(Cartoonist: Harley Schwadron;Cartoonstock.com)

Has the media been scaring investors into thinking that we are in a deflationary spiral and that deflation spells disaster? Should we factor this while taking investing decisions?

Deflation v/s Disinflation

There is a fair bit of confusion on the terms ‘disinflation’ and ‘deflation’. Deflation is a sustained fall in prices, just as inflation is a sustained increase in prices. We are all used to inflation. Disinflation is a period of falling inflation. Most of the world was facing disinflation till the third quarter of 2014. Then suddenly oil prices collapsed. The media started swinging the deflation theme. As happens so often, once the media starts swinging, most all of us swing with the media.

Deflation: The new definition

The Bank for International Settlements (BIS) has on 18th March 2015 released a report titled ‘The costs of deflations: a historical perspective’. Click here to read the report in full. The BIS operates like a Central Bankers Bank and also as a think tank. The report claims to have tested the historical link between output growth and deflation. The sample size covers 140 years across 38 economies. In the normal course, I would have expected the BIS report cited to follow the script and echo the consensus view, that D stands for Deflation and Disaster. However, the BIS research cited above is subversive. The following are the important takeaways from the survey:

-

The BIS is pointing to the fact that there is a difference between a general fall in prices accompanied by a fall in asset prices and one which is not accompanied by a fall in asset prices. It seems the former is bad; the latter is good.

-

It ends up arguing that a fall in prices can be positive. The BIS research does show that there had been numerous periods since 1870 when deflation occurred amid growth.

-

Historically deflation signals a fall in demand resulting in a fall in prices and incomes. However deflation may also result from increased supply. It seems supply driven deflation is what we are currently experiencing. This, the report says, depresses prices while raising incomes and output.

-

The BIS argues that during the period of the Great Depression of the 1930’s, there was a fall in prices of all assets. That period (1930) is an exception. In the current scenario, this is not true. Hence, it seems, the current bout of deflation is of the ‘good’ variety.

Yashodhan here. If for the sake of argument one does assume that the BIS is correct, then the raison d’être of the current easing experiment seems less compelling than it is being made out to be. The risk in the current scenario is a bit different. The way in which the money printing has been going on, it has a likelihood of creating asset bubbles. When these bubbles burst, it can result in ‘bad’ deflation. That is the only risk for us as investors. However, I wouldn’t want to let that thought affect my decision-making when it comes to buying the dip.

Is the current deflation temporary?

Inflation readings and oil prices are positively correlated. There is an important observation regarding oil prices which is worth sharing. The image below shows the price of oil on a yearly basis:

From the above image, one can draw the following conclusions:

1. It is clear that oil prices are off by about 50 per cent year on year (YOY).

2. This has had its toll on the inflation figures that have been reported for the last couple of months. The higher base effect of oil has been giving abysmally low inflation readings.

3. Everything else remaining the same, the inflation figures for the next few months will likely show a downtrend or sideways direction (depending on the price of oil). However, once the higher oil prices of the earlier period fall out of the base comparison yardstick, the spectre of falling inflation (disinflation) will cease.

4. In other words, as we progress further into 2015, the higher oil prices of yesteryear’s disappear from the denominator. We then start reading inflation from a lower base. If oil prices do stabilise, the effect on inflation readings will not be as devastating as it has been thus far. The media on its part will start swinging in a different direction altogether, be prepared for that.

5. Please note that this assumption is on the basis of ‘relatively’ stable oil prices. Any upward or downward movement in oil prices needs to be factored in separately.

Deflation and current stock valuations

Markets have shown time and again that ‘what everyone knows isn’t worth knowing’. If we are in a deflationary spiral, it is already embedded in stock prices. In a nutshell the answer to the valuation question is:

- The crux of the argument is whether the current valuations are justified. My take is simple. In the past corrections have not occurred because of high stock valuations. There has always been an ‘additional reason’. This ‘additional reason’ in conjunction with high stock valuations, has resulted in corrections.

- Stocks are forward-looking and are pricing in future growth. The current earnings season is critical. If earnings do not support high valuations, then stocks will correct.

- In other words, stocks will tend to look even more highly valued in case earnings are way below expectations. Whether or not earnings surprise on the downside, we will have to wait and watch.

- The current debate over FII taxation (MAT, etc.) is not even worth discussing. It is buying opportunity.

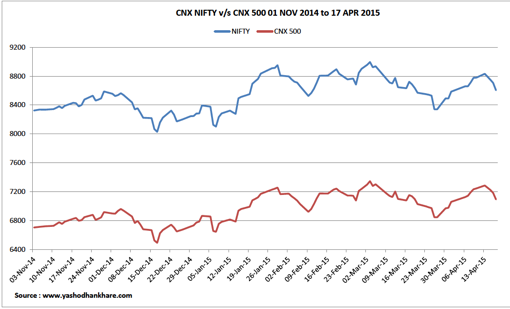

Have a look at the image below:

It shows the Nifty from 01st November, 2014 till date, almost six months. It also shows the CNX 500 for the same period. Both show little movement in this period. The following are the key takeaways:

- Most investors are afraid that the markets are going to fall off a cliff. Markets will correct, they always do and they should. The word ‘crash’ is a bit of heightened pessimism, to which I do not subscribe. Markets fall off the cliff by exception and not by rule.

- Investors need to focus on valuations of individual companies. That should not be confused with overall market valuations. If you see the index in absolute terms, it has gone nowhere for the past six months. Individual stocks have. Someone called John Lennon famously said: ‘Life is what happens while you are busy making other plans’. This is very true when it comes to investing. We are brought upon words like ‘risk appetite’, ‘headwinds’ and ‘tailwinds’, etc. These mean little and are mostly irrelevant to our investing decisions.

- In short valuations along with downbeat earnings should be considered a ‘buying opportunity’. This depends on what you are buying and at what price you are buying.

Deflation: Good, Bad or Ugly?

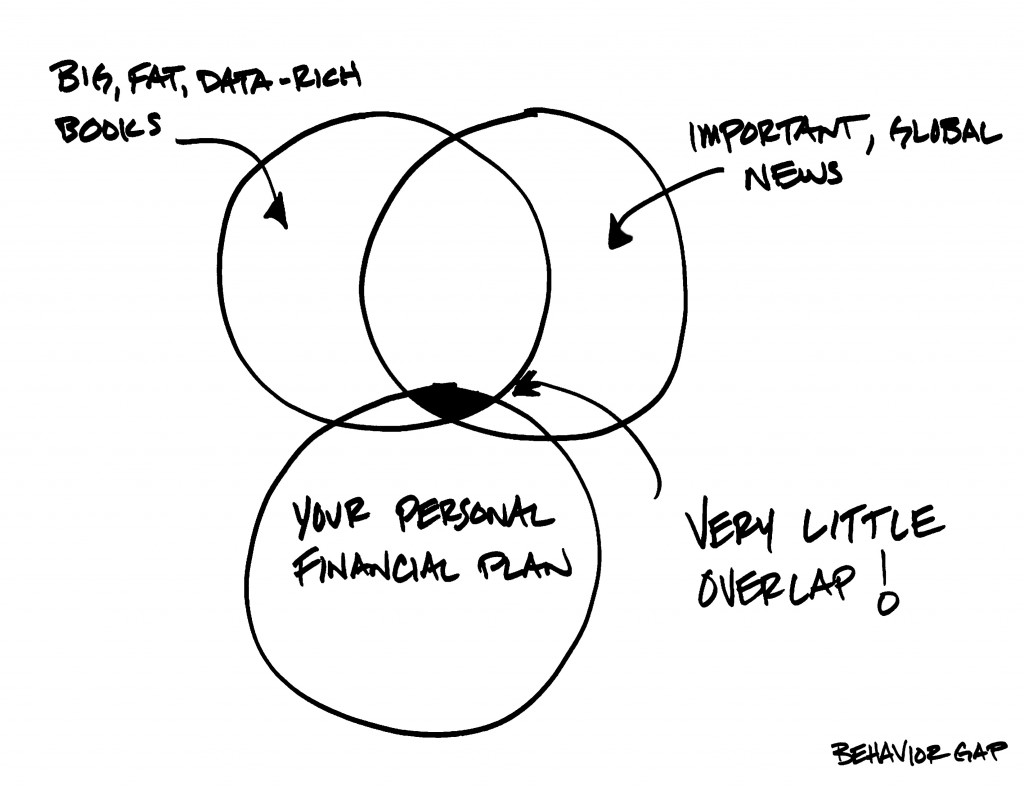

The debate is now shifting from deflation to ‘secular stagnation’. The honest answer is that nobody knows. The best thing to do is to not hold views too firmly on either side. Deflation or Secular Stagnation, does it really matter? I don’t think so. The sketch below says it better than words:

(Sketch Credit: Carl Richards – Reproduced under a Creative Commons License).

There always been much chaos on the Govt released economic data and fig by other agencies. Everyone says reality ground is different. Now inflation fig. are in negative and we all do not find prices have come down in reality.

I find there is great mismatch between Govt and RBI responsibilities. The RBI has given prime responsibility to control inflation but the underlying contents are controlled by Govt like Oil prices, PDS system, different subsidaries etc. Governor has also expressed dissatisfaction.

Secondly, we all know indians are running parallel economy in CASH. We are taking mangoes at 500/- in cash, mall purchases in cash, gold / silver in cash etc. Small and rural economy is running 80 % on cash. Where it is getting accounted for or on which Govt data it is reflecting…? While our stock mkt. analysts are going behind such economic data. and recommending sector to buy…? And later on we find we have entered in wrong stock…

The best way to build a portfolio of your own choice of sector and of blue chip stock, stay invested and take out money frequenly from mkt. min after one yr. The remaining micro/small/mid cap stocks can be invested thro’ different MF for long term wealth creation.These may be @ 6000 no. of stocks on which it is impossible to track on….

Very True

As I am not an economist, I may not be the right person to express my opinion on deflation or its consequences. Probably you may be right. But unless I see a slightest change in the price of Batatawada or Pawbhaji, due to the throw-away prices of potato and tomato respectively, it may be difficult to believe on term “deflation” prevailing in India for a common man! Perhaps, we may come to conclusion that the class of investors who drive our market are not the people who deal with these indigenous products .

As everybody is aware the IPO scenario is completely pathetic and will continue to remain languishing, going ahead, at least in near term. Secondary markets however are at better platform and investors could see lot of volatility, of late, in spite of so called deflation. In short what one needs to look at is the opportunity to buy/ accumulate good stocks; and I am convinced that we are in the same phase! At last as advised by Warren Buffet, we should be greedy if others are so fearful!!

The wholesale price index is negative. All the figures are absurd. Nobody believes them. Even Raghuram Rajan has said last week that he can’t figure out the GDP growth from figures released by the government. Also see the comment below, I have clarified some things there.

An article based on reports/ so called facts away from ground realities. Ask any Indian,who spends a major portion of his income on consumer items ,whether he is experiencing Disinflation or deflation or a steady rise in prices for all items he needs, barring petrol/diesel prices.

All the above mentioned terms are created for the elite world of Financial markets & are not related to the ground realities. It is true for India, I do not for the rest of the world.

In India, where the surplus income is a scarce commodity, who cares for the figures of Inflation given by Govt agencies/RBI ? .

These figures matters most for those who live in the small world of Indian investors of stocks/MF etc.

Would the falling price of diesel at some time result in an increase in the ‘take home’ for the Indian citizen? It has to or at least the cost of living may not go up. That is not the point. The point is that a deflation scare does result in investors shying away from investing in the Indian Stock market. That I feel is the ground reality, not whether we are experiencing a fall in price. First it was the US credit rating downgrade, then Greece, then deflation and now secular stagnation. We will keep on waiting and waiting and waiting endlessly. There have been so many opportunities, every time most of us have just decided to wait and watch. Does it really matter in the longer term, I don’t think so.