If there is one thing about markets which is certain it is the uncertainty of price discovery especially when we are on the threshold of a make or break event in India. I do not remember a single election in history where so much was at stake for the Indian business community as in this one. Bull markets like the current one generally climb the ‘wall of worry’. Markets generally discount all known phenomena and what we all know is already priced in, so watch for surprises. The general tendency is that we cannot observe the situation in advance or if we do we are just not paying attention. I do not want to sound bullish or bearish but over the years markets always spring surprises and there could be plenty of those in store for all of us. To the best of my knowledge retail positions in the F&O segment are thin and as far the cash segment is concerned scepticism is pretty high, most investors are under invested or not at all invested in stocks but there is a very high element of hope. There is almost unanimity on the fact that change is imminent and if it results in the NDA coming to power AND Narendra Modi becoming the Prime Minister expectations will hit the roof. In short there is only one solution and that is to expect the unexpected on both the seat allocation and the market reaction to the same.

SECTORAL INDEX COMPARISON

There is a lot of debate about which sector is likely to outperform in the event of an NDA government and a look at the past data shows that in the year 2009 all the sectoral indices were in the green and the best performing ones can be seen below. (The data for 2014 is till 09 May 2014.)

| SECTORAL INDICES COMPARISON | ||||||

| Sectoral Indices | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| CNX AUTO | 186.06 | 32.42 | -19.53 | 43.93 | 8.53 | 13.58 |

| CNX BANK | 76.48 | 29.40 | -32.79 | 56.02 | -10.03 | 20.77 |

| CNX ENERGY | 58.13 | 3.55 | -28.74 | 12.65 | 0.36 | 10.07 |

| CNX FINANCE | 84.60 | 29.16 | -29.31 | 51.85 | -8.35 | 17.66 |

| CNX FMCG | 41.00 | 29.01 | 8.41 | 50.19 | 11.57 | 3.42 |

| CNX IT | 155.18 | 27.46 | -18.06 | -3.10 | 57.76 | -4.38 |

| CNX MEDIA | 75.24 | 3.76 | -33.22 | 59.38 | 0.44 | -3.37 |

| CNX METAL | 210.15 | -1.73 | -48.66 | 16.24 | -15.97 | 3.01 |

| CNX PHARMA | 58.34 | 35.46 | -10.42 | 32.13 | 26.06 | 4.46 |

| CNX PSU BANK | 69.95 | 32.52 | -41.89 | 40.24 | -32.01 | 19.24 |

| CNX REALTY | 59.88 | -25.76 | -51.70 | 53.63 | -36.22 | -3.52 |

It is clear that the CNX FMCG sector has always given positive returns in the last five years and remains the best defensive sector to invest in, click on the index to get the top 10 constituents by their weight age.

STOCKS V/S BONDS

The last 90 days the only trigger in the Indian Markets has been the outcome of the General Elections and once the exit polls are out what will be left are the actual results. All the punters will then be back to looking at Europe, then the U.S. and wake up and look at the Asian markets. There is no such thing as “decoupling” and since the Indian market is driven by FII flows it makes a lot of senses to see what is happening in the U.S. The vicious correction from May 2013 to August 2013 in Indian stock markets was driven by FII selling in the Indian Debt market. (Which also resulted in the Rupee weakness). At the beginning of the calendar year 2014 the expectation was that the bond yield in the U.S. would go up and there would be a rotation from bonds into equities which would result in lower bond prices and higher equity prices. What has happened thus far is exactly the opposite, Bond prices have gone up, yields have gone down and stocks are sideways (with a negative bias since the dotcoms and the so-called growth stocks have been massacred). The chart below shows stocks and bonds both moving higher.

The explanation being offered are

(a) There is a flight to safety due to the Ukraine crisis,

(b) People have been caught short in the bond market and

(c) There is a shortage of supply since the Fed is not issuing or has reduced further debt issuance thus buyers of the longest term treasuries are facing a potential shortage of supply

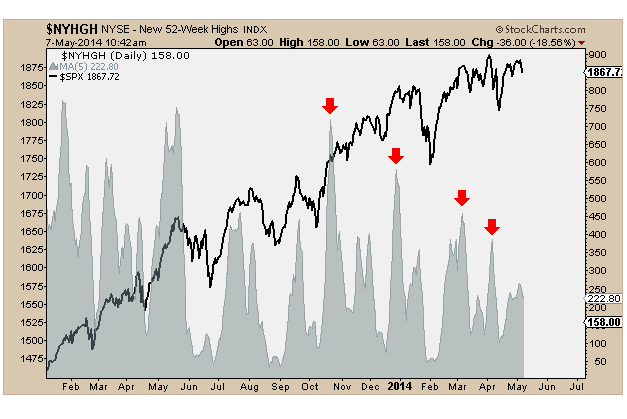

(In the stock market there is an explanation for everything but i wonder why they could not have figured it out in January itself !!!) In my humble opinion it is more to do with the fact that if Portugal can raise debt at 3 % and Greece at a shade under 5 % (both bankrupt nations) then the U.S. yields at around 2.5 % are still high and have room to go down further. Incidentally German debt yields 1.5 %. In any case this is something which has to be continuously watched since it gives a good indication of the direction of the equity markets and of the Indian Rupee, historically speaking when the equity and bond market give confusing signals the bond market is generally right. Over the next couple of months one of the groups is bound to be proved wrong. What does all this mean for the Indian stock market, quite simply the rotation from stocks into equity in the U.S. will continue to play out but the money will get diverted to Emerging market equities (since U.S. equities are already richly valued) and India will receive its share of the same. Hence the Fed taper which has been widely publicized will have little or no effect on Indian equities and the currency. This may have already started to play out and the U.S. markets are displaying what in technical terms is called a ‘negative divergence’ which means that the list of NYSE 52 week highs as compared to the S&P is falling whereas the indices are making new highs. This is something which cannot be ignored and when you read that the U.S. markets are closing at an all time high what is not stated is that the actual breadth of the market has been deteriorating. It is worthwhile doing a similar study for the Indian markets in the coming months as Indian markets try to reach for the stratosphere. The chart below shows the phenomenon graphically for the U.S. markets.

INTERESTING LINKS

FII REACTION TO THE INDONESIAN POLL RESULTS

THE AVERAGE STOCK IS IN A BEAR MARKET (U.S.)

It is the hard fact of life that lately our markets have sustained and grown only because of the foreign funds. As you rightly said in your article, if anything adverse happens around the globe, Indian indices may tank for sure. Domestically, as I see in the economy the things are not turning up. Power shortage in industries, water shortage, reduction in sales particularly in auto sector, engineering and realty sector, no sound policy for agriculture, probable Bank licence to Indian Post and shocking increase in NPAs of banks tend to frighten us for sure! If rupee goes strong as expected, it will also add oil in the fire. All this is giving us an indication that NIFTY may be around 5,500 to 5,800 by December-January, irrespective of whoever comes to power! Believe me, pharma stocks and FMCG may be the only bets one should stick to near future. Also investor should be over careful on banking stocks.