(Source: www.shutterstock.com/cartoonresource)

It seems to be a foregone conclusion that the U.S. Federal Reserve will raise the Fed Funds Rate at its next meeting. The question is what happens after that?

Fed Funds Rate – Historical Narrative

I think that a Fed Funds Rate hike is positive for Emerging Markets and Indian equities in particular. To understand my reasoning, one has to see how things have evolved since the advent of Quantitative Easing (QE). I have constructed the narrative into three parts. Very briefly:

1. Part I: Circa 2011. The flow of QE dollars resulted in many companies in the Emerging Markets (EM) space borrowing in dollars at low rates of interest. These funds were invested in projects in their home countries. This resulted in:

- QE dollars being used by commodity producing businesses in EM’s. Many a times leveraging was used to maximise expected profits from the utilization of QE funds. The extent of leveraging is unknown. The result: a commodity glut and a heavily leveraged corporate debt structure in EM’s.

- Central bankers from EM countries were worried that the flood of QE dollars would inflate/strengthen their currencies. It would result in a loss of competitive strength for their exports. Hence, central bankers in EM economies resorted to ‘competitive devaluation’ of their respective currencies. The result: an inevitable currency war.

2. Part II of the narrative is the taper tantrum. The Federal Reserve announced in May 2013 that they will be winding down their QE program. Currencies again took a battering for entirely different reasons.

3. Part III is the end game wherein the Federal Reserve starts increasing the Fed Funds Rate. QE resulted in an inflow of dollars. The logical corollary would be that a hike in the Fed Funds Rate ought to lead to an outflow of dollars from EM’s. It is expected to exacerbate problems in fragile EM economies. The fears are:

- The estimated flow of QE dollars into EM economies is to the tune of $ 7 trillion. It is an estimated figure. Nobody knows what the actual numbers look like, they could be more or less. Hence, the size of the debt pile in the EM world is

toughimpossible to estimate. The fear is that actual figures will be much higher than estimates. -

There is a supply overhang with all commodity producers which depresses commodity prices. This commodity overhang has resulted in a debt overhang. The expectation is that it will take years to recover from this duopoly. Hence, the future outlook for EM’s is hazy.

Why is a Fed Funds Rate hike bullish?

Why would a Fed Funds Rate hike be bullish in such a scenario? The reasons are:

1. Warren Buffett has famously said ‘it’s only when the tide goes out do you know who’s been swimming naked’. Effectively, money managers are waiting for the tide to go out. When that happens, they know who is naked. Once that happens, the gap between perceptions and reality narrows to an ‘investable’ level. Markets inevitably tend to recover in such scenarios. Markets will only know ‘who’s been swimming naked’ after the Fed Fund Rate rate hike, not before it. Hence, the Fed Funds Rate hike ought to be positive and will lead to greater clarity from an investing perspective.

2. Within the EM’s there is the concept of BRIC investing. (BRIC is the abbreviation for the four countries; Brazil, Russia, China and India. South Africa was added later on to make it BRICS). On November 08 2015, Goldman Sachs, the international firm quietly stepped away from the BRIC concept. Click here to read. It was Jim O’Neill, the chief economist at Goldman who devised the concept of BRIC investing. The fact that Goldman decided to dump the idea does mean the following:

- It is a tacit acceptance of the fact that China is not an Emerging Market (EM). It is the second most powerful economic force in the world (after the U.S.A). Surely, it can’t still be ’emerging’. I wonder why it took so long for the guys at Goldman to realise this?

- There is no synergy between Brazil, Russia and India. Brazil and Russia are commodity exporters. India is an importer; we don’t manufacture anything that the world deems as worth buying! Rupee parity is a lame excuse; everyone knows that.

- Effectively, Goldman is accepting that the whole idea of packaging four countries was not one of the best ways to invest. As a result, they smashed the BRIC concept.

Once clarity on the Fed Funds Rate emerges, money managers would start thinking of individual countries on a standalone basis, not as BRIC’s. In such a scenario, among EM economies, Indian equities score high on the valuation risk parameter. However, the political risk of investing in Indian equities is the lowest. I think that in the overall hierarchy of risk parameters used for global investing, perceptions of political risk would have more weight as compared to valuation risk. Hence, Indian equities ought to get preference in global asset allocations in a rising Fed Funds Rate and ‘post-BRIC’ scenario.

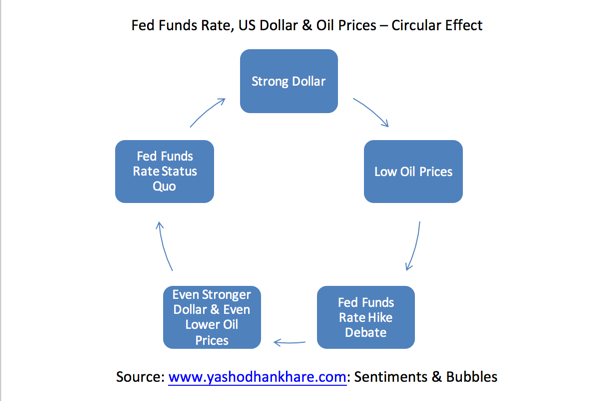

3. There is a circular logic at work in the markets. The competitive devaluation by Central Bankers all over the world has resulted in a strong dollar index. Hence, the starting point is a strong dollar. The circular logic looks something like this:

The circuitous effect, something like a dog chasing its tail, shown above, would be arrested once the Fed Funds Rate hike is behind us. EM’s have been living under the spectre of renewed dollar strength on Fed policy action. The Fed Funds Rate hike would provide clarity and reduce uncertainty.

Is Dollar Strength on a Fed Funds Rate hike a given?

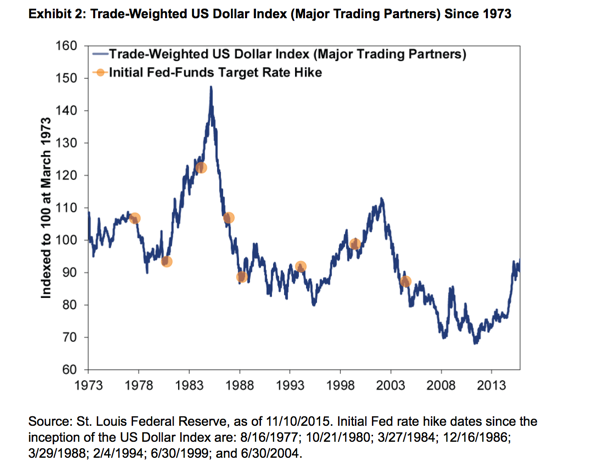

Does a Fed Funds Rate rise always lead to a stronger dollar? The image below shows the historical behaviour of the dollar index on past hikes in the Fed Funds Rate. Take a look:

The U S ‘trade-weighted’ dollar index shown above uses a much larger range of currencies. Under this, currencies of Singapore, Taiwan and Indonesia are used to monitor dollar trading. From the image the following surmises can easily be made:

-

Eight data points are visible. Of these, dollar strengthening as an offshoot of past hikes in the Fed Funds Rate has occurred on four occasions, exactly fifty percent of the time.

- There doesn’t seem to be a perfect correlation between dollar strength and a hike in the Fed Funds Rate. The market is assuming that two are, in fact, perfectly correlated.

Markets move ahead of policy not after announcements. The dollar index has already appreciated by over 10 percent in the current year. The markets have been preparing for a rise in the Fed Funds Rate by pushing the dollar higher. As on date, ‘bullish dollar’ is a very crowded trade. Expecting renewed dollar strength on an actual rate rise is a tad optimistic.

Disclaimers, Caveats, etc.

After a nine-year ‘interest rate hike hiatus’, there shouldn’t have been the need for any of the members of the U.S. Federal Reserve to ‘make the case’ for a rate rise. If things were normal, Fed Funds Rate hikes should have happened without the need for any debate. Clearly, things are pretty abnormal. Hence, I think it is critical to highlight the following:

-

A Fed Funds Rate rise will not address the fact that the indices that measure global productivity are not showing encouraging trends. Oil prices continue to show a downward drift. Also, a Fed Funds Rate hike will accentuate monetary policy divergence within the developed world. While making investment decisions in such a scenario, we need to be very modest about what we know and don’t know about financial markets.

- The question of how markets react in a rising Fed Funds Rate scenario is uppermost in the minds of most of us. I am not in the prediction business. As such, all of the above should not be misconstrued as a prediction. At best it is a calculated guess. Markets are and will always remain unpredictable.

- The Fed Funds Rate futures are used to express the market’s views on the likelihood of changes in U.S. monetary policy. In the past, Fed Fund futures have provided the most accurate predictions of U.S. monetary policy.

-

As on date, Fed Fund futures show the probability of a rate rise as 79 percent. It does mean that there is a 21 percent chance of status quo. What happens if there is status quo? That would be a major surprise. Plenty of volatility always accompanies market reactions to surprises. To paraphrase a famous Yogi-ism, market reactions to policy shocks would be ‘like déjà vu all over again.’