How many times have we heard that markets slip on weak earnings? We are already into what is popularly called the earnings season. It is mandatory for Corporate India to report their earnings every quarter. The results, as reported, do bring about a fair bit of volatility in the prices of the respective stocks. How the prices eventually move is more a function of earnings expectations before they are announced. The media run a poll of ‘expectations’. You then have an analysis whether the company ended up beating expectations. Another feature is the ‘guidance’ which is announced by the management. Many a time, stocks remain subdued on earnings announcements and move drastically after the conference call which many companies routinely conduct. In financial markets, what matters is not whether things are good or bad, but whether things are getting better or worse. This explains most of the price action that follows earnings announcements. In short the reaction to the news matters, not the news itself.

5 THINGS TO KNOW ABOUT THE EARNINGS SEASON

- It is better to rely on factors over which we have a control and ignore the price movements pursuant to earnings announcements. It must be remembered that the announcements are only of quarterly numbers. One of the important things to look at is the base effect i.e what are we comparing with. Everything is relative to something else. We have global cues, local issues, weather, peer group comparison, top line, bottom line and all kinds of mumbo-jumbo which is indecipherable to the average investor. Generally, analysts look for the rate of growth. What investors must concentrate on is the direction of earnings. Earnings do not predict the stock market, it is the trend of the earnings that matters more than the magnitude of growth. Markets are forward-looking and historical earnings generally have only a temporary effect on prices and valuations.

- Since markets are forward-looking and have scant respect for historical data, there is a lot of importance attached to the guidance and forecasts that companies provide along with their quarterly numbers. The price that a stock trades for is a reflection of future expectations and trends. Hence, we find that despite the company reporting excellent numbers, there is a decline in the price and vice versa. In most cases, major company announcements and projects will reflect in their earnings after a period of 12 to 18 months. The price, however, does get factored in much before that.

- In reality, guidance is just an attempt at forecasting. In today’s scenario, it has become routine to forecast weak earnings and then outperform. When expectations are lower than reported earnings, there is out-performance and positive surprises. In effect, companies are incentivized to set expectations as low as possible, raising the chances that they can be beaten. They set the bar low, so to say. So you routinely have software stocks beating expectations. The IT bellwether is a past master at this, read here to find out how.

- Stocks in the software sector are the most volatile pursuant to earnings season. Why? Most of the software stocks are professional run outfits where the promoter / major stake holder hires people to run the company. In such cases the compensation packages for the top management are structured on the basis of Employee Stock Options (ESOPS) and similar sounding products (Restricted Stock Units – RSU’s) which are made available to them. Since this is so blatantly done, how can you expect top management to be careless about their stock price? In fact, they are not, with the result that they inadvertently end up trying to play the market through their post earnings announcements and prognostications. Since the bellwether stock has set a precedence of guidance, all companies in this sector think that they too have to. The software sector, as a whole, is forever in a forecasting mood. I think promoters of software companies fancy themselves as soothsayers. They think that it is their obligation to give forecasts and guidance. I have noticed that earnings announcements and price volatility is dominant in announcements made by software companies. In every quarter, there is at least one software stock whose stock price has a roller coaster ride.

- There is a tendency to place too much importance on quarterly earnings announcements. One has to be wary of companies like SATYAMCOMP where EBITDA was jocularly called Earnings Before I Tricked the Dumb Auditor and not for Earnings Before Interest, Taxes, Depreciation and Amortization. Again it is the software sector where these kind of cookbooks are a frequent occurrence.

EARNINGS & MEDIA

- The role of the media in the Earnings season cannot be understated. The fact remains that earnings estimates and the relative out/under performance are all media driven explanations after the price action and rarely before the price has moved. The fact remains, that the price of a stock does move considerably in the aftermath of this under / over performance metric. Among the multiple media houses which forecast earnings estimates there is seldom any disparity worth noticing. In other words, they all echo each others earnings estimates. I find that very often investors base their decisions on what they see and hear on the television. In fact, many a time the media tom toms the same events once with a bullish undertone and then with a bearish undertone. How do they do this? Simply put the interpretation of the event is altered to fit the price action as it happens in the market. The problem is that most investors need good advice and not advice that sounds good. The media only peddles advice that sounds good and investors lap it up since it fits in with what they wanted to hear in the first place. In short, investors should not be relying on the financial media for advice at all. At best, the media can only act as a data distribution mechanism and should be treated as one.

- The financial media is the only vertical in the media business which is presumed to have some reporting responsibility. If you look at sports, Bollywood, fashion, art or any other vocation the media is not taken as seriously as it is in the financials vertical. Why this is so I have no idea, it seems to be a world-wide phenomenon. When people listen to the financial media they seem to be inclined to take the next step of acting on the what they hear. This cannot be blamed on the media, they are just doing their job (which is to increase TRP rating). Investors should keep this in mind the next time they tune in to any financial media channels and even more so during the earnings season.

CONCLUSION

In a heavily researched market, the earning announcements do affect near term price trends considerably. In fact, in many cases, they affect the next quarter i.e. till the next earnings announcements. These periods, generally, throw up the best opportunities for picking good companies when they get hammered on the basis of a bad quarter. The effect of 24×7 reporting influences mass sentiment and breeds a herd mentality. The media tend to sensationalize the most trivial of issues. This results in investors staying optimistic or pessimistic for longer periods of time than they normally would. We live in a world with excessive data where investors are being continuously ‘forward guided’ . There is a tendency to ignore what matters and concentrate on inconsequential things during the earnings season which the media keeps tom tomming incessantly. I would strongly advise readers to watch the video here before reading any further.

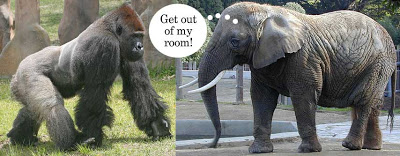

The video shows a selective attention test where it was found that roughly half the people failed to see the gorilla. It is also called ‘The Invisible Gorilla’ test. It shows the failure to see an event because all our conscious mental attention is diverted to something else. The case highlights the risk of overpaying attention to something else thereby ignoring what is obvious. It points to the striking similarities between minds and markets. Should the earnings season and attendant media obsession be treated as the ‘invisible gorilla’ in the market? Are we treating it as the Elephant in the room instead?

[jetpack_subscription_form]