(Cartoonist: John McPherson;Cartoonstock.com)

(Cartoonist: John McPherson;Cartoonstock.com)

Tata Global Beverages Limited (TGBL) and Starbucks Corporation, an American global coffee company, are 50:50 partners in the joint venture called Tata Starbucks Limited. This is common knowledge. Why is the brand value being largely ignored by the market? Is it a buying opportunity? I have tried to answer these questions.

Definition of Brand value

Brand value is the ‘monetary premium that results from having customers who are committed to a particular brand and who are willing to pay extra for it’. This definition ensures the following:

-

It enables the brand owner to charge a higher price for its product, as compared to what it’s competitors are charging, or are capable of charging for an identical product. Hence, brand names bring pricing power. Pricing power translates into higher margins and enhanced profitability.

-

In the long run, brand names have proved to be one of the most sustainable competitive advantages that a business has.

Brand value as a basis for stock selection

The basic idea is to buy companies with strong and recognisable brand names. At what price to buy them is the trillion-dollar question. The following are useful pointers for buying ‘brand value stocks’.

-

The brand name should be recognisable to a majority of the population. Starbucks is not that dominant a brand in India, as yet. Neither was ‘Maggi’ noodles fifteen years ago. If someone told you ‘Maggi’ noodles are now being consumed in every corner of rural India, you might change your opinion about Starbucks and TGBL.

- The brand must have a nationwide presence. In the case of TGBL, this can be expected to happen in the long-term.

- Is the brand name and the company name the same? In this case, it isn’t.

- The stock price must be cheap. In a heavily researched market, getting stocks that have a strong brand value at a throwaway price, is not going to be easy. I wouldn’t say it is impossible. It did happen in 2008.

- There are two caveats to brand value investing. The first one is that any brand that fails to contribute to the bottom line of the company is not meaningful from an investment standpoint. The second is patience. This business of buying brand value stocks requires not tonne’s, but mountains of patience.

TGBL – Starbucks is just one of its many brands

TGBL is a beverages company. It operates in three segments, tea, coffee and water. It is the second largest tea company in the world and among top ten global coffee players. Since it operates in forty countries, it does seem to be a global beverages company. Its brands are:

- Tata Starbucks Ltd owns and operates Starbucks stores in India. The cafe’s do sport the brand name; ‘Starbucks: A Tata Alliance’. Starbucks is an iconic brand name; there is no doubt about that.

- The other brands owned by TGBL are Tata Tea, Tetley, Good Earth, Eight O’Clock, Himalayan Water, Grand, Vitax, Jemča, Tata Coffee, Laager, Tata Water Plus. Tata Gluco. You can click here to read about all TGBL brands.

-

Did I forget something? I almost did. The TATA brand – India’s topmost.

Why is TGBL worth buying?

1. I think the current market price only factors in the value of the TATA brand and not that of the STARBUCKS brand.

2. TGBL is part of the CNX FMCG Index. The demographic structure of our country ensures that FMCG companies always do well in the long run. As investments, they are extremely boring. Within the CNX FMCG Index, I would classify TGBL as the ‘most boring’ stock.

3. The biggest risk to brand value investing is that the pricing power that the brand commands today may lag in the longer term. Two classic examples of brand value erosion are Xerox and Kodak. They did not evolve with time. Technological advances delivered a debilitating blow to both. As a result, the value of the brand did not pass from one generation to the next. TGBL is in the beverages business. Hence, I don’t think it runs the risk of brand value erosion.

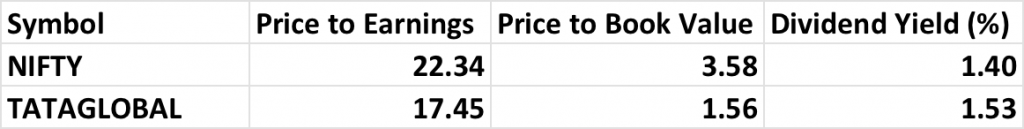

4. The logic of brand value investing goes something like this: ‘Buy stocks with nationally recognisable brands when they are available at a cheap price’. The catch is the word cheap. How does one decide what is cheap and what is expensive? The closing price of TGBL on 24 April, 2015 was Rs. 147.25. On that basis, the comparative ratios (on consolidated numbers of TGBL) look like this:

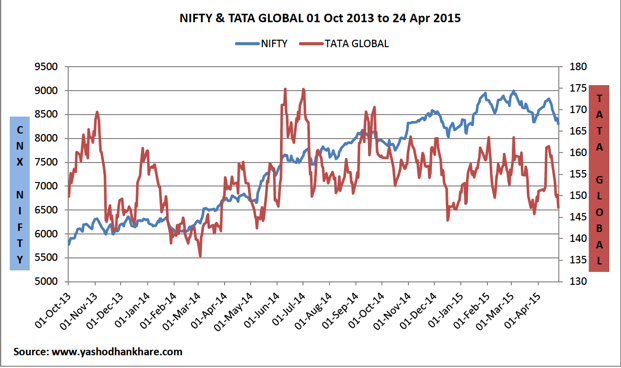

TGBL has a face value of 1. Its 52 week high is 177.15 (10 Jun 2014) and its 52 week low is 137.05 (17 Dec 2014). At its current market price, it does not look expensive. However, it continues to underperform the benchmark. Have a look at the image below:

The image shows the movement of TGBL relative to the benchmark from 01 October, 2013. Why is this stock languishing? I could think of the following reasons:

- Brand value is intangible. Arriving at a ‘value’ is not easy. Most of the company valuations that we see are pricing reports, not valuations.

-

‘Sentiment’ is another intangible that has not been working in TGBL’s favour for the last couple of years. Sentiment can change on a dime. The herd mentality among all of us ensures that we chase what is ‘hot’. TGBL has been as cold as a cucumber in the current bull run.

-

The TGBL – Starbucks joint venture has not been contributing to TGBL’s profitability in any way as on date. This can change. I am betting that it will.

-

The cafe business in India is facing tough times. There are many players. Some are looking to close down since they have yet to turn profitable, even after a decade of operation. The ‘cafe experience’ the world over is known for its plush outlets and premium pricing. The existing players are looking to scale up their ‘cafe experience’ to global levels. So far, they have been unable to do so. Starbucks Corporation, on the other hand, knows the business model like nobody else does – it operates 17000 stores across the globe.

Brand value investing: Does it work?

The market seems to be taking a breather. Since the union budget, selling on the rise, instead of buying on the dip, has been more profitable. I think we should use the current downtrend to ‘accumulate’ TGBL for the long-term, because of the following reasons:

-

When one talk’s of Flipkart and the e-commerce brigade, the words used are ‘implied valuation’ and ‘estimated valuation’. All such stocks command premium prices. They quote at anything between seventy to hundred times historical earnings. The logic is that future earnings will justify the valuation. The reality is that all such stocks have rapidly growing sales and even faster-growing hopes. In such a scenario, I would buy ‘brand valuation’ instead of ‘implied valuation’ and ‘estimated valuation’.

-

Starbucks started operations in India in October 2012. As on date the company operates 58 Starbucks stores, across six cities in India. Of late the pace of new store opening has quickened. Between 22nd November 2013 and 01st October 2014, the company opened as many as 38 new stores.

-

Yes, brand value investing does work. Big brand names take their own sweet time to get entrenched. The store count of the joint venture has been increasing steadily. It is only a matter of time before the joint venture with Starbucks starts contributing to the profitability of TGBL. I wouldn’t want to wait till that happens. If you think you can time that event and buy TGBL at the absolute bottom, be my guest!

I should say, really a good stock you have found out this time for readers’ consideration. No doubt the products of Tata Global have good market penetration, excellent visibility in FMCG industry, it has also the credentials like able management, transparent financials and good governance structure, being Tata group company. It is pertinent to note that for almost last 2 years the stock has hardly moved and offered a pleasure to an investor.

It may be worth noting about the stock of Tatas Global and its products:-

1. Historically any TATA group company does not tend to be investor friendly.

2. Obviously the company applies a conservative policy on dividend, bonus, rights, consolidation or such other value creation. Post merger also the picture will continue to remain non-event.

3. This happens in spite of the fact that promoters (TATA group companies) hold around only 35% shares of the company.

4. Till today business mix is dominantly relied on Tea only and historically Tea companies have not performed well from the perspective of Indian Investors.

5. The coffee shops in India have not clicked as they were contemplated like malls. I think they need to apply different ideas like coffee with innovative products like ice cream or with Indianized snacks etc. Considering the number of shops it could be said that they are at very nascent stage and hence not even to comment upon.

6. Brand of mineral water is almost invisible on the backdrop of Pepsi, Coke and Cad-bury, in spite of the fact that the concerned Tata group company was in this business for about 18 years. This creates doubt in the minds of investors on the rider of market penetration.

Starbucks has actually dared to touch India at a time when India’s coffee outlets business in doldrums. Gloria Jean’s Coffee, Barista, Costa Coffee have already incurred and everyday incurring losses due to heavy rentals and fixed overheads. In a nutshell, these shops will continue to eat profits of the company in days to come. As I understand Starbucks has made an investment around Rs. 350 Crores for business and partner development but mind you, if the partner could not performed well, it may not shy away from leaving the partner….after all its a US company, where business is business!

Disclaimer: I do not hold any share of a company pertaining from Tata Group

I wouldn’t generalize on Tata companies. It is a diversified group. Only time will tell. Ofcourse, divergent opinions makes a market. So, you may be right.

Great insights as always.

Thank You Sir

The only tangible risk I see is that at some point in time (say 3 years out), when Starbucks learns the ropes of the crazy Indian market, they will dump Tata and go it themselves. This has happened with pretty much every MNC I know.

Your opinion ?

Regards

Vinay

That’s true. With the TATA name, it could be different. Whenever any such thing has happened in the past, the Indian partner has proved to be a tough nut to crack. It won’t be so easy. Within the TATA fold, I can think of Tata Timken. Another instance is of Hero Honda where this has happened. In both cases, the shareholders have benefitted. If it does happen, I suppose it will be beneficial for shareholders of TGBL. Again, the reason any such thing would happen would decide whether the shareholders will benefit or otherwise. One thing I am sure about, that is STARBUCKS is here for the long haul. If STARBUCKS does decide to dump TATA’s, they will have to ‘make an offer that TGBL shareholders can’t refuse’!