(Cartoonist: Bacall, Aaron; cartoonstock.com)(Sunday, 9 October 2016)

The connotation of the term Alpha in the investing world has nothing to do with it being the first letter of the Greek alphabet.

What is Alpha?

Before talking about investing Alpha, a word about benchmarking. In the investing world, a benchmark is considered to be representative of the returns of the market. A benchmark is a barometer against which a fund’s performance is measured. It is supposed to be an investing lifeline. If a fund’s returns exceed those of its benchmark, it is referred to as outperformance or that it has generated Alpha.

For money managers, Alpha is their report card; a comparison of their performance and investment skills (over a fixed period, usually twelve calendar months) vis-a-vis their stated benchmark. In a way, Alpha denotes the value added by the money manager over and above the benchmark. As a result, money managers are continuously tracking the performance of their portfolios and that of the benchmark. The proliferation of online tools for tracking one’s portfolio has ensured that most retail investors end up benchmarking their portfolios (inadvertently or otherwise). Since Alpha is all about benchmarking, investors need to remember the following:

- The ‘active share’ of a portfolio is an indication of how different any given portfolio is, as compared to its benchmark. The higher the active share, the higher the probability of outperformance. In other words, the difference between a portfolio and its benchmark will help in predicting the Alpha of the concerned portfolio.

- It follows that, as an investing strategy, portfolios ought to be built around those companies that do not form part of the benchmark composition. As a corollary, before selecting a Mutual Fund Scheme to invest in, calculating the ‘active share’ of the scheme might be a good idea.

Nifty Alpha 50 Index

The National Stock Exchange of India (NSE) disseminates the Nifty Alpha 50 Index (Click here to read the factsheet). In a nutshell, the methodology adopted for inclusion of a stock in the Nifty Alpha 50 Index is as follows:

- NSE uses one-year trailing prices for calculating the Alpha of eligible securities.

- The top fifty securities with the highest Alpha’s form part of the Nifty Alpha 50 Index.

- A review of the Nifty Alpha 50 Index is conducted on a quarterly basis and changes made accordingly.

Interested readers may click here to read the methodology document.

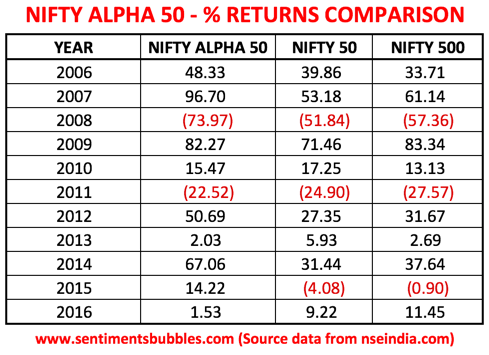

What I did was to compare the returns of the Nifty Alpha 50 Index with that of the benchmark and the Nifty 500 for the last ten years. This is shown below:

The table above is self-explanatory. I wish to highlight the following:

- What surprised me was the fact that the Nifty Alpha 50 Index has outperformed the benchmark indices in most years except the current year. Even after considering the fact that there are still three months left in the current year, the size of the ‘underperformance gap’ in the current year, is a bit surprising. I think it just goes to highlight the fact that nothing works all the time. The fact that the Nifty Alpha 50 is ‘not working’ in the current year (thus far), does not say anything about its future performance.

- A reading of the methodology document of the Nifty Alpha 50 Index, gives me the impression that the Nifty Alpha 50 Index is more of a ‘movers and shakers’ list of the Indian Stock Market. In that sense, it encourages a very short-term view. Some of you may like it that way, nothing wrong with that. If all investors were to change their perspective to the long-term, we wouldn’t have a market! In other words, for the short-term guys the Nifty Alpha 50 Index is the ‘go to’ source. What about the boring, old-fashioned, long-term guys?

- For the long-term guys who follow a buy and hold strategy, the idea is to be invested in fundamentally good businesses, reinvest dividends and then do nothing. The investing world has a name for this as well; it’s called ‘Dumb Alpha,’ no jokes! ‘Dumb Alpha’ sounds easy to implement, it is anything but. It requires a lot of patience and discipline to embrace a ‘Dumb Alpha’ strategy with the 24×7 news cycle being what it is. Dumb Alpha is the antithesis of our proclivity to trade and take advantage of every market move; however insignificant it may be.

Earnings Season and Alpha

We are on the threshold of another earnings season. Expectations v/s Actual is what earnings season is all about. In that sense, during the earnings season, Alpha can be maximised by betting against what the market expects. At such times, it doesn’t hurt to look at what’s been working thus far in 2016 and what’s not.

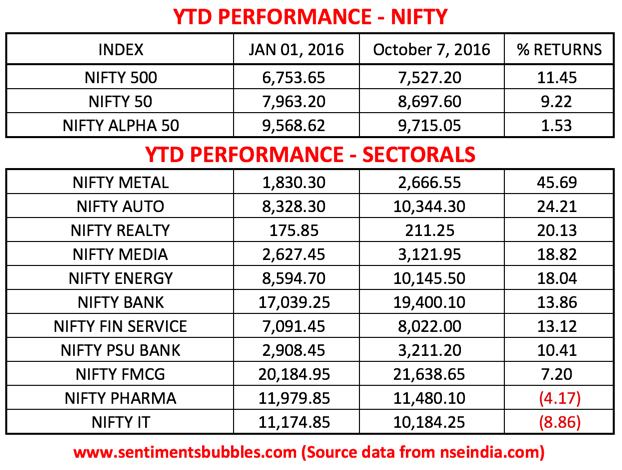

The image below shows the year-to-date performance of the benchmark indices, the Nifty Alpha 50 Index and the Sectoral Indices, from 1 January 2016 till date, in descending order of their performance.

My thoughts:

- During the Earnings Season, analysts take a call on the change in the trend in the earnings announcements and price discovery follows. Since everybody and their grandmother is ‘desperately seeking Alpha,’ trades tend to get crowded very fast, and reversals are sharp. It’s human nature to try to find an explanation for every market move. Many times what we consider to be a change in trend is a shift in sentiment. The point is, one has to be cautious while seeking Alpha during the earnings season.

- The fact that Emerging Markets (EM) are outperforming those of the Developed world is known. Market denizens have scant respect for economics (broadly) and for economies (narrowly). If investing is EM’s is going to generate excess returns (Alpha), that’s where they chose to invest. Clearly, investors who identified the change from DM to EM early in 2016 have generated Alpha in the current year. I have used the EM v/s DM argument as an analogy; the point is ‘Cycle Recognition’ is what generates Alpha, more than anything else. In my opinion, Cycle Recognition is the ‘mother of all Alpha’s.’ The Earnings Season can be put to good use for trying to identify cycles and changes in them.

Bull markets like the ongoing one, don’t serve as a test of investing prowess. ‘A rising tide lifts all boats,’ as they say. The real test is in bear markets when the idea is to be ‘down less’ than the benchmark. In other words, how does one’s portfolio hold up when things start going wrong is what generating Alpha is all about.

Conclusion – Buffett’s Alpha

There is a ton of research on ‘Buffett’s Alpha.’ Many do not consider him to be an investing god. Myriad opinions have been aired, ranging from the fact he is just plain lucky or is privy to inside information. Human nature being what it is, analysts and commentators have dug deep to find out what is Warren Buffett’s ‘secret sauce.’

In a research paper published in the year 2013 and titled ’Buffett’s Alpha‘ (click here to read), the researchers Andrea Frazzini, David Kabiller, and Lasse Heje Pedersen have posited on how Warren Buffett generates Alpha. According to them, Buffett’s strategy of buying low risk, cheap and high-quality stocks tends to perform well over the long-term.

Warren Buffett seldom responds to any of the research that is published on his methods. He sticks to his one-liners instead. I think he is very modest when he says: “Ben Graham taught me 45 years ago that in investing it is not necessary to do extraordinary things to get extraordinary results”.

Nice article again…giving different perspective!

However I am of the opinion that the more we go deep into the waters; more we get suffocating! Better to make your own comfort…..strategy of investing. Like Buffet, everybody should design his/her own Alpha; which may give him/ her desired results for sure.

Ha ha, we are already neck deep and always afraid that we might get submerged!! We have been trying to generate Alpha looking at the screen for the last so many years. Time to look for a better strategy!

Ignoring the Alphas, Betas of investing, I would say, for a non active investor ( here active is the one who spends more time in looking at Companies & their performances, and not who is active in the market) to buy low risk, cheap & high quality stock is an extraordinary thing to do.(मराठीमधे हे म्हणजे आखुडशींगी,बहुदुधी गाय शोधल्यासारखं आहे)

In fact, it is, that’s why I think that Buffett is modest. Does being very active – does it improve one’s chances of stock selection? I wonder!