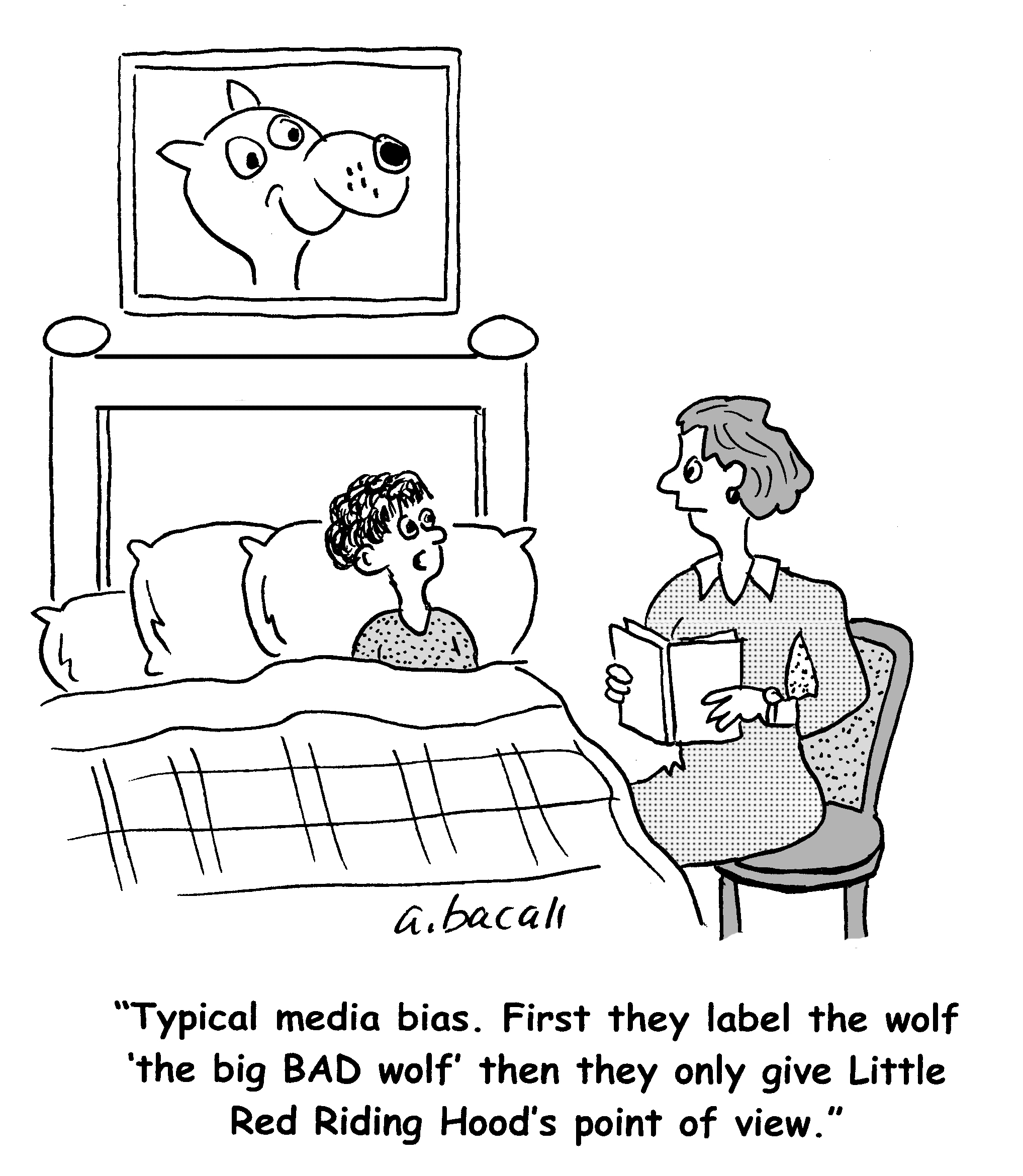

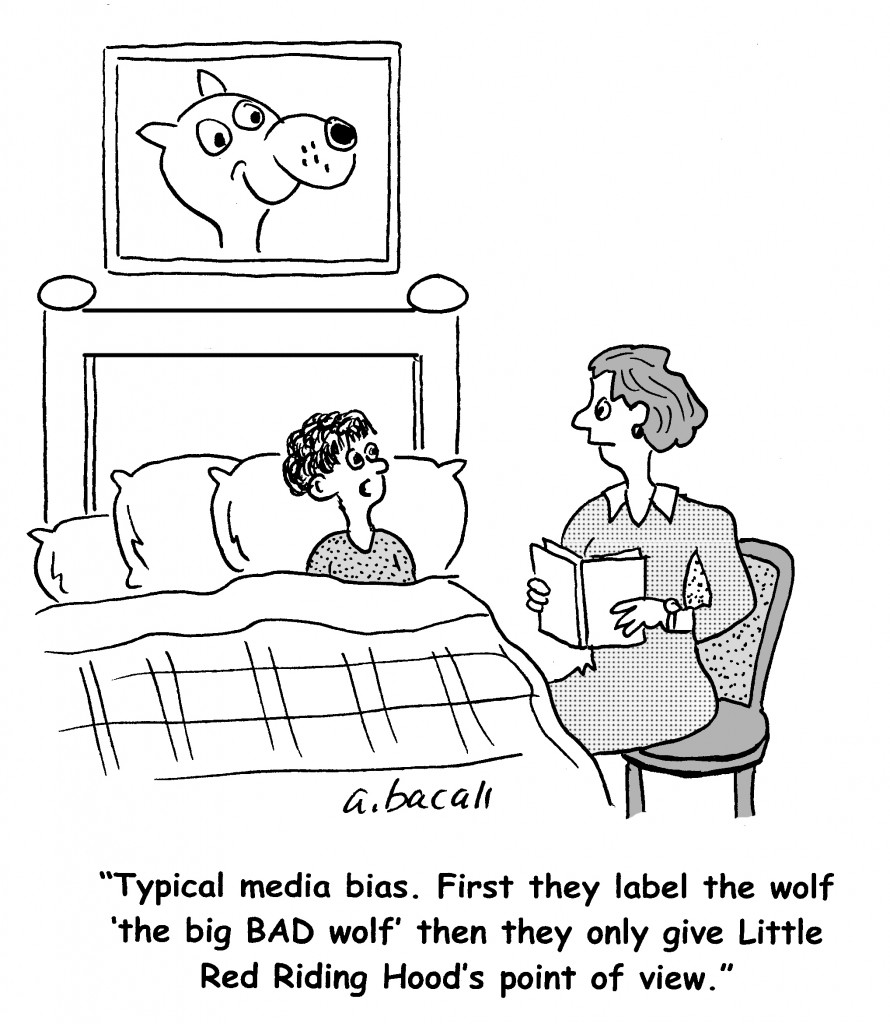

(Cartoonist: Aaaron Bacall: Cartoonstock.com)

It is common knowledge that most of us make our buy and sell decisions based on sentiments, fads and on other psychological biases. This is true not only for us, but also in the case of money managers, and other professionals in the investing arena. In this post, when I refer to investors, it means the whole universe, you, me and the professionals.

Why the bias?

In today’s perennial connected world, our biases result in many of us not acting in our own best interests. This is mainly due to the increased awareness of economic factors, central bank actions and a deeply biased media. The media are always looking for breaking news. Knowingly or unknowingly, we are all drawn in to the circus of having an opinion, voicing it and then acting on it. All this unknowingly affects our attitude and behavior It does result in a bias, one way or another.

What is a bias

As human beings we have countless biases. This happens to be a very interesting and challenging topic. However it is pretty boring to read about, without any practical application. Hence, what I did was to embed a few videos showing human traits, with a brief commentary of how it plays out in the market. I have just highlighted two of the countless human biases. These, to me, are relevant in the current market scenario.

What is a Cognitive Bias

A cognitive bias is a tendency to think in a certain way. These biases affect our decision-making process. A great deal of research has been done on the negative effect of such cognitive biases. This is where human decision-making comes in to play. More often than not we make the wrong decision.

Bias 1 : The Anchoring Bias

While basing their buy and sell decisions investors invariably “anchor” their decisions to a price. Usually the investor is making a comparison to the company’s (lower or higher) stock price, at some earlier point in time. This is our default response. We’re always hunting for bargains. What’s really going on is called “anchoring” — and when it comes to investing, it can really hurt you. This is a cognitive bias. It is not discussed very often. Investopedia defines it as: “The use of irrelevant information as a reference for evaluating or estimating some unknown value or information. When anchoring, people base decisions or estimates on events or values known to them, even though these facts may have no bearing on the actual event or value.”

How We Anchor as Investors

Anchoring is letting one piece of information influence our thinking about another. We all do it without even realizing it. Our first move, when we come across a stock idea, is to check recent prices. The next thing we generally do is one of the following:

-

If the stock price has declined over the past few months, we anchor on the higher price and worry if there’s something wrong now.

- If the stock price has climbed we see the lower price as a bargain. We then use this lower price as our anchor.

- If the stock price has climbed, we also wait for a pull back. This is the ‘missed boat’ syndrome – anchoring again. When the pull back does occur, most of us set the anchor to a price that is even lower than our previous anchor. Why? Because the media is screaming: “doomsday”.

-

If the stock price is near an all-time high, we worry that the price cannot go higher, anchoring as if it’s an impenetrable ceiling.

Anchoring is a default response

Our brains inevitably anchor to some number or another. It may be the 52 week high or low, yesterdays closing, issue price, or any number which we can easily relate to. The choice of the number used as an anchor, will vary from one person to another. It has been proved that this bias works against our interest. As an example, I had a client who wanted to buy stocks when they hit their 52 week lows. I tried to reason that this was a wrong way to go about selecting stocks, and that this was just another number. There was no use arguing with him. He was convinced, so strong was his anchoring bias. I have noticed it is strong in most of us (including me). Unless a conscious attempt is made, we will not be able to overcome our anchoring bias, even though it works against us. Some market guru has rightly said “When your brain seizes on a number, it becomes stuck, as if it had been coated in glue.” Watch this short 90 second video to see how our anchoring bias kicks in:

What you can do about the anchoring bias

So if we anchor without realizing it, how can we minimize the damage? Here are three methods:

1. The anchor number invariably leads to an anchor bias, thereby distorting the decision-making process. Wipe out the anchor number from your mind. If not, just discredit it, and start afresh. Then go and form your own estimates. If someone gives you a target for a stock, just look at the average price earning it has traded at over the last 5 years. Then decide if the target is achievable. This is just a thumb rule, you can devise your own.

2. Stop paying attention to meaningless barriers, like all-time highs. It’s what happens going forward from today that counts, not a price a stock supposedly can’t break through. In the current market there are many stocks which have quadrupled. This just goes to prove that the price is just a number, nothing else. Don’t let it influence your decision-making process.

3. Don’t think in terms of index or price levels. For example Nifty at 9000, Hindustan Unilever at 1000. This will create a bias, even though you may not have one to start with.

Bias 2 : The Story Bias

In the stock market there is always a story which creates a bias. Actually, this is said to be a cognitive error, which distorts clear thinking. The Modi Sarkar story has taken all of us by storm. Of course there is a story. Expecting it to play out in a couple of months is a bit ridiculous. The markets are already discounting a GDP of 6.5 when the current GDP is 5. This is the power of a good narrative. It simply distorts reality. It is known as the story bias. This results in poor decision-making. I am highlighting it because currently we are all under its spell. This is not meant to be a bearish statement. I would prefer to call it realistic. If there was a Narendra Modi fan club then I would have been one of the first members (right from 2010), even before he announced his Prime Ministerial ambitions. To me, it does look like market participants are overwhelmed by a story bias. Why ?

- The current regime is being compared to its predecessor. Actually there is no comparison. Why? The benchmark we are comparing with is so low, that it just does not make any sense. The current regime is the best since Indian independence (my personal opinion), so there is no comparison.

- The international media coverage has added to the narrative. I personally find myself almost hypnotized when I listen to the speeches delivered by the honorable Prime Minister. He does manage to cast a spell on the listener, there is no doubt about that.

- I have no right to comment on the speed of the reforms process, or the achievements of the new government. All I am trying to highlight is that it is a superb story. How it unfolds will decide the course the market takes over the next couple of years. When we invest, it is fair to discount six months, not six years!!

- The Modi Sarkar Story is being extended to most of the listed stocks. The bear hammering in stocks with dubious stories has already begun. The indices do not reflect this. This results in a false sense of complacency. It does give a wrong picture of the market as a whole.

How the media fuels the story bias

The media always catches on to any story. Remember the year 2000 and the Y2K story. The media blew it out of proportion. In 2007 it was the BRIC’s story. All well constructed narratives attract us. Another problem with stories is that they give us a false sense of understanding, which inevitably leads us to take greater risks. Click here to see what Daniel Kanheman (who is the author of the book ‘Thinking, Fast and Slow’.) has to say about story telling. He is considered to be an authority on the psychology of judgement and decision-making. What he is saying is :

- There is a common thread in all stories. In reality, what you see is all there is. In other words, construct stories on the basis of what is visibly happening in the immediate future. We are not aware of what we don’t know. So do not build stories around what you do not know. If you are holding stocks of a company with a dubious story, just remember: What you see is all there is. Do not fall prey to stories which are far-fetched.

- On the other hand, the interest rate cut story has been around for almost 45 days. This media propelled story continues, even after the Reserve Bank of India (RBI) denial on 2nd December, 2014. The honorable RBI governor (who is being referred to as the best central banker in the world), seems to have a mind of his own. There are so many opinions as to whether he should or should not cut rates, that now every person has an opinion on this. This is a classic example of trading on a story bias. How? The media are affecting our thinking process in such a way, that we end up forming an opinion on something which, in reality, none of us fully understand. The media keep at it, so slowly but surely we all feel that a rate cut is our birthright at this juncture, and that we are being denied the same. The fact of the matter is that the RBI will cut rates when it has to. The RBI knows best, definitely better than you, me, the media or the honorable Finance minister. Trading bank stocks on this story, is like trading on a story, which at the present juncture, is dubious.

-

Never underestimate the power of a great story – in a lighter vein on the art of story telling, have a look at this short 90 second video:

Conclusion

In today’s market, the way individual and professional investors make investment decisions is so skewed, that achieving both high returns and long-term objectives, is nearly impossible. The direction of the market is more a function of the investment behavior of the investors, than any thing else. The following will drive home the point:

- About sentiment: in reality, very difficult to define. The dictionary meaning is: “an attitude to something”. How does it work in the stock market? Maybe an analogy would be apt. The closing price of Jet Airways on 25th November, 2014 was 244.75. The oil price had been falling from June 2014, this was always a positive trigger for the stock. The closing price on 11th December 2014 was 441.35. What happened in two weeks? In reality, nothing new. It was just a case of change in sentiment, nothing else. This is a very recent and live example of the power of investor psychology in the markets.

- The current bout of market volatility will, in all likelihood, bring potential opportunities for the savvy investor, who knows where to look. What that means in practical terms is that if you want to buy Maruti at 1700, then do not anchor to this figure. It could reach any figure, higher or lower. Take a call on information that is readily available, and not on any anchor numbers you may have conjured up, or any media stories that float around.

In reality, changing behaviors in individual and professional investors is very difficult. Investor attitudes and sentiment are the key. Since it is very difficult to gauge sentiment, we can, instead, study investor bias. Most investors start off with a long-term investment objective, only few achieve it. The reason is the inherent biases that all of us succumb to. In case you are serious about making resolutions, maybe this could be a good one to make : ‘I shalt not succumb to my cognitive biases.’ I don’t know about you, I am definitely going to give it a try.

Your point that one lives by biases is valid…

Not only in the world of investing…but life at large!

I would rather change the word BIAS to “Frame of reference” (FOR)

And fundamentally we all look at the world from our FOR at all times.

Question and challenge is to zoom out of MY FOR and then maybe we get to see the bigger or hopefully full picture!

And possibly make Objective, Learned and maybe the Correct Decisions!!

Cheers and Thanks for a thought provoking article!

Call it what you like. Very difficult to get rid of for all of us – we can only try our best!!

Very articulate.

Few investors realize that they indeed have a bias, or try to overcome it. Guess majority of humans are conditioned to be cautious with their money, especially if it comes to investing in a volatile segment like the stock exchange.

Regards

Shailesh

True. You might find the following two videos worth watching, they cannot be embedded – not allowed, but they are available for viewing

http://www.morningstar.com/cover/videocenter.aspx?id=605646#.VJgXGwqggEA.gmail

https://www.youtube.com/watch?v=pzrjlNScWLo