Efficient Market Hypothesis

Before we start with the Efficient Market Hypothesis, we need to understand a couple of concepts. Even though you may know of these very elementary concepts they bear repeating since these concepts have to be ‘seared in’. In other words, they are extremely important.

Benjamin Graham on Mr. Market

Benjamin Graham is considered to be the father of Value Investing. In his books, he always emphasised that a change in the price of a stock does not equate to a change in the value of the underlying business. Yet, in the stock market we find that value does not drive prices, but that, in fact, prices drive value. Graham attributed this behaviour to the fact that most of us allow Mr. Market to get the better of our decision-making process.

To summarise, Mr. Market:

- Is emotional, euphoric, moody

- Is often irrational

- Offer transactions that are strictly at your option

- Is there to serve you, not to guide you.

- Is in the short run a voting machine. In the long run, the market a weighing machine.

- Will offer you a chance to buy low, and sell high.

- Is frequently efficient…but not always. The level of efficiency of Mr Market is increasing with each passing day.

This behaviour of Mr Market allows the investor to wait until Mr Market is in a ‘pessimistic mood’ and offer a low sale price. The investor has the option to buy at that price. Therefore patience is such an important virtue when dealing with Mr Market.

Difference between Investment and Speculation

“All investment is, is laying out some money now to get more money back in the future. Now, there’s two ways of looking at the getting the money back. One is from what the asset itself will produce. That’s investment. One is from what somebody else will pay you for it later on, irrespective of what the asset produces, and I call that speculation. So, if you are looking to the asset itself, you don’t care about the quote because the asset is going to produce the money for you.” –Warren Buffett

To be clear, there is nothing wrong with speculation. Just don’t fool yourself that you’re investing when your actions and psyche clearly show that what you are doing is speculating. Speculation is not a bad word, but when you speculate, the rules of the game are different than when you invest. Please don’t confuse the two. In the words of Benjamin Graham: ‘An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.’

What is Benchmarking?

In the investing world, like in our life we benchmark to some standard that is used as means of measurement. Benchmarking is the process of comparing ones performance to that of the industry in which one operates. A benchmark is the standard by which everyone is measured.

The excess return of the fund relative to the return of the benchmark index is a fund’s alpha. Simply stated, alpha represents the value that a portfolio manager adds to or subtracts from a fund’s return. Investors’ alpha is the value a retail investor adds to or subtracts from the alpha delivered by the portfolio manager. The return of the respective index is considered to be zero alpha, so any excess over the index is considered positive investor alpha.

Behaviour Gap

In the investing business, benchmarking takes the form of comparing our returns with that of the benchmark which is the Nifty 50 or the Sensex as the case may be. Lets just assume that we benchmark our returns to that of the the Nifty 50. In a particular calendar year if the returns from the Nifty 50 are 10 percent and we earn 8 percent, we have underperformed our benchmark. If instead our returns are 12 percent we have outperformed our benchmark. This outperformance is called Alpha. In reality, most of us end up underperforming our stated benchmark because of our behaviour. And this gap is known as the Behaviour Gap. In other words, the Behaviour Gap is the difference between Investor returns and Investment returns.

Why should there be a gap between the investor returns and the investment returns?

Since we want to generate Alpha, we are continuously trying to optimise our investment process and we keep searching for the investment that will give us the highest returns; it may be a stock, a commodity like gold or a hard asset like land. We are all searching for the best possible investment. Hence, we read magazines, research reports and various other sources to find the investment that will give returns that are better than average. What actually happens when we search for an investment? We find one, then we meet someone who tells us that he has a better idea so we sell what we have bought and buy the new idea. And this behaviour gets repeated several times over our investing lifetime. What if, the investment that we sold turns out to be superior to the one that we replaced it with? It affects our overall returns. As a result, we end up doing worse than the average investment.

Another reason why there is likely to be a gap between investment returns and investor returns is because of fees. Since the returns from an investment before fees are higher than those after fees, there is a gap. As a result, investor returns tend to be below the investment returns and this Gap is called the Behaviour Gap.

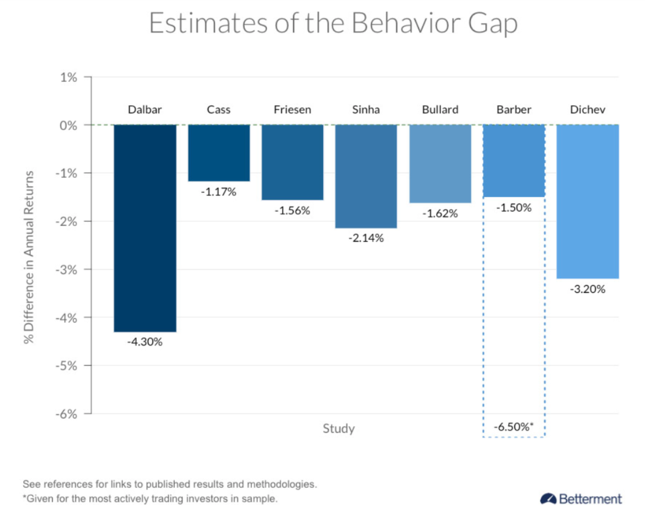

A lot of research has been done to try and quantify the Behaviour Gap as an actual number or percentage. Various studies have estimated the Behaviour Gap and the results vary as shown in the image above. However, the fact that the Behaviour Gap exists is undeniable.

To summarise as investors we want to:

- Buy Low and Sell High or vice versa

- Reduce the Behaviour Gap

- Generate Behavioural Alpha

What is Market Capitalisation?

The market capitalisation of a business is the total value of what that business is worth as on a particular date. It is derived by multiplying the number of shares issued with the current market price. There is a distinction between ‘free float’ and ‘full’ market capitalisation, but its not important for the time being. If Reliance is trading at Rs. 1100 and the market capitalisation is 700,000 crores it means that the entire business of Reliance Industries can be bought outright for Rs. 700,000 crores. In other words, if one of you were to pay this amount you will be the new owner of Reliance. The question is – is this the fair value for the business? Since stock prices are so important, it follows that the information that they convey must be accurate. To summarise:

- Stock prices are important since they convey a lot of information. Moreover, market capitalisation which is derived from stock prices represents ownership stakes in the businesses.

- It follows that prices at which these securities or stocks trade should fully reflect all available information about the business that they represent.

- The question is: are stock prices lying and if they are how often are they lying? To illustrate, when Maruti was quoting at Rs. 9600 in January 2018, can we say that it was an accurate price? Or is the price of Maruti, which was quoting at Rs. 6600 in November 2018, the correct price? Is Maruti undervalued, overvalued or fairly valued? Why should the value of a business fluctuate so wildly in a matter of 10 months when there has been no change in the business fundamentals. In other words, are the prices that we stare at accurate, or are they lying. What changed from February 2018 to October 2018 that the price corrected so severely? Then reality is that the only thing that changed during the intervening 10 months is the sentiment on the stock; it turned over from extremely bullish to mildly bearish.

George Soros & The Theory of Reflexivity

George Soros is a very famous and successful hedge fund manager and he propounded the Theory of Reflexivity.

What is the Efficient Market Hypothesis?

The primary role of the capital market is to allocate ownership of an economy’s capital. Once the capital generated is properly allocated to different assets, the stock exchange platform provides liquidity to these assets. An ideal market is one in which entrepreneurs can take capital allocation decisions and investors can choose among the securities present for allocation of capital.

In 1970 Eugene Fama published the paper that is today known as the Efficient Market Hypothesis. What is a hypothesis?

A hypothesis is defined as an assumption made in order to test its logical or empirical consequences. The only way to test a Hypothesis is to look for all the information that disagrees with it.

The Efficient Market Hypothesis, or EMH, is an investment theory whereby share prices reflect all information and consistent alpha generation is impossible. According to the EMH, stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalued stocks or sell stocks for inflated prices. To simplify:

- Fama defined a market to be informationally efficient if the stock prices at each moment incorporate all available information about future values.

- The informational efficiency flows from the competitive nature of the markets. This part has become very true today, where the cost of obtaining the information is basically zero. In other words, since information is disseminated in real-time and is mostly free, information per se does not confer an ‘edge’.

- When Fama said that prices are informationally efficient what he meant was that at any given point in time, prices reflect available information. It follows that since the information keeps changing, markets are and will forever be unpredictable.

- According to Fama, trading rules, technical analysis, market newsletters and all the available tools have essentially no power beyond that of luck in forecasting stock prices.

In the real world, markets are not efficient ALL the time and neither are they inefficient at ALL times. The reality is somewhere between these two extreme points. As a student of the market we need to be aware of the following:

- We need to think of market efficiency in pieces. To start with: why do we need the markets to be efficient? The whole idea behind investing in the stock market is to generate a return that exceeds our stated benchmark. By definition when we buy or sell a stock, we are selling to someone or buying from someone. Our overconfidence bias ensures that we always assume that the person on the ‘other side of the trade’ is wrong and we are right. Since the stock market is a zero-sum game, one of the parties to any trade is right and the other one is wrong. When we trade, the implied meaning is that in our opinion, the current price is an inefficient one and that we can generate a positive return by trading at the current market price. Assuming that we are correct in our analysis, we need the market to correct the inefficient price; only then can we generate ‘Alpha’. If the market were to stay inefficient forever, we cannot generate excess returns. Hence, market efficiency is a necessary and desirable outcome. Fortunately for us, the market does tend to be efficient over the long-term. If that were not to be the case, no one will ever generate excess returns.

- The Efficient Market Hypothesis is more of a concept than a law. We have to understand that each piece or part of the concept is an approximation. There are so many moving parts in the ‘market equation’ that nothing can be defined in an ‘exact’ manner. It is safe to say that the markets are not efficient ALL the time. At the same time, when we trade, the default assumption we must make is that the price at which we intend to trade is an ‘efficient’ one. Having done that, we must then ‘work backwards’ to disprove our default assumption. Needless to say, humility is a necessary condition when we trade markets. We must be open minded and prepared to accept that we may be wrong and that the market may be right. The point is that ‘staying wrong is far worse than being wrong.’

- An important point that merits consideration is that the Efficient Market Hypothesis does not talk of valuation. Nowhere does Fama posit that such an efficient market price is a rational price. Fama only stresses the fact that at any given point in time, (a) the market has all the available information and (b) this information is fully reflected in security prices.

- The words ‘all available information’ are critical to understanding the definition of an efficient market. Information can be further classified as public and non-public information. Subsequently, one has to consider how material the information is from a price discovery point of view. In other words, there is a large amount of ambiguity in the definition that Fama has posited.

- The second part of the definition says that, all such information has to be fully reflected in security prices. Again, we have to arrive at some consensus on what is meant by the words, ‘fully reflected’. As a working rule, we can look for the following three conditions to be satisfied. These are: (a) information must be disseminated to a sufficient number of investors; (b) the information must be processed by a sufficient number of investors and (c) the information so disseminated must be incorporated into the market price by a sufficient number of investors.

- To understand the term ‘sufficient number of investors’ we need to understand the concept of the ‘Wisdom of the Crowds’ and when this wisdom manifests itself into the ‘Madness of the Crowds’.

The above discussion, wouldn’t be complete unless a reference is made to a paper titled On the Impossibility of Informationally Efficient Markets by Sanford J. Grossman and Joseph E. Stiglitz published in 1980. They posit that, by definition, markets cannot be informationally efficient at all times. In a nutshell what their paper says is as follows:

- If one were to assume that there is no room for price arbitrage of any kind, a competitive economy will always be in equilibrium. And we know that this is not true.

- They accept that prices do reflect the information of informed individuals, but only partially. As a result, those individuals who have expended efforts to obtain information do receive compensation.

- How informative the pricing is will depend upon how many number of individuals are informed. These informed individuals then act upon the information and the resultant volatility results in a flow of information from the ‘informed individuals’ to the ‘uninformed individuals’. Since this ‘flow’ is not perfect, an equilibrium cannot exist.

- A related point is that we are reluctant to share private information or we tend to share it in an incomplete manner. Sharing of information in an incomplete manner may be intentional or it may be unintentional. As a result, the aggregation of information is inherently inefficient.

- If all individuals were to be equally informed, there would be no trade since the perceived benefits of entering into a trade would not be worth the cost. We know that this is not the case. Once information has been disseminated, or for that matter has become publicly available, the interpretation of the information differs widely. The reason is that individuals ‘weight’ information according to their ‘belief system’. Eventually, price discovery is a function of the ‘beliefs’ of the participants. Since beliefs differ widely, price volatility is a given and markets cannot be considered as ‘informationally efficient’ in such circumstances.

- What the paper clarifies is that they are not trying to destroy the Efficient Market Hypothesis, but are attempting to redefine it. The caveat is that when information is very precise, the prices will tend to be efficient. At the same time such markets are likely to be ‘thin’.

Criticisms of EMH

The active stock pickers who criticise the efficient market hypothesis argue that

- The active stock pickers argue that the market only reflects the irrational investor desires. This they argue is done very efficiently by the markets.

- The active managers effectively believe that investor biases lead to mispricing. The biases lead to the wrong price earning multiples. This results in stocks quoting too high or too low. So good and bad news is extrapolated in an irrational manner with the result that the price earning ratios get skewed. These biases also result in abnormal price variations on both good and bad news.

- Burton G Malkiel in his seminal book A Random Walk Down Wall Street – The Time-Tested Strategy for Successful Investing has famously written: A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one selected by experts. The phenomenal popularity of the book ensured that the ‘dart-throwing chimpanzee’ became famous in the investing world. Many in the investing world argued that Malkiel may have given too little credit to monkeys!

- The best definition of market inefficiency is offered by Seth Klarman who says that: “Markets are inefficient because of human nature – innate, deep-rooted, and permanent. People do not consciously choose to invest according to their emotions-they simply cannot help it”. He says that market efficiency is an academic theory and is unlikely to bear any resemblance to the real world of investing.

- Price is a liar.

How has EMH evolved?

What the Efficient Market Hypothesis did was to bring a scientific method to the study of financial markets. It is because of the Efficient Market Hypothesis that a lot research then began to be done about the manner in which price discovery takes place in the stock market. And today there is a ton of research on the anomalies in investing process and how we can take advantage of them. There is a lot of confusion about what Fama said and he has been criticised by those who haven’t understood exactly what he was saying. As a result, the Efficient Market Hypothesis has continued to evolve and as on date there is a consensus on the following:

- Stock prices are unpredictable and there is no accurate way in which we can predict the future course which prices will take. In other words, stock prices are random in nature and there is no reason to believe that this will change in the near future. Basically, that is what Fama was saying.

- Over the long-term, stock prices are efficient but in the short-term, they are not. Hence, the frequent crashes that we see in the stock market all get resolved over the long-term. That is what Benjamin Graham meant when he said that ‘over the short-term, a stock market is a voting machine (it ranks stocks according to those which are currently popular and unpopular). But over the long-term, it is a weighing machine (the market assesses the business of the company)’.

- The legendary Ben Graham was asked this question about Wall Street professionals: Are Wall Street professionals accurate in their forecasts of stock market trends? If the answer is no then why is it so? The answer he gave was: ‘Our studies indicate that you have your choice between tossing a coin and taking the consensus of expert opinion, the result is just about the same in each case. The reason for this is that everybody in Wall Street is so smart that their brilliance offsets each other, and whatever they know is reflected in the stock prices. What happens in the future is what they don’t know.’This it seems is proof that he was, in fact, saying what Eugene Fama said many years later.

- As on date, there is a consensus about one thing and that is: (a) Markets are efficient most of the time, but not all the time and (b) Over the short-term, markets are inefficient but over the long-term, they get it right. And to clarify further, the short-term would be anything up to to 12 months and the long-term would be any period exceeding 12 months.

Chaos Theory

Investopedia defines Chaos Theory as: ‘a mathematical concept that explains that it is possible to get random results from normal equations. The main precept behind this theory is the underlying notion of small occurrences significantly affecting the outcomes of seemingly unrelated events. Chaos theory is also referred to as “non-linear dynamics.’

Chaos theory has been applied to many different things, from predicting weather patterns to the stock market. Simply put, chaos theory is an attempt to see and understand the underlying order of complex systems that may appear to be without order at first glance. In 1972 that American meteorologist Edward Lorenz wrote a paper titled Predictability: Does the Flap of a Butterfly’s Wings in Brazil Set Off a Tornado in Texas?. It inspired the ‘Chaos Theory’, also known as the ‘Butterfly Effect’. How The Arab Spring Started is a comparatively recent event that illustrates the Chaos Theory. This four-minute YouTube video explains the Chaos Theory:

The Stock Market as a Complex Adaptive System

Michael Mauboussin is a prolific writer of several books and research papers. Using the vast amount of work that he has done, we are able to understand the features of any Complex Adaptive System. Almost everything that appears herein below is attributed to wisdom gained from the work of Michael Mauboussin.

What is a Complex Adaptive System?

A canonical example of a complex adaptive system is an ant colony. Each individual ant has a decision role. Am I foraging? Am I doing midden work? Each one also interacts with the other ants and almost all of that is local interaction. The net outcome from all the interaction of all the ants is the ant colony. If you want to understand an ant colony at the colony level, one has to forget about individual ants. As soon as we start looking at an ant colony as a colony, it seems to have the characteristics of an organism. Its robust and adaptive. It has a life cycle. The individual ant is working with local information and the interaction is local. In such a situation, you wouldn’t interview one of the ants to understand the ant colony. In other words, you cannot understand an ant colony by looking at the behaviour of individual ants.

The inability to understand the system based on its components prompted Philip Anderson, a physicist and Nobel Prize winner, to draft the essay, “More Is Different.” Anderson wrote, “The behavior of large and complex aggregates of elementary particles, it turns out, is not to be understood in terms of the simple extrapolation of the properties of a few particles. Instead, at each level of complexity entirely new properties appear.”

Similarly, in the stock market asking an individual or so-called expert his or her opinion about the market is useless. It is imperative to understand that investment experts aren’t better of than ants. These so-called experts, come with their own perceptions and biases. If you want to understand the market, look at the market itself. That is the essence of a Complex Adaptive System. Despite the fact that it is well documented that expert predictions are quite poor, we listen to them knowing fully well that these so-called experts are predicting something that’s fundamentally impossible to predict. The experts who come across as more authoritative or more talkative tend to be more believable. However, we tend to forget that being talkative and being accurate are not correlated.

Complex Adaptive Systems disguise cause and effect; no single person knows what is going on with any degree of certainty. In such a system, any attempt made at bringing about a change in the system can have disastrous consequences, since the cause and effect is not linear; it is totally random and unpredictable. Once we see something happening in a complex adaptive system, our mind is going to create a narrative to try and explain what’s happened. The reality is that when a system like ours (human) which is predicated on seeking cause and effect, meets a Complex Adaptive System (stock market) that effectively conceals cause and effect, accidents are bound to happen.

What are the characteristics of a Complex Adaptive System?

Any Complex Adaptive System has four parts and these four parts are consistent across domains. The four parts are:

- First, there has to be a group of heterogenous agents. These agents may be neurons in our brain, bees in a hive, investors in a market, or people in a city. Heterogeneity means that each agent has different and evolving decision rules that both reflect the environment and also attempt to anticipate change in it. These different agents are not complex by themselves. Also, there has to be an aggregation of these heterogenous agents.

- Secondly, there are adaptive decision rules which means that participants combine information from the environment with their own interaction with the environment, in such a way that each of the participants derives independent decision rules.

- Thirdly, these agents interact with one another, and their interactions create structure that scientists often call ’emergence’. The feedback loop mechanism works in such a way that the output of one iteration becomes the input of the next iteration. As a result, feedback loops may amplify or dampen the overall effects.

- Fourthly, the structure that emerges behaves like a higher level system and has properties and characteristics that are distinct from those of the underlying agents themselves. In other words, the aggregate is not equal to the sum of the parts. As such, there is an inherent non-linearity in any Complex Adaptive System.

It is easy to conclude that the Stock Market is a Complex Adaptive System since it shows all four of the above characteristics. To illustrate, there is aggregation of the orders from different investors; investors styles and time horizons vary; the feedback loops like imitations are very much active and lastly distributions are fat-tailed, which means that there is non-linearity. Hence, we can characterise the Stock Market as a Complex Adaptive System.

How should we deal with a Complex Adaptive System like the Stock Market?

To understand how we should deal with a Complex Adaptive System, we first need to understand the concept of ‘Reductionism’. Reductionism is the idea that we could understand the world that we live in, by understanding the smaller pieces of it. These smaller pieces when assembled, would explain the whole. Reductionism can be used to understand any system that has low complexity and wherein we can define interactions in a linear manner. Since the Stock Market is a complex adaptive system, ‘Reductionism’ as a system does not work in the Stock Market.

To be able to deal with a complex system like the stock market in an efficient manner, we need to embrace two characteristics. First, you must be able to create a ‘simulation’ in your head allowing you to conceive and select strategies. Secondly, you must populate your mental system with information from diverse sources.