(Cartoonist: Patrick Hardin: Cartoonstock.com)

With oil down 40% and sentiment at bearish extremes, nobody wants to touch commodities. That is when opportunity emerges. Commodities, anyone?

Did commodities capitulate on 28th November 2014?

The OPEC meeting on the 27th of November was on expected lines. I thought the market reaction was strange. The market reacted as if it had been expecting a production cut. It is evident that the Saudis want the Americans to blink first, in so far as output cuts are concerned. There was, in my opinion, capitulation after the U S markets opened. A word about Capitulation, since it is very important in the markets. Capitulation is defined as:

“When investors give up any previous gains in stock price by selling equities in an effort to get out of the market and into less risky investments. True capitulation involves extremely high volume and sharp declines. It usually is indicated by panic selling. The term is a derived from a military term which refers to surrender.”

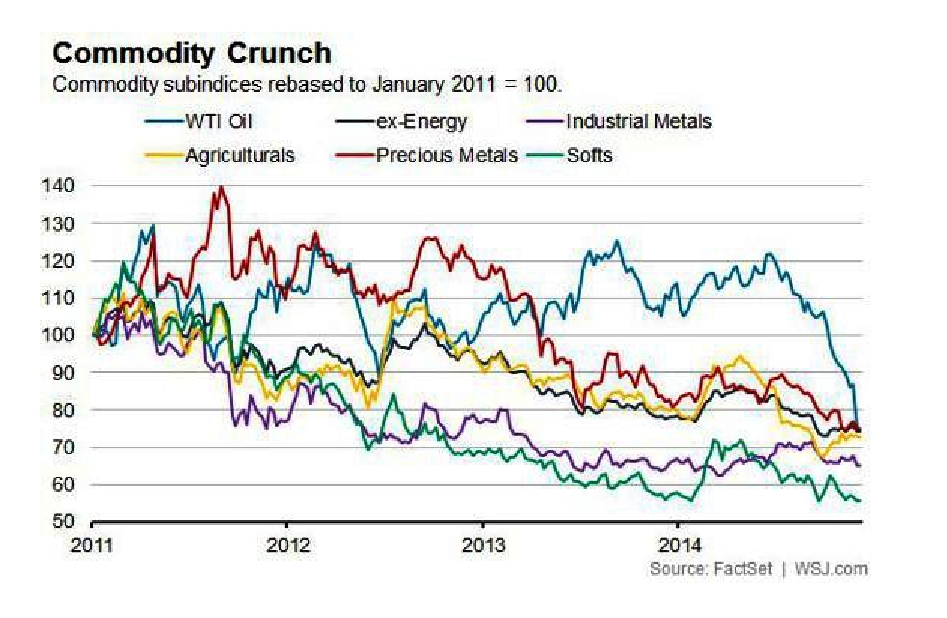

When there is capitulation a lot of the hot money that has come into the market finds its way out. When that happens, the smart money gets back in. I think this is what happened in the oil market on Friday, 28th November 2014. My own experience with such moments is that it generally takes time for the trend to reverse, but reverse it does, in most cases. Whereas, everybody is focused on oil, all commodities have taken a pasting. Have a look at the image below:

On the NSE, there is the sectoral CNX Metal index which reflects the movement of commodity stocks. This index has been under performing the CNX Nifty for the last four years, and in the current year as well.

| INDEX | 2010 | 2011 | 2012 | 2013 | 2014 |

| CNX NIFTY | 17.25 | 24.90 | 27.35 | 5.93 | 35.49 |

| CNX METAL | –1.73 | 48.66 | 16.24 | 15.97 | 12.62 |

Can Commodities generate ‘alpha’ for investors?

What is Alpha? Investors generally seek returns that beat a benchmark, known as alpha in financial jargon. In my opinion, the best chance for investors to generate alpha, would be if they challenge broadly accepted, herd-like opinions. The money managers have shunned commodities till date. They feel that commodities cannot generate ‘alpha’. This is why commodities have been lagging for the past four years. Can commodities generate alpha in the year 2015? To understand this better, I decided to analyse the two sides of the equation: the Bull case and the Bear case for commodities.

Commodities – The Bull Case

1. There is a new phrase coined by the media which is: this is a ‘new era’, with oil expected to continue falling. I have learnt from experience that any such ‘new era’ declaration is always nonsense. If there is going to be a ‘new era’, nobody will know about it, till it has arrived and is entrenched.

2. The media are behaving as if the Saudi’s or Americans may never cut production. This can change, without prior notice. In the event of a cut in production, there will be a spike in the price of oil. If oil rebounds, so will their commodity cousins.

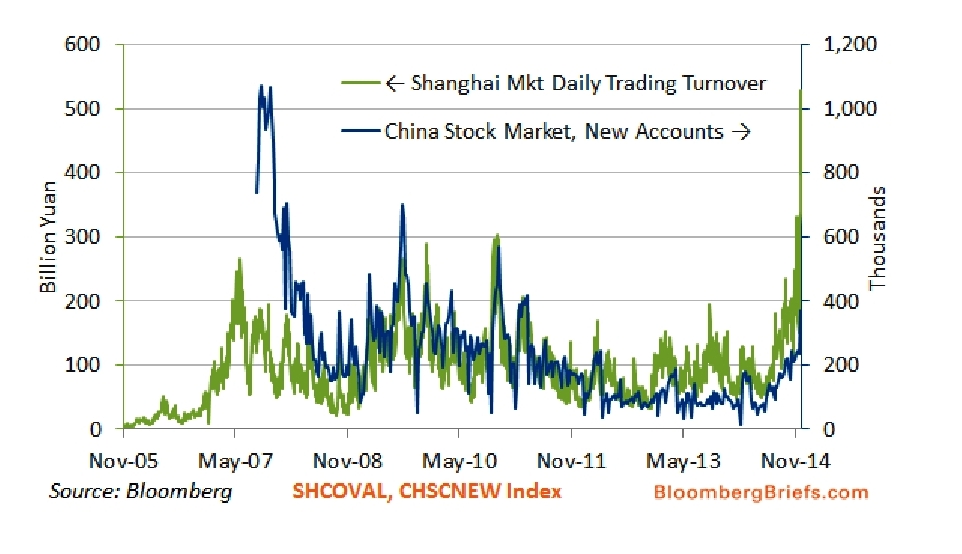

3. The story about China slowing down is now so old, that it sounds more like a news item saying ‘dog bites man’. It is jaded. I have been hearing it since 2008. In spite of all the media hammering of China’s growth story, there is unanimity that it will grow at 7 per cent or 6.5 per cent. Even that is far more than any of the countries in the Euro-zone. In short what is being touted as slowing growth by the media, is actually quite a rapid growth, on a comparative basis. It is said that markets act as precursors to economic growth. If one were to assume this as correct (which I agree is a big assumption), then have a look at the image below:

As shown in the graphic, China’s Shanghai benchmark index is up about 39 % this year. A booming stock market in India, is perceived as a precursor to economic growth. This should be true in China as well. At least that is what common sense suggests. Effectively, the Chinese stock market does look like it’s economy will rebound. If China is synonymous with commodities and its economic growth is due for a rebound, so should commodity prices.

According to Bloomberg:

“China is poised to surpass Japan as the world’s second-largest stock market for the first time in three years as equity investors bet Xi Jinping will have an easier time reviving economic growth than Shinzo Abe. China’s market capitalization has increased 29 percent this year to $4.3 trillion as of Nov. 24, versus a 3.3 percent drop in Japan to $4.5 trillion. China was briefly the second-biggest market, behind the U.S., in March 2011 after an earthquake in Japan sent shares tumbling in Tokyo. While the weakening yen has played a part in Japan’s shrinking market value in dollar terms, China’s Shanghai Composite Index climbed twice as much as the Topix gauge this year. — Zhang Shidong, Bloomberg News”

Have a look at the investor sentiment in China:

“Mainland Chinese investors are opening stock accounts at the fastest pace in three years. Trading in Shanghai surged above 500 billion yuan yesterday for the first time and initial public offerings have returned an average 180 percent in 2014. Central bank efforts to bolster China’s economic growth are reviving optimism in the $4.6 trillion stock market after the Shanghai Composite lost more value than any other major benchmark index worldwide in the past five years. — Allen Wan and Zhang Shidong, Bloomberg News”

4. I know that this post is about commodities, but no discussion about commodities can be initiated without looking at what China is doing. Consider the following misconceptions:

- Oil is falling because of a supply glut. There is no problem with the demand.

- Commodities are falling because China is slowing down, there is a demand problem.

How can both of the above be correct? The Chinese stock market does not show it, in any case. While the media has been obsessed about Japan and India, the Chinese market has come out of nowhere, to be the best performing market of 2014. China as an investment theme is getting hot after almost 5 years.

| COUNTRY & INDEX | 01/01/2014 | 05/12/2014 | % |

| JAPAN – NIKKEI 225 | 15908.88 | 17920.45 | 12.64 |

| CHINA – SHANGHAI COMPOSITE | 2109.39 | 2937.65 | 39.27 |

| INDIA – NIFTY | 6301.65 | 8538.30 | 35.49 |

5. China like India is a consumer of oil and not a manufacturer. The oil glut does not affect it. In fact, if it is favourable for India, as is the popular opinion, it is favorable for China as well. Crude prices are expected to add 0.3 to 0.5 percentage point to growth in China. There was a rate cut in China last month, and more easing is expected before the end of the year. If, as the above images suggest, there is an up-tick in growth in China there is bound to be a rebound in the price of commodities. That is a given.

6. Remember 2008. Oil hit US$ 140. There was a report by Goldman Sachs that it will hit US$ 200. We all know what happened. Now we are in exactly the opposite situation. Now we have the media screaming that oil will touch US$ 40.

7. The crude oil prices and commodities are influenced by demand and supply. The futures market, which is an electronic exchange, also has a big role in determining prices. The sharpness of the price move in oil, feels more like some large player(s), who were relying on a higher oil price, finally hit their “stop loss” point, and their risk control desk closed out the trade. The electronic exchanges trade more rapidly than physical shifts in net demand. Also risk control and margin trades, ensure that prices will move for non-economic reasons.

8. In markets, sharp price moves tend to mean-revert. Slow moves tend to persist. Commodity markets often are self-correcting, because lower prices tend to stimulate demand. With rates so low globally, the opportunity cost of holding commodity-related investments is low. The future prices of key commodities like oil, are about the same as spot prices. In fact gold is in backwardation, which is rare.

Commodities – The Bear case

1. Commodities are cyclical in nature and it is very difficult to time the cycle. What is cyclical? ‘Cyclical’ is defined as “A type of industry that is sensitive to the business cycle, such that revenues are generally higher in periods of economic prosperity and expansion, and lower in periods of economic downturn and contraction”.

It seems that commodities run in ‘super cycles’. The first one started from 1968 and ended in 1981. The current one started in 1998 and ended in 2011. That is the commentary. It seems that commodity cycles are long drawn, around 13 to 15 years. There is an explanation for this. When the price of a commodity goes up, it is usually due to demand. This results in more people getting attracted to the business. This inevitably leads to a supply glut. A point comes when supply exceeds demand and prices of commodities correct. This cycle of demand supply adjustment takes 15 years, according to historical evidence. By this logic, it seems we are in the initial phase of a cyclical down turn in commodities

2. It is generally difficult to call the bottom of any stock. In markets, trying to catch a falling stock, is compared to calling a falling knife, your portfolio can bleed.

3. There is also the argument that commodities outperform in times of accelerated growth. Since the global economy is slowing , so will commodities. It seems that the global slowdown in growth will take oil to US$ 50 in ten years and Gold to US$ 800 (currently US$ 1200). In the interim there will be rallies but these will not be trade-able.

4. As far as commodities are concerned – too much supply and not enough demand; China is slowing; Europe is on the brink of recession; and Japan is faltering again. U.S. oil production has surged. The new story line is that inflation has ceased to be a problem despite massive stimulus by global central banks. Deflation, not inflation, supposedly is the real risk. This is not good for commodities.

5. Part of the ramp up in commodity prices was due to stock piling of commodities by the Chinese. By this logic this the beginning of the carnage, not the end, since falling prices may force the Chinese to sell.

6. The rally in the Shanghai stock exchange is expected to be short-lived. The rally has coincided with increased use of leverage, hence is not a precursor to any economic growth. The rally in Chinese shares is also due to Shanghai-Shenzen stock connect. This is a new trading link connecting the stock exchanges of mainland China and Hong Kong.

Conclusion

I have always thought of investing as buying stocks, rather than sectors. Over the last couple of years, the market moves are more sector specific and sector rotations are common. In markets, it is true that trying to ‘hit the top’ and ‘catch the bottom’ are risky trades. However, investing is all about making assumptions and taking calculated risks – with a long-term horizon. Hitherto the commodities sector has been an ‘unloved’ one. For those that investors who have little or no exposure to the commodities space, this is a buying opportunity. Why? The reasons are:

- In markets it is impossible to predict cycles. All the analysis is always in hind sight, which incidentally, is known to be perfect. Unloved sectors don’t remain unloved for very long. These are called ‘underweight’ sectors. In case they start moving the analysis is that the sector was ‘under-owned’. For you and me they all mean the same thing – they are not popular and money managers do not want to invest in them because they cannot generate ‘alpha’. However, it is here that the greatest opportunities are generally found.

-

India’s economic growth can never overtake that of China. The simple reason for that is: India is a democracy and China is not. If India is going to grow at 7, 8 or 9 per cent then China should be growing faster than that. If this is wrong, then so is the ‘India story’. If both the nations grow faster than they are currently growing, can commodity prices remain where they are?

-

The media does influence our thinking. I remember in 2008 after QE was announced the market started moving after 6 months. During these 6 months, it seems ‘they’ were buying and ‘we’ were selling. The ‘they’ is the so-called operators, insiders, smart money etc. The ‘we’ is you and me. All the while, the media went hammer and tongs about how an average of 50 American banks were failing per month, week or day. Then one fine day in May 2009, when the left parties were voted out, Rakesh Jhunjhunwala (who I think is India’s answer to Warren Buffet) made the immortal comment that ‘the left is out and everyone is left out’. The rest is history. Now it looks like ‘they’ are buying and ‘we’ will be left out. A buy in commodities is the ‘mother of all contrarian trades’ at this juncture.

I am of the opinion that its best not to miss out on the prevailing trend and one must ride it for a time, but slowly and surely one also needs to start getting disconnected from the trend. History has demonstrated that the biggest money is made by the contrarians. And it will be proven in the future also.

As always, I admire Yashodhan’s independent thinking and respect his deep analysis.

Thanks Sadru. I agree, in markets, trend is your friend. But you don’t know when it will bend, until, of course it is too late to take corrective action.

Another shrewd tweet by a rational investor…