixed period for measuring past winners and losers. Traders use a period ranging from the past three to twelve months for measuring momentum.

4. Momentum, per se, has nothing to do with the fundamentals of the company that is traded. Price is the only metric that is tracked. Other parameters like earnings, economic data, valuations don’t matter. In a way, the argument is that all of the other parameters have already been discounted in the price. As a result, one only needs to track the price. For the momentum trader, the fundamental truth is the demand and supply of the concerned stock. The price at which the stock is trading captures this demand-supply dynamic.

5. The primary reason that momentum investing works is because markets tend to trade consistently in any given direction for extended periods of time – far longer than investors can fathom. Momentum investing strategies take advantage of this inherent irrationality. We can never really tell when the momentum will stop or change direction. That’s why it is said that, momentum investing works, until it doesn’t.

Conclusion

An investor who invests by fundamentals or value is searching for mispricing. Once mispricing is evident, the value investor would normally trade in the opposite direction. In the case of momentum, one is trading in the direction of the mispricing. In other words, momentum investing tends to accentuate mispricing. The following merits consideration:

- When a mechanised approach is developed to identify and trade momentum, it ends up in what is popularly called ‘High-Frequency Trading (HFT)’ or ‘Algorithmic Trading (Algo)’. In other words, chasing performance to capture momentum in a systemic way, using computers and algorithms. These are the guys with the ‘pump and dump’ strategies.

- I was under the mistaken impression that Algo strategies are at a very nascent stage in the Indian Stock Market. It looks like I was wrong. Hottest Emerging Market for Algo Trades Wants to Cool as reported by Bloomberg is an eye opener.

- I have always thought of momentum investing as a game of musical chairs. One doesn’t know when the music will stop playing. In other words, trading momentum is neither simple nor easy.

- It seems that someone by the name of Richard Driehaus used the strategy of ‘buying high and selling even higher’ for running his funds. The trading heuristics that he practised have evolved into what is now popularly called momentum investing. I think it is best to conclude with his views. In the words of Richard Driehaus; “The stock market is like a woman, you observe her, you respond to her, and you respect her – that is not as easy as it sounds. Just ask my ex-wife.”

Article is surely interesting and never thought of such kind of strategy of “momentum investing”, earlier. As construction, metal, energy and even financial services sectors are the most dominating elements in this high beta index, the returns shown in the table are likely to be deceptive. Secondly investing in high beta stocks needs conviction, which a common investor seldom has.

The only rule in my view for intelligent investing is to apply your decisions on disclosed information, and reading the lines in between! … as the price runs on prediction!!

It looks deceptive because only a few stocks are moving with the upward momentum. One has to try and identify stocks where the momentum has started to build or try and short stocks where momentum has started to fade.

Very well said about “top down” investing – and the way the capitalism is going to go from here into future “Bottom up” Warren Buffet way may be for the history books

Thanks. Currently it does look like the Buffett style is on the wane. I hope it’s temporary, though.