(Sketch Credit: Carl Richards – Reproduced under a Creative Commons License)

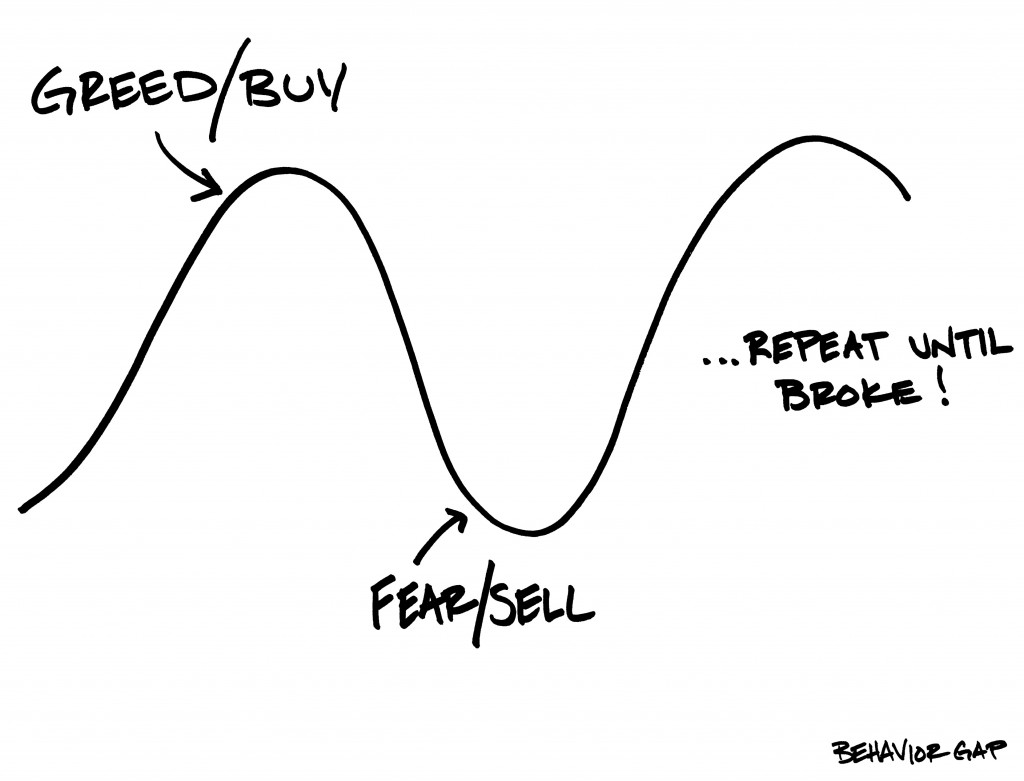

Gold is making headline news. Unfortunately for the wrong reasons. The recent fall in the price of Gold presented an opportunity to highlight a couple of behavioural biases which are inherent in all of us. In markets, they say that the four most dangerous words are ‘this time it’s different’. In reality, it’s different every time. However, human behaviour remains the same at all times.

Greed, Fear & Gold

Fear and Greed are twin evils. They are perennial in our financial lives. Financial decisions made by us are more often than not, driven by one of these two behavioural biases. The fact that they exist is known. It is easy to write and talk about them, but very difficult to rein them in.

As can be seen in the image above, Gold hasn’t crashed with a thud. The continuous and slow motion downward drift has taken more than three years. The spiral in Gold prices had investors, inadvertently participating in commodity speculation with a religious fervour. The Gold fiasco is an anecdotal study of the Greed and Fear syndrome. All of us succumb to it at some point in time. Consider the following:

1. The media played the biggest role in ‘selling’ Gold as an investment thesis. After the yellow metal first shot up, I remember the media bandwagon advising Gold as an investment option. What is significant is that the media barrage started after Gold had shot up, not before. Every possible publication in the print and television media was encouraging all and sundry about having ‘some gold’ in their portfolio. Unfortunately, investors bought Gold for the wrong reasons. All of us succumbed to the following four behavioural biases:

- The confirmation bias, defined as ‘the tendency to search for, interpret, favour, and recall information in a way that confirms one’s beliefs or hypotheses’. Investors were convinced that hyperinflation was round the corner. Gold was ‘sold’ as a hedge against inflation. Investors had a choice, buy Gold or face financial Armageddon. The ‘media effect’ ensured that investors chose Gold.

- The hindsight bias defined as ‘the inclination, after an event has occurred, to see the event as having been predictable, despite there having been little or no objective basis for predicting it’. It seems that investors knew all along that Gold would go up. When they saw it move, they expected more of the same. There was an obvious temptation to switch to what had worked in the recent past. This, more often than not, is not the right thing to do. As a result, those who did not buy Gold until the year 2011 rushed to buy it subsequently. It worked, but only up to a point. Investors did end up switching horses midway, abandoning other asset classes in favour of Gold.

- Herd mentality described as ‘how people are influenced by their peers to adopt certain behaviours, follow trends, and purchase items’. Trying to keep up with the herd is tantamount to financial hara-kiri. Gold mania ensured that investors were gripped with FOMO – the ‘Fear Of Missing Out’. Not wanting to miss out on what the herd was doing, ensured that everyone was ‘trying to keep up with the Joneses’.

(Sketch Credit: Carl Richards – Reproduced under a Creative Commons License)

-

Overconfidence effect is a situation where ‘a person’s subjective confidence in his or her judgments is reliably greater than the objective accuracy of those judgments, especially when confidence is relatively high’. Psychological studies show that men are more confident than women in financial matters. Is it a coincidence that, for a change, it was the male fraternity that fell in love with Gold and was leading the ‘bull’ charge on the yellow metal? Overconfident investors earn lower returns; that is a given.

(Sketch Credit: Carl Richards – Reproduced under a Creative Commons License)

Is Gold an investment or is it an ‘Act of Faith’?

Should an investor buy Gold at the currently depressed price? My point is that it doesn’t matter. To me, Gold doesn’t form part of an investment portfolio. Own it if you will, but don’t confuse yourself into thinking that you are investing. I think that buying Gold is an ‘Act of Faith’ and not an investment for the following reasons:

1. The definition of faith is given as: “Faith is the substance of things hoped for, the evidence of things not seen”. Surely such acts of faith cannot be confused with an investment thesis. The fact that an investment in Gold is faith-based is given credence by the fact that any discussions on the topic arouses extreme passions, positive and negative. You don’t see this when talking about stocks.

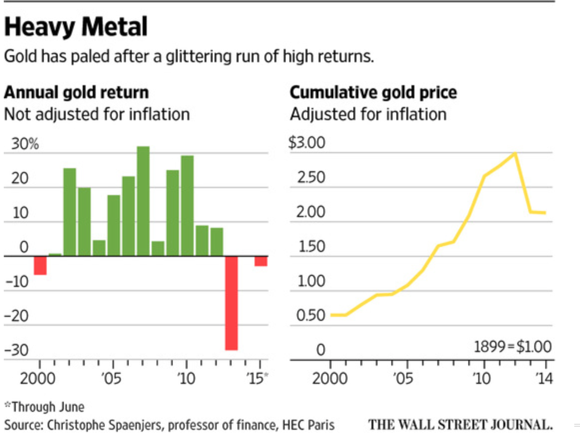

2. An investment is something that will either appreciate in future or will provide income. Gold as an asset doesn’t exactly fit the definition. The simple reason is that Gold is not procreative. If one owns an X quantity of Gold in the year 2000, one would still end up holding the same quantity today – no dividends, no return on investment apart from expected capital appreciation adjusted for inflation. The image below shows that historically Gold as an investment has delivered sub-par returns.

3. The only basis for the ascent of Gold was distrust of paper currencies and central bankers. Gold as an investment option means subscribing to extreme pessimism about everything remotely connected with the economy. Historically, such pessimism has always resulted in investors incurring an enormous cost in terms of missed opportunities. Hence, it is not worth the gamble. It may yet turn out to be a hedge against inflation – some day. If and when that happens, it will be a Pyrrhic victory for Gold bugs, there is no doubt about that.

4. For the sake of argument, if one were to accept the investment thesis for Gold as an asset class. How much should you own? In other words, how much Gold would qualify as the ‘required’ or ‘must have’ quantity in a diversified portfolio? In India, this act of faith disguised as an investment has assumed gigantic proportions. Indian marriages manifest themselves as cultural ‘Gold exchanges’. The bride, whether or not she remains married to her husband, remains eternally married to her Gold. As a result, every Indian equity investor does possess some quantity of Gold. In fact, most investors already own more than the optimum quantity. For those of who you don’t, anything more than two percent of one’s portfolio would, in my opinion be an act of faith, a leap in the dark. Don’t confuse it with any investment thesis that someone might sell to you.

Will Gold and commodities continue to melt?

The drop in Gold prices has been accompanied by a decline in prices for all commodities. Unfortunately, that does not tell you anything, least of all when this decline will end. This ‘fear and greed’ syndrome in the yellow metal does have the following important takeaways for equity investors:

-

Historically, investors buy Gold when the future is uncertain or when they are fearful. With the drop in Gold prices, it does look like the ‘investor fear index’ has dropped. Currently, investors are not super excited about the stock market. At the same time, they don’t seem to be afraid of investing in stocks either.

-

In markets, there is a metaphor which says that stocks are ‘sold, not bought’. In the current context, the media is now trying to ‘sell’ the commodity correction as ‘manna from heaven’ for the Indian economy. The media are projecting that commodity prices will remain ‘lower for longer’. The implied meaning is that stocks that stand to benefit as a result of the decline in commodity prices are a ‘must have’ in one’s portfolio. Indian companies do stand to benefit from lower commodity prices; this is true. However, most of the positives are already priced into the current valuations of such stocks. How long will commodity prices continue to decline is unknown. Saying that commodity prices will be ‘lower for longer’ means nothing from an investment standpoint. Hence, buying stocks whose fortunes are linked to a further decline in commodity prices is fraught with risk.

-

Unfortunately, investors seem to be biting the bait. Many stocks that stand to benefit as a result of the decline in commodity prices have doubled in the past forty-five days, even though the benchmark indices have remained firmly sideways. There is a drop in the investor fear index for owning such stocks. This does not mean that one should go short or run away from investing in the stock market. It does mean that investors should be very stock selective and very cautious. It does lend credence to the ‘do nothing’ trade.

-

Am I just being overly analytical and succumbing to my confirmation bias or will ‘greed and fear’ lead stock prices lower? Will investors again succumb to their hindsight bias? Will investors again display herd mentality by rushing to buy stocks that benefit from lower commodity prices? Or will it be different this time? Only time will tell.

Excellent ! Gold

Thanks

Dear Yashodhan:

Your article on ” gold ” is golden, an excellent one. Yes – it is a matter of faith – Children, grand-children and may be, great-grandchildren later, of individuals who have bequeathed their bought-out gold to their heirs, will cherish this heritage gift and feel grateful (posthumously !!!) – Speculation on gold is sheer madness, its shine remains ” golden ” for ever.

Thank you, Sir, I am glad you found time to read my post.

In our Indian context, Gold is an alternative investment. Middle class people work hard all their life and save through the banking system. Unfortunately, the Rupee constantly keeps getting depreciated and the purchasing power of the savings of a pensioner becomes much lower than it should be. Regular Gold buying in small quantities during the working life of a person does take the form of an alternative investment. You may however call it capital preservation in dollar terms.

Very true since the INR never appreciates. That is a fact. Also, we now have an import duty. Buying for keeps may make sense as long as the Rupee continues to depreciate. Unfortunately, most people who have bought or are still buying are not ‘forever’ investors.

Though no one can predict how high or low gold prices may go, can you offer some insight on the production cost of gold ? It may offer some clue as to at what price investors may think of buying, if at all, for whatever reason they would like to.

Difficult question, the media says that the cost is somewhere near the current market price. But then the media keeps changing their opinion. The cost will mean nothing since today many countries are selling oil below their cost price.

Yashodhan

Yes, I agree with Ashutosh. I too look forward to your thoughtful insights.

Keep the articles coming!

Shailesh

Thanks

As rightly pointed out by you, gold can never become an investment option. This asset is having surprisingly high scale of emotional attachment and ever considered for sell as last resort. Like any other metal, gold in my view will continue to come down till Rs. 20,000 and may not see its shining price above Rs. 32,000 in near future.

Government has also initiated efforts to disassociate gold from common-man through the gold monetization schemes, bonds etc, which in my patriotic view utmost necessary step for our fuel and gold importing country. Their effective and practical implementation may be the key to keep our foreign reserves intact. We should discourage our near and dear from purchasing gold ornaments and/ or engaging in avoidable schemes like Suvarna bhishi.

True. The price in India is artificially propped up due to the import duty. Secondly, the INR parity does act as a cushion.

Excellent article and written at the right time. Many people are planning to jump on the gold bandwagon now that prices are lower. Hopefully they might see reason after reading this. It’s a delight to read your articles and I actually look forward to Monday mornings to read the next well researched and insightful article. Keep up the good work!

Thanks a lot.

GOLD WISDOM: Here are some important info on Gold, I learned over the years:

1.Gold is unlike any other asset on earth. You DO NOT buy gold to get rich – you buy gold BECAUSE you are rich. You do not ask what is the return on your gold investment- it is like going to Rolls Royce showroom and ask what is the gas milage on this car? If you have to ask, you cannot afford that car. For some people and at some point in everybody’s life point of preservation of principal becomes more important than return on your principal. As an investment Warren Buffet never owns ANY gold.

2.Gold is ultimate money and has been from the dawn of civilization. Does gold has any intrinsic value? Not any different than say copper, cement, paper, or any other commodity. It is always what is somebody is willing to pay for it. Does a original Rembrandt worth $120 million than a cheap Chinese lithograph? It is like ultimately, “something is beautiful, how beautiful ? Is like stocks- is gold in a bubble? Value of gold is in the bubble for the last 5000 years and very well the bubble will last for the next 10,000 years.

3. Gold is a generational pass down asset- it has been always expensive-As they say- “Real estate is good to inherit, but not good to buy.” Because the benefit comes way after you die. Like planting a tree fruits come after decades. No gold ever dug out of the ground, has been found thrown in the garbage, in other words, every ounce of gold which was dug out from mother earth, is accounted for or recycled and used. For the most of the people your entire life’s assets could be liquidated into few small gold bricks and carried away anywhere you want. (Of course then there is the cost of storage, security, etc.)

4.Gold is the only asset which has been very successfully passed down the generations. It is an extraordinary metal. Does not rust, does not react with any other compound (No wonder they call it “as something as good as gold.”) no termite eat it.Fire does not destroy it. It is shiny, easy to work with and you can wear and even flaunt it – show you are rich. Supply of gold and demand and human population have so far gone hand in hand. Except for the last few years gold manipulation of price by Fed Banks, throughout the history once bought gold has never been sold below the paper price of printed money by any sovereign country at a future date.

5.Now return on your investment – history of capitalism is very short considering 280,000 years of human history. As everybody knows- a single dollar invested @ 6 % compound interest -mathematically grows in to trillions of dollars in just 200 years. Has anybody ever gotten that return? Even the stalworth food companies (since everybody needs to eat) have barely given dividends over the last 100 years. Several years ago, companies such as Disney, introduced 100 years 6% bonds. These were snapped up like hot cakes- bottom line such a long term stable return has never happened in human history. Preservation of capital alone has always been important to human beings.

6.I have gone deep underneath the Johnsborough gold mines in South Africa over 1 mile deep in mother earth’s belly- seen horrible conditions- and I tell you human beings need to stop this gold digging madness. I have a rare collection of “historic gold Mohurs,” they have gone up in value, but am I ever gonna sell them? No. Investment, where you are never going materialize the return- and return in what? Buy gold only as a gift to your grand children or great great grandchildren or whatever when it is cheap- probably so..…..

7.Former Fed Chief: Allen Geenspan was a gold bug. His famous indicator was P* . essentially, his theory was gold is an ultimate commodity, and when the price of that commodity is stable- essentially everything falls in place and is “fine” in the world of printed money. He asks a very poignant question: If gold has no intrinsic value- then why do all the central banks store thousands of tons of it ? Especially – US which holds 8000 tons of gold.

Thank you, Sir, very informative. I didn’t know any of this. I suppose Gold is bought for keeps. Like you have said, it is not bought with the intention of selling. Warren Buffett, who buys stocks ‘forever’ does end up selling stocks if he sees better opportunities. Like you have correctly pointed out Gold is a ‘generational pass down’ asset.